How to Convert Satoshi to USD Easily

The world of digital currencies is rapidly evolving, offering a unique opportunity for individuals to engage with a new form of asset. As interest in these currencies grows, understanding their value in traditional monetary terms becomes essential. Many enthusiasts and investors seek tools that provide seamless transitions between various units of these innovative assets and conventional currencies. The rise of user-friendly platforms has made this process more accessible than ever.

In this context, individuals often find themselves navigating the complexities of pricing metrics and market fluctuations. With an array of factors influencing valuations, keeping track of the latest trends and conversions is more important than it has ever been. By utilizing straightforward methods to gauge worth, users can make informed decisions while minimizing uncertainty.

Ultimately, the ability to assess the monetary equivalent of digital currency units opens up new avenues for investment and usage. By harnessing available resources, anyone can become adept at translating values promptly and with confidence. Embracing this knowledge empowers users to participate more fully in the dynamic landscape of cryptocurrency.

Understanding Satoshi: The Smallest Bitcoin Unit

The world of digital currencies is intricate, with various components that contribute to its overall functionality. One of the fundamental aspects lies in the measurement of value within this ecosystem. The smallest unit plays a crucial role in enabling precise transactions and allowing users to engage in micro-transactions that were previously difficult with traditional currencies. This section delves into the importance of this minuscule denomination, its significance in the larger context of cryptocurrency, and how it integrates into everyday financial interactions.

Historical Context

The inception of this tiny unit traces back to the early days of the cryptocurrency revolution. As the technology evolved, so did the need for a mechanism that permitted users to engage in transactions of varying sizes. By dividing the primary currency into smaller parts, a new dimension of flexibility was created, catering to both large investments and minor purchases. This adaptability has made the digital currency more accessible to a broader audience, fostering its adoption around the globe.

Practical Use Cases

In practice, the minuscule denomination allows for numerous applications, from online tipping to purchasing low-cost goods and services. This flexibility has significant implications for merchants and users alike, promoting a decentralized and inclusive financial system. Businesses can cater to a range of consumer needs without being impeded by high transaction costs or limitations associated with conventional financial systems. As the market continues to mature, this smallest denomination remains an indispensable element, bridging gaps and enhancing the overall user experience.

How to Convert Satoshi to USD

Understanding the value relationship between digital currency fragments and traditional monetary units is essential for anyone engaging in the crypto space. The process of determining the worth of these smaller units can enhance trading decisions and investment strategies.

To begin, ascertain the current rate of the digital currency in question. This information is readily available on a variety of financial websites, cryptocurrency exchanges, and market tracking platforms. By identifying this value, you can then evaluate how many of the small units you possess.

Once you have the current rate and the amount of smaller units, the next step involves basic arithmetic calculations. Multiply the quantity by the market rate to achieve the total worth in traditional currency. This straightforward method ensures you obtain an accurate valuation of your holdings.

For those who prefer automation, numerous online tools and calculators are also available. These digital resources can save time and minimize the risk of human error, providing quick results with a simple input of values.

Lastly, it is advisable to stay updated with market fluctuations, as the values can change rapidly. Regularly monitoring the market helps in making informed decisions regarding your digital assets and their respective worth in conventional finances.

Top Tools for Cryptocurrency Conversion

In the rapidly evolving world of digital currencies, having access to reliable tools for assessing value is essential. A variety of platforms and applications exist that can facilitate the process of measuring worth, providing users with up-to-date pricing, historical data, and user-friendly interfaces.

Here are some excellent options for managing conversions:

- CoinMarketCap – A comprehensive platform offering real-time pricing for thousands of cryptocurrencies, alongside market cap information and trading volume.

- CoinGecko – Similar to CoinMarketCap, this tool allows users to track pricing trends, historical data, and provides insights into various coins.

- Blockchain.com Wallet – A secure wallet option that not only allows users to store their assets but also provides features to assess value in various currencies.

- CryptoCompare – This platform not only offers pricing tools but also enables users to compare different coins and their performances in real market conditions.

- Binance – One of the largest exchanges, providing users with tools to monitor real-time market prices, charts, and integration features for trading.

- CoinStats – An application enabling users to track their portfolios, monitor pricing, and connect with various exchanges for a consolidated view.

Utilizing these resources can significantly enhance one’s capacity to manage digital assets effectively, ensuring that individuals remain informed and make sound decisions based on current market dynamics.

Real-Time Market Analysis for Accuracy

Monitoring the fluctuations of digital currencies in real-time is essential for precise evaluations. By staying updated with the latest market trends and price shifts, investors can make informed decisions that reflect current values. This ongoing analysis provides insights into potential movements in the market, enabling individuals to react promptly to changes.

Several factors impact the valuation of cryptocurrencies, including trading volume, market sentiment, and external economic influences. Understanding these elements is crucial for anyone looking to gauge the financial landscape accurately. Below is a table summarizing key components that contribute to real-time evaluations:

| Factor | Impact on Value |

|---|---|

| Trading Volume | Higher volumes typically indicate stronger trends. |

| Market Sentiment | Positive sentiment can lead to price increases, while negative sentiment may cause declines. |

| News & Events | Major news can cause swift changes in pricing. |

| Technological Developments | Innovations may enhance trust and drive value upward. |

| Regulatory Changes | Laws can significantly impact financial markets. |

By analyzing these aspects regularly, individuals can refine their understanding of market dynamics, allowing for more strategic planning. This continuous assessment is a fundamental part of any investment approach in the volatile environment of cryptocurrencies.

Factors Influencing Bitcoin Value Fluctuations

The value of cryptocurrency can experience significant variations due to a multitude of interconnected elements. Understanding these driving forces is essential for anyone looking to navigate the volatile landscape of digital currencies.

Market demand plays a crucial role in determining the price, as interest from both retail and institutional investors can rapidly alter the balance. Speculation often leads to price surges or declines, with traders reacting to news and trends, creating a ripple effect throughout the market.

Regulatory changes also impact value, as government actions can foster or hinder the adoption of cryptocurrencies. Countries that embrace blockchain technology may see increased confidence, while heavy restrictions can lead to uncertainty and price drops.

Technological advancements represent another significant factor. Innovations that improve transaction speed or security can boost cryptocurrency attractiveness, thereby affecting its market performance. Conversely, security breaches or flaws can undermine trust and lead to declines in value.

Additionally, macroeconomic conditions, such as inflation rates or geopolitical events, can drive individuals towards or away from alternative assets. Economic instability often prompts investors to seek refuge in cryptocurrencies as a hedge, while economic growth may reduce interest in non-traditional investments.

Lastly, the supply dynamics inherent to cryptocurrencies, particularly those with capped limits, such as Bitcoin, can lead to scarcity-driven price movements as demand fluctuates against a fixed supply.

Common Mistakes in Crypto Conversions

When dealing with digital currency exchanges, there are several pitfalls that can lead to inaccurate outcomes. Users often overlook essential factors that may skew the results, leading to confusion and potential financial loss. Understanding these common errors can help individuals make informed decisions and navigate the crypto landscape more effectively.

Neglecting Real-Time Rates

One frequently encountered issue is relying on outdated exchange rates. The digital currency market is highly volatile, and prices can fluctuate dramatically within short periods. Users who fail to check the current rates may find themselves miscalculating their holdings or transactions, which can result in unaffordable discrepancies.

Ignoring Transaction Fees

Another significant oversight involves not accounting for fees associated with transactions. Each platform has its own fee structure, which can vary considerably. Neglecting to include these costs in calculations can lead to misleading estimations of value, ultimately affecting investment strategies and overall financial outcomes.

Q&A: Convert satoshi to USD

What is a Satoshi and how does it relate to Bitcoin?

A Satoshi is the smallest unit of Bitcoin, named after the pseudonymous creator of Bitcoin, Satoshi Nakamoto. One Bitcoin is divisible into 100 million Satoshis, making the Satoshi an essential unit for transactions when dealing with smaller amounts of Bitcoin. When converting Satoshis to USD, it is important to first determine the current value of Bitcoin, as the exchange rate dictates how many US dollars correspond to the Satoshis you have.

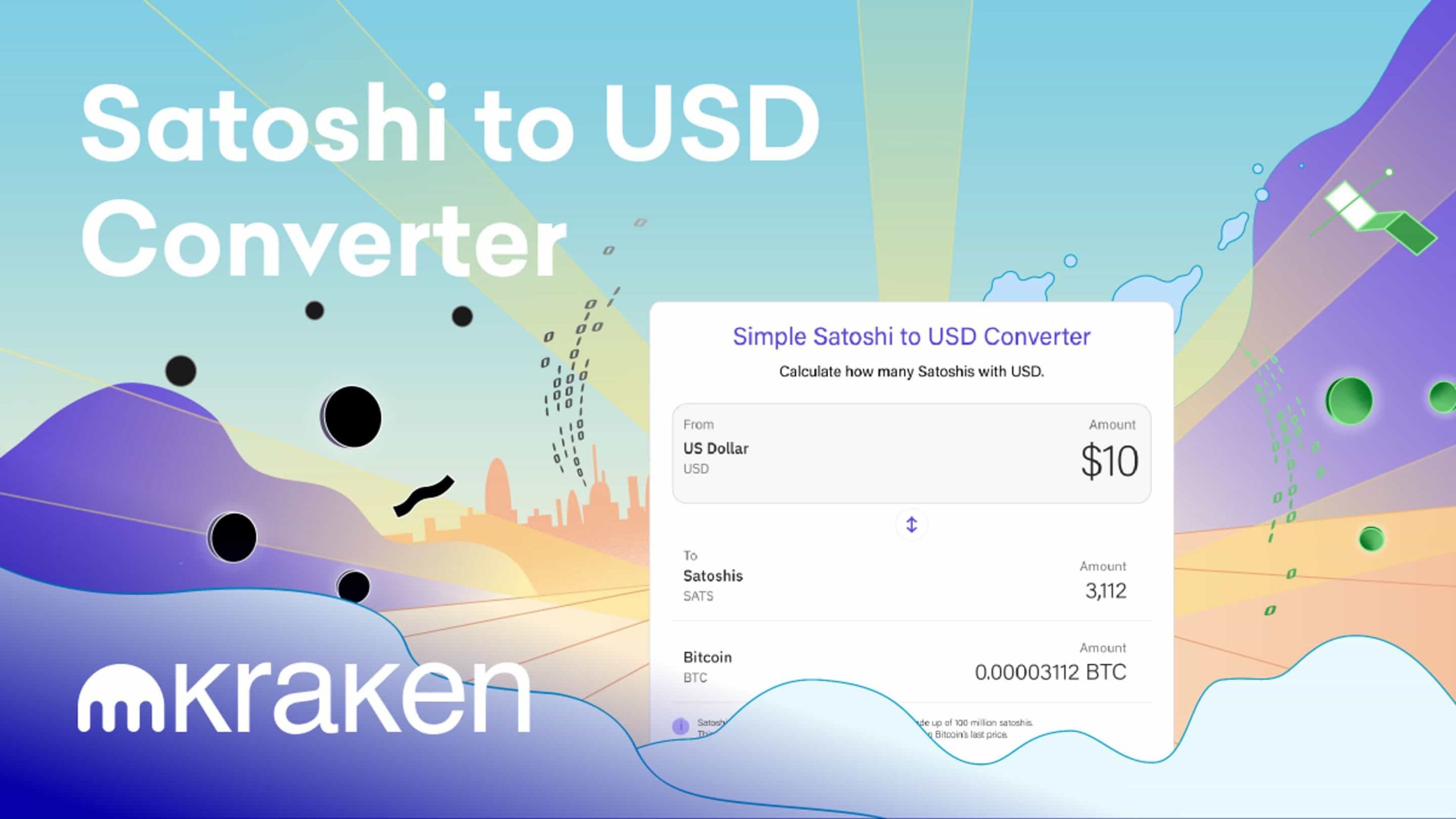

How can I accurately convert Satoshi to USD?

To accurately convert Satoshis to USD, you can use various online calculators that provide real-time conversion rates. Start by checking the current price of Bitcoin (in USD) on a reliable cryptocurrency exchange or financial website. Since 1 Bitcoin equals 100 million Satoshis, you can calculate the value by using the formula: (Current Bitcoin Price in USD / 100,000,000) * Number of Satoshis. This will give you the equivalent amount in USD. Remember that Bitcoin prices are volatile, so it’s advisable to check the exchange rate frequently to ensure accuracy.

Are there any tools or apps that simplify Satoshi to USD conversions?

Yes, there are numerous tools and apps available for converting Satoshis to USD easily. Many cryptocurrency exchanges, financial news websites, and mobile apps offer built-in calculators that automatically update with the latest Bitcoin prices. Some popular options include CoinMarketCap, Binance, and Coinbase, which provide user-friendly interfaces that allow you to input the number of Satoshis, and they will instantly show the USD equivalent. Additionally, some dedicated cryptocurrency conversion apps allow for quick conversions without navigating through extensive websites.

What factors can affect the conversion rate of Satoshis to USD?

The conversion rate of Satoshis to USD is primarily influenced by the market price of Bitcoin. Several factors can affect this price, including supply and demand dynamics, regulatory news, macroeconomic trends, and the overall sentiment in the cryptocurrency market. Events such as halving (when the reward for mining Bitcoin is cut in half) and significant technological advancements can also impact Bitcoin’s price. Additionally, global economic conditions and changes in investor confidence can lead to fluctuations in Bitcoin’s value, thereby affecting how much your Satoshis are worth in USD.

How much is 1 satoshi to usd?

1 satoshi to usd depends on the current exchange rate of bitcoin. The value of 1 satoshi is calculated as a fraction of 1 btc. You can use a satoshi to usd converter or check real-time exchange rates on crypto exchanges to find the exact value.

How can I convert sats to usd?

You can convert sats to usd by using a usd converter or a satoshi to usd calculator. Simply enter the amount of sats you want to convert, and the tool will provide the equivalent value in us dollar based on the current btc exchange rate.

What is the exchange rate of 1 satoshi in usd?

The exchange rate of 1 satoshi in usd fluctuates with the price of bitcoin. Since 1 btc equals 100 million satoshis, you can divide the current price of bitcoin by 100 million to get the usd price of 1 satoshi.

Can I convert satoshi to fiat currencies like eur, inr, aud, and gbp?

Yes, you can convert satoshi to fiat currencies like eur, inr, aud, and gbp using an exchange calculator or crypto exchanges that provide real-time exchange rates. The conversion rate changes every few seconds based on market fluctuations.

Where can I find historical price data for satoshi to usd conversion?

You can find historical price data for satoshi to usd conversion on crypto exchanges and financial websites that track bitcoin price history. These platforms provide conversion tables, price data for the last 24 hours, last 7 days, and last 30 days, helping users analyze trends.