Enhancing Market Efficiency Through Asset Tokenization

The evolution of ownership structures in recent years has sparked a profound transformation in the way we perceive value and participate in economic activities. By redefining how properties and rights are represented, a new paradigm emerges that fosters accessibility and liquidity in diverse sectors. This innovative approach not only democratizes ownership but also introduces new participants into previously exclusive markets.

As traditional barriers dissolve, the potential for fractionalized participation becomes increasingly viable. Individuals can invest in previously unreachable opportunities, thereby broadening the investor base and stimulating economic growth. This shift allows for a more fluid exchange of value, paving the way for a spurt of creativity and collaboration among various stakeholders.

Furthermore, the systematic representation of ownership in a digital format leads to streamlined transactions and reduced friction in trading processes. The once convoluted pathways are simplified, enabling faster and more transparent interactions. This development serves not only to attract investment but also to instill greater confidence among participants, thus fortifying the entire economic landscape.

Understanding Asset Tokenization

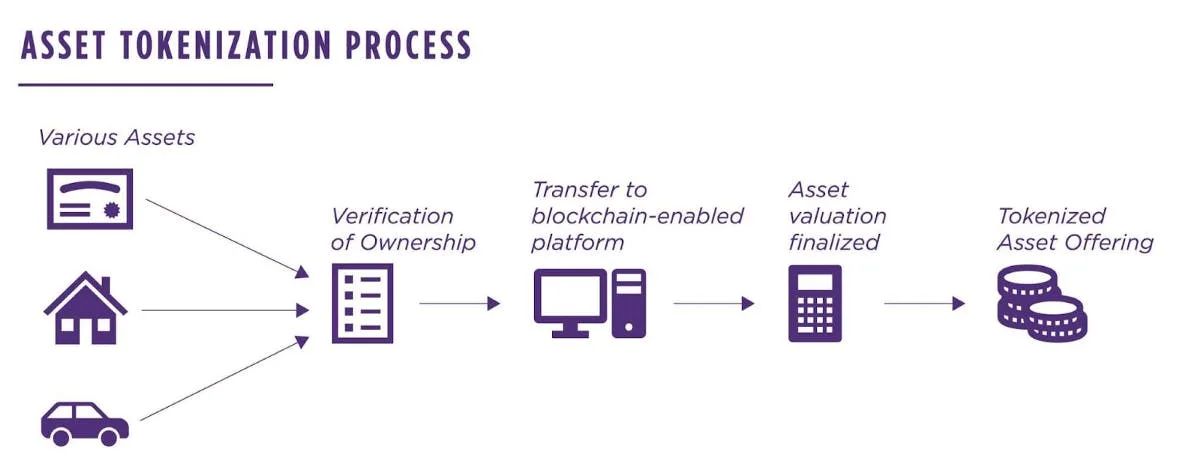

The concept involves the process of converting real-world entities into digital representations, facilitating their broader accessibility and liquidity. By utilizing cutting-edge technology, traditional forms of ownership can be transformed into a fractionalized, easily tradable format, allowing for a more inclusive approach within various sectors.

This transformation not only provides individuals and institutions with the ability to own smaller portions of high-value items but also improves the overall dynamics of buying and selling. The digital format allows for seamless transactions across borders, reducing the barriers that often hinder participation in diverse investment opportunities.

Moreover, the innovation fosters transparency and trust, as the details surrounding transactions are securely recorded and publicly accessible on distributed ledgers. This accountability encourages engagement from a wider audience, as potential investors can verify the integrity of their investments with greater confidence.

Ultimately, the shift towards digital embodiments of ownership marks a significant evolution in how trades are conducted, paving the way for a more versatile and adaptable environment in various industries. This reimagining of ownership and exchange opens new avenues for growth and collaboration within the global economy.

Benefits of Tokenized Assets in Markets

The integration of digital representations of value into traditional trading systems presents significant advantages. By transforming physical or traditional financial items into digital forms, participants have access to enhanced capabilities that fundamentally improve transaction processes and overall participation in various economic environments.

- Increased Liquidity: Digital tokens allow for fractional ownership, enabling a larger pool of investors to participate. This approach can lead to more active trading and quicker conversions to cash.

- Global Accessibility: Utilizing digital representations allows individuals from diverse geographic locations to engage in trading without cumbersome barriers, thereby broadening the investor base.

- Reduced Costs: The process of transferring ownership through digital means often incurs lower fees compared to traditional methods, resulting in more favorable conditions for participants.

- Enhanced Transparency: Most digital representations utilize blockchain technology, which records all transactions publicly. This ensures a higher level of trust and accountability among participants.

- Improved Settlement Times: The use of digital tools typically allows for near-instantaneous transactions, eliminating delays that can occur in traditional systems.

In summary, the transition to digital forms of value not only creates opportunities for greater interaction within financial systems but also provides numerous competitive advantages to both investors and organizations. It fosters an environment where resources can flow more freely, driving innovation and economic growth.

How Blockchain Improves Transaction Speed

In recent years, a revolutionary technology has emerged that significantly accelerates the process of exchanging value. This innovation has transformed traditional dealings, making them quicker and more reliable. As a result, individuals and organizations are benefiting from reduced waiting times and enhanced convenience.

One of the primary ways this technology achieves rapid transactions is through its decentralized nature. Unlike conventional systems that require intermediaries to validate proceedings, this approach allows for direct interactions. The elimination of middlemen leads to several advantages:

- Faster Confirmation Times: Transactions can be validated in real-time, drastically reducing the period needed for approval.

- Streamlined Processes: The automatic execution of transactions through smart contracts minimizes delays caused by manual verification.

- Improved Data Integrity: Transactions are recorded on a secure ledger, ensuring all parties have access to the same information without discrepancies.

Additionally, the use of a distributed network further aids in enhancing speed. By spreading the workload across numerous nodes, the system can process multiple transactions concurrently. This leads to:

- Scalability: The capability to handle a growing volume of transactions without compromising performance.

- Resilience: Increased reliability, as the network can withstand interruptions or failures in specific nodes.

Overall, the transformative potential of this technology lies in its ability to expedite transactions, providing users with a seamless and effective experience. With these advancements, the future of exchanges looks promising, paving the way for quicker and more reliable interactions in various sectors.

Liquidity Boosts from Digital Tokens

The advent of digital tokens has revolutionized the way value is exchanged, unlocking a myriad of opportunities for stakeholders. These innovative instruments serve as a bridge between traditional financial systems and the digital realm, significantly enhancing the fluidity with which participants can engage in various transactions. The introduction of these electronic representations has paved the way for a more dynamic financial landscape, enabling quicker and easier access to capital across diverse sectors.

Facilitating Swift Transactions

One of the key advantages of utilizing digital representations lies in their capacity to streamline transaction processes. With the ability to settle trades almost instantaneously, liquidity rises, as participants can move in and out of positions with unprecedented speed. This rapid execution diminishes the friction that often plagues conventional structures, thus attracting a broader audience eager to capitalize on new opportunities.

Attracting Global Participants

The digital nature of these instruments allows for participation from individuals and institutions worldwide, effectively broadening the pool of investors. This inclusivity fosters increased trading volumes and a more vibrant trading environment. As demand surges, prices stabilize, and the overall health of the financial ecosystem improves, creating a symbiotic effect that benefits all parties involved.

Regulatory Considerations in Tokenization

As the financial landscape shifts towards digital representations of value, the necessity for a robust legal framework becomes increasingly apparent. These digital representations often operate in a complex environment where traditional laws intersect with innovative technologies. Establishing clear regulatory guidelines is essential for mitigating risks and fostering a stable environment for participants.

Compliance Challenges

Entities involved in the creation and distribution of digital representations face a myriad of compliance challenges. Jurisdictions vary significantly in their approach, leading to uncertainty for businesses. Navigating these regulations requires a deep understanding of local laws and international standards. Companies must account for aspects such as anti-money laundering (AML) measures and customer identification protocols.

Future Outlook

As the ecosystem matures, regulatory bodies are likely to adapt existing frameworks to encompass new technological developments. Increased collaboration between innovators and regulators can lead to the formulation of policies that not only safeguard participants but also encourage growth in this evolving sector. Staying informed of regulatory trends is crucial for ensuring sustainable operations in this digital age.

Future Trends in Market Efficiency

The upcoming shifts in economic dynamics signal a transformative phase for the financial landscape. Innovations are poised to reshape traditional methodologies, making transactions not only swifter but also more transparent. This evolution will likely lead to a redefined understanding of how value is exchanged in various sectors.

Technological Advancements Driving Change

Emerging technologies, particularly in digital frameworks, are set to revolutionize the financial ecosystem. Blockchain, artificial intelligence, and smart contracts are just a few tools that promise to streamline operations and foster trust among participants. The integration of these technologies is expected to diminish friction and create a more fluid exchange environment.

Regulatory Developments and their Impact

As new financial mechanisms evolve, regulatory bodies are also adapting to these changes. Striking a balance between innovation and consumer protection is essential. Improved regulations will likely promote better oversight while still encouraging growth, thus contributing to a more reliable and robust trading environment.

| Trend | Description |

|---|---|

| Decentralization | Shifting power dynamics towards distributed networks to promote equal opportunities. |

| Integration of AI | Employing advanced algorithms for predictive analytics and decision-making. |

| Focus on Sustainability | Increasing emphasis on ethical practices and environmentally friendly solutions. |

| Enhanced User Experience | Streamlining interfaces and improving accessibility for all participants. |

Q&A: Tokenizing Assets Could Boost Market Efficiency

What does it mean to tokenize assets, and how does it enhance market efficiency?

Tokenizing assets refers to the process of converting physical or intangible assets into digital tokens that can be traded on a blockchain. This process enhances market efficiency by increasing liquidity, as tokens can be easily bought, sold, or traded without the complexities associated with traditional asset transactions. Furthermore, tokenization allows for fractional ownership, enabling more investors to participate in markets that were previously accessible only to a select few, thereby broadening the investor base and improving market dynamics.

What types of assets can be tokenized, and what are some examples?

A wide variety of assets can be tokenized, including real estate, stocks, art, commodities, and even intellectual property. For example, a piece of real estate can be divided into multiple tokens, allowing several investors to own a fraction of the property, benefiting from its appreciation and rental income. Similarly, art pieces can be tokenized to enable shared ownership among art enthusiasts, democratizing access to investment in high-value items.

What are the potential risks associated with asset tokenization?

While tokenization offers many benefits, it also comes with certain risks. These include regulatory uncertainties, as governments are still figuring out how to regulate digital assets. Additionally, the technology surrounding blockchain and tokenization can be complex, potentially leading to security vulnerabilities if not properly implemented. Moreover, as tokenized assets are often traded on secondary markets, there may be concerns regarding market volatility and the liquidity of specific tokens.

How does tokenization affect traditional financial systems?

Tokenization has the potential to disrupt traditional financial systems by providing more efficient alternatives to conventional methods of asset trading and ownership transfer. By leveraging blockchain technology, transactions can become faster and more transparent, reducing the need for intermediaries such as brokers or banks. This can lower transaction costs and increase accessibility for a broader range of investors. However, it may also challenge existing financial institutions to adapt to new technologies and business models or risk becoming obsolete.

What role does blockchain technology play in the tokenization process?

Blockchain technology is central to the tokenization process as it provides a secure, transparent, and decentralized framework for recording transactions. When assets are tokenized, each token is represented on the blockchain, ensuring that ownership records are immutable and easily verifiable. This enhances trust among participants, as the underlying data cannot be altered without consensus from the network. Additionally, smart contracts—self-executing agreements with the terms directly written into code—can automate and streamline the processes involved in trading and transferring tokenized assets, further improving market efficiency.

How does tokenization of real-world assets improve financial market accessibility?

Tokenization of real-world assets allows fractional ownership, enabling a wider range of investors to access high-value assets such as real estate and financial instruments. By converting traditional assets into digital tokens, market participants can trade these assets more efficiently, reducing barriers to entry and democratizing access to investment opportunities.

What are the benefits of asset tokenization for traditionally illiquid assets?

Tokenization transforms traditional assets by making illiquid assets more liquid and easier to trade. Assets like real estate and high-value assets such as art or collectibles can be divided into smaller digital units, allowing investors to buy and sell fractional ownership. This process also enhances transparency, security, and efficiency in asset management.

How does blockchain technology support asset ownership and trading of tokenized assets?

Blockchain technology provides a secure and immutable record of ownership for tokenized assets, ensuring that ownership rights are protected. Using tokenized assets on a blockchain allows real-world assets to be tracked and traded in a decentralized manner, reducing the need for intermediaries and increasing efficiency in financial markets.

Which asset classes can be tokenized, and what are some use cases?

A wide range of assets can be tokenized, including tangible assets like real estate and commodities, as well as intangible assets such as intellectual property and financial instruments. Tokenization of assets enables new use cases, such as creating asset-backed tokens for lending, enabling fractional ownership of real-world assets, and enhancing liquidity for asset management.

What challenges exist when tokenizing real-world assets, and how can they be addressed?

Tokenizing real-world assets presents challenges such as regulatory compliance, legal ownership verification, and integration with existing financial markets. Ensuring proper asset management and establishing clear ownership rights are essential for the success of tokenized assets. Collaboration between financial institutions, regulators, and blockchain developers can help create a framework for secure and efficient tokenization of financial assets.