How Does Cryptocurrency Work

To grasp the nuances of this financial innovation, start with a foundational knowledge of blockchain technology. This decentralized ledger serves as a backbone, recording transactions securely and transparently across a network of computers, preventing tampering and ensuring trust.

Next, focus on wallet functionality. Unlike traditional banking, where accounts are maintained by institutions, users control their assets through private keys stored in digital wallets. Choosing between various wallet types–hot, cold, or hardware–depends on individual needs regarding convenience versus security.

It’s also crucial to learn about transaction processes. Miners validate transactions, adding them to a block on the blockchain for compensation in the form of new coins. This incentivizes maintaining network integrity while regulating supply. Understanding the implications of transaction fees, speed, and scalability can significantly affect user experience in trading and investment.

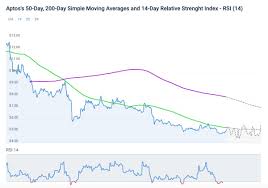

Explore market dynamics as well. Price movements are influenced by supply and demand, regulatory developments, and market sentiment, making active research and data analysis vital for informed trading decisions. Recognizing key indicators can provide insights into potential market shifts.

How Cryptocurrency Transactions Work in Practice

To execute a transaction using virtual currency, follow these steps:

- Initiation: The sender generates a transaction request using a digital wallet, entering the recipient’s address and the amount to transfer.

- Verification: This request is sent to a network of nodes. Nodes validate the transaction details by checking the sender’s balance and ensuring the transaction adheres to protocol rules.

- Broadcasting: Once verified, the transaction is broadcast to the network. It becomes visible to all nodes and miners.

- Mining Process: Miners compete to solve complex mathematical problems to add the transaction to a new block. The first miner to solve it creates a block containing the transaction data.

- Confirmation: Once a block is mined, it’s added to the blockchain. Other nodes confirm the validity of the new block, providing multiple confirmations for greater security.

- Completion: Once accepted by the majority of the network, the transaction is deemed complete. The recipient’s wallet reflects the new balance, and the transaction data is permanently recorded on the blockchain.

For security, ensure:

- Use multi-signature wallets to enhance protection.

- Verify recipient addresses meticulously; sending to an incorrect address can lead to irreversible loss.

- Enable transaction alerts to monitor account activity.

Transaction fees vary based on network congestion and block size. Higher fees can expedite processing times; hence, check current network conditions before sending.

Key Features of Blockchain Technology Behind Cryptocurrencies

Utilize the decentralized nature of blockchain, which ensures transactions are processed across multiple nodes. This eliminates reliance on a central authority and enhances transparency.

- Immutable Ledger: Each transaction is securely recorded in a block, which, once confirmed, cannot be altered. This ensures data integrity and builds trust among users.

- Consensus Mechanisms: Employ methods like Proof of Work or Proof of Stake to validate transactions. This prevents fraudulent activities and ensures participants agree on the ledger state.

- Smart Contracts: These self-executing contracts allow for automated processes when certain conditions are met, reducing the need for intermediaries and minimizing costs.

- Anonymity and Privacy: Blockchain can provide pseudonymous transactions, allowing users to maintain a degree of privacy while still ensuring accountability.

- Scalability Solutions: Explore layer two solutions and sharding to increase transaction throughput, making systems more adaptable to growing demand.

Focus on interoperability to enable different blockchains to communicate, enhancing functionality and expanding usage scenarios within various ecosystems.

- Regularly update protocol standards to enhance security and user experience.

- Incorporate robust encryption techniques to safeguard data against unauthorized access.

- Promote community-driven governance for democratic decision-making and enhanced user involvement.

Stay informed on regulations around blockchain technology to navigate potential legal complexities and ensure compliance.

Security Measures in Cryptocurrency Wallets and Exchanges

Implement two-factor authentication (2FA) for an additional layer of security on your accounts. This measure requires not only a password but also a second piece of information, often a code sent to your mobile device.

If utilizing hardware wallets, choose reputable brands and always purchase from official sources to avoid counterfeit products. This type of wallet stores assets offline, significantly reducing exposure to hacking attempts.

Regularly update wallet software and application versions to patch known vulnerabilities. Developers frequently release updates with important security enhancements.

| Security Measure | Description |

|---|---|

| Two-Factor Authentication (2FA) | Provides an extra verification step for account access. |

| Hardware Wallets | Store assets offline, minimizing hacking risk. |

| Software Updates | Patches vulnerabilities and enhances security features. |

Check for insurance policies on exchanges to safeguard against potential breaches. Many platforms offer insurance for client assets, providing an added assurance in case of cyberattacks.

Utilize strong, unique passwords for all accounts associated with digital assets. Consider using password managers to create and manage complex passwords.

Be cautious with public Wi-Fi networks. Avoid accessing sensitive accounts on unsecured networks, as they are susceptible to interception.

Monitor account activity regularly. Immediate reporting of unauthorized transactions can mitigate potential losses.

Consider using multisig wallets, requiring multiple private keys to authorize a transaction, which adds another verification layer before moving funds.

Educate yourself on phishing scams. Always verify email addresses and links before clicking, as attackers often attempt to steal credentials through deceptive communications.

Real-World Use Cases of Various Cryptocurrencies

Bitcoin stands as a premier choice for borderless transactions and wealth preservation. Enabling users to send funds across countries at low fees positions it as a key asset for individuals in areas with unstable currencies.

Ethereum serves as a backbone for decentralized applications (dApps) and smart contracts. Organizations leverage its capabilities to automate processes in finance, supply chain, and real estate, streamlining operations significantly.

Ripple excels in cross-border payments, providing financial institutions with a solution for fast and low-cost international transfers. With established partnerships, Ripple is transforming the way banks handle transactions.

Litecoin offers quicker transaction confirmation times, making it ideal for everyday purchases. Retailers accepting Litecoin can benefit from lower fees compared to traditional payment options, thus enhancing customer experience.

Chainlink enhances data accessibility through decentralized oracles, enabling smart contracts to interact with real-world data. This is pivotal for sectors like insurance and supply chain, where accurate real-time information is crucial.

Stablecoins like USDT and USDC maintain a peg to fiat currencies, providing a stable medium for trading and transactions. They are widely used in exchanges and decentralized finance platforms for liquidity and risk management.

Cardano focuses on sustainability and scalability, finding real-world applications in educational credentials and identity verification systems, enhancing trust and efficiency in these domains.

Monero prioritizes privacy, making it suitable for users seeking anonymity. This feature attracts individuals concerned about surveillance and data mining, leading to its adoption in various niche markets.

In agriculture, VeChain utilizes blockchain to enhance supply chain transparency, verifying product origins and ensuring quality control. This fosters trust between producers and consumers, adding value to agricultural products.

Non-fungible tokens (NFTs) created on Ethereum enable ownership of unique digital assets, leading to innovative applications in art and gaming. Artists utilize this technology to monetize their work directly, removing intermediaries.

Cosmos aims for interoperability between blockchains, allowing assets and data to move seamlessly across networks. This enhances collaboration and innovation in decentralized applications, benefiting developers and end-users alike.

Impact of Mining on Cryptocurrency Supply and Economic Models

Mining significantly influences supply mechanisms for virtual currencies, directly affecting their price and economic models. Each time a miner successfully validates a block, new coins enter circulation, which gradually diminishes over time through halving events. This process is paramount for implementing a controlled scarcity, akin to precious metals.

As rewards decrease, miners face increased operational costs, leading to a shift in economic dynamics. Miners might abandon unprofitable operations, resulting in lower network security and potential price volatility. Advanced analytics indicate that when mining difficulty adjusts, market reactions can either stabilize prices or cause sharp fluctuations based on miner participation.

Examining the interplay between mining costs and market conditions reveals crucial insights. It’s advisable to monitor energy prices and hardware efficiencies since they directly impact miners’ profitability, consequently shaping coin supply. A robust and adaptable mining model can sustain coin value, attracting investment and encouraging broader adoption.

Regulatory aspects further complicate the landscape. Regions with favorable mining regulations attract more participants, amplifying supply chains. Conversely, stringent restrictions can diminish mining activity and reduce available coins, leading to a bullish effect on prices.

Looking ahead, predictive models that incorporate mining patterns and market behavior will become increasingly important for investors and stakeholders, aiding in strategic decision-making. Balancing mining rewards and demand will remain a focal point for maintaining long-term viability in this asset class.

Regulatory Challenges Facing Cryptocurrency Adoption Globally

Prioritize cooperative frameworks among nations to streamline regulations around virtual currencies. Fragmented policies lead to confusion and inhibit growth, as companies face vastly different compliance requirements in various jurisdictions.

Establish rigorous anti-money laundering (AML) and know your customer (KYC) policies to build trust and legitimacy in the cryptocurrency market. Countries should implement standardized verification processes to mitigate risks associated with illicit activities.

Encourage dialogue between regulators and blockchain innovators to address concerns while fostering innovation. This partnership can aid in developing effective regulatory measures that don’t stifle technological advancement.

Monitor the impact of existing regulations on small and medium enterprises (SMEs) to ensure a level playing field. Overly burdensome regulations can disproportionately affect smaller firms, reducing competition and innovation.

Evaluate taxation policies to avoid deterring investment. Transparent and fair tax frameworks will encourage individuals and organizations to participate without fear of punitive measures.

Implement adaptable regulations that can evolve with technological advancements. Static regulations may fail to address new challenges and opportunities in the cryptocurrency industry.

Prioritize consumer protection and education to promote informed participation in this financial landscape. Regulatory bodies should provide resources and guidelines to help users navigate the risks associated with virtual assets.

Promote cross-border collaboration to tackle jurisdictional ambiguities. International agreements can help create a cohesive environment, reducing regulatory arbitrage and fostering growth.

Regular assessment of regulatory measures is necessary to ensure they remain relevant and effective. Engaging stakeholders and incorporating feedback can facilitate continuous improvement.

Q&A: How does cryptocurrency work

What is cryptocurrency in 2026, and how is it different from traditional currencies like the us dollar and other traditional currencies?

In 2026, cryptocurrency is a digital form of money that exists only on a blockchain network, so cryptocurrency is a digital record secured by cryptography rather than paper controlled by a central bank. Unlike traditional money such as the us dollar, a crypto asset can move globally in minutes without going through a bank, and you can send and receive payments directly between users. Cryptocurrency isn’t automatically better or worse than traditional currencies, but it offers new options for digital money, cross-border cryptocurrency payments and investment in cryptocurrency beyond the usual banking system.

How does blockchain works with cryptography to verify transactions when people send and receive crypto like bitcoin and ethereum?

In 2026, most cryptocurrencies like bitcoin and ethereum rely on using blockchain technology and strong cryptography to verify transactions without a central authority. Every crypto transaction is grouped into blocks that are linked together, creating a cryptocurrency blockchain where each block’s hash depends on the previous one. Nodes in the network check digital signatures and confirm that the sender has enough cryptocurrency units before they send and receive funds, so the system can securely record cryptocurrency transactions on a public blockchain. This design makes it very difficult to alter past data, which is why many cryptocurrency networks are seen as trustless compared to traditional money systems.

How do people buy cryptocurrency and sell cryptocurrency on a cryptocurrency exchange or crypto exchange in 2026?

By 2026, most newcomers use many cryptocurrency exchanges where they can buy and sell digital currencies with bank transfers, cards or stablecoins. On a modern cryptocurrency exchange or crypto exchange, you open an account, complete verification, deposit funds and then trade cryptocurrencies like bitcoin and ethereum using simple buy and sell orders. These platforms make cryptocurrency trading feel similar to stock trading, but fees, withdrawal limits and the list of types of cryptocurrency can vary a lot between providers. Experienced users often move coins off the exchange into a crypto wallet for long-term storage, keeping only what they need for active crypto trading online.

What role does a crypto wallet play compared to an exchange when you store cryptocurrency and use cryptocurrency for everyday transactions?

In 2026, a crypto wallet is the main tool that lets you store your cryptocurrency safely and control your own keys, while a cryptocurrency exchange is more focused on trading volume and order matching. When you keep crypto on an exchange, the wallet provider or platform holds the keys for you, but with a personal wallet you store your private keys and can send and receive digital money without asking permission. Many users now combine a mobile crypto wallet for small daily crypto transactions with a more secure device or app to store your cryptocurrency for the long term. This approach gives you flexibility for everyday crypto payments while still protecting larger cryptocurrency funds from exchange hacks or outages.

What are the main types of cryptocurrency, and why are cryptocurrencies like bitcoin and ethereum still popular cryptocurrency choices in the crypto market?

In the 2026 crypto market, the main types of cryptocurrency include payment coins like bitcoin, smart-contract coins like ethereum, platform tokens and many niche tokens tied to specific projects. Cryptocurrencies like bitcoin remain a well-known cryptocurrency for people who see it as digital money or “store of value,” while the native cryptocurrency of the ethereum blockchain powers a huge blockchain platform for dapps and defi. Many newer projects issue a new cryptocurrency to support their own ecosystem, but bitcoin and ethereum still dominate market capitalization and trading volume. For most beginners, learning what cryptocurrency does in real use cases is more important than chasing every new cryptocurrency that appears.

How does cryptocurrency mining support a blockchain network in 2026, and why doesn’t it need a central bank like a bank?

In 2026, cryptocurrency mining (or other validation methods) lets a distributed group of computers secure a blockchain network without any single central bank making the rules. Miners or validators use cryptography and bitcoin and cryptocurrency technologies to confirm new blocks, proving that transactions follow the protocol and that no one is spending coins twice. Because each node keeps a copy of the blockchain data and agrees on valid blocks, the system can function more like many small record-keepers instead of one big bank. This design lets people use cryptocurrency across borders and time zones without relying on a traditional money issuer or a government-controlled ledger.

How can beginners in 2026 invest in cryptocurrency more like stocks while managing risk in their cryptocurrency investments?

In 2026, many beginners treat investment in cryptocurrency a bit like stocks, setting clear budgets and spreading funds across several crypto asset positions instead of chasing one coin. They learn how cryptocurrency trading works on exchanges, but they also remember that cryptocurrency prices can move faster than stocks and that crypto market swings can be extreme. A cautious plan might include only risking money you can afford to lose, using a crypto wallet you control for long-term holds, and avoiding complex products until you understand cryptocurrency explained in plain language. By treating crypto like a high-risk part of a broader portfolio, new investors can seek upside without putting all their savings into digital currencies.

How are businesses in 2026 starting to accept cryptocurrency as payment, and what should they know about whether cryptocurrency legal in their region?

By 2026, more online shops, freelancers and even some large brands accept cryptocurrency as payment, sometimes alongside traditional currencies. A merchant can use dedicated cryptocurrency tools or payment processors to accept cryptocurrency, automatically convert it to us dollar or another fiat, and record cryptocurrency payments for accounting. However, every business must check local rules, because in some places cryptocurrency legal status is clear while in others tax or reporting obligations are still evolving. Before adopting cryptocurrency as payment, companies need basic legal advice and a reliable crypto wallet or gateway so that cryptocurrency transactions fit safely into their normal financial operations.

How do cryptocurrency prices move on major networks, and what role do platforms like the ethereum blockchain play in the future of cryptocurrency by 2030?

In 2026, cryptocurrency prices change constantly based on supply, demand, news, regulation and overall sentiment in the crypto market. Platforms like the ethereum blockchain host thousands of dapps, tokens and defi protocols, so demand for their native cryptocurrency can rise when more people use those services. As other blockchain platform projects grow, competition may spread value across more coins, but bitcoin and ethereum still shape much of the market’s direction. Many analysts expect the future of cryptocurrency through 2030 to depend on whether real-world users keep choosing crypto and digital currencies for payments, savings and decentralized applications rather than just short-term speculation.

What should everyday users in 2026 know about safety when they use a crypto wallet and trade on cryptocurrency exchanges in the wider cryptocurrency market?

In 2026, anyone using crypto needs to treat security as a core habit: a crypto wallet with strong passwords and backups is as important as choosing the right cryptocurrency exchange. You should move long-term holdings into wallets where you control the keys, keep only limited funds on many cryptocurrency exchanges, and be cautious with links or apps that ask for access to your cryptocurrency blockchain accounts. Good practice includes learning how blockchain works at a basic level so you can spot fake websites, check addresses and avoid sending digital money to the wrong place. With these steps, cryptocurrency safe usage becomes much more realistic, and people can explore the world of bitcoin and cryptocurrency technologies with fewer unpleasant surprises.