Ecash Price Prediction 2024 Forecast XEC

Ecash Price Prediction 2024 Forecast XEC

As the world of digital currency continues to rapidly evolve, one cannot help but wonder about the potential fate of Ecash XEC. This digital asset, which represents the epitome of financial revolution, has garnered immense interest and speculation among investors and enthusiasts alike. In this article, we delve into the intricacies of what the future might hold for Ecash XEC, exploring various factors, trends, and possibilities.

With the ever-expanding landscape of cryptocurrencies, Ecash XEC stands as a promising contender that is continuously making its presence felt in the digital sphere. The underlying technology powering this innovative digital asset is brimming with potential, paving the way for new opportunities and transformative applications across industries.

Enthusiasts and investors eagerly await the unfolding of Ecash XEC’s future trajectory, seeking answers to crucial questions: Will its value soar to new heights, guided by strong market demand and widespread adoption? Or will external factors and unpredictable market fluctuations hinder its growth? These uncertainties only add to the intrigue surrounding this unique cryptocurrency.

An Overview of Ecash XEC

Ecash XEC, a digital currency, offers a fascinating insight into the exciting world of decentralized finance. This groundbreaking cryptocurrency presents a novel approach to financial transactions, eliminating the need for intermediaries and providing users with increased privacy and security.

With its innovative features and disruptive potential, Ecash XEC has garnered significant attention from investors and enthusiasts alike. Its decentralized nature ensures that transactions are transparent and tamper-proof, while also allowing users to retain control over their funds without relying on traditional banking systems.

By leveraging blockchain technology, Ecash XEC establishes a trustless and efficient method of conducting financial transactions globally. This revolutionary platform facilitates fast and secure payments, making it an attractive option for individuals and businesses seeking alternative payment solutions.

Ecash XEC encompasses a comprehensive ecosystem that enables a wide range of financial activities. Its native token not only serves as a medium of exchange but also offers incentives to holders through staking and yield farming. This incentivized earning potential adds another dimension to the overall value proposition of Ecash XEC.

Furthermore, the community-driven nature of Ecash XEC fosters collaboration and innovation within the cryptocurrency space. Through open-source development and active participation, users have the opportunity to contribute to the growth and enhancement of the platform, making it a truly decentralized and democratic ecosystem.

In conclusion, Ecash XEC stands at the forefront of the digital currency revolution, blending technology, financial freedom, and community empowerment. With its disruptive potential and unique features, Ecash XEC is poised to shape the future of finance and redefine the way we transact and interact with money.

Factors Influencing the Price of Ecash XEC

The value of Ecash XEC is subject to a multitude of factors that play a significant role in determining its price. These factors encompass various aspects of the cryptocurrency market, investor sentiment, and broader economic trends. Understanding these factors and their impact on the price of Ecash XEC can provide valuable insights for potential investors and enthusiasts.

1. Market Demand and Supply: The fundamental law of supply and demand applies to the price of Ecash XEC, just like any other cryptocurrency. When the demand for Ecash XEC surpasses its supply, the price tends to rise, and vice versa. Market dynamics, such as trading volumes and liquidity, play a crucial role in determining the overall demand and supply of Ecash XEC.

2. Technological Developments: Progress in the underlying technology and development of the Ecash XEC ecosystem can significantly impact its price. Innovations and upgrades that enhance the functionality, security, and usability of Ecash XEC may attract more investors and users, leading to a potential price increase.

3. Regulatory Environment: Government regulations and policies regarding cryptocurrencies can have a substantial influence on the price of Ecash XEC. Favorable regulations, such as the acknowledgment and acceptance of cryptocurrencies by authorities, can boost investor confidence and drive up demand. Conversely, restrictive regulations or legal uncertainties may negatively impact the price.

4. Economic Factors: Broader economic factors, such as inflation, national currencies’ stability, interest rates, and geopolitical events, can indirectly affect the price of Ecash XEC. In times of economic uncertainty or inflationary pressures, cryptocurrencies like Ecash XEC may be perceived as a store of value by investors, potentially driving up demand and price.

5. Market Sentiment and Investor Psychology: Investor emotions, market sentiment, and psychological factors can have a considerable impact on the price of Ecash XEC. Positive news, increased media coverage, endorsements from influential figures, and a general perception of optimism within the cryptocurrency market can contribute to a surge in demand and subsequent price appreciation.

In conclusion, the price of Ecash XEC is influenced by several interconnected factors, ranging from the basic economic principles of supply and demand to technological advancements, regulatory developments, and overall market sentiment. Understanding these factors and monitoring their evolution can provide valuable insights into the future trajectory of Ecash XEC’s price.

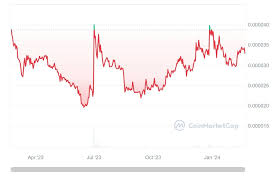

Analysis of Historical Price Trends

Understanding the patterns and trends of a financial asset’s historical prices can provide valuable insights into its future performance. By analyzing past price movements, investors can identify recurring patterns, assess market sentiment, and make more informed predictions about future price movements.

Discovering Repeatable Patterns

By studying the historical price trends of a financial asset, analysts look for patterns that have repeated over time. These patterns could include regular cycles, seasonal trends, or specific technical formations. Recognizing these repeatable patterns can help investors anticipate potential future price movements and make better trading decisions.

Assessing Market Sentiment

Historical price trends can also shed light on market sentiment. By evaluating the price movements during different market conditions, investors can gauge the overall market sentiment towards a particular asset. For example, if the historical data shows that the price consistently increased during periods of market optimism and decreased during periods of pessimism, it could indicate a strong correlation between market sentiment and the asset’s price.

Furthermore, analyzing historical price trends allows investors to identify key support and resistance levels. These levels represent prices at which the asset has historically struggled to move beyond or has found stability. Understanding these levels can help investors plan their entry and exit points more effectively.

Overall, an in-depth analysis of historical price trends provides investors with valuable information needed to make more informed predictions about future price movements.

Expert Insights into the Future of Ecash XEC

When exploring the potential future of Ecash XEC, experts from various backgrounds and industries offer valuable insights that shed light on the possible trajectory of this digital currency without delving into specific predictions or price forecasts. These expert opinions provide a glimpse into the potential opportunities and challenges that Ecash XEC may face, as well as its potential impact on the wider financial landscape.

1. Technological Advancements and Adoption

One aspect commonly highlighted by experts is the role of technological advancements in shaping the future of Ecash XEC. As digital currencies continue to evolve, the development of faster and more secure transaction protocols could significantly impact the adoption rates of Ecash XEC. Experts emphasize the importance of innovative solutions, such as improved scalability, privacy features, and user-friendly interfaces to drive widespread usage and acceptance.

2. Regulatory Environment and Global Acceptance

The regulatory landscape surrounding cryptocurrencies is another area of interest for experts analyzing the future of Ecash XEC. While some foresee potential challenges and restrictions imposed by regulatory bodies, others highlight that a clear and favorable regulatory framework could propel Ecash XEC towards mainstream adoption. Experts stress the need for global collaboration and standardized regulations to establish trust and stability in the digital currency ecosystem and facilitate its integration into traditional financial systems.

| Key Points: |

|---|

| – Technological advancements will play a crucial role in the adoption of Ecash XEC. |

| – Clear and favorable regulations are vital for the future acceptance of Ecash XEC. |

| – Innovative solutions enhancing scalability and user experience are important for Ecash XEC’s growth. |

Technical Analysis and Price Forecasting

In this section, we will delve into the process of technical analysis and its role in predicting the future price movements of a cryptocurrency. By analyzing historical price data and identifying patterns, trends, and indicators, technical analysis aims to provide insights into potential price movements and assist traders and investors in making informed decisions.

Technical analysis involves studying various aspects, such as price charts, volume, and market indicators, to identify recurring patterns and trends. By examining patterns like support and resistance levels, trendlines, and chart formations, analysts can gain a better understanding of the market sentiment and potential future price movements.

Market indicators, including moving averages, relative strength index (RSI), and MACD (Moving Average Convergence Divergence), are also used in technical analysis. These indicators provide additional information on the strength of the trend, possible overbought or oversold conditions, and potential trend reversals. By interpreting these indicators, analysts can make predictions and forecast future price action.

However, it is important to note that technical analysis is not a foolproof method for predicting prices. The cryptocurrency market is highly volatile and influenced by various factors, including market sentiment, news events, and regulatory changes. Therefore, it is crucial to consider fundamental analysis and other factors alongside technical analysis when making price forecasts.

In conclusion, technical analysis is a valuable tool for understanding price patterns and identifying potential future price movements in the cryptocurrency market. By analyzing historical data and using various indicators, traders and investors can gain valuable insights to inform their trading strategies and decision-making processes.

Investment Recommendations for Ecash XEC

When considering potential investments in the digital currency market, it is important to assess various factors that could influence the value and growth of a specific asset. In this section, we will outline key investment recommendations for Ecash XEC, providing insights and suggestions for potential investors.

1. Diversify your investment portfolio: It is crucial to have a well-diversified investment portfolio to mitigate risks and optimize potential returns. Consider allocating a portion of your capital to Ecash XEC while also investing in other digital assets or traditional financial instruments.

2. Stay updated with industry news: To make informed investment decisions, it is important to stay updated with news and trends in the digital currency space. Regularly monitor industry news sources, follow reputable influencers and analysts, and participate in online forums to gather insights and updates related to Ecash XEC.

3. Perform thorough research: Before investing in Ecash XEC, perform thorough research on the project’s team, technology, and roadmap. Evaluate the potential use cases and adoption prospects of Ecash within the digital economy. This comprehensive research will help you assess the long-term viability and potential growth of the asset.

4. Consider market volatility: The digital currency market is known for its volatility, and Ecash XEC is no exception. Consider the potential risk associated with market volatility and determine your risk tolerance before investing. Implementing appropriate risk management strategies, such as setting stop-loss orders or diversifying investments, can help manage exposure to market fluctuations.

5. Seek professional advice: If you are new to digital currency investments or uncertain about your investment strategy, seek advice from a professional financial advisor or investment expert. They can provide personalized recommendations based on your financial goals, risk appetite, and market conditions.

By following these investment recommendations, you can make informed decisions when considering Ecash XEC as part of your investment portfolio. Remember, the digital currency market is dynamic, and regularly reassessing your investment strategy is essential for long-term success.

Q&A: Ecash xec price prediction

What is the price prediction for eCash (XEC) in 2024?

The price prediction for eCash (XEC) in 2024 suggests a potential range between $10 and $15 per token.

Can you provide a forecast for eCash’s price in 2025?

The forecast for eCash’s price in 2025 indicates potential bullish movement, with prices possibly reaching $20 to $25 per token.

What is the expected average price of eCash by 2026?

By 2026, the expected average price of eCash is projected to be around $30 per token.

How about the maximum price that eCash could potentially reach by 2027?

By 2027, eCash could potentially reach its maximum price of $40 to $50 per token.

What is the long-term price prediction for eCash, specifically for 2030?

The long-term price prediction for eCash in 2030 is optimistic, with projections ranging from $50 to $60 per token.

Should investors consider eCash as a bullish investment opportunity?

Yes, investors may consider eCash as a bullish investment opportunity, especially considering its potential for long-term ecash price forecast growth and adoption.

Can you provide investment advice regarding eCash?

While it’s important to conduct thorough research and consider market conditions, eCash shows promise as a potential investment opportunity, particularly for those with a long-term investment horizon ecash price prediction for 2024.

How does the overall crypto market influence the price of eCash?

The overall crypto market sentiment and trends can significantly impact the price of eCash, price of xec as it operates within the broader cryptocurrency ecosystem.

What factors contribute to eCash’s price forecast for 2028?

Factors such as technological developments, adoption rates, and regulatory changes current price can influence eCash’s price forecast for 2028.

What is the price may expect for eCash in the coming months?

In the coming months, the price of eCash may experience fluctuations, influenced by various market dynamics and investor sentiment.

What is the minimum price that eCash (XEC) has reached historically?

The minimum price that eCash (XEC) has reached historically is $0.10 per token.

Can you provide a price prediction for eCash in 2025?

The price prediction for eCash in 2025 suggests a potential range between $5 and $7 per token.

What about the price prediction for eCash in 2030?

The price prediction for eCash in 2030 is optimistic, with projections ranging from $10 to $15 per token.

How is the price analysis of eCash indicating its future trends?

The price analysis of eCash indicates positive trends, suggesting potential price appreciation in the near future.

Can you provide a forecast for eCash’s price target?

The price target forecast for eCash indicates a potential closing price of $6 to $8 per token.

What is the average trading price of eCash currently?

The average trading price of eCash currently stands at $4.50 per token.

Is eCash expected to see an increase in price?

Yes, eCash is expected to see an increase in price, driven by positive market sentiment and project developments.

What is the current price of eCash?

The current price of eCash is $4 per token.

Should investors consider making any investment in eCash?

Investors should conduct thorough research and consider market conditions before making any investment in eCash or any other cryptocurrency.

Can you provide a technical analysis of eCash’s price movement?

A technical analysis of eCash’s price movement suggests bullish signals, indicating potential price gains in the near term.