Understanding Fungible and Non-Fungible Tokens in the Digital World

The landscape of value exchange has undergone a remarkable transformation with the advent of innovative instruments that capture ownership in a unique manner. These new forms of representation have revolutionized how individuals perceive and interact with property and collectibles in a virtual space.

As society increasingly embraces technology, traditional concepts of value are being challenged and redefined. This evolution opens doors to diverse opportunities, enabling people to acquire, trade, or showcase ownership of unique items, whether they take the form of art, collectibles, or even virtual real estate.

In this article, we delve into the intricacies of these emerging instruments, examining their implications for ownership, commerce, and the creative economy. By unraveling the nuances of these innovative vehicles, we aim to shed light on their potential to reshape the landscape of value exchange in our increasingly interconnected world.

What Are Fungible Tokens?

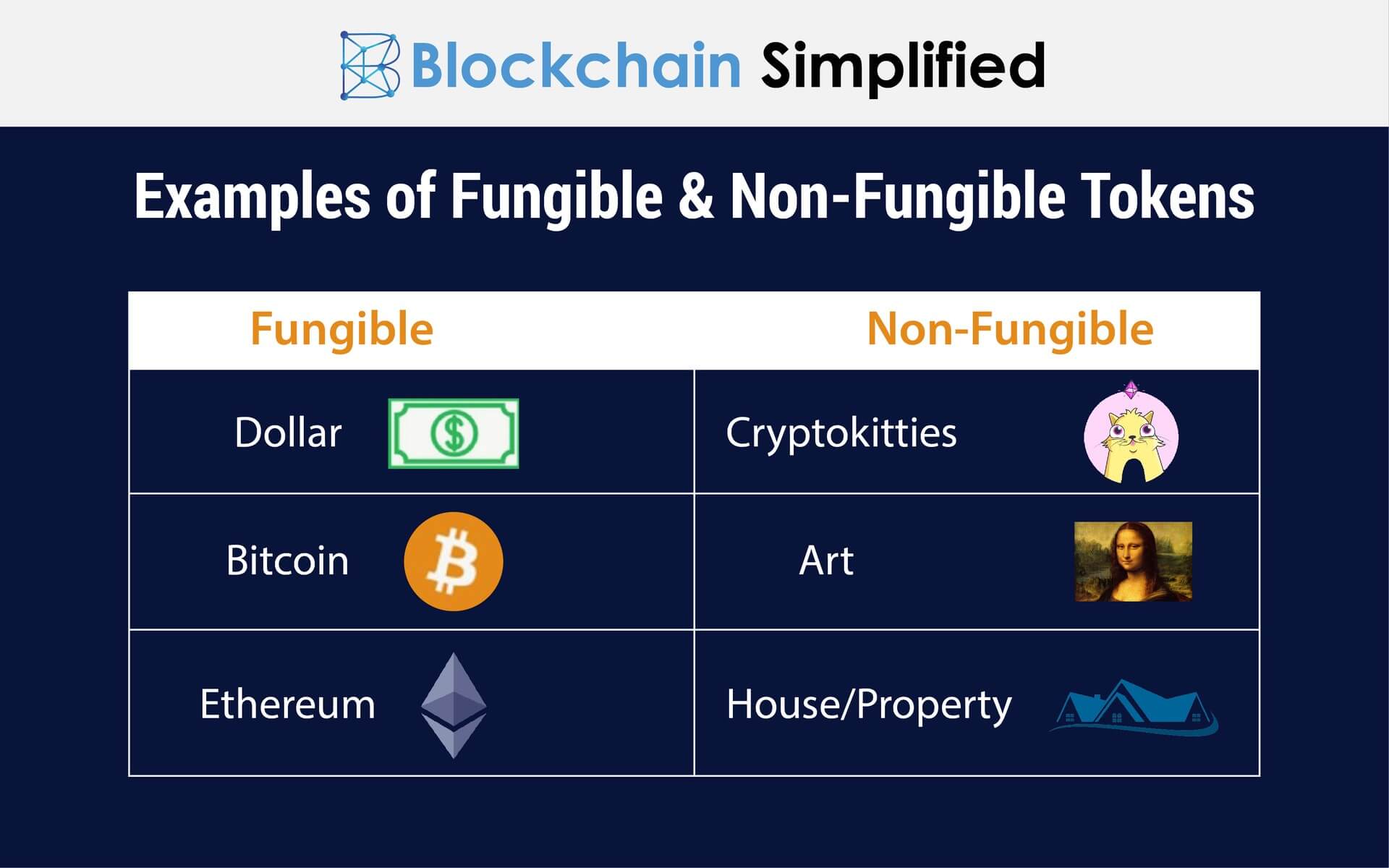

In the realm of modern finance, certain assets are characterized by their interchangeability, enabling seamless trade and exchange. These units can be compared to traditional currencies, where each piece holds equivalent value and can be substituted for one another without any loss of worth. This quality forms the foundation of a broader ecosystem of identical and easily replaceable items that provide liquidity and foster economic activity.

Key Features of These Assets

- Interchangeability: Each unit can be exchanged for another of the same type without any discrepancies in value.

- Divisibility: They can be broken down into smaller parts, allowing for flexible transaction amounts.

- Uniformity: All units possess identical properties, ensuring they are viewed as equal in value.

Common Examples

- Cryptocurrency: Assets like Bitcoin or Ethereum can be easily traded and hold consistent value across the market.

- Utility Tokens: Often used within specific platforms, these can be exchanged seamlessly for services or products.

- Gift Cards: They can be redeemed for equal monetary value at designated retailers.

Exploring Non-Fungible Tokens (NFTs)

In the evolving landscape of virtual ownership, certain items have emerged as unique creations that challenge traditional notions of value. These exclusive representations are reshaping how we perceive authenticity, origin, and individuality in the online realm.

One of the most significant aspects of these unique creations is the way they allow individuals to possess distinct items that cannot be exchanged on a one-to-one basis. Here are some key features that highlight their uniqueness:

- Scarcity: Unlike most commodities, each piece is limited in quantity, often leading to heightened demand and perceived value.

- Provenance: The history and origin of each item can be traced, providing transparency and building trust among creators and collectors.

- Ownership: Each piece is linked to a specific owner, providing an unambiguous record of possession on an immutable ledger.

- Cultural Impact: These exclusive items have gained popularity across various sectors, from art and music to gaming and fashion.

As technology continues to grow, the implications of such distinctive items expand significantly. Artists, musicians, and creators are leveraging these unique identifiers to claim ownership and ensure their work is recognized as genuinely theirs. Conversely, collectors are exploring new avenues to invest and share in the creative economy.

To summarize, the exploration of these exceptional creations reveals a changing paradigm in ownership, creativity, and investment in the virtual world, highlighting the ongoing evolution of how we value individuality and connection in contemporary society.

Key Differences Between Token Types

This section outlines the fundamental distinctions between various categories of blockchain-based assets. Each category serves unique purposes and exhibits differing characteristics that influence their functionality, value, and application within the ecosystem.

Characteristics of Each Category

One of the most prominent differences lies in the trait of interchangeability. Some categories are interchangeable, meaning each unit is identical and can easily substitute another. This characteristic makes them ideal for transactions and pricing strategies in markets. Conversely, other categories possess unique features, rendering each unit one-of-a-kind. As a result, they often represent ownership of specific items or rights, establishing individual value that cannot be replicated.

Use Cases and Applications

The practical applications also vary significantly between the two types. Interchangeable units are well-suited for transactions, payments, and trading in financial markets, while unique items find their niche in areas like art, collectibles, and ownership records. The differences in usage scenarios directly influence the inherent value and demand for each type within their respective markets.

The Role of Blockchain in Assets

Blockchain technology serves as a transformative force in the realm of property management, providing unparalleled transparency, security, and efficiency. By leveraging this innovative system, transactions can be documented immutably, ensuring trust among participants without the need for intermediaries.

Enhancing Security and Trust

This decentralized ledger dramatically reduces the risk of fraud, as each entry is cryptographically secured and verifiable by all stakeholders. Participants can confidently engage in transactions, knowing that their rights are protected, and ownership records are accurately maintained. The built-in consensus mechanisms of blockchain further bolster reliability, creating a robust environment for value exchange.

Streamlining Transactions

By digitizing ownership rights, this technology simplifies processes that traditionally involve lengthy paperwork and multiple parties. Automation through smart contracts allows for instantaneous compliance with predefined conditions, ultimately minimizing delays and streamlining workflows. As a result, this innovation not only enhances user experience but also opens avenues for new economic models.

Current Trends in Digital Collectibles

The landscape of virtual collectibles is rapidly evolving, attracting enthusiasts and investors alike. New developments are reshaping how people perceive ownership, creativity, and value in the online space. This section delves into the latest movements that define this fascinating sector.

- Increased Interactivity: Many collectibles now offer interactive elements, allowing users to engage with the assets in innovative ways. Gamification is becoming a prominent feature, enhancing user experience.

- Community Engagement: Collectors are forming communities around specific themes or projects, fostering collaboration and shared interests. Social media platforms play a crucial role in these interactions.

- Celebrity Collaborations: Well-known figures from various industries are entering the collectible market, creating unique pieces that attract their fans. This trend contributes to the growing popularity and mainstream acceptance of such items.

- Environmental Awareness: As concerns about eco-friendliness grow, some platforms are adopting sustainable practices in the creation and trading of collectibles. This shift appeals to environmentally conscious users.

- Cross-Platform Integration: Collectibles are increasingly being integrated across multiple platforms, enhancing accessibility and fostering a broader audience. This interconnectivity allows users to showcase their collections in various virtual environments.

These trends highlight the dynamic nature of virtual collectibles, showcasing their potential to transform the way individuals interact with technology and art. As this space continues to develop, it is essential to stay informed about the latest innovations and community shifts.

Future Prospects for Digital Ownership

The landscape of asset possession is evolving rapidly, driven by technological advancements and shifting societal perceptions. As individuals and businesses explore innovative ways to claim and transfer ownership in the virtual realm, a new paradigm emerges that could redefine personal and commercial interactions.

With the increasing value ascribed to virtual commodities, the importance of establishing provenance and authenticity has become paramount. Individuals are seeking ways to ensure that their holdings are not only secure but also verifiable and unique. This trend is fostering a shift towards systems that empower users and facilitate ownership verification.

| Trends | Impact |

|---|---|

| Emergence of Decentralized Platforms | Enhances trust and reduces intermediaries in transactions. |

| Integration with Traditional Markets | Bridges the gap between virtual and physical ownership. |

| Increased Regulation | Provides a framework for protection and legitimacy. |

| Collective Ownership Models | Promotes shared investment and collaboration. |

As we move forward, the intersection of technology, culture, and policy will further shape ownership norms. The blend of innovation and necessity will likely lead to more secure, transparent, and accessible forms of claiming rights in both digital and traditional realms. The evolution of possession is on the horizon, inviting all participants to rethink their relationship with the concept itself.

Q&A: Fungible and non-fungible tokens

What are fungible tokens and how do they differ from non-fungible tokens?

Fungible tokens are digital assets that are interchangeable and identical in value, similar to physical money. For example, one Bitcoin is equivalent to another Bitcoin, making them fungible. Non-fungible tokens (NFTs), on the other hand, are unique and cannot be exchanged on a one-to-one basis. Each NFT represents ownership of a specific item or piece of content, such as digital art, music, and collectibles. This uniqueness gives NFTs distinct value and properties that set them apart from fungible tokens.

Can you give an example of how NFTs are used in the art world?

Certainly! NFTs have revolutionized the art world by allowing artists to sell their work directly to consumers using blockchain technology. For instance, a digital artist can create a piece of artwork and mint it as an NFT. When sold, the NFT serves as proof of ownership and authenticity. Notable sales, like Beeple’s artwork selling for over $69 million as an NFT, demonstrate how artists can reach global audiences and receive royalties from future sales, reshaping how we perceive and transact art. This technology creates new revenue streams and allows artists to retain more control over their work.

What potential advantages do digital assets like NFTs offer over traditional assets?

Digital assets such as NFTs offer several advantages over traditional assets. First, they provide enhanced security and transparency through blockchain technology, which makes it nearly impossible to forge or replicate them. Second, digital assets allow for fractional ownership, enabling more people to invest in high-value items by purchasing shares of NFTs. Third, they can facilitate quicker and more efficient transactions with lower fees, as intermediaries are often minimized. Lastly, the global reach of NFTs allows creators and owners to connect and sell to a worldwide audience, expanding market opportunities beyond local confines.

Are there any risks associated with investing in NFTs or digital assets?

Yes, investing in NFTs and digital assets comes with several risks. The market is highly speculative and can be extremely volatile, with values fluctuating unexpectedly. Additionally, the technology is still relatively new, meaning there are uncertainties regarding regulatory frameworks and potential legal issues. There is also the risk of scams and fraud, as the popularity of NFTs has attracted bad actors. Furthermore, the environmental impact of blockchain technology, especially proof-of-work systems, raises concerns over sustainability. It’s crucial for investors to conduct thorough research and understand these risks before diving into this market.

How do I create and sell my own NFT? What steps should I follow?

Creating and selling your own NFT requires several steps. First, you’ll need to choose a digital wallet that supports cryptocurrency and NFTs, such as MetaMask or Trust Wallet. Next, buy some cryptocurrency (like Ethereum) to cover minting and transaction fees. Once you have your wallet set up, select a platform to mint your NFT; popular options include OpenSea, Rarible, and Foundation. Upload your digital artwork or content, fill in the necessary information (title, description, and royalties), and pay the minting fee. After minting, your NFT will be listed for sale on the marketplace, where you can set your price. Interest in your NFT will depend on your marketing efforts and the uniqueness of your creation, so promote it through social media and relevant channels for maximum reach.

What are fungible tokens and how do they differ from non-fungible tokens?

Fungible tokens are digital assets that are interchangeable and identical in value. A classic example is cryptocurrencies like Bitcoin or Ethereum, where each unit is the same as every other unit. Non-fungible tokens (NFTs), on the other hand, are unique digital assets that represent ownership of a specific item or piece of content, such as digital art, collectibles, or virtual real estate. Unlike fungible tokens, each NFT has distinct characteristics and cannot be exchanged on a one-to-one basis with another NFT, making them unique and valuable in different ways.

How do fungible and non-fungible tokens impact the future of digital assets?

The impact of fungible and non-fungible tokens on the future of digital assets is profound. Fungible tokens facilitate decentralized transactions and serve as a means of exchange, enabling users to transfer value easily across platforms. This could revolutionize payment systems and remittances around the world. Non-fungible tokens, on the other hand, are changing how we perceive ownership and value in the digital realm. They enable creators to monetize their art, music, and other content directly, fostering a new economy built on authenticity and individuality. As more industries explore the potential of these tokens, we may see innovations in areas like gaming, virtual reality, and intellectual property, making digital assets a pivotal part of the economy.

What is the difference between fungible and non-fungible tokens?

Fungible tokens are interchangeable and represent assets with identical value, such as cryptocurrencies like Bitcoin. Non-fungible tokens (NFTs), on the other hand, represent unique assets with distinct value, such as digital art or collectibles. NFTs cannot be exchanged one-to-one as each token has a unique value based on its metadata, making them ideal for representing real-world assets in the digital world.

How do NFTs work on the Ethereum blockchain?

NFTs on the Ethereum blockchain are created and stored as unique digital tokens, using Ethereum’s ERC-721 standard. These tokens represent assets like artwork, collectibles, or even virtual land, and are secured by the blockchain’s decentralized network. The metadata of each NFT, such as its creator and ownership history, is recorded on the blockchain, ensuring transparency and authenticity.

What are some popular examples of non-fungible tokens in the NFT marketplace?

Popular examples of non-fungible tokens in the NFT marketplace include collections like Cryptokitties, Bored Ape Yacht Club, and various NFT art pieces. These NFTs represent unique digital assets, each with its own metadata that determines its value. Users can buy, sell, and trade these NFTs on platforms like OpenSea, where each item is distinct and offers a unique value to the owner.

How do fungible tokens differ from non-fungible assets in the context of the NFT market?

Fungible tokens, such as cryptocurrencies, are interchangeable with one another, and each unit holds the same value. Non-fungible assets, however, represent unique items, such as an NFT collection, which cannot be exchanged for an identical token. Non-fungible tokens hold unique value based on their individual metadata, making them suitable for representing collectibles, digital art, and other one-of-a-kind assets in the NFT market.

What role do NFTs play in representing real-world assets in the crypto ecosystem?

NFTs play a significant role in representing real-world assets in the crypto ecosystem by tokenizing physical items like art, real estate, and collectibles. Through NFT technology, these assets are minted into unique digital tokens, which can then be bought, sold, or traded on NFT marketplaces. This allows for greater accessibility, security, and fractional ownership of assets that were traditionally difficult to exchange or prove ownership of.