Exploring Ripplenet the Decentralized Network of Banks

In a world where economic transactions are increasingly digitized, the pursuit of a more efficient, transparent, and accessible financial system has never been more pertinent. This innovative paradigm seeks to reimagine traditional methodologies, offering seamless connectivity among various entities. By addressing the limitations of conventional structures, this approach lays the groundwork for a transformative shift in how individuals and institutions engage in monetary exchanges.

The essence of this new ecosystem lies in its ability to facilitate real-time interactions across borders, eliminating the delays and complexities that often plague existing systems. Leveraging cutting-edge technology, it fosters an environment where trust and security are paramount. Participants can engage with one another effortlessly, forging a path toward a more inclusive economic landscape.

Emphasizing collaboration over competition, this conceptual framework opens channels for diverse stakeholders to participate in a shared vision of financial fluidity. By integrating innovative solutions, it not only enhances operational efficiency but also empowers users with greater control over their assets. Ultimately, this initiative represents a significant leap forward in redefining financial relationships within a global context.

Understanding the Basics of Ripplenet

This section aims to clarify the fundamental aspects of a transformative financial ecosystem designed to enhance cross-border transactions. It focuses on the principles and mechanisms that facilitate quick and efficient transfers, catering to the needs of various entities engaged in global commerce.

At its core, the system is built to streamline interbank communication, allowing institutions to execute transactions in real-time. By leveraging innovative technology, it establishes a seamless flow of information and funds, reducing the complexities associated with traditional methods.

The framework operates on a unique consensus model that prioritizes reliability and transparency. Each participant contributes to the verification process, ensuring that all exchanges are secure and verifiable, which bolsters trust among users.

Moreover, the architecture employs advanced protocols that allow for instant settlement, minimizing delays that often plague conventional mechanisms. This expedited process not only enhances liquidity but also provides financial players with a competitive edge in an increasingly interconnected marketplace.

Overall, grasping these essential elements enables a deeper comprehension of how this modern system addresses the challenges of the current financial landscape while paving the way for future innovations in international transactions.

Key Features of Decentralized Banking

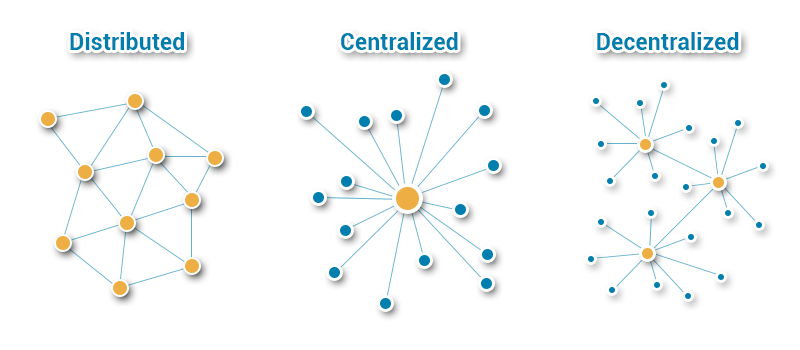

The modern financial landscape has evolved, introducing a dynamic framework that redefines traditional concepts. This innovative approach emphasizes autonomy, transparency, and enhanced security. By removing intermediaries, users gain greater control over their assets and transactions, fostering a more inclusive financial environment.

Enhanced Security and Privacy

One of the most significant advantages of this innovative system is the robust security measures it employs. Utilizing advanced cryptographic techniques, transactions are securely verified and recorded on an immutable ledger. This ensures that user data remains confidential, mitigating the risks of fraud and unauthorized access while fostering trust among participants.

Accessibility and Inclusivity

This financial model offers unprecedented accessibility to individuals who may have been excluded from conventional services. By leveraging internet-based platforms, even those in remote areas can engage in financial activities. This inclusivity opens up opportunities for economic participation, enabling users to manage their finances without reliance on traditional institutions.

The Role of Blockchain Technology

Blockchain technology serves as the backbone of innovative financial systems, enabling secure and efficient transactions across a variety of platforms. This transformative approach provides a reliable way to store and verify data, fostering trust among participants without the need for central authorities. By utilizing distributed ledgers, parties can engage in transactions with enhanced transparency and accountability.

Key Features of Blockchain

- Decentralization: Eliminates the reliance on a single entity, thus reducing the risk of failures and corruption.

- Transparency: All transactions are recorded on a public ledger, allowing participants to trace information easily.

- Immutability: Once data is recorded, it cannot be altered or deleted, ensuring the integrity of the information.

- Security: Advanced cryptographic techniques safeguard sensitive data, making unauthorized access extremely difficult.

Implications for Financial Services

- Enhanced Efficiency: Streamlined processes reduce the time and cost associated with transactions.

- Increased Accessibility: Broader participation from various stakeholders encourages financial inclusion.

- Innovative Solutions: New applications such as smart contracts offer automated and self-executing agreements.

- Improved Customer Experience: Faster transactions and lower fees lead to greater satisfaction among users.

In summary, the integration of blockchain technology not only transforms the operational landscape but also paves the way for a new era of secure and efficient financial interactions, reshaping the future of the industry.

Advantages of Using Ripplenet

Utilizing cutting-edge technology can bring numerous benefits to financial transactions and payment systems. Effective solutions have the potential to enhance efficiency, reduce costs, and foster a more seamless experience for all participants involved. The current innovations in the financial sector are setting the stage for transformative changes that can reshape the way institutions operate.

Efficiency and Speed

One of the primary advantages is the remarkable speed of transactions. The advanced infrastructure enables near-instantaneous transfers, allowing for rapid settlement of payments. This feature significantly decreases the time it takes to complete financial exchanges, which is beneficial for both businesses and consumers.

Cost Reduction

Moreover, the implementation of this innovative system leads to substantial cost savings. By streamlining processes and minimizing the need for intermediaries, participants experience reduced fees associated with traditional methods. This efficiency translates into enhanced profitability and a more competitive edge within the market.

Comparison with Traditional Banking Systems

The traditional financial systems have long served as the backbone of economic activities, facilitating transactions and managing monetary resources. However, these institutions often exhibit characteristics that can limit efficiency, accessibility, and innovation. In contrast, newer platforms aim to address these shortcomings by leveraging cutting-edge technology to streamline processes and enhance user experiences.

One of the most significant differences between established financial institutions and emerging alternatives lies in the speed of transactions. Conventional systems frequently involve lengthy processing times due to bureaucratic procedures, which can lead to delays and increased costs. On the other hand, modern solutions often provide near-instantaneous transfer capabilities, significantly reducing the time required for transactions to settle.

Moreover, the level of accessibility represents another area of divergence. Traditional institutions may impose stringent requirements for account opening and service utilization, which can alienate certain demographics. In contrast, newer approaches often prioritize inclusivity, allowing broader access to a variety of users, regardless of their financial background.

Security is also a key factor in this comparison. While conventional methods have employed established security measures for decades, the rise of advanced cryptographic techniques offers enhanced protection against fraud and cyber threats in modern platforms. This evolution in security features helps build trust among users who may be cautious of adopting innovative solutions.

Lastly, the cost structures associated with these systems can vary significantly. Traditional finance often entails various fees for services rendered, which can accumulate over time. Emerging alternatives typically aim to reduce these costs by minimizing overhead and streamlining operations, thus providing consumers with more favorable terms.

Future Prospects of Decentralized Finance

The landscape of financial services is undergoing a profound transformation, driven by innovative technologies that are reshaping traditional models. As more individuals and enterprises seek alternatives to conventional systems, the emergence of a new framework centered around self-sovereignty acquires momentum. This evolution not only challenges established practices but also opens avenues for broader accessibility and enhanced efficiency within economic interactions.

Key Trends Influencing the Evolution

Several trends are poised to shape the trajectory of this financial paradigm. Advancements in technology, regulatory discussions, and evolving consumer expectations play crucial roles in this evolution. Below are some of the primary trends:

| Trend | Description |

|---|---|

| Increased Adoption | More users are embracing alternative financial solutions, leading to a growth in participation. |

| Regulatory Frameworks | Governments and authorities are beginning to establish guidelines to provide clarity and security in transactions. |

| Interoperability Solutions | Technological advancements are aimed at connecting various systems for seamless exchanges. |

| User-Friendly Platforms | Companies are focusing on building intuitive interfaces that cater to a broader audience. |

Potential Challenges and Opportunities

While the advancements present significant opportunities, challenges also exist. Security concerns, evolving regulations, and the need for consumer education are critical hurdles that need addressing. However, these challenges can drive innovation, leading to enhanced security measures and robust frameworks. As financial systems continue to adapt and evolve, collaboration among technology providers, policymakers, and users will be vital in realizing the full potential of this promising landscape.

Q&A: RippleNet the Decentralized network of banks

How do banks use ripple for cross-border payments?

Banks use ripple for cross-border payments by leveraging ripplenet, a decentralized network that enables fast and cost-effective international transactions. Ripplenet allows banks worldwide to send and receive payments in real-time without relying on traditional financial intermediaries. By using xrp as a bridge currency, banks can reduce liquidity costs and settlement times, making cross-border payments more efficient.

What are the benefits of ripplenet for banks and financial institutions?

The benefits of ripplenet for banks and financial institutions include faster transaction speeds, lower costs, and improved transparency in international payments. Ripplenet provides a global payment network that connects banks worldwide and enables seamless transfers of value using xrp as a digital asset. The network uses blockchain technology to ensure security and reduce reliance on correspondent banking relationships.

How does ripplenet work as a decentralized network for global payments?

Ripplenet works as a decentralized network for global payments by enabling direct transactions between banks and payment providers without the need for intermediaries. The network uses blockchain technology to facilitate secure and instant cross-border payments. Ripplenet offers on-demand liquidity through xrp, allowing banks to settle transactions without maintaining pre-funded accounts in multiple currencies.

What role does xrp play in the ripplenet network?

Xrp is the native token of the ripplenet network and plays a crucial role in facilitating cross-border payments. Xrp allows financial institutions to bridge different fiat currencies, reducing transaction costs and settlement times. The xrp cryptocurrency also provides liquidity within the ripplenet ecosystem, making it easier for banks and payment providers to execute global transactions efficiently.

What is the future of ripplenet and its impact on banks and payment providers?

The future of ripplenet is focused on expanding its adoption among banks and payment providers worldwide. Ripplenet has the potential to revolutionize how banks handle cross-border transactions by offering a more efficient alternative to traditional financial systems. With the development of central bank digital currencies, ripplenet is being used to enhance payment solutions and improve financial inclusion across different regions.

How does the xrp ledger support cross-border payment solutions?

The xrp ledger is a blockchain network designed to facilitate cross-border payment solutions by enabling fast and cost-effective transactions. Ripple labs developed the xrp ledger to provide financial institutions worldwide with a more efficient alternative to traditional payment networks. The xrp ledger ensures that transactions are secure and settled almost instantly, making it an attractive solution for banks and payment providers looking to improve international payment processes.

How do banks and financial institutions use xrp as a bridge currency?

Banks and financial institutions use xrp as a bridge currency to facilitate international payment transactions by converting different digital currencies quickly and efficiently. Using xrp as a bridge currency reduces transaction costs and eliminates the need for pre-funded accounts in multiple countries. This allows banks and other financial institutions to enhance liquidity and improve cross-border payment processes within the ripple network.

What are the key components of ripplenet that enable banks to send international payments efficiently?

The key components of ripplenet that enable banks to send international payments efficiently include xrp as a bridge currency, the xrp ledger for secure and fast transactions, and a global network of financial institutions. Ripplenet also offers solutions such as on-demand liquidity, which allows banks to settle transactions in real-time without requiring large reserves of fiat currency. This network and xrp work together to make international payment processes faster and more cost-effective.

How does ripplenet help financial institutions worldwide with cross-border payments?

Ripplenet helps financial institutions worldwide by providing a decentralized network that streamlines cross-border payment processes. Ripplenet enables banks to offer faster, more transparent, and cost-effective international payment services compared to traditional financial systems. By utilizing xrp as a digital asset, ripplenet reduces the reliance on pre-funded nostro accounts and minimizes transaction fees, making it easier for banks and payment providers to facilitate global payment transactions.

What are some of the regulatory challenges ripplenet faces in global financial markets?

Ripplenet faces regulatory challenges in global financial markets due to ongoing discussions about the classification of xrp as a digital asset. Financial institutions worldwide must comply with various regulations when using digital currencies, and the legal status of xrp has been a subject of debate. Despite these challenges, ripplenet is becoming a widely adopted solution for banks and payment providers looking to modernize their cross-border payment systems while ensuring compliance with financial regulations.