Exploring the Benefits of DeFi Staking with Proof of Stake Coins

In the realm of cryptocurrencies, many individuals are on the hunt for innovative methods to enhance their investments. A noteworthy avenue that has emerged is centered around earning rewards through various platforms, allowing participants to put their digital holdings to work while simultaneously contributing to network security and efficiency. This lucrative approach appeals to both seasoned investors and newcomers alike, providing a pathway toward diversified income streams.

As the landscape evolves, an array of digital assets has gained prominence, each offering unique mechanisms for generating rewards. Understanding how these mechanisms work can empower individuals to make informed decisions regarding their portfolios. By delving into different options and their underlying technologies, investors can uncover promising opportunities that align with their objectives.

Moreover, as the popularity of these financial strategies continues to rise, it’s essential to examine the various contenders in this space. Each asset showcases distinct features and potential returns, inviting scrutiny and comparison. In this investigation, we’ll highlight some noteworthy alternatives that stand out for their innovative protocols and community-driven initiatives, paving the way for a rewarding experience in the digital economy.

Understanding Decentralized Finance Staking

In recent years, digital finance has transformed the way individuals engage with financial services. One of the key mechanisms within this innovative landscape allows participants to earn rewards through their contributions to network security and operations. This approach not only encourages user involvement but also fosters a thriving ecosystem built on trust and collaboration.

This method offers advantages that appeal to both novice and experienced users. By locking up assets for a certain period, participants can receive returns based on the volume of assets held and the overall activity of the network. This creates an incentive for users to remain committed, promoting stability and ongoing development.

Moreover, this process significantly enhances the decentralization aspect. Unlike traditional financial systems, where central authorities dictate terms, this framework allows individuals to actively partake in governance and decision-making. Users can influence protocol adjustments and contribute to community initiatives, ensuring that their voices are heard in a rapidly evolving space.

As platforms continue to emerge, understanding the intricacies of this financial paradigm becomes essential for making informed decisions and maximizing potential gains.

How Proof of Stake Works

This section delves into the fundamental mechanisms behind a type of consensus algorithm that aims to secure networks and validate transactions. It operates differently from traditional methods, focusing on the ownership of assets rather than computational power to determine who gets to add new blocks to the blockchain.

The central concept involves participants who hold a certain amount of digital currency, granting them the right to validate new transactions. This approach makes the process more energy-efficient compared to its predecessor.

- Validators: Individuals or entities who hold a stake in the network. They are responsible for confirming transactions and creating new blocks.

- Selection Process: Instead of competing to solve complex mathematical problems, validators are chosen based on the amount of currency they hold and are willing to “lock up” as collateral.

- Rewards: Successful validators earn incentives for their contributions, typically in the form of additional tokens, which encourages ongoing participation.

In essence, the system is designed to promote security and stability while slashing energy consumption. As more participants join, the network becomes more resilient, paving the way for a decentralized ecosystem.

Advantages of Staking in DeFi

Putting your digital assets to work offers a range of benefits that can enhance your financial portfolio. By participating in these mechanisms, users can earn rewards, improve network security, and actively contribute to the ecosystem. This practice not only fosters community involvement but also provides a more engaging experience with one’s investments.

Potential for Passive Income

One of the most appealing aspects of this practice is the opportunity for passive earnings. Users can generate revenue on their holdings without needing to trade or manage assets actively. Rewards are often distributed regularly, creating a steady stream of income that can be reinvested or utilized for other purposes.

Enhanced Security and Network Participation

Engaging in this process significantly improves the security and reliability of the network. By locking assets, participants help maintain the integrity of the system, deter malicious activities, and assist in validating transactions. This not only strengthens the platform but also gives users a sense of ownership as they contribute to its growth and stability.

Top Performing Proof of Stake Coins

In the rapidly changing landscape of blockchain technology, certain cryptocurrencies built on the concept of consensus mechanisms have shown remarkable performance. These digital assets leverage a decentralized approach, allowing participants to earn rewards while contributing to the network’s security and efficiency.

Among these noteworthy contenders, a few stand out due to their robust frameworks, community support, and innovative use cases. By assessing their market behavior and underlying technology, investors can identify promising opportunities that align with their strategic interests.

Cardano (ADA) is one of the front-runners in this domain. Its unique layered architecture not only enhances scalability but also fosters sustainable development. The platform’s commitment to academic research and formal verification ensures high-quality growth.

Polkadot (DOT) represents another significant player. This multi-chain network facilitates interoperability among various blockchains, allowing seamless data and asset transfer. Its distinct governance model attracts a diverse range of developers and projects.

Tezos (XTZ) is celebrated for its self-amending protocol. This means that the system can evolve without requiring hard forks, offering stability and adaptability. The emphasis on on-chain governance empowers token holders to influence future upgrades.

Solana (SOL) has gained attention due to its exceptional speed and low transaction costs. The project utilizes a unique consensus mechanism that enables high throughput, making it ideal for decentralized applications and high-frequency trading.

Investors interested in diversifying their portfolios should consider these high-performing digital currencies. Each coin offers distinct advantages that cater to different market needs, setting the stage for potential capital appreciation and innovation within the blockchain ecosystem.

Risks Associated with DeFi Staking

The practice of earning rewards through participation in blockchain networks can present various vulnerabilities that investors should consider. Understanding these risks is essential for making informed decisions and protecting assets in this rapidly evolving landscape.

This type of investment comes with inherent uncertainties, ranging from technological flaws to economic instability. Below is a table outlining some of the primary risks involved:

| Risk Type | Description

|

|---|---|

| Smart Contract Vulnerabilities | Code errors or security flaws can lead to hacks or loss of funds. |

| Market Volatility | Significant fluctuations in asset prices may result in reduced returns or potential losses. |

| Liquidity Risks | Challenges in converting assets back into liquid form may cause delays and losses. |

| Regulatory Risks | Changes in laws or regulations can impact platforms and user rights. |

| Protocol Risks | Flaws in the underlying blockchain protocol could affect performance and security. |

Awareness of these factors is crucial for anyone considering involvement in this innovative sector, allowing for better risk assessment and management strategies.

Steps to Start Staking Today

Getting involved in earning rewards through decentralized networks can be an exciting venture. Whether you’re a seasoned investor or a newcomer, understanding how to participate effectively is crucial. Follow these simple steps to begin your journey into this promising financial landscape.

Step 1: Choose the Right Asset

Your first task is to select a suitable cryptocurrency that offers the ability to earn rewards through holding. Research various digital currencies, evaluating their performance, community support, and potential benefits.

Step 2: Set Up Your Wallet

Once you have chosen an asset, you need a secure wallet to store your digital tokens. There are different types of wallets, including hardware, software, and online wallets. Make sure to choose one that aligns with your security preferences and provides the necessary features.

Recommended Wallets

| Wallet Type | Pros | Cons |

|---|---|---|

| Hardware Wallet | High security, offline storage | Costly, less convenient |

| Software Wallet | User-friendly, quick access | Potential vulnerability, internet-dependent |

| Online Wallet | Easy to use, accessible anywhere | Less secure, relies on third-party |

Step 3: Join a Pool or Directly Participate

Depending on your choice, you may opt to join a reward pool or stake directly. Pools allow multiple investors to combine resources for better rewards, while direct participation could yield higher personal gains, albeit with more risk.

Step 4: Monitor and Optimize

After getting started, it is crucial to keep track of your assets and the overall market conditions. Regularly evaluate your strategy to ensure maximum benefits from your holdings.

Q&A: Defi staking proof of stake pos coins

What is DeFi staking and how does it work?

DeFi staking is a process where users lock up their cryptocurrency assets in a decentralized finance protocol to earn rewards or interest. This process typically involves depositing coins into a smart contract which helps secure the network and validate transactions. In return for staking your coins, you receive rewards, often in the form of additional tokens. The yield can vary based on factors like the specific protocol’s incentives, the amount you stake, and the duration of the staking period. By participating in staking, users contribute to the overall security and efficiency of the blockchain, while also earning passive income from their holdings.

What are some of the best Proof of Stake (PoS) coins to consider for staking?

When it comes to staking in the Proof of Stake (PoS) ecosystem, several coins stand out due to their popularity, stability, and potential returns. Some of the best PoS coins include Ethereum 2.0 (after its transition from PoW), Cardano (ADA), Polkadot (DOT), and Tezos (XTZ). Each of these coins has its unique features and community backing, making them attractive for stakers. For instance, Ethereum 2.0 enables users to earn rewards for securing the network, while Cardano focuses on scalability and sustainability. Before choosing a coin for staking, it’s essential to research the project’s fundamentals, the staking process, and the expected rewards to find the best fit for your investment strategy.

Are there risks involved in DeFi staking?

Yes, there are several risks associated with DeFi staking. First and foremost is the risk of smart contract vulnerabilities. Since DeFi protocols rely on code to execute transactions, any bugs or exploits in the smart contract can lead to loss of funds. Secondly, market volatility poses a risk; the value of the staked coins may drop significantly, impacting the overall returns. Additionally, there may be liquidity risks if you’re unable to withdraw your staked coins within a desired timeframe. Lastly, consider regulatory risks as governments may impose stricter regulations on DeFi activities. To mitigate these risks, it’s advisable to do thorough research on the protocol, understand the staking process, and only stake amounts you can afford to lose.

How do I start staking my crypto assets in DeFi?

To start staking your crypto assets in DeFi, follow these steps: First, choose a cryptocurrency that supports staking; popular options include Ethereum, Cardano, and Solana. Next, acquire the chosen cryptocurrency from an exchange and transfer it to a wallet that supports staking. Depending on the coin, you may have to select a specific staking platform or protocol. For example, you might use Ethereum 2.0’s Beacon Chain for ETH staking or a DeFi platform like Aave for stablecoin staking. Once your coins are in the wallet, follow the protocol’s instructions to stake your assets, setting parameters like the amount and duration. Finally, monitor your staked tokens to track your rewards, making adjustments as needed based on market conditions or personal financial goals.

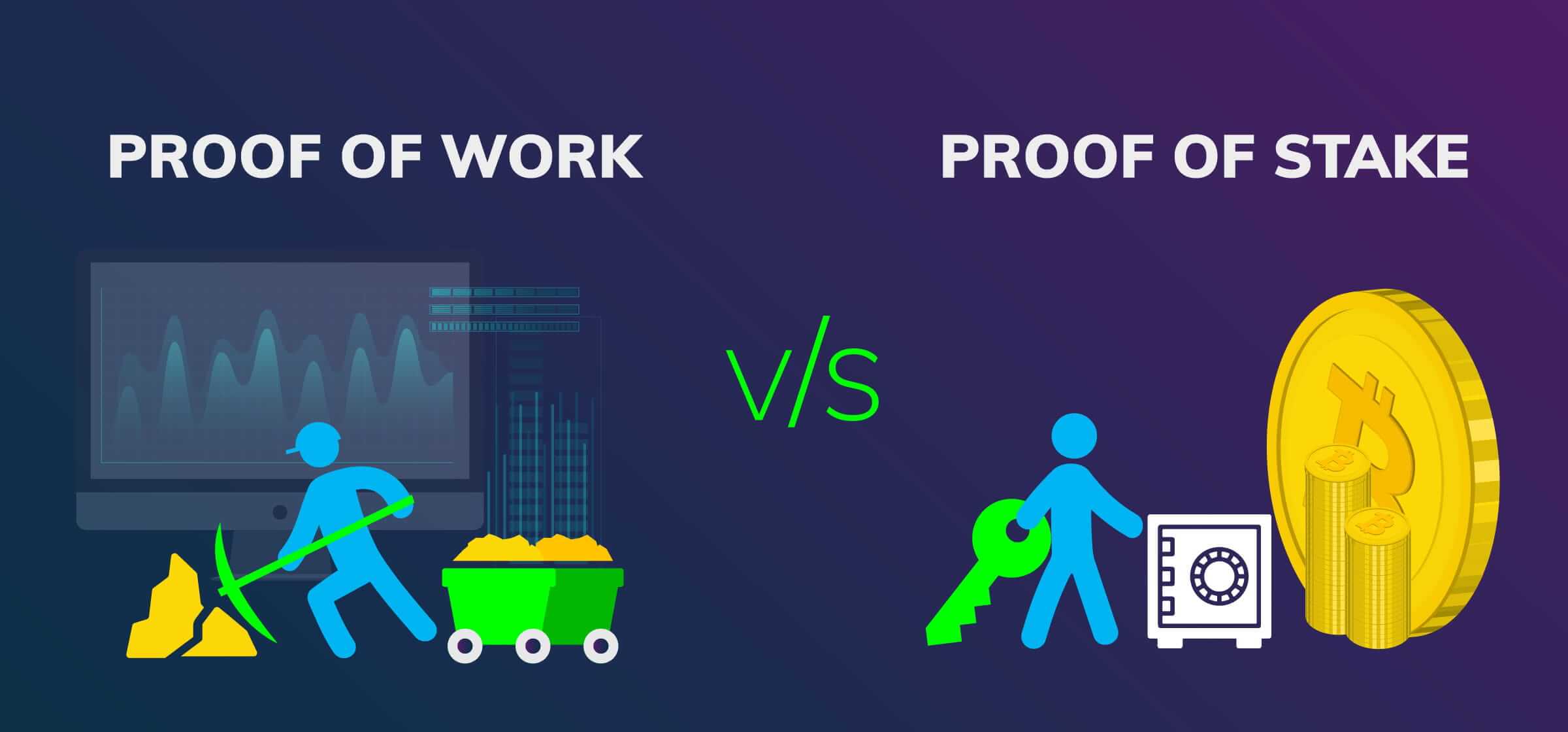

What are the differences between PoW and PoS staking?

The primary difference between Proof of Work (PoW) and Proof of Stake (PoS) lies in how they validate transactions and secure the blockchain. PoW, used by Bitcoin, relies on miners who solve complex mathematical problems to validate transactions, consuming significant computational power and energy. In contrast, PoS does not require mining; instead, validators are chosen to create new blocks based on the number of coins they hold and are willing to “stake.” This mechanism is more energy-efficient and can lead to faster transaction processing. Additionally, PoS encourages users to hold their assets long-term to earn rewards, aligning incentives and potentially reducing market volatility. Overall, while both systems aim to secure their networks, PoS offers a more sustainable and scalable approach compared to PoW.

What is crypto staking, and how does it work on a PoS blockchain?

Crypto staking involves locking up staked assets in a crypto wallet to support the operations of a PoS blockchain network. By doing so, users contribute to the network’s security and transaction validation, earning staking rewards in return. The process typically requires a cryptocurrency staking platform or a native token wallet to participate.

What are the benefits of staking cryptocurrencies compared to other investment options?

Staking provides a way to earn passive income by staking assets while helping maintain the PoS blockchain’s operations. Staking typically involves lower risk than trading and can generate consistent rewards. It is also a more energy-efficient alternative to proof-of-work mining, as it relies on the PoS consensus mechanism.

How do staking pools work, and why are they beneficial for users with fewer assets?

A staking pool allows multiple users to combine their staked assets to increase their chances of earning staking rewards. This is particularly beneficial for users who cannot meet the minimum staking requirements set by the blockchain platform. By participating in a staking pool, users can earn rewards proportionally to their contribution.

What is liquid staking, and how does it differ from traditional staking?

Liquid staking allows users to stake cryptocurrency while still having access to their staked assets through tokenized representations. Unlike traditional staking, where assets are locked, liquid staking introduces flexibility, enabling users to trade or use their tokens in various DeFi staking platforms while continuing to earn staking rewards.

How do staking rewards vary depending on the platform and network?

Staking rewards depend on factors such as the type of PoS blockchain, the number of staked assets, and the staking protocol. Platforms offering staking services may also charge fees that affect net rewards. Flexible staking options or platforms with high liquidity might offer slightly lower rewards compared to decentralized staking with fixed terms.