The Ultimate Guide to Understanding Compounds Ctokens

In a rapidly evolving digital landscape, new concepts emerge continuously, transforming the way individuals interact with various platforms. Among these developments lies a specific form of digital representation that has garnered attention from enthusiasts and investors alike. This intriguing method holds the potential to redefine financial transactions and community engagement, offering unique opportunities for users seeking to enhance their experiences.

Understanding this innovative asset is vital for those who wish to fully leverage its potential. Delving into various aspects reveals its underlying mechanisms, which contribute to a more streamlined and efficient process. By examining its characteristics, one can appreciate how it fosters interaction in decentralized networks, paving the way for more seamless exchanges and collaborative efforts.

Moreover, the advantages presented by this digital instrument are noteworthy. Enhanced security features, reduced transaction costs, and increased accessibility highlight its appeal. As users navigate this evolving terrain, recognizing the implications of adopting such solutions can lead to informed decisions and greater participation in an increasingly interconnected global marketplace.

Understanding Ctokens and Their Functionality

At the core of innovative financial solutions lies a mechanism designed to enhance transactional efficiency and streamline various processes within digital ecosystems. This approach not only simplifies exchanges but also introduces unique features that foster greater engagement among users. By grasping the underlying principles, one can appreciate how this tool shapes interactions in modern finance.

Core Mechanics

This mechanism operates by creating a digital representation of value, enabling seamless transactions across diverse platforms. It facilitates interactions by providing users with a secure method to engage in exchanges, while also maintaining transparency. Additionally, these representations often incorporate advanced protocols that encourage efficient management and tracking of assets.

Applications and Use Cases

The versatility of this system allows it to be utilized in various domains, from decentralized finance to loyalty programs. In these contexts, participants can benefit from enhanced liquidity, as well as increased accessibility to multiple services. Moreover, the ability to leverage such a system empowers users to make informed decisions, ultimately fostering a vibrant economic landscape.

Key Advantages of Using Ctokens

Numerous benefits accompany the implementation of digital tokens in various applications. These assets offer innovative solutions that enhance user experience while promoting security and efficiency. By harnessing advanced technology, individuals and organizations can enjoy new opportunities and streamline their processes.

Enhanced Security Features

One significant advantage involves the robust security measures inherent in digital token systems. Utilizing cryptography ensures that transactions remain secure, minimizing the risk of fraud or unauthorized access. This level of safety is crucial for users who prioritize the protection of their assets and personal information.

Increased Accessibility and Flexibility

Another notable benefit is the increased accessibility offered to users. Digital tokens can be easily managed through various platforms, allowing individuals to engage in transactions from virtually anywhere. This flexibility supports a more inclusive environment for users, facilitating seamless interaction with digital ecosystems worldwide.

How Ctokens Enhance Decentralized Finance

Innovative financial instruments are transforming the landscape of decentralized finance, offering new opportunities for users to maximize their assets. These digital assets provide unique solutions to common challenges faced by participants in blockchain networks, fostering a more inclusive and efficient ecosystem.

One significant aspect is liquidity provisioning, where various decentralized platforms utilize these tokens to improve capital efficiency. By enabling seamless exchanges and reducing slippage, participants can trade with greater confidence, ultimately promoting higher trading volumes and market stability.

Moreover, these financial tools enable users to stake their assets, allowing them to earn rewards while maintaining ownership. This feature not only incentivizes participation but also aligns the interests of various stakeholders, fostering a collaborative atmosphere within the decentralized environment.

Additionally, enhanced interoperability is crucial for the expansion of decentralized finance. Through token standards, different platforms can communicate and interact fluidly, allowing users to navigate seamlessly between various services, including lending, borrowing, and trading without the need for intermediaries.

In conclusion, such financial instruments play a pivotal role in reshaping the decentralized finance sector. By addressing liquidity issues, enabling staking rewards, and promoting interoperability, they significantly contribute to a more robust and accessible financial landscape for all participants involved.

Integrating Ctokens with Existing Systems

Establishing seamless connections between digital assets and present frameworks can enhance operational efficiency and broaden functionality. This integration process involves aligning cutting-edge technologies with current infrastructures to ensure smooth data flow and interoperability.

Utilizing APIs is one of the most effective methods for linking new technologies with traditional platforms. By leveraging these interfaces, developers can create robust connections, enabling real-time data exchange and operational synchronization. Furthermore, employing middleware solutions can facilitate communication between disparate systems, offering a bridge that streamlines processes and optimizes user experiences.

Training existing personnel on the nuances of these digital tools is crucial for maximizing their potential. Ensuring staff is well-versed in operational protocols not only boosts engagement but also fosters a culture of innovation within the organization. Regular workshops and training sessions can help employees adapt to changing environments and leverage new functionalities effectively.

Additionally, security protocols must be considered when embedding modern technologies into old systems. Implementing layered security measures protects sensitive data while ensuring compliance with industry standards. Employing encryption, access controls, and monitoring tools can bolster defenses against potential threats.

Finally, ongoing assessment of integrated systems will determine their effectiveness and identify areas for improvement. Establishing KPIs and conducting frequent reviews fosters continuous enhancement and ensures that all components work harmoniously. Embracing an iterative approach allows organizations to adapt swiftly to technological advancements and shifting market demands.

Challenges and Solutions in Ctokens Adoption

Embracing innovative financial instruments can often be met with various hurdles. These challenges may stem from misunderstandings, lack of infrastructure, or regulatory obstacles. To successfully integrate such tools, it is essential to identify these issues and explore effective strategies for overcoming them.

Common Challenges

- Regulatory Uncertainty: Many individuals and organizations are unsure about the legal implications surrounding the use of these new financial technologies.

- Technological Barriers: Limited access to necessary tools and platforms can prevent widespread adoption.

- Lack of Awareness: Potential users might not fully understand the functionalities or advantages, leading to skepticism.

- Security Concerns: Fears of fraud or cyber threats can deter participation in new financial systems.

Proposed Solutions

- Educational Initiatives: Providing workshops, webinars, and informative materials to promote understanding and awareness can help demystify these assets.

- Seeking Clear Regulations: Engaging with policymakers to establish transparent guidelines may alleviate fears and foster trust.

- Enhancing Technological Infrastructure: Investing in user-friendly platforms and tools can simplify access and usability.

- Strengthening Security Measures: Implementing robust security protocols and educating users about risks can build confidence in new systems.

Future Trends in Ctokens Technology

Emerging advancements in tokenization are setting the stage for transformative changes across various sectors. As digital assets gain traction, innovative solutions are anticipated to enhance efficiency, security, and accessibility. Industry leaders are exploring novel applications that redefine interactions within the digital economy.

One prominent trend involves the integration of decentralized finance (DeFi) with tokenized assets, creating new financial instruments. This fusion is expected to democratize access to investment opportunities, allowing a wider audience to participate in wealth-building activities.

| Trend | Description |

|---|---|

| Interoperability | Facilitation of seamless interactions between different blockchain networks, enabling smooth transactions and asset transfers. |

| Regulatory Compliance | Enhancements aimed at meeting evolving legal frameworks, fostering greater trust among users and institutions. |

| Enhanced Security Protocols | Implementation of advanced cryptographic techniques to safeguard digital assets from breaches and fraud. |

| Environmental Sustainability | Development of eco-friendly solutions to minimize the carbon footprint of tokenized assets, promoting greener practices. |

| User-Friendly Interfaces | Creation of intuitive platforms that simplify interactions with tokenized systems, attracting non-technical users. |

These trajectories indicate a dynamic evolution in the landscape of digital tokenization. Stakeholders remain vigilant, anticipating advancements that will shape the future of finance and investment.

Q&A: The ultimate guide to compounds ctokens

How does Compound Finance operate within the DeFi space?

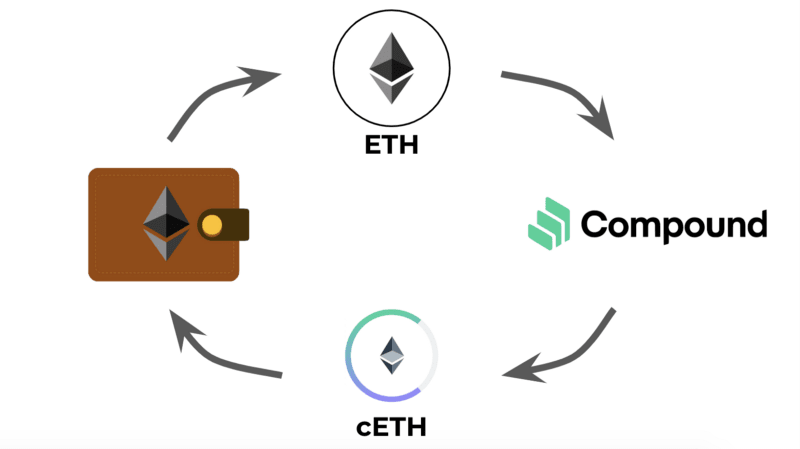

Compound Finance is a decentralized protocol that allows users to lend and borrow crypto assets without intermediaries. It utilizes smart contracts to automate interest rate adjustments based on supply and demand. Users can deposit ERC20 tokens into a liquidity pool and receive cTokens in return, which represent their stake in the protocol and accrue interest over time.

What is the role of cTokens in Compound Finance, and how do they work?

cTokens are interest-bearing tokens that users receive when they supply assets to Compound Finance. Each cToken represents a claim on the underlying asset in the liquidity pool. As interest accrues, the value of cTokens increases relative to the supplied asset, allowing users to earn passive income while retaining liquidity.

How can users send ETH to the Compound protocol and utilize the Compound protocol?

To send ETH to the Compound protocol, users must first wrap it into an ERC20 token, such as WETH, since Compound only supports ERC20 tokens. Once wrapped, they can utilize the Compound protocol by supplying WETH to the liquidity pool, earning interest, and receiving cTokens in exchange. These cTokens can be used as collateral for borrowing other assets.

What are the benefits of using Compound Finance compared to other DeFi protocols?

Compound Finance is an algorithmic protocol that automatically adjusts interest rates based on supply and demand, making it highly efficient for users looking to lend and borrow assets. Unlike some platforms, Compound is decentralized, governed by the Compound community through COMP tokens. It also supports multiple ERC20 tokens, allowing users to diversify their holdings while earning interest.

Who is behind Compound Labs, and what is its role in the Compound ecosystem?

Compound Labs is the company that originally developed the Compound protocol. While Compound is now governed by the community, Compound Labs has already played a significant role in its growth and development. The CEO of Compound, Robert Leshner, was instrumental in launching the platform and driving innovation within the DeFi space.

What is the Compound protocol and how does it work?

The Compound protocol is an algorithmic interest rate protocol that allows users to earn interest on their crypto assets or borrow against them. It operates as a decentralized finance (DeFi) protocol, where supply and demand determine interest rates algorithmically. Users interact with the Compound protocol by supplying assets into Compound, receiving cTokens from Compound in exchange, which represent their stake and accrue interest over time.

What is COMP and how does it function in Compound governance?

COMP is the governance token for the Compound protocol, allowing holders to participate in decision-making. Holders of COMP tokens can propose, discuss, and vote on changes to the protocol, such as adjusting interest rate models or adding new assets to the Compound protocol. COMP tokens are distributed as rewards to users who lend and borrow through Compound.

How does Compound allow users to earn interest on their crypto assets?

Compound offers users the ability to earn interest by supplying crypto assets into Compound markets. When users deposit ERC-20 tokens into the Compound platform, they receive cTokens from Compound in exchange, which automatically accrue interest. The interest rate is determined algorithmically based on supply and demand within the Compound ecosystem.

What are the benefits of Compound compared to other DeFi protocols?

Compound is one of the leading DeFi protocols that provides decentralized, algorithmic interest rate adjustments, allowing users to lend and borrow assets seamlessly. Unlike some centralized platforms, Compound doesn’t require intermediaries, ensuring greater transparency and security. Additionally, the Compound network rewards users with COMP tokens based on their activity, further incentivizing participation in the ecosystem.

How can a user borrow from Compound, and what are the requirements?

Borrowing from Compound requires users to first supply assets into Compound as collateral. The amount of COMP and other crypto assets a borrower can access depends on the collateral factor assigned to each asset. Users interact with the Compound protocol by locking their crypto assets, receiving an indicated amount of underlying tokens for borrowing. The interest rate protocol determines borrowing costs dynamically, based on supply and demand.