Exploring Non-Fungible Yearn and the NFY Token Potential

In today’s rapidly evolving financial landscape, innovative assets are capturing the attention of investors and enthusiasts alike. These distinctive items, characterized by their uniqueness and indivisibility, open up a new realm of possibilities within the investment sector. As traditional concepts of ownership are redefined, the emergence of these digital collectibles offers an exciting avenue for diversification and engagement.

The appeal of such assets lies not only in their rarity but also in their potential to revolutionize how value is perceived and traded. By leveraging blockchain technology, ownership can be authenticated, and provenance established, thus fostering trust among participants in a decentralized economy. As the market matures, understanding the dynamics and implications of these innovative investments becomes increasingly critical.

This exploration delves into the essential components surrounding these assets, examining the mechanisms that underpin their value and the factors that shape their market behavior. With a focus on the latest trends and developments, we aim to provide a comprehensive overview of this intriguing domain, helping readers navigate the complexities of this digital frontier.

Understanding Non-Fungible Yearn Concept

The concept revolves around unique digital assets that represent ownership within a specific ecosystem, creating a distinct value proposition in the realm of decentralized finance. This approach emphasizes individuality and scarcity, setting these assets apart from traditional fungible options that are interchangeable and uniform.

At its core, this notion integrates the principles of blockchain technology, enabling the verification of authenticity and ownership through a transparent ledger. Participants can engage in a unique marketplace that reflects their individual tastes and investment strategies, allowing a new level of personalization in asset management.

This innovative framework not only enhances user experience but also fosters community engagement, as individuals can trade, collect, or utilize their unique items in various contexts. Such a paradigm shift invites users to explore new avenues for value creation and economic interaction on digital platforms.

Furthermore, the ecosystem encourages collaboration and experimentation, as developers and collectors alike contribute to an ever-evolving landscape of digital representation. This dynamic environment challenges traditional concepts of value and ownership, making it a fascinating area for exploration and investment in the future.

Exploring the Role of NFY Tokens

The significance of specific digital assets has surged in recent years, particularly within decentralized ecosystems. Understanding their functionalities and implications provides valuable insights into their contributions for holders and the broader community. This section delves into the multifaceted roles of these unique digital assets and their impact on various stakeholders.

Functions and Utilities

- Governance Participation: Holders are often granted voting rights, enabling them to influence decisions regarding project developments and resource allocation.

- Staking Rewards: By participating in staking mechanisms, individuals can earn additional rewards, enhancing their overall asset value.

- Access to Services: Possession of these assets may unlock exclusive services, features, or platforms within the ecosystem.

Impact on Ecosystem

The roles of these digital assets extend beyond individual benefits, shaping the entire ecosystem’s dynamics:

- Incentivizing Participation: They motivate users to engage actively, which can lead to increased transaction volumes and community growth.

- Enhancing Liquidity: The presence of these assets can contribute to improved market liquidity, making it easier for participants to buy and sell.

- Fostering Innovation: As projects evolve, the unique characteristics of these assets can drive the creation of new solutions and enhance overall utility.

In summary, the role of these unique digital assets extends into governance, reward mechanisms, and broader implications within their respective ecosystems. Their significance cannot be overstated, as they serve as vital components driving engagement and innovation.

Market Trends Surrounding NFY Assets

The landscape of unique digital assets has witnessed considerable evolution, impacting investment behavior and community engagement. Investors and enthusiasts are increasingly drawn to these distinct assets, seeking opportunities that transcend traditional financial boundaries. Understanding current market tendencies can provide valuable guidance for stakeholders looking to navigate this dynamic environment.

Several prominent patterns have emerged in relation to these digital assets:

- Increased Demand: There has been a notable uptick in interest from collectors and investors alike. Limited availability and distinct characteristics contribute to a competitive marketplace.

- Integration with DeFi: The convergence of decentralized finance and unique assets has opened new avenues for earning and investment. Many are exploring innovative protocols that enhance the utility of their holdings.

- Community Engagement: The social aspect of these assets is a driving factor. Active communities are forming around various projects, fostering collaboration and collective growth.

Additionally, external influences play a significant role in shaping trends:

- Market Sentiment: The overall attitude of investors towards the broader cryptocurrency space often impacts the value and interest in unique assets.

- Technological Advancements: Innovations in blockchain technology continue to enhance the functionality and security of digital assets, attracting new users.

- Regulatory Frameworks: As governments establish clearer guidelines, confidence among investors may rise, leading to greater participation.

In summary, the market around these assets is vibrant and ever-changing. Stakeholders must remain vigilant, adapt to shifting trends, and actively engage with the community to maximize their potential in this exciting space.

Comparative Analysis with Other NFT Projects

This section aims to provide a thorough evaluation of the current project in relation to various other initiatives within the digital collectible sphere. By examining key characteristics, structure, and market positioning, we can better understand the unique attributes and potential competitive advantages of this initiative.

| Project | Type | Market Focus | Community Engagement | Revenue Model

|

|---|---|---|---|---|

| CryptoPunks | Collectibles | Art & Culture | Strong | Sales and Resales |

| Bored Ape Yacht Club | Collectibles | Membership & Community | Highly Interactive | Royalties and Merchandise |

| Decentraland | Virtual Reality | Gaming & Real Estate | Active | Land Sales and Events |

| Axie Infinity | Gaming | Blockchain Gaming | Highly Engaged | Play-to-Earn |

| Current Project | Dynamic Assets | Finance & Collectibles | Building | Utility-driven |

Through this comparison, it becomes evident how the examined project carves out its niche within the broader landscape. With a distinctive revenue approach and a focus on user engagement, it stands to offer significant value to its participants, setting it apart from other well-established platforms.

Investment Opportunities in Non-Fungible Yearn

The world of digital collectibles presents a multitude of avenues for astute investors looking to diversify their portfolios. By exploring unique assets that offer intrinsic value, individuals can capitalize on the growing demand for exclusive digital representations. This section delves into potential financial ventures associated with these distinct assets that hold both cultural and market significance.

One promising area involves acquiring rare digital items that not only showcase artistic merit but also possess an inherent scarcity that enhances their desirability. As collectors seek to own pieces that reflect their tastes, the market for such treasures continues to expand. This trend creates an opportunity for savvy investors to curate collections that are likely to appreciate over time.

Moreover, engaging with platforms that facilitate trade in these unique assets opens doors to liquidity options previously unavailable in traditional markets. By leveraging decentralized solutions, participants can experience seamless transactions while navigating the fluctuations of this evolving landscape. Early involvement in these innovative ecosystems may yield substantial returns as interest and user engagement escalate.

Additionally, collaborating with creators and artists can provide mutually beneficial arrangements. By establishing partnerships or acquiring limited releases, investors not only support the creative community but also secure positions within a market increasingly driven by social influence and branding. This allows for strategic movements within the realm of digital investments.

As the landscape matures, understanding market trends and buyer behavior will be crucial for maximizing returns in this vibrant sector. By attentively monitoring developments and adapting strategies, investors can harness the potential of exclusive digital assets. This promising frontier offers ample opportunities for those prepared to dive into its depths.

Future Developments for NFY Ecosystem

The forthcoming advancements within this innovative framework promise to enhance user experience, foster community engagement, and expand the utility of the associated digital assets. With a vision focused on continuous improvement, various strategies will be implemented to address both technological and user-centric challenges.

One of the primary focuses will be on the integration of advanced protocols that aim to optimize transaction efficiency. This could involve deploying layered solutions to mitigate congestion and reduce fees, ensuring smoother interactions for participants. Enhancements in security measures will also be prioritized to safeguard assets against potential threats, thereby bolstering user confidence.

Furthermore, collaborations with other decentralized platforms are anticipated, allowing for greater interoperability. Such partnerships could unlock new avenues for asset exchange and liquidity provision, enhancing the overall value proposition for users. Educational initiatives will also play a crucial role in familiarizing the community with emerging features and functionalities, encouraging more profound participation.

Finally, governance models are expected to evolve, empowering users to partake actively in decision-making processes. By incorporating feedback mechanisms and voting systems, the ecosystem could become more adaptable to the changing needs of its community, laying a solid foundation for sustainable growth.

Q&A: Non-fungible yearn and NFY token research

What is the Non-fungible Yearn (NFY) project, and how does it differ from traditional DeFi protocols?

The Non-fungible Yearn (NFY) project is an innovative approach to the decentralized finance (DeFi) ecosystem, focusing on the integration of non-fungible tokens (NFTs) with the functionalities of yield farming. Unlike traditional DeFi protocols that typically operate with fungible tokens, NFY leverages unique, non-fungible tokens that represent ownership in curated, specialized investment strategies. This creates an opportunity for users to engage with yield generation in a more personalized and distinctive way, as owners can trade or use these NFTs while simultaneously earning returns on their investments.

How can investors benefit from the NFY token and what are its main use cases?

Investors can benefit from the NFY token in several ways. Firstly, holders of NFY tokens can participate in governance decisions regarding the project’s future, allowing them to influence development and protocol upgrades. Additionally, the tokens can be staked to earn rewards, thus promoting passive income. Moreover, the NFTs within the NFY ecosystem can represent curated yield strategies, which can be traded or sold, providing flexibility and potential profit opportunities for investors looking to capitalize on unique investment approaches.

What risks should investors consider when engaging with the Non-fungible Yearn project and the NFY token?

Investing in the Non-fungible Yearn project and NFY token comes with various risks that potential investors should consider. The volatility of the cryptocurrency market can lead to significant price fluctuations. Additionally, the NFT space, while innovative, can be speculative and carries risks related to liquidity and potential devaluation. Furthermore, as NFY operates within the DeFi landscape, smart contract vulnerabilities are a concern, as they could lead to loss of funds. Therefore, thorough research and risk assessment are crucial before engaging with the NFY ecosystem.

Can you explain how the NFY token interacts with NFTs within the Non-fungible Yearn platform?

Within the Non-fungible Yearn platform, the NFY token acts as the underlying currency and governance token while facilitating interactions with NFTs representing unique yield strategies. Each NFT is specifically crafted to encapsulate distinct investment approaches, which are then linked to the NFY token for transaction purposes. Users can acquire NFTs using NFY tokens, participate in staking to earn additional NFY rewards, and trade their NFTs on secondary markets. This integration effectively merges the benefits of yield farming with the collectibility and uniqueness of NFTs, creating a dynamic ecosystem for users.

What does the future hold for Non-fungible Yearn and the NFY token in the rapidly evolving DeFi space?

The future of Non-fungible Yearn and the NFY token appears promising, particularly in the context of the rapidly evolving DeFi landscape. As more investors and users seek innovative ways to participate in yield farming and the NFT market, NFY’s unique proposition of combining these elements may attract significant interest. Developing partnerships with other DeFi projects, expanding the range of yield strategies available through NFTs, and enhancing user experiences will be crucial in maintaining relevance and competitiveness. Additionally, as regulatory clarity improves in the crypto space, NFY could see wider adoption and integration within established financial frameworks, paving the way for further innovation and growth opportunities.

What are Non-fungible Yearn and its significance in the DeFi space?

Non-fungible Yearn (NFY) refers to a decentralized finance (DeFi) project that aims to enhance yield farming by utilizing non-fungible tokens (NFTs) to represent unique yield-generating assets. Its significance lies in its capacity to bridge the gap betweenNFTs and traditional DeFi yield strategies, enabling users to own, trade, and leverage unique financial products. This innovation enhances liquidity and creates new investing opportunities, allowing users to diversify their portfolios in a novel way.

How does the NFY token work, and what benefits does it provide to its holders?

The NFY token is a governance and utility token for the Non-fungible Yearn ecosystem. Holders of NFY tokens can participate in decision-making processes regarding protocol upgrades, allocations of funds, and the direction of the project. Additionally, holding NFY may provide access to unique yield farming opportunities or staking rewards, incentivizing long-term investment and engagement with the platform. This approach not only empowers users but also fosters a community-driven ecosystem, enhancing overall transparency and security.

How does non-fungible yearn utilize the full potential of non-fungible tokens in the defi sector?

Non-fungible yearn is an ethereum-based defi platform that allows users to utilize the full potential of non-fungible tokens by integrating ERC-721 tokens into decentralized finance. By using NFT technology, non-fungible yearn enables unique token staking, governance rights, and liquidity pool participation on platforms like Uniswap.

What factors influence the price of non-fungible yearn, and how can investors analyze its market price?

The price of non-fungible yearn is affected by trading volume, circulating supply, and overall demand within the defi sector. Investors can analyze its market price by tracking real-time data on platforms like CoinMarketCap and Coingecko, reviewing historical price trends, and monitoring non-fungible yearn news for updates on ecosystem developments.

How does the non-fungible yearn platform handle staked tokens, and what role do they play in governance?

On the non-fungible yearn platform, staked tokens provide users with governance rights, allowing them to participate in decision-making processes. Users who stake their tokens may also earn rewards from liquidity pools, and unstaking can be done based on platform conditions and liquidity requirements.

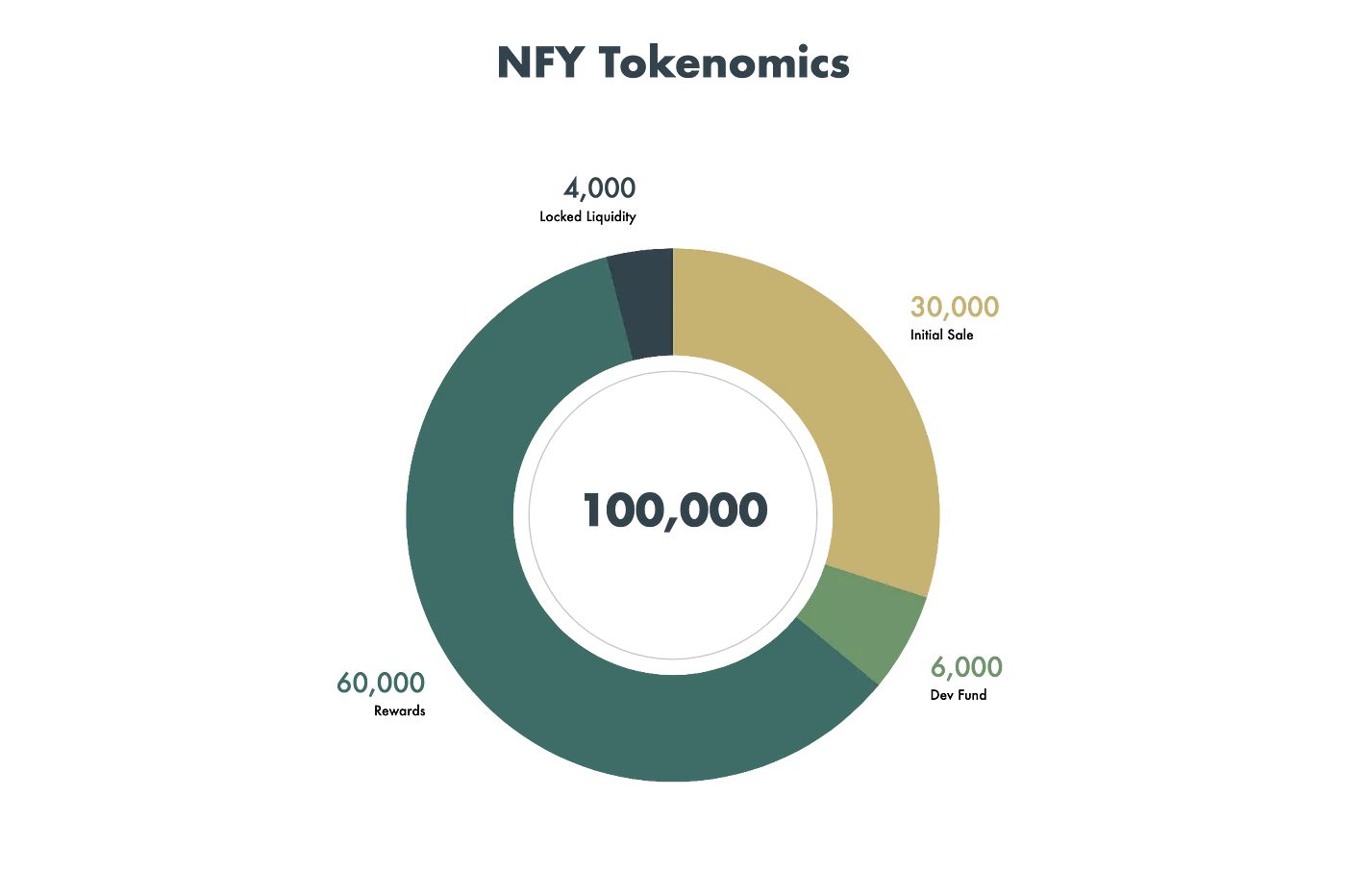

What is the total supply and circulating supply of non-fungible yearn, and how do they impact the market cap?

The total supply of non-fungible yearn represents the maximum supply of tokens that will ever exist, while the circulating supply reflects the number of tokens actively available in the market. These factors directly impact the market cap, which is calculated by multiplying the market price by the circulating supply.

Where can users buy non-fungible yearn, and how can they store it securely?

Users can buy non-fungible yearn on decentralized exchanges like Uniswap, where it is traded against cryptocurrencies such as ethereum and bitcoin. To store it securely, users should use a compatible crypto wallet that supports ERC-721 tokens, ensuring the protection of their wallet address and private keys.