Polygon Matic Price Forecast Blockchain Cryptocurrency

Polygon Matic Price Forecast Blockchain Cryptocurrency

As the world of cryptocurrency continues to evolve at an unprecedented pace, an emerging player has been garnering attention and gaining traction in the market. This article delves into the future prospects of Polygon Matic, exploring the potential trends and growth opportunities that lie ahead for this innovative blockchain project.

Within the realm of decentralized finance, Polygon Matic has rapidly become a prominent name. With its scalable infrastructure and groundbreaking solutions, it presents a compelling case for long-term viability and success. This analysis aims to provide insights into the factors that could influence the price trajectory of Polygon Matic, without providing specific predictions or recommendations.

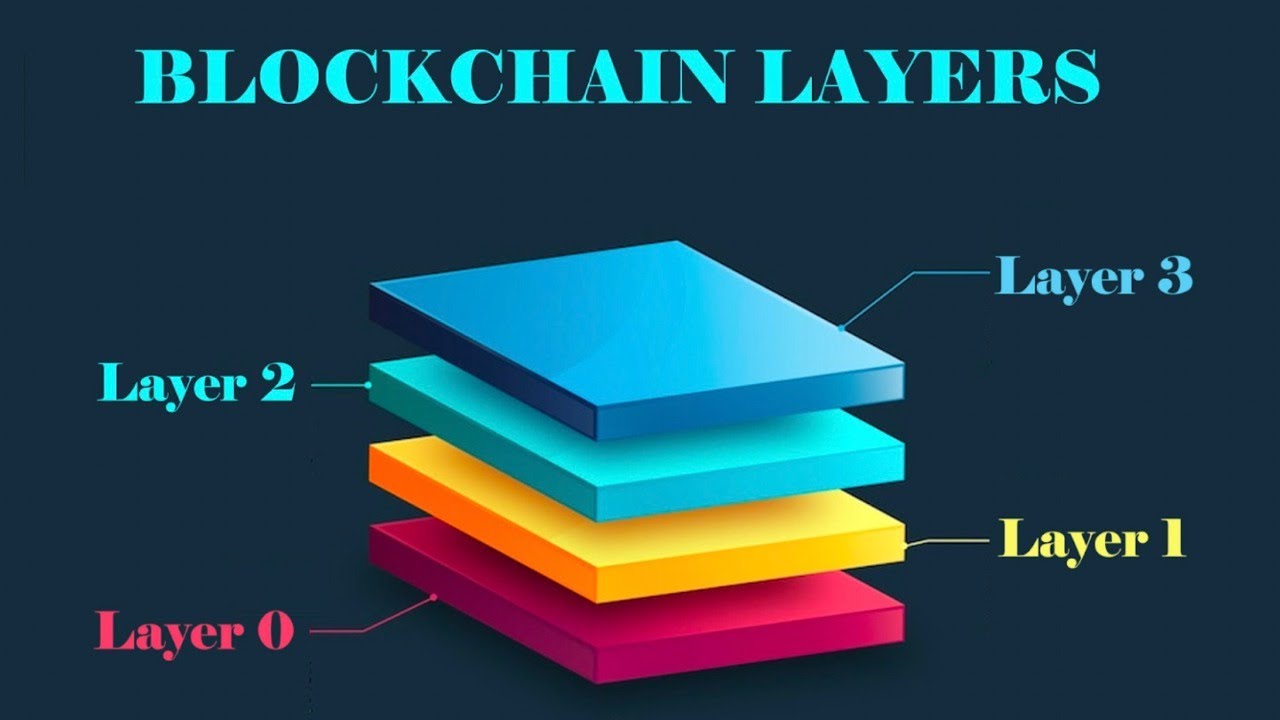

Underlying the evaluation of Polygon Matic’s future growth potential is a comprehensive understanding of its core technology and the market dynamics that shape the cryptocurrency ecosystem. By integrating Layer 2 scaling solutions and adopting a multi-chain framework, Polygon Matic has positioned itself as a transformative force within the industry.

Examining historical price patterns and comparing them with broader market trends can offer valuable insights into the potential growth trajectory of Polygon Matic. Additionally, analyzing the project’s strategic partnerships, community engagement, and development roadmap provides a holistic perspective on the factors that contribute to the project’s growth potential.

While this article does not aim to provide specific price predictions or financial advice, it serves as an informative resource for individuals interested in understanding the potential of Polygon Matic and the evolving landscape of the cryptocurrency market. By analyzing various industry factors and trends, we can gain a deeper understanding of the potential growth opportunities that lie ahead for Polygon Matic in the coming years.

Polygon Matic Price Projection

In this section, we will explore the potential future trajectory of Polygon Matic’s value. By examining various factors and market trends, we aim to provide an insightful analysis regarding the possible direction of Matic’s price movement.

As we delve into the dynamics and market conditions surrounding Polygon Matic, we will consider factors such as adoption rate, network utilization, and technological advancements. These elements play a key role in shaping the growth potential of Polygon Matic, and by extension, its price.

Furthermore, we will analyze the ecosystem surrounding Polygon Matic, including the partnerships, projects, and developments that contribute to its overall value proposition. By assessing the network’s collaborations and innovations, we can gain a better understanding of the potential impact on its future price trends.

While it’s essential to consider the broader market conditions and trends, we will also focus on factors specific to the Polygon Matic network itself. This includes analyzing the platform’s scalability, security measures, and community engagement, as these elements heavily influence investor sentiment and confidence in the long-term viability of Polygon Matic.

Additionally, we will explore the ever-evolving regulatory landscape and macroeconomic factors that could impact the price of cryptocurrencies, including Polygon Matic. Understanding the potential risks and opportunities presented by external factors is crucial in making an informed price prediction.

In conclusion, by thoroughly examining the various aspects discussed above, we aim to provide a comprehensive analysis of Polygon Matic’s price projection. It is important to note that price predictions in the cryptocurrency market are inherently speculative, and multiple variables can influence the outcome. Therefore, it is crucial to consider this analysis as an informative tool rather than an absolute prediction.

Analyzing Current Market Trends

The following section examines the present state of the market and identifies the prevailing trends and patterns that have emerged. By delving into the current market landscape, we gain valuable insights into the factors shaping the industry and the potential opportunities that lie ahead.

1. Market Volatility

The market for cryptocurrency and blockchain technology is renowned for its inherent volatility. It is crucial to analyze the current volatility levels to assess the risk factor associated with investments. Understanding the market volatility allows investors and enthusiasts to make informed decisions based on the anticipated price swings.

2. Adoption and Integration

An essential aspect of analyzing the current market trends is to evaluate the level of adoption and integration of the technology. This encompasses examining the number of businesses, organizations, and individuals actively utilizing and implementing blockchain solutions. Additionally, it involves exploring the integration of cryptocurrencies in various industries and sectors.

- Identification of key industries incorporating blockchain technology.

- Analysis of the impact of cryptocurrency integration.

- Evaluation of the level of mainstream acceptance.

3. Regulatory Landscape

Regulatory frameworks play a significant role in shaping the future of cryptocurrencies and blockchain technology. Analyzing the current regulatory landscape allows us to comprehend the level of governmental acceptance and the legal framework in place. This understanding helps predict the potential impact of regulations on the market.

- Assessment of regulations governing cryptocurrencies and blockchain.

- Identification of regions with favorable or restrictive policies.

- Prediction of future regulatory developments.

By examining these aspects of the current market trends, we gain a comprehensive understanding of the evolving cryptocurrency and blockchain landscape. This knowledge equips us with the insights needed to assess the potential growth opportunities and make informed decisions in the dynamic market environment.

Exploring the Growth Potential

In this section, we will delve into the possibilities for expansion and development of the Polygon Matic cryptocurrency, examining the various avenues that may drive its future growth. By exploring the potential areas of advancement, we can gain insight into the factors that may have an impact on the value and adoption of Polygon Matic.

One significant aspect to explore is the ecosystem surrounding Polygon Matic and how it can foster growth. This ecosystem comprises developers, applications, and projects that leverage the Polygon network to enhance their functionality and scalability. By analyzing the current state of the ecosystem and its growth potential, we can assess the opportunities for Polygon Matic to flourish in the future.

To further understand the growth potential, we will also examine the market trends and demand for blockchain solutions, particularly those related to scalability and cost-efficiency. As cryptocurrencies continue to gain mainstream recognition, there is a growing need for solutions that can handle high transaction volumes without compromising speed, security, and affordability. By positioning itself as a viable solution to these challenges, Polygon Matic stands to benefit from the overall growth in the blockchain market.

Moreover, the partnerships and collaborations formed by Polygon Matic will play a crucial role in its growth trajectory. By joining forces with established players in the industry, Polygon Matic can tap into their existing user base, resources, and expertise. These partnerships can not only enhance the visibility and credibility of Polygon Matic but also facilitate the integration of its technology into various sectors, further driving its growth potential.

- Diversification of use cases and applications can also be a key factor in exploring the growth potential of Polygon Matic. By expanding beyond its current applications and exploring new use cases, such as decentralized finance (DeFi), non-fungible tokens (NFTs), and gaming, Polygon Matic can attract a broader range of users and investors, thereby increasing its growth potential.

- Another aspect to consider is the regulatory landscape and its impact on the growth of Polygon Matic. As governments and regulatory bodies around the world continue to develop frameworks for cryptocurrencies, complying with these regulations can provide Polygon Matic with a competitive edge and instill confidence among potential users and investors.

Overall, by exploring the growth potential of Polygon Matic, we can gain valuable insights into the various factors that may influence its future trajectory. From the development of its ecosystem and market trends to strategic partnerships and diversification of use cases, these factors will undoubtedly shape the growth and success of Polygon Matic in the coming years.

Factors Influencing Polygon Matic’s Valuation

In the dynamic cryptocurrency market, various factors contribute to the valuation of Polygon Matic, establishing its position and determining the direction of price trends. This section explores some key elements that have a significant impact on the value of Polygon Matic, delving into its growth potential and market performance.

1. Network Adoption and Utilization

Wide-scale adoption of the Polygon Matic network by individuals, businesses, and decentralized applications (dApps) plays a crucial role in determining its price. The more extensively the network is utilized, the higher the demand for Matic tokens, which can positively influence its valuation. Factors such as transaction volume, user growth, and partnerships with prominent projects can contribute to increased adoption and utilization of the Polygon Matic network.

2. Technological Advancements and Scalability

The underlying technology of Polygon Matic and its ability to scale efficiently are key considerations for investors and market participants. Technological advancements that enhance the network’s performance, scalability, and security can attract more users, developers, and investors, ultimately impacting the price of Matic tokens. Upgrades, protocol improvements, and successful implementation of Layer 2 solutions can play a vital role in Polygon Matic’s valuation.

Furthermore, interoperability with other blockchains and integration with various DeFi protocols can extend Polygon Matic’s use cases and potentially contribute to its value.

3. Market Sentiment and Investor Confidence

Market sentiment and investor confidence within the cryptocurrency industry can significantly impact the price of Polygon Matic. Positive market sentiment, driven by factors such as regulatory clarity, institutional adoption, and positive media coverage, can instill confidence among investors, leading to increased demand and higher valuation for Polygon Matic. Conversely, negative sentiment and uncertainty can have a detrimental effect on its price.

It should be noted that the cryptocurrency market is highly volatile, and factors influencing Polygon Matic’s price can change rapidly. Therefore, conducting thorough research and staying informed about the market developments is essential for making well-informed investment decisions.

Expert Opinions and Speculations

In this section, we will explore the thoughts and speculations of industry experts and analysts regarding the potential future growth and trends related to the price movements of Polygon Matic cryptocurrency. While we won’t be making any specific predictions, we will examine the opinions of these professionals in order to provide insights into the potential trajectory of Polygon Matic.

The Perspective of Experts

When it comes to the future of Polygon Matic, experts have varying perspectives. Some are cautiously optimistic, highlighting the protocol’s scalability solutions and its potential to attract developers and users. They believe that as more projects choose to build on Polygon, the demand for Matic tokens may increase, leading to a positive price movement.

On the other hand, some experts express concerns about the highly competitive nature of the blockchain ecosystem and the potential for market saturation. They argue that while Polygon Matic may have promising technology, it might face challenges in establishing itself as a long-term player in the market.

Speculations and Factors

Speculations regarding Polygon Matic’s future price movements often revolve around factors such as market sentiment, adoption by large institutions, and regulatory developments. While these factors can have a significant impact on the cryptocurrency market as a whole, their specific influence on Polygon Matic remains uncertain.

Some analysts speculate that increased institutional adoption, such as investments from major financial entities or partnerships with well-known companies, could propel the price of Polygon Matic to new heights. Others argue that regulatory actions could have a negative impact on the growth of Polygon Matic if they introduce uncertainties or restrictions on the use of cryptocurrencies.

It’s important to note that these opinions and speculations are subject to change as the cryptocurrency market evolves and new information becomes available. Investors and traders should always conduct their own research and seek professional advice before making any investment decisions.

In conclusion, while it is impossible to determine the exact future price movement of Polygon Matic, considering expert opinions and speculations can provide valuable insights into the factors that could potentially influence its growth and trends in the coming years.

Future Potential for Investors

Exploring the untapped opportunities in the evolving landscape of digital assets, there lies a potential goldmine for investors seeking new avenues of growth and profitability. As the world of decentralized finance continues to expand and innovate, careful analysis and strategic investments hold the key to unlocking the future potential that lies ahead.

Embracing Technological Advancements

In this era of rapid technological advancements, investors have the unique opportunity to leverage cutting-edge tools and platforms that are revolutionizing the financial industry. By embracing blockchain technology, smart contracts, and decentralized applications, investors can tap into a world of unparalleled transparency, efficiency, and security in their investment endeavors. These innovations not only provide enhanced convenience but also create a level playing field for investors of all backgrounds.

Diversification and Risk Management

With the future potential in mind, it is essential for investors to diversify their portfolios and manage risks effectively. By allocating a portion of their investments to digital assets, investors can benefit from the growth potential of emerging technologies such as Polygon Matic and take advantage of the disruptive nature of decentralized finance. Alongside traditional investment vehicles, diversified portfolios present a balanced approach that can mitigate risks and maximize long-term gains.

As new trends and opportunities emerge within the digital asset space, staying informed and adapting to market dynamics become paramount. The future potential for investors lies in the ability to identify promising projects, evaluate their underlying fundamentals, and make informed investment decisions that align with their risk appetite and long-term objectives. By remaining agile and continuously researching the evolving landscape, investors can position themselves for success and capitalize on the growth potential that awaits.

Q&A: Polygon matic price prediction

What is Ethereum?

Ethereum is a decentralized blockchain network and cryptocurrency platform that enables the development and deployment of smart use polygon contracts and decentralized applications (DApps).

How does Ethereum utilize the concept of staking?

Ethereum employs a Proof of Stake (PoS) consensus mechanism, where participants (validators) stake their cryptocurrency holdings to validate transactions and secure the network, earning rewards in return.

What role does the Ethereum blockchain network play in the crypto ecosystem?

The Ethereum blockchain network serves as a foundation for various decentralized applications, smart polygon uses contracts, and tokens, making it a fundamental component of the broader cryptocurrency ecosystem.

How are transaction fees managed within the Ethereum network?

Transaction fees within the Ethereum network are determined by the network’s congestion and users’ willingness to pay fees to prioritize their transactions. These fees are typically denoted in Ethereum’s native cryptocurrency, Ether (ETH).

What developments or advancements occurred in the Ethereum ecosystem in 2021?

In 2021, Ethereum saw significant developments, including upgrades to its network, increased adoption of decentralized finance (DeFi) applications, and the rise of layer 2 scaling solutions such as Polygon (formerly Matic).

What is Polygon, and how does it relate to Ethereum?

Polygon is a layer 2 scaling solution for Ethereum that aims to improve transaction speed and reduce fees by offloading transactions from the Ethereum mainnet to its sidechains.

Who are Sandeep Nailwal and Anurag Arjun, and what contributions have they made to the Ethereum ecosystem?

Sandeep Nailwal and Anurag Arjun are co-founders of Polygon (Matic Network), a project focused on improving Ethereum’s scalability and usability through layer 2 scaling solutions.

What consensus mechanism does Ethereum use, and how does it differ from other blockchain networks?

Ethereum currently utilizes a Proof of Stake (PoS) consensus mechanism, where validators stake their Ether to secure the network and validate transactions, unlike Bitcoin’s Proof of Work (PoW) mechanism.

What advantages does Polygon offer in terms of transaction speed and fees compared to the Ethereum network?

Polygon provides faster transaction speeds and lower fees compared to the Ethereum mainnet by leveraging its sidechains and offering a scalable infrastructure for decentralized applications.

How can one buy Matic, Polygon’s native cryptocurrency, and what is its significance within the Polygon ecosystem?

Matic can be purchased from various cryptocurrency exchanges, and it serves as the native token of the Polygon network, used for transaction fees, governance, and other functions within the ecosystem.

What is Polygon, and how does it work in the crypto ecosystem?

Polygon is a layer 2 scaling solution for Ethereum, known for its high throughput and low transaction fees. It operates as an Ethereum-compatible blockchain network that aims to address scalability issues by providing sidechains and other scaling solutions.

How can one stake Matic, the native cryptocurrency of the Polygon network?

Users can stake their Matic tokens through various staking platforms or protocols supported by the Polygon ecosystem. By staking Matic, participants help secure the network and earn rewards in return.

What role does Matic play within the Polygon ecosystem?

Matic serves as the native cryptocurrency of the Polygon network, used for various purposes such as paying transaction fees, participating in network governance, and facilitating value transfer within the ecosystem.

What are some key features of Polygon 2.0?

Polygon 2.0 introduces improvements to the Polygon blockchain, including enhanced scalability, interoperability with other blockchains, improved security, and support for decentralized applications (DApps) and smart contracts.

How does Polygon differentiate itself from other blockchain networks?

Polygon distinguishes itself by offering Ethereum-compatible scaling solutions, low transaction fees, high throughput, and a vibrant ecosystem of decentralized applications and projects.

Who created the Matic Network, now known as Polygon?

The Matic Network, later rebranded as Polygon, was created by a team of developers led by Jaynti Kanani, Sandeep Nailwal, and Anurag Arjun in 2017.

What is the significance of staking Matic tokens within the Polygon network?

Staking Matic tokens helps secure the Polygon network, validate transactions, and maintain network consensus, while also allowing participants to earn rewards in the form of additional Matic tokens.

How does Polygon address network congestion and high fees commonly associated with blockchain transactions?

Polygon uses a modified Proof of Stake (PoS) consensus mechanism and employs layer 2 scaling solutions to improve transaction throughput and reduce fees, offering a more efficient and cost-effective alternative to the Ethereum mainnet.

What is the relationship between Polygon and Ethereum?

Polygon operates as a layer 2 scaling solution for Ethereum, providing interoperability and compatibility with the Ethereum blockchain while offering enhanced scalability and usability for decentralized applications and transactions.

What prompted the rebranding of the Matic Network to Polygon, and what changes were introduced along with the rebrand?

The rebranding of the Matic Network to Polygon aimed to reflect the project’s broader vision of becoming a multi-chain scaling solution for Ethereum and other blockchain networks. Along with the rebrand, Polygon introduced various upgrades and improvements to its protocol and ecosystem.