Understanding Bitcoin (BTC) Rainbow Chart for Effective Trading – How to Use It

In today’s dynamic financial landscape, visual representations hold immense value for both novice and seasoned investors. Utilizing graphical tools can simplify complex data and offer profound insights into market trends. One such intriguing tool captures the attention of cryptocurrency enthusiasts, providing an engaging way to analyze digital asset price movements over time.

With vibrant colors and strategic overlays, this graphical representation serves as a guide, highlighting potential market phases ranging from accumulation to exuberance. Investors can glean important signals regarding entry and exit points while gaining a clearer understanding of long-term performance trajectories within a volatile environment.

By diving deep into the nuances of this compelling visual representation, individuals can enhance their decision-making processes. From identifying potential investment strategies to recognizing when to tread cautiously, embracing such analytical frameworks can lead to more informed choices in a rapidly evolving market.

What is the Bitcoin Rainbow Chart?

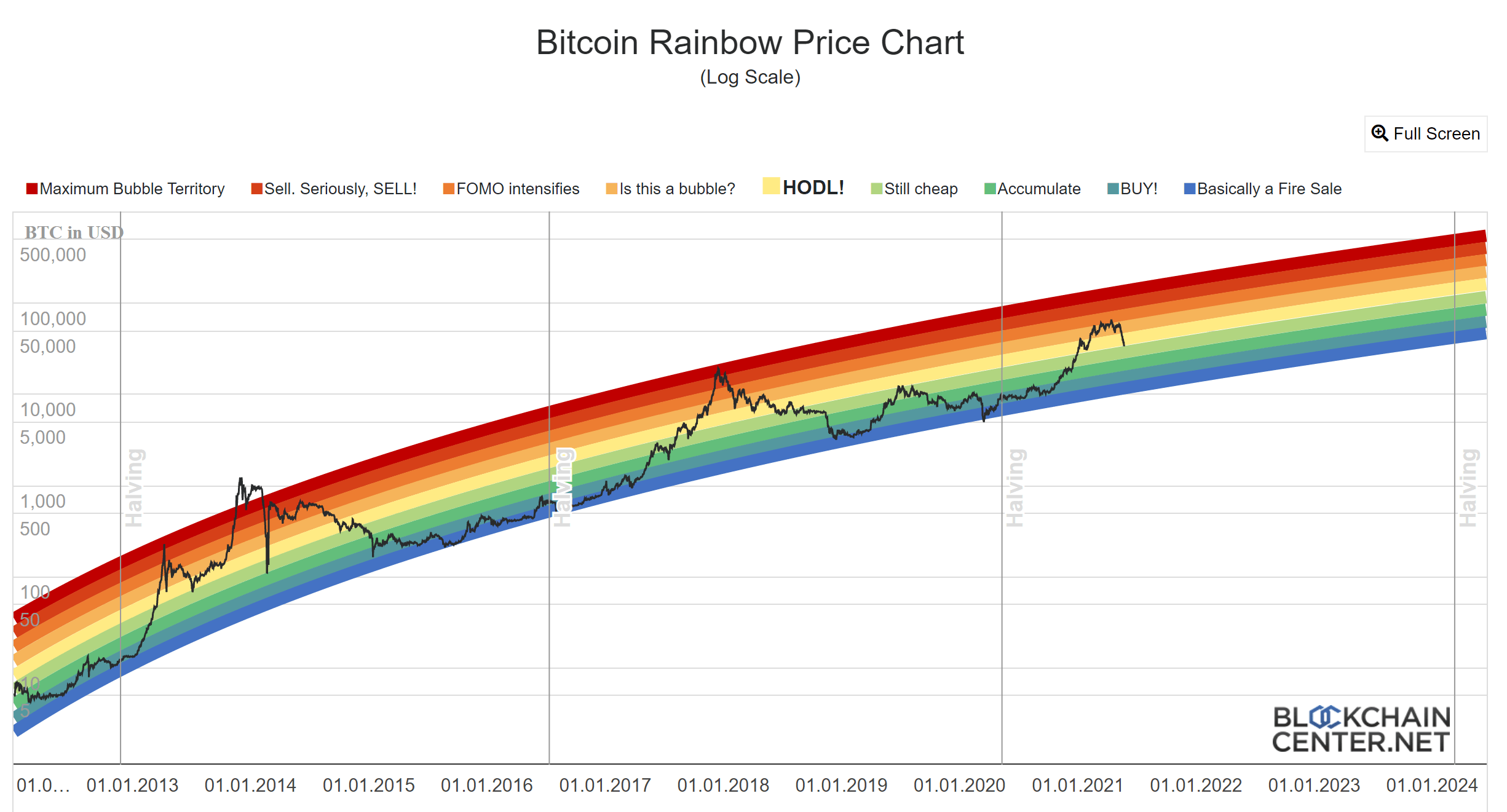

This visual tool serves as a colorful representation of price trends in cryptocurrency markets. It provides enthusiasts and investors with a perception of progress and potential future movements based on historic data. Utilizing different colors, it creates a spectrum that indicates various phases of market cycles, ranging from high optimism to deep corrections.

The concept behind this graphical illustration revolves around the idea that price trajectories tend to follow predictable patterns over time. By analyzing these patterns, one can glean insights into potential entry and exit points for investments. The chart is structured in such a way that it allows users to perceive at a glance whether the current price is approaching, within, or far from established trends.

Historical Analysis of Bitcoin Price Trends

Exploring past price movements of this digital asset reveals significant patterns and notable phases that can provide insights into potential future developments. By examining historical data, one can gain an appreciation for volatility, recurrent cycles, and the impacts of external factors on valuation. Analyzing trends over various time frames enables one to draw conclusions about investor behavior and market psychology.

Key Price Milestones

Throughout the years, various pivotal moments stand out in the timeline of this cryptocurrency. These milestones are often marked by drastic price fluctuations and shifts in market sentiment. Understanding these key events helps in grasping the broader narrative of value fluctuations.

| Year | Event | Price Movement |

|---|---|---|

| 2010 | First Recorded Transaction | $0.08 to $0.10 |

| 2013 | First Major Surge | $13 to $266 |

| 2017 | All-Time High Surge | $1,000 to $19,783 |

| 2020 | Institutional Interest Grows | $4,000 to $29,000 |

| 2021 | Reaches $64,000 | Continued Bull Run |

Market Sentiment Analysis

The emotional and psychological elements that influence market participants also play a crucial role in shaping price trends. Periods of optimism are typically followed by euphoric highs, while fear often precipitates sharp declines. Identifying these sentiments during key price movements can enhance one’s perspective on potential future trends and behaviors.

Interpreting the Color Bands Meaning

Each hue within this visual representation carries significance, reflecting various phases of market cycles. By analyzing these shades, one can derive insights regarding potential price movements and investment strategies. The bands symbolize distinct ranges of value, providing a visual framework to gauge market sentiment.

The initial band often signifies a phase of undervaluation, indicating potential buying opportunities. As prices progress, subsequent bands represent different levels of growth and bullish trends. Conversely, colors tend to shift to warmer tones during market exuberance, hinting at overextension and suggesting the possibility of market corrections.

By recognizing the transitions between these color bands, investors can make informed decisions, positioning themselves according to market conditions. This framework serves as a quick reference, enabling users to assess the current situation relative to historical trends. Ultimately, interpreting these color indicators can enhance awareness and strategic planning in financial engagements.

Practical Applications for Investors

This segment delves into actionable strategies that can empower investors to navigate market dynamics effectively. Through a robust analytical framework, individuals can identify potential entry and exit points, helping them make informed decisions based on historical trends and market behavior.

Strategies for Analysis

- Identifying Market Cycles: Recognizing patterns in price movements can help investors anticipate shifts in momentum.

- Timing Investments: Investors can leverage historical data to pinpoint opportune moments for buying or selling assets.

- Risk Management: Employing a visual tool can aid in assessing risk levels associated with differing price ranges.

Long-Term Planning

- Dollar-Cost Averaging: Investors can adopt this strategy by investing a fixed amount regularly, mitigating the impact of volatility.

- Diversifying Portfolios: Insights gained from analysis can guide allocation across various assets, enhancing the resilience of investment portfolios.

- Setting Price Targets: Establishing specific price points for taking profits or cutting losses can lead to disciplined trading practices.

By employing these pragmatic approaches, investors can enhance their decision-making process, ultimately leading to more successful financial outcomes in their investment journeys.

Common Misconceptions About the Chart

There are several prevalent misunderstandings about this visualization tool that can lead to confusion among users. Many individuals interpret the color-coded ranges as definitive forecasts rather than probabilities, influencing their investment choices inappropriately.

Belief in Guaranteed Predictions

A common fallacy is the assumption that the color zones predict specific price points accurately. While the segments provide insights into historical trends, they should not be viewed as certainties. Volatility inherent in the market means that actual outcomes can significantly deviate from these suggested ranges.

Overlooking Historical Context

Another misconception is neglecting the historical context behind patterns reflected in the visualization. Users often ignore that past performance does not guarantee future results. It is essential to consider broader market factors and events that can influence price movements, rather than relying solely on this graphical representation.

Limitations and Risks of Using It

Every analytical tool has its own constraints and potential hazards, and this visual representation is no exception. While it can offer valuable insights regarding market trends, relying solely on it can lead to misguided decisions. Investors should remain aware of these limitations to navigate effectively through the complexities of cryptocurrency investments.

- Subjectivity in Interpretation: Different users may interpret the visualizations differently, leading to various conclusions.

- Historical Data Reliance: Past performance does not guarantee future results; the market is influenced by unpredictable factors.

- Volatility of Market: The cryptocurrency market is known for its rapid fluctuations, making any predictions highly uncertain.

- Potential for Misleading Signals: Price movements might create false signals, leading investors to act impulsively.

- Lack of Fundamental Analysis: It does not incorporate underlying factors affecting value, such as technological advancements or regulatory changes.

In conclusion, while this tool can serve as a helpful guide, it should not be the sole basis for financial decisions. Investors are encouraged to consider additional data sources and analyses to mitigate risks associated with their choices.

Q&A: Bitcoin Rainbow Chart – How to Use It

What is the Bitcoin Rainbow Chart, and how does it work?

The Bitcoin Rainbow Chart is a visualization tool that represents the historical price movements of Bitcoin over time. It uses a series of colored bands to indicate different levels of price zones, ranging from ‘buy’ when the price is low to ‘sell’ when the price is high. The chart is based on logarithmic scaling, which means it adjusts to absorb the exponential growth of Bitcoin’s price. The colors on the chart range from red to blue, signifying bearish to bullish zones, and help traders understand market sentiment and price trends more intuitively.

How can I effectively use the Bitcoin Rainbow Chart in my trading strategy?

To effectively use the Bitcoin Rainbow Chart in your trading strategy, it is essential to first understand its colors and what they signify. When Bitcoin’s price is in the ‘green’ zone, it indicates a potential buying opportunity, while the ‘red’ zone suggests that the price may be overheated. It is beneficial to combine the Rainbow Chart with other technical analysis tools, such as moving averages or RSI, to confirm signals. Additionally, remember that while the chart can provide insights into historical trends, it should not be the sole basis for making investment decisions. Always conduct your own research and consider market conditions.

Is the Bitcoin Rainbow Chart reliable for predicting future prices?

The Bitcoin Rainbow Chart is primarily a historical tool that illustrates past price movements and provides a visual context for the current market climate. While it can help identify trends and potential price zones, it should not be considered a guaranteed predictor of future prices. Cryptocurrency markets are highly volatile and influenced by numerous factors such as regulatory news, market sentiment, and macroeconomic conditions. Therefore, while the Rainbow Chart can be a useful part of your analysis toolkit, it should be used in conjunction with other predictive methods and risk management strategies.

Are there any limitations to using the Bitcoin Rainbow Chart?

Yes, there are several limitations to using the Bitcoin Rainbow Chart. One notable limitation is that it relies on historical price data, which means it may not accurately reflect future price movements, especially during unprecedented market shifts or events. Additionally, the chart does not account for external variables that might impact Bitcoin’s price, such as regulatory changes or technological advancements. Traders might also misinterpret the color zones if they do not fully understand the principles behind the chart. Therefore, while it can provide valuable insights, it should not be the only tool used in trading decisions.

Can beginners use the Bitcoin Rainbow Chart, or is it more suited for advanced traders?

The Bitcoin Rainbow Chart can be a helpful tool for both beginners and advanced traders. For beginners, it offers a straightforward visual representation of Bitcoin’s price history and potential trading zones, making it easier to grasp market behavior. However, to use it effectively, beginners should take the time to learn its underlying concepts and how it fits within a broader trading strategy. As they grow more experienced, they can incorporate additional technical analysis tools and indicators to enhance their trading decisions. Overall, with proper education and understanding, beginners can certainly benefit from using the Rainbow Chart.

What is the Bitcoin Rainbow Chart and how does it work?

The Bitcoin Rainbow Chart is a visual representation of the historical price movements of Bitcoin, designed to provide insights into potential future price trends. It consists of several colored bands that represent different price levels; these bands are plotted based on logarithmic growth trends. As Bitcoin’s price fluctuates, it moves through these bands, which are generally intended to illustrate whether Bitcoin is currently undervalued, overvalued, or fairly priced. The chart is primarily used by investors and traders as a tool for making decisions about when to enter or exit the market, helping them to gauge the overall sentiment of Bitcoin’s price action. However, it’s essential to understand that while the Rainbow Chart can help visualize trends, it’s not a guaranteed predictor of future performance, and investors should consider it alongside other analyses.

What is the purpose of the Bitcoin rainbow chart, and how is it useful for analyzing Bitcoin’s price movements?

The Bitcoin rainbow chart is a technical analysis tool that uses a logarithmic regression model to track Bitcoin’s long-term price trends. Based on historical data, the chart provides a visual representation of Bitcoin’s potential price range over time. The chart helps investors interpret Bitcoin’s price movements and determine whether Bitcoin is undervalued or overvalued based on historical patterns. By using this chart, traders can make informed decisions about when to buy Bitcoin or hold their investments.

How accurate is the Bitcoin rainbow chart, and should investors rely on it for making trading decisions?

The accuracy of the Bitcoin rainbow chart is debated, as it is based on historical data and does not guarantee future performance. While the chart can provide valuable insights into Bitcoin’s long-term price trends, it should not be solely relied upon for making trading decisions. The chart uses a logarithmic regression model, which helps to visualize Bitcoin’s price movements over time, but external factors such as market conditions, regulations, and the Bitcoin halving cycle can also significantly impact Bitcoin’s price.

What does the Bitcoin rainbow chart indicate about Bitcoin’s price, and how can it help investors?

The Bitcoin rainbow chart indicates potential price ranges for Bitcoin based on historical data and long-term price trends. It helps investors interpret the general direction of the market and identify whether the current Bitcoin price is in a “buy zone” or an “overvalued” region. The chart is a useful tool for spotting market cycles, and it helps investors understand if Bitcoin is undervalued, providing a good time to buy. The colors of the rainbow represent different price levels, simplifying complex market analysis.

How can investors use the Bitcoin rainbow chart to make decisions about buying or selling Bitcoin?

Investors can use the Bitcoin rainbow chart to gauge the long-term price trends of Bitcoin and assess whether the current price aligns with historical patterns. The chart represents Bitcoin’s price in a range of colors, with each color corresponding to a different price range. When Bitcoin enters the lower “blue” zone of the rainbow, it may indicate that Bitcoin is undervalued and a good time to buy. Conversely, when the price enters the higher “red” zone, it may suggest that Bitcoin is overvalued, potentially signaling a good time to sell or hold.

What is the significance of the Bitcoin halving event in relation to the Bitcoin rainbow chart?

The Bitcoin halving event, which occurs approximately every four years, has a significant impact on Bitcoin’s price and is often reflected in the Bitcoin rainbow chart. Historically, Bitcoin’s price has seen large increases following each halving, as the supply of new Bitcoin is reduced. The rainbow chart helps to identify long-term price trends and can be useful for understanding the effects of halving on Bitcoin’s price movements. As Bitcoin’s demand increases with a lower supply, the chart may indicate upward movement in price, suggesting favorable market conditions for investors.