Crypto Teading Chart Pattern

Crypto Teading Chart Pattern

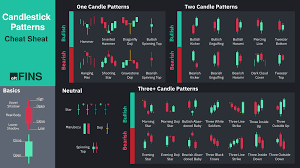

Welcome to our comprehensive manual on understanding and effectively utilizing the intricate world of cryptocurrency chart patterns. In this article, we will delve into the intricacies of analyzing and interpreting the various trends and formations that dominate the ever-evolving market of digital currencies. By mastering the art of identifying these patterns, traders can gain invaluable insights into potential price movements and enhance their decision-making abilities in order to maximize profits.

Throughout this guide, we will explore the vast array of chart patterns that emerge within the cryptocurrency sphere, while avoiding over-reliance on specific terms or jargon. By adopting a more inclusive approach, we aim to cater to traders of all levels – from beginners looking to grasp the fundamentals, to seasoned professionals seeking to refine their strategies. By emphasizing the importance of visual analysis, we will empower traders with the tools necessary to navigate the volatile crypto market with confidence.

Within the realm of cryptocurrency trading, chart patterns serve as a universal language that allows traders to interpret price movements and identify opportunities for lucrative trades. This guide will act as a compass, guiding you through the maze of patterns, from basic formations such as triangles and rectangles, to more complex structures like double bottoms and head-and-shoulders patterns. By providing real-life examples and highlighting key characteristics of each pattern, we aim to equip you with a comprehensive framework that will enhance your ability to spot these formations as they arise.

Moreover, our guide will also address the significance of timeframe analysis, a crucial aspect of effectively utilizing chart patterns. By understanding how these patterns manifest across various timeframes, traders can gain a deeper understanding of market dynamics and make more informed decisions. Whether you are a short-term trader seeking quick gains or a long-term investor looking for strategic entry and exit points, this guide will provide you with the knowledge and skills necessary to master the art of chart pattern analysis in the cryptocurrency market.

Understanding the Significance of Chart Patterns in Cryptocurrency Trading

In the realm of cryptocurrency trading, the patterns illustrated by charts hold significant importance for traders looking to make informed decisions. These patterns provide valuable insights into the price movements and potential future trends associated with various cryptocurrencies. Understanding the significance of chart patterns in crypto trading can empower traders to identify favorable entry and exit points, ultimately enhancing their chances of profitability in the volatile market.

The Language of Charts

Chart patterns serve as a visual representation of the market sentiments and behavior of cryptocurrency prices. By analyzing these patterns, traders can decipher the underlying dynamics and make informed predictions about the future direction of prices. These patterns often display repetitive formations that reflect the collective actions of traders and investors in the market. Familiarizing oneself with the language of charts enables traders to interpret these patterns accurately, gaining an edge in their trading strategy.

The Role of Chart Patterns in Trading Decisions

Chart patterns provide traders with valuable information about the market sentiment and potential price movements. They offer insights into the psychology of market participants, illustrating the equilibrium between buyers and sellers. By identifying patterns such as triangles, head and shoulders, double tops, and more, traders can anticipate potential breakouts or reversals in price trends. This understanding helps traders devise effective trading strategies, including identifying support and resistance levels, setting stop-loss orders, and establishing profit targets.

| Pattern Type | Description |

|---|---|

| Head and Shoulders | A bearish reversal pattern consisting of three peaks, with the middle peak (head) being higher than the others. |

| Double Tops | A bearish reversal pattern characterized by two consecutive peaks at approximately the same level. |

| Triangles | These patterns represent a period of consolidation, with narrowing price ranges that indicate a potential breakout in the future. |

It is important for traders to develop a solid understanding of chart patterns and their implications in order to make informed trading decisions. By recognizing and accurately interpreting these patterns, traders can increase their probability of success in the dynamic world of cryptocurrency trading.

The Basics: Common Chart Patterns and Their Significance

In this section, we will delve into the fundamental concepts of identifying and understanding common chart patterns in the world of cryptocurrency trading. By familiarizing ourselves with these patterns, we gain insights into the potential future price movements of digital assets based on historical data.

Chart patterns are visual representations of price movements over time, allowing us to identify recurring patterns that may indicate future trends. By recognizing these patterns, traders can make informed decisions about when to buy or sell a particular cryptocurrency.

There are several widely recognized chart patterns, each with its own significance and potential implications for price action. The most common chart patterns include:

- 1. Head and Shoulders: This pattern typically signals a reversal in the current trend, with the price reaching a peak (the head) followed by two smaller peaks (the shoulders). Traders often interpret this as a bearish signal.

- 2. Double Top and Double Bottom: These patterns occur when the price reaches a resistance level (double top) or support level (double bottom) twice before reversing. They are seen as significant points of trend reversal.

- 3. Cup and Handle: This pattern resembles a cup with a handle, indicating a temporary consolidation before the price continues its upward movement. Traders often see this as a bullish continuation pattern.

- 4. Ascending and Descending Triangles: These patterns are formed by converging trendlines, with ascending triangles indicating a potential bullish breakout and descending triangles suggesting a bearish breakout.

- 5. Rectangle: This pattern is characterized by parallel support and resistance levels, indicating a period of consolidation. Traders often interpret this as a continuation pattern.

Understanding and interpreting these common chart patterns can provide valuable insights into the potential future price movements of cryptocurrencies. It is important for traders to study and master these patterns to enhance their trading strategies and improve their chances of success in the crypto market.

Identifying and Interpreting Bullish Chart Patterns

Understanding and recognizing bullish chart patterns is crucial for traders looking to capitalize on positive market trends and make informed investment decisions. By learning to identify and interpret these patterns, traders can gain valuable insights into potential price movements and take advantage of profitable opportunities in the crypto market.

The Role of Bullish Chart Patterns in Technical Analysis

Bullish chart patterns play a significant role in technical analysis, which focuses on studying historical price and volume data to predict future market trends. These patterns provide traders with visual representations of market sentiment and can indicate potential reversals or continuations of an upward price trend.

Common Bullish Chart Patterns

There are numerous bullish chart patterns that traders commonly encounter while analyzing price charts. Some of the most recognizable ones include:

- 1. Triangle Patterns: Ascending triangles, symmetrical triangles, and expanding triangles

- 2. Cup and Handle Patterns

- 3. Double Bottom Patterns

- 4. Head and Shoulders Patterns

- 5. Bullish Flag Patterns

- 6. Bullish Pennant Patterns

- 7. Inverse Head and Shoulders Patterns

Each pattern has its own unique characteristics and significance, and understanding their formation and implications is essential for successful trading.

Interpreting Bullish Chart Patterns

Interpreting bullish chart patterns involves analyzing various factors such as volume, timeframe, and pattern confirmation criteria. Traders should look for confirmation signals such as breakout levels, price targets, and volume patterns to validate the bullish pattern.

Furthermore, it is important to consider other technical indicators and market conditions in conjunction with the identified bullish chart pattern to make well-informed trading decisions.

By gaining proficiency in identifying and interpreting bullish chart patterns, traders can improve their ability to recognize profitable opportunities and enhance their overall trading strategies.

Spotting and Analyzing Bearish Chart Patterns

In this section, we will explore the art of identifying and analyzing bearish chart patterns in the world of cryptocurrency trading. By learning how to spot these patterns, traders can gain valuable insights into the potential downtrends and make informed decisions.

Recognizing Bearish Trends

Before delving into specific bearish chart patterns, it is crucial to understand the significance of recognizing bearish trends. Bearish trends indicate a decline in price over an extended period, providing traders with an opportunity to take advantage of potential profit-making strategies.

Analysts employ various tools and indicators to identify bearish trends, such as moving averages, trendlines, and support and resistance levels. By studying the historical price data and understanding market dynamics, traders can better comprehend the underlying trend and adjust their trading strategies accordingly.

Analyzing Bearish Chart Patterns

Once a bearish trend is identified, traders can further analyze specific chart patterns that suggest a potential continuation of the downtrend or a reversal. Understanding these patterns can help traders identify entry and exit points for their trades.

Some common bearish chart patterns include the head and shoulders, double top, descending triangle, and bearish flag. Each of these patterns has its own characteristics and provides valuable insights into the sentiment of the market.

Traders should pay attention to the volume accompanying these patterns as it can help confirm the validity of the bearish pattern. Higher trading volumes often indicate stronger market sentiment and validate the potential continuation of the downtrend.

It is important for traders to combine the analysis of bearish chart patterns with other relevant indicators and market factors. This comprehensive approach can enhance their understanding of potential bearish trends and improve their decision-making process.

By mastering the art of spotting and analyzing bearish chart patterns, traders can develop a competitive edge in the cryptocurrency market. These skills can contribute to successful trading strategies and help traders navigate the complexities of the market with confidence.

Applying Advanced Techniques to Trade Crypto Chart Patterns

In this section, we will explore innovative and advanced strategies that traders can employ to effectively navigate and profit from crypto chart patterns. By incorporating these techniques into their trading approach, traders can gain a competitive edge in the cryptocurrency market.

1. Analyzing Trend Reversal Patterns

One key advanced technique is the analysis of trend reversal patterns. These patterns, such as head and shoulders, double tops, and double bottoms, can provide valuable insights into potential market reversals. By understanding the characteristics and significance of these patterns, traders can anticipate trend changes and adjust their trading strategies accordingly.

Furthermore, the identification of trend reversal patterns can be enhanced through the use of technical indicators, such as moving averages, relative strength index (RSI), and stochastic oscillators. These indicators can help validate the presence of a trend reversal pattern and provide additional confirmation for traders.

2. Implementing Fibonacci Retracement Levels

Another advanced technique involves the application of Fibonacci retracement levels to crypto chart patterns. Fibonacci retracement levels are based on a mathematical sequence that can be used to identify potential support and resistance levels in price movements. By applying these levels to chart patterns, traders can determine optimal entry and exit points for their trades.

Additionally, combining Fibonacci retracement levels with other technical analysis tools, such as trendlines and candlestick patterns, can provide further insights into market trends and potential price targets. This integrated approach allows traders to make more informed decisions and increase their profitability.

| Benefits of Applying Advanced Techniques | Examples of Crypto Chart Patterns |

|---|---|

| Enhanced trading accuracy and profitability | Ascending triangles |

| Better risk management and position sizing | Descending triangles |

| Improved market timing | Wedges |

| Increased confidence in trading decisions | Flags |

By incorporating these advanced techniques, traders can elevate their understanding and utilization of crypto chart patterns. It is important to note that these techniques should be used in conjunction with proper risk management strategies and continuous learning to maximize their effectiveness.

Managing Risk and Setting Effective Profit Targets with Chart Patterns

In this section, we will explore the importance of managing risk and setting effective profit targets using chart patterns in the cryptocurrency market. Understanding how to properly assess and mitigate risks is crucial for traders to ensure long-term success. Additionally, accurately setting profit targets plays a vital role in maximizing gains and minimizing losses.

Importance of Managing Risk

Managing risk is a fundamental aspect of successful trading. It involves making informed decisions based on thorough analysis and minimizing potential losses. Chart patterns serve as valuable tools in assessing risk levels as they provide visual representations of historical price movements, allowing traders to identify potential entry and exit points.

By analyzing various chart patterns, traders can determine the probability of certain price movements, helping them assess the level of risk involved in a particular trade. This enables them to set appropriate stop-loss orders and establish risk management strategies to protect their capital.

Setting Effective Profit Targets

Setting effective profit targets is equally as important as managing risk. It involves determining the price level at which to close a trade to secure profits. Chart patterns offer valuable insights into potential price targets by identifying key levels of support and resistance.

Traders can utilize chart patterns to set profit targets by analyzing previous market behavior and identifying areas where price movements are most likely to reverse or encounter significant resistance. By establishing profit targets based on these patterns, traders can maximize their gains and avoid the common pitfall of holding onto trades for too long, potentially losing out on profits.

It is crucial for traders to strike a balance between setting realistic profit targets and not being too conservative. By properly analyzing chart patterns and taking into account market conditions, traders can set profit targets that align with their risk appetite and trading objectives.

In conclusion, managing risk and setting effective profit targets with chart patterns is essential for traders in the cryptocurrency market. By identifying and mitigating risks through the analysis of chart patterns, traders can make informed decisions and protect their capital. Additionally, setting profit targets based on these patterns allows traders to maximize their gains and avoid potential losses. Implementing these strategies in conjunction with proper risk management techniques can greatly enhance the overall trading experience and increase the likelihood of success.

Q&A: Crypto chart patterns

What is a “trading pattern” in the context of cryptocurrency trading?

A trading pattern refers to a recognizable formation or structure observed on price charts that may indicate potential future price movements. These patterns are often used by traders to analyze market sentiment and make informed trading decisions.

How do traders use a “trend line” in identifying trading patterns?

Traders use trend lines to identify the direction and strength of price trends. By connecting consecutive lows in an uptrend or highs in a downtrend, trend lines help traders visualize the trajectory of price movements and identify potential reversal or continuation patterns.

What is a “rising wedge” pattern in crypto trading?

A rising wedge pattern is a bearish reversal pattern characterized by converging trend lines with higher highs and higher lows. This pattern suggests weakening bullish momentum and potential downward price reversal.

Can you describe a “falling wedge” pattern commonly seen in crypto trading?

A falling wedge pattern is a bullish reversal pattern characterized by converging trend lines with lower highs and lower lows. This pattern suggests weakening bearish momentum and potential upward price reversal.

How do “crypto traders” utilize wedge patterns in their trading strategies?

Crypto traders utilize wedge patterns, such as rising and falling wedges, to identify potential trend reversals or continuations. By recognizing the formation of these patterns and waiting for confirmed breakouts, traders can make more informed decisions about entering or exiting positions.

What role do “bullish reversal patterns” play in crypto trading?

Bullish reversal patterns indicate potential shifts from downtrends to uptrends in cryptocurrency prices. Traders use these patterns, such as double bottoms or bullish wedges, to identify opportunities to enter long positions and capitalize on upward price movements.

How do traders distinguish between “top and bottom” formations in crypto patterns?

Traders distinguish between top and bottom formations in crypto patterns based on their position within a price trend. Top formations, such as double tops or rising wedges, occur at the end of uptrends, signaling potential reversals. Bottom formations, like double bottoms or falling wedges, occur at the end of downtrends, indicating potential reversals.

How can traders learn to “read crypto patterns” effectively?

Traders can learn to read crypto patterns effectively by studying chart patterns, understanding their characteristics and implications, and practicing pattern recognition through technical analysis. Experience and exposure to various market conditions can also enhance a trader’s ability to interpret patterns accurately.

In what ways do “patterns help” crypto traders in making trading decisions?

Patterns help crypto traders in making trading decisions by providing visual cues about market sentiment and potential price movements. By recognizing patterns such as wedges, triangles, or head and shoulders formations, traders can anticipate market direction and adjust their strategies accordingly.

What strategies do crypto traders employ when trading based on patterns?

Crypto traders employ various strategies when trading based on patterns, including waiting for confirmation of pattern formations, setting entry and exit points based on pattern projections, and using additional technical indicators to validate their analysis. Risk management techniques, such as setting stop-loss orders, are also crucial when trading pattern-based strastegies.

What are some common chart patterns used in crypto trading?

Some common chart patterns used in crypto trading include ascending triangles, descending triangles, head and shoulders, double tops, double bottoms, flags, pennants, and wedges.

How do traders interpret chart patterns for crypto trading?

Traders interpret chart patterns by analyzing the formation’s characteristics, such as trend lines, price levels, and volume. They look for patterns that suggest potential trend continuation or reversal, helping them make informed trading decisions.

What does an ascending triangle pattern suggest in crypto trading?

An ascending triangle pattern suggests a potential bullish continuation in crypto trading. It forms when there is a horizontal resistance level and a rising trend line, indicating that buyers are gradually gaining control over the market.

Can you explain how chart patterns help in crypto trading?

Chart patterns help in crypto trading by providing visual representations of price movements and potential market trends. Traders use these patterns to identify key levels, entry and exit points, and to gauge market sentiment.

What are some reliable trend reversal patterns commonly observed in crypto trading?

Some reliable trend reversal patterns in crypto trading include double tops, double bottoms, head and shoulders, and triple tops or bottoms. These patterns indicate potential shifts in market direction from bullish to bearish or vice versa.

How do traders differentiate between top and bottom patterns in crypto chart formations?

Traders differentiate between top and bottom patterns in crypto chart formations based on their position within a price trend. Top patterns, such as double tops or head and shoulders, form at the peak of an uptrend, while bottom patterns, like double bottoms or inverse head and shoulders, form at the trough of a downtrend.

What role do rectangle chart patterns play in crypto trading?

Rectangle chart patterns, also known as trading ranges or consolidation patterns, indicate periods of indecision in the market. They form when prices trade within a horizontal range, suggesting potential breakouts in either direction.

How do traders identify a bearish continuation pattern in crypto trading?

Traders identify a bearish continuation pattern in crypto trading by recognizing chart formations, such as bear flags, pennants, or descending triangles, that occur within a downtrend. These patterns typically signal a temporary pause before the resumption of the prevailing bearish trend.

What types of crypto trading patterns are considered reliable for making trading decisions?

Reliable crypto trading patterns for making trading decisions include those with well-defined structures and high probability outcomes, such as symmetrical triangles, ascending triangles, and bull flags or pennants. Traders often rely on these patterns to anticipate future price movements.

How do traders use chart patterns for trading based on chart formations?

Traders use chart patterns for trading based on chart formations by identifying patterns that suggest potential market trends or reversals. They wait for confirmation signals, such as breakouts or breakdowns, before entering or exiting positions, ensuring they align with the identified pattern’s direction.