A Comprehensive Beginner Guide to Crypto Masternodes

The world of digital assets has opened up exciting possibilities for those looking to expand their financial portfolios. Among the various opportunities available, one approach stands out due to its unique blend of technology and potential profitability. This approach not only allows participants to engage with evolving digital ecosystems but also provides avenues for generating passive income through strategic involvement.

As individuals navigate this complex landscape, understanding the mechanics behind these innovative frameworks becomes essential. With a focus on a specific investment model, participants can unlock significant benefits by actively supporting the network’s operations while also earning rewards. This intricate balance of responsibility and reward shapes the experience for those who choose to delve into this fascinating segment of the financial market.

For those eager to explore this realm, familiarizing oneself with the underlying principles and mechanisms can pave the way for informed decision-making. By grasping the fundamental concepts and evaluating their potential risks and rewards, participants can embark on a rewarding journey that aligns with their financial aspirations. Through careful planning and strategic participation, the aspiration of financial growth can become a tangible reality.

Understanding the Basics of Masternodes

This section aims to clarify the fundamental principles surrounding specific network nodes that play a pivotal role in various decentralized systems. These components are essential for maintaining the integrity and functionality of their respective ecosystems.

Key Characteristics

Nodes serve multiple purposes within their networks. Here are some essential features:

- Participate in transaction validation and confirmation.

- Enhance the overall security of the blockchain.

- Provide instant communication between users.

- Facilitate governance and decision-making within the community.

Requirements for Operation

To successfully operate these nodes, participants must typically meet certain prerequisites:

- Maintain a stable and reliable internet connection.

- Hold a specified amount of the native currency as collateral.

- Allocate computing resources to run the necessary software.

How Masternodes Function in Blockchain Networks

The operation of specific nodes within blockchain networks plays a pivotal role in enhancing the functionality and efficiency of these decentralized systems. These nodes contribute to various aspects such as governance, security, and transaction processing, ensuring that the network remains robust and reliable.

Nodes in these networks serve as crucial components, participating actively in the validation of transactions and offering additional features that differ from standard nodes. They maintain a complete copy of the blockchain while also carrying out unique tasks, which can include enabling faster transaction processing or implementing privacy features.

To operate a specific type of node, users often need to stake a certain amount of the network’s native digital asset, which helps align their interests with the overall health of the network. This staking requirement acts as a form of collateral, encouraging node operators to act in the best interest of the community.

Furthermore, these specialized nodes may participate in the decision-making processes related to network upgrades or governance proposals, thereby allowing those who contribute to play an influential role in the system’s evolution. This decentralized approach to governance fosters a sense of community and shared responsibility among network participants.

Overall, the functionality of these advanced nodes enhances the blockchain’s scalability, security, and governance, making them integral to the advancement and sustainability of the ecosystem.

Benefits of Running a Masternode

Engaging in the operation of a node can yield significant advantages for individuals looking to enhance their digital asset portfolio. This involvement not only creates passive income opportunities but also contributes to the overall stability and functionality of the network.

Steady Income Stream

One of the most appealing aspects is the potential for a consistent revenue stream. By participating in the network, operators typically receive rewards in the form of tokens. This can provide financial benefits over time, as the accumulation of rewards may increase significantly depending on network performance.

Network Support and Governance

By running a node, individuals play a crucial role in supporting the entire infrastructure. This not only improves transaction processing times but also enhances overall security. Furthermore, operators often gain voting rights, allowing them to influence decisions related to updates and changes in the network. This creates a sense of ownership and involvement in the project’s future.

Key Requirements for Setting Up

Establishing a successful node within a decentralized network involves several critical factors that determine its functionality and profitability. Understanding these prerequisites is essential for ensuring a smooth setup process and long-term operation.

Firstly, hardware specifications play a vital role. You will need a reliable computer or server that meets the necessary processing power and storage capacity to handle network tasks efficiently. Opting for high uptime and stable internet connectivity is also crucial to maintaining your node’s performance.

Next, financial investment must be considered. Certain projects require a minimum amount of tokens to be held as collateral, which may be locked for a specified duration. Ensuring that you are financially prepared for this commitment is important for successful participation.

Additionally, software setup is paramount. Familiarity with the specific operating system and client software associated with your chosen project will aid in the configuration process. Regular updates and maintenance are integral to keep the node operational and aligned with network developments.

Lastly, it is essential to stay informed about network criteria, which may include participating in governance decisions, contributing to the security of the system, and adhering to the community’s best practices. Being actively engaged with the project’s ecosystem can enhance your experience and potential returns.

Investment Risks and Considerations

Entering the rapidly evolving world of digital assets comes with a variety of potential challenges and uncertainties. Understanding these factors is crucial for making informed decisions. This section outlines key risks and points to reflect on when contemplating this type of investment. By being aware of the inherent dangers, individuals can better navigate the complexities of this market.

| Risk Factor | Description |

|---|---|

| Market Volatility | The value of assets can fluctuate dramatically within short periods, leading to significant gains or losses. |

| Regulatory Changes | Changes in laws and regulations can impact the viability and legality of various investment options. |

| Technical Risks | Issues such as software bugs, security vulnerabilities, and network outages can affect the performance of investments. |

| Liquidity Concerns | Certain investments may not be easily tradable, making it difficult to exit positions when desired. |

| Scams and Fraud | The prevalence of fraudulent schemes in the digital asset space requires vigilance and due diligence. |

Being mindful of these factors will help mitigate potential downsides. Comprehensive research and strategic planning are essential components of navigating this landscape effectively.

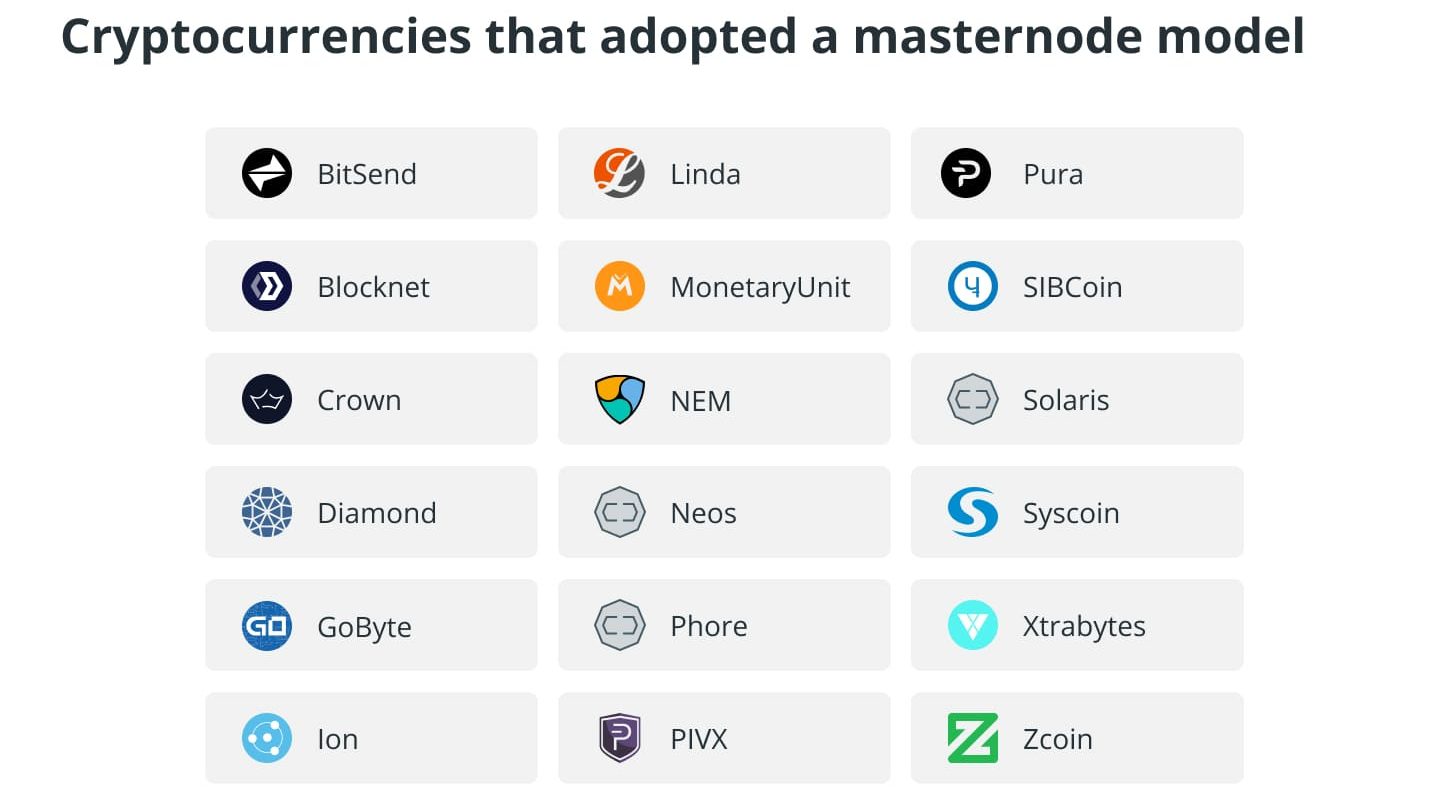

Choosing the Right Cryptocurrency for Your Masternode

When it comes to selecting a digital asset to support a node, making an informed decision is crucial. The choice affects not only potential earnings but also the overall experience of running the operation. A variety of factors come into play, ranging from the coin’s market stability to its community support and technological foundation.

Market Capitalization: It’s essential to assess the market capitalization of the asset in question. Higher market caps often indicate a more established and reliable option, while smaller caps can present opportunities, albeit with higher risks. Researching early indicators of growth can help in making a sound selection.

Network Activity: Evaluating the level of activity within the network is vital. Look for metrics such as transaction volume, user engagement, and the number of active nodes. A vibrant and active network typically suggests a healthy ecosystem where your resources will be utilized efficiently.

Community Support: A robust community can significantly influence the sustainability of a digital asset. Engaging with forums, social media, and official channels will give insight into the development roadmap and future potential. A strong developer team and active user base often correlate with ongoing innovation and stability.

Technological Advantages: Consider the underlying technology of the asset. Innovations, benefits such as scalability, and unique features can differentiate one digital currency from another. It is beneficial to analyze whitepapers and project updates to understand the technology’s effectiveness and potential for future growth.

Regulatory Environment: Existence within a robust legal framework is a key consideration. Regulated projects or those with clear compliance strategies are likely to be less susceptible to abrupt market changes or legal complications.

Ultimately, selecting the right asset involves a thorough understanding of several interrelated factors. Conducting in-depth research and aligning your choice with your personal investment strategy is essential for success.

Q&A: A beginners guide to crypto Masternodes

What is a masternode and how does it work in cryptocurrency networks?

A masternode is a type of server within a cryptocurrency network that helps maintain the network’s integrity and performance. Unlike traditional nodes that only store and transmit network data, masternodes perform additional functions such as enabling instant transactions and providing privacy features. To operate a masternode, an investor must hold a specified amount of the cryptocurrency as collateral, which is known as a stake. In return for their services, masternode operators earn rewards in the form of cryptocurrency, often resulting in a passive income stream.

What are the benefits of running a masternode for new investors?

For new investors, running a masternode can offer several advantages. Firstly, it can provide passive income through block rewards, which can be attractive compared to traditional investment avenues. Secondly, masternodes contribute to the security and efficiency of the network, giving investors a sense of involvement in the project. Additionally, by participating in a masternode, investors can often influence governance decisions within the cryptocurrency ecosystem, such as protocol upgrades or changes in parameters. However, it’s essential to be aware that operating a masternode requires a significant investment and technical know-how, which may be challenging for beginners.

What are the risks associated with investing in masternodes?

Investing in masternodes carries several risks that new investors should carefully consider. The foremost risk is the potential loss of the initial investment; if the cryptocurrency’s value decreases significantly, the rewards generated may not justify the investment. Additionally, the technical requirements for setting up and maintaining a masternode can be daunting for those without IT experience. There’s also the risk of network attacks or issues with the project itself, which could render the masternode unprofitable. Therefore, potential masternode operators should conduct thorough research and understand the specific cryptocurrency they are interested in to mitigate these risks effectively.

How do I choose the right cryptocurrency for my first masternode investment?

Choosing the right cryptocurrency for your masternode investment involves several key factors. First, you should research the market capitalization and community support behind the cryptocurrency, as a strong community often indicates stability and ongoing development. Next, consider the required collateral amount; some cryptocurrencies may require a substantial investment upfront, which may not be feasible for all investors. Additionally, evaluate the rewards structure and the historical performance of the cryptocurrency to understand potential returns. Finally, look for projects with a clear roadmap and active development, as this can greatly affect the long-term viability of your masternode investment. Taking the time to analyze these factors can help you make a more informed decision.

What is the role of masternodes in a decentralized network?

Masternodes play a crucial role in maintaining the network’s security and ensuring the validation of transactions. Unlike regular nodes, masternodes verify transactions, contribute to the consensus mechanism, and help manage private transactions within the network. They are specialized nodes that help with the decentralization of blockchain systems.

How does proof-of-stake (PoS) differ from proof-of-work (PoW) in cryptocurrency mining?

Proof-of-stake (PoS) and proof-of-work (PoW) are both consensus mechanisms used to validate transactions, but they operate differently. PoW, used in systems like Bitcoin, requires miners to solve complex mathematical problems using expensive mining gear, while PoS, used in networks like Ethereum, validates transactions based on the amount of cryptocurrency a user holds and is willing to stake, reducing the energy consumption of the network.

What are the requirements to set up and run a masternode?

Running a masternode typically requires hosting a full node with a specified amount of cryptocurrency as collateral, a stable IP address, and the technical know-how to maintain the system. The requirements to become a masternode operator can vary by network, but they often involve having a certain amount of masternode coins, ensuring network connectivity, and meeting security standards to validate transactions.

How do masternode operators receive rewards?

Masternode operators are rewarded for their contribution to the network, including validating and verifying transactions. They typically receive a portion of the cryptocurrency generated from the creation of new blocks. These rewards incentivize masternodes to participate in the network’s consensus mechanism and ensure the security and functionality of the blockchain.

What are the different types of masternodes and how do they work?

Different types of masternodes serve various functions within blockchain networks. Some, like Dash masternodes, are responsible for validating transactions and participating in governance decisions, while others may focus on private transactions or securing network protocols. Masternodes are specialized nodes that offer benefits like passive income for operators, though they often require a significant investment in cryptocurrency and infrastructure.