Understanding Nakamoto Consensus in Bitcoin

In the realm of digital currencies, a groundbreaking approach has emerged that fosters cooperation among participants in an unregulated landscape. This innovative framework enables a network of individuals to reach a unified decision without the need for a central authority. By harnessing collective effort and cryptographic techniques, this system not only secures transactions but also propels the continuity of the digital economy.

At the heart of this mechanism lies a robust method for validating contributions, ensuring that all members are incentivized to act in the best interest of the network. As a result, it effortlessly maintains the integrity of the shared ledger while allowing for transparency and traceability. Through a combination of strategic incentives and a decentralized structure, this protocol eliminates the risks associated with traditional intermediaries, positioning itself as a revolutionary solution for the future of finance.

The process is not without its challenges, as varying interests and potential conflicts can arise. However, through careful orchestration of actions and rewards, participants are guided towards a desirable outcome. Exploring the intricacies of this innovative protocol reveals how it underpins a thriving ecosystem, paving the way for a new era in monetary exchanges.

What is Nakamoto Consensus?

This mechanism serves as the backbone of decentralized networks, allowing participants to reach an agreement without relying on a central authority. It is designed to enable a secure and trustless environment for all users, ensuring the integrity of the network while facilitating peer-to-peer interactions. The foundation of this protocol lies in its ability to foster collaboration among diverse nodes, each playing a vital role in maintaining the system’s reliability and transparency.

At its core, this protocol ensures that all transactions are verified and recorded accurately, preventing issues like double spending. It achieves this by utilizing competitive processes that reward participants for contributing computational power, thus incentivizing honest behavior across the network.

| Feature | Description |

|---|---|

| Decentralization | No central authority governs the network, allowing users to operate independently. |

| Security | Robust mechanisms protect against fraud and attacks, ensuring the integrity of transactions. |

| Incentives | Participants are rewarded for their contributions to the network’s operation and maintenance. |

| Transparency | All transactions are publicly recorded, providing visibility and accountability for every user. |

This innovative approach has transformed how digital currencies function, setting the stage for various blockchain applications. By allowing secure and efficient agreement among participants, it has opened up new possibilities for trustless interactions in the digital realm.

Mechanics of Bitcoin’s Consensus Mechanism

This section delves into the intricate processes that enable a decentralized network to reach agreement on the state of its ledger. By employing a unique methodology, the system ensures that all participants are aligned, facilitating trust and security without the need for a central authority.

At the core of this mechanism are several key components that work in harmony:

- Distributed Nodes: Each participant operates a node that maintains a copy of the entire transaction history.

- Proof of Work: Miners compete to solve complex mathematical puzzles, validating transactions and securing the network.

- Block Creation: Once a puzzle is solved, a block containing validated transactions is added to the chain.

- Chain Integrity: The longest chain rule ensures that the most accepted version of the ledger is recognized by all nodes.

The interaction between these elements fosters a competitive yet cooperative environment. Miners are incentivized to act honestly, as deception would lead to financial losses. Additionally, the difficulty of the mathematical challenges adjusts over time, ensuring a steady flow of new blocks while maintaining network stability.

Ultimately, the collaborative efforts of all participants cultivate an ecosystem that thrives on transparency and reliability. By adhering to these fundamental principles, the network can operate effectively, facilitating transactions with confidence and security.

Role of Miners in the Process

Miners occupy a crucial position in the functioning of decentralized networks, acting as both validators and creators of new units. Their primary responsibility involves solving complex mathematical puzzles that secure the integrity of the blockchain. By dedicating computational resources, they ensure that transactions are processed accurately and efficiently, thereby maintaining trust among participants.

The process begins when individuals initiate transactions, which are then aggregated into blocks. Miners compete to be the first to solve the cryptographic challenge associated with these blocks. This competition not only incentivizes performance but also enhances the overall security of the network. Once a miner successfully solves the puzzle, they add the new block to the existing blockchain, thereby confirming the transactions it contains.

In return for their efforts, miners receive rewards in the form of newly generated cryptocurrency and transaction fees. This system of incentives is fundamental, as it encourages continuous participation and investment in the network’s infrastructure. Moreover, the distribution of mining power helps prevent the centralization of control, fostering a more resilient ecosystem.

Ultimately, the contributions of miners are essential for ensuring the reliability and stability of decentralized systems. Their role encompasses not just the validation of transactions but also the safeguarding of the network against potential threats, making them indispensable to the entire operation.

Challenges in Maintaining Consensus

Maintaining agreement in a decentralized system is not without its obstacles. Various factors can influence the ability to reach a unified state, leading to potential conflicts and fragmentation. Understanding these hurdles is crucial for those involved in the ecosystem.

Factors Affecting Agreement

- Network Latency: Delays in communication can disrupt the synchronization of nodes, causing discrepancies in the shared ledger.

- Forks: Divergence in the chain can occur due to differing interpretations or competing versions, resulting in a split amongst participants.

- Malicious Actors: The presence of individuals or groups intending to exploit vulnerabilities can threaten the overall integrity of the system.

- Software Updates: Changes to protocols or client software can create temporary divisions if not all participants adopt the new version simultaneously.

Impacts on Stability

The challenges outlined above can have significant repercussions on the reliability and security of the system. For instance, persistent forks may lead to a loss of trust among users, while delays in reaching agreement can hinder transaction processing speeds. Ultimately, addressing these difficulties is vital for fostering a resilient and robust environment.

Benefits of Using Nakamoto Consensus

The mechanism that underpins decentralized networks provides several advantages that enhance the overall functionality and security of digital currencies. By allowing participants to agree on the state of the ledger without the need for a centralized authority, this approach fosters trust and transparency among users.

One of the primary benefits is increased security. The decentralized nature of the protocol makes it extremely challenging for malicious actors to alter transaction history, as they would need to control a significant portion of the network. This feature not only protects against fraud but also instills confidence in users who interact within the ecosystem.

Another key advantage is the promotion of inclusivity. Individuals can join the network and participate in the validation process without requiring permission from any central entity. This open access encourages widespread participation, which strengthens the network and contributes to its resilience.

The protocol also enhances efficiency in transaction processing. By utilizing a system where agreement is reached through competitive validation, transactions can be confirmed in a decentralized manner without relying on intermediaries. This leads to quicker transaction times and reduced costs for users.

Finally, the model supports innovation within the ecosystem. As developers and participants continuously seek improvements, the flexibility of this decentralized approach allows for the evolution of the network, accommodating new features and operational enhancements that benefit all users.

Future Developments and Innovations

As the landscape of decentralized networks continues to evolve, there are numerous opportunities for advancements that could enhance the efficiency, security, and scalability of these systems. The ongoing exploration of new methodologies and technologies holds the potential to redefine the way participants interact within the ecosystem, paving the way for more sustainable and robust frameworks.

Scalability solutions remain at the forefront of innovation, with projects focusing on layer two architectures designed to alleviate congestion and facilitate quicker transactions. Techniques such as state channels and sidechains are being refined to deliver enhanced throughput without sacrificing the fundamental principles of decentralization.

Moreover, enhancements in security protocols are critical as the threats facing digital currencies become increasingly sophisticated. Future innovations may involve advanced cryptographic techniques and multi-signature solutions that bolster user protection while maintaining ease of access.

Interoperability between various platforms is another key area poised for growth. By developing standards that encourage seamless interaction among different systems, users can benefit from a more unified experience, thus expanding the overall utility and appeal of these decentralized solutions.

Lastly, the incorporation of artificial intelligence and machine learning could lead to more intelligent transaction verification processes, potentially streamlining operations and reducing resource consumption. The combination of these technologies might result in a more resilient and adaptive ecosystem, capable of responding to changing demands in real-time.

Q&A: What is nakamoto consensus bitcoin

What is Nakamoto Consensus and why is it important for Bitcoin?

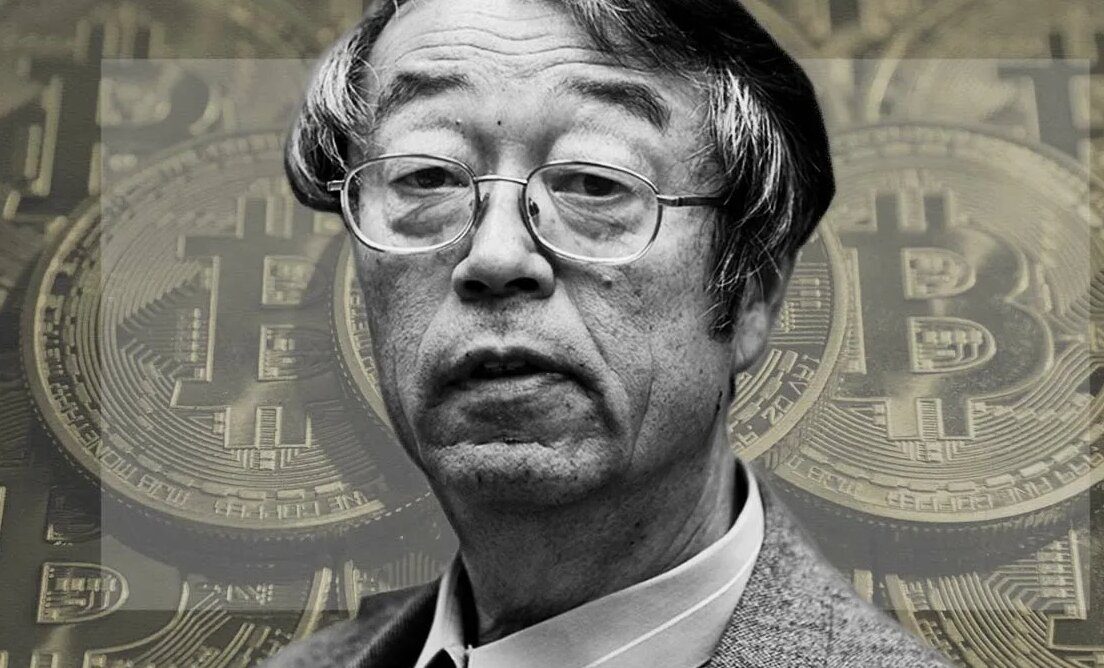

Nakamoto Consensus is a fundamental component of the Bitcoin protocol developed by its pseudonymous creator, Satoshi Nakamoto. It refers to the method by which transactions are verified and added to the blockchain. This consensus mechanism enables decentralized agreement on the state of the blockchain without the need for a central authority. It is important because it ensures the integrity and security of the Bitcoin network, allowing users to trust that their transactions are valid and preventing issues like double-spending. By utilizing a proof-of-work mechanism, Nakamoto Consensus incentivizes miners to solve complex mathematical problems, thus securing the network while providing a reliable way to achieve consensus among all participants.

How does the proof-of-work mechanism function in Nakamoto Consensus?

The proof-of-work mechanism is the underlying process that enables Nakamoto Consensus to function. Miners compete to solve cryptographic puzzles, and the first one to find a valid solution gets to add a new block of transactions to the blockchain. This process involves hashing the block’s header, which includes a variety of data such as the previous block’s hash, a timestamp, and a nonce. The difficulty of these puzzles adjusts approximately every two weeks to ensure that new blocks are added roughly every ten minutes. This system adds a layer of security, as solving these puzzles requires significant computational power and energy, making it costly for any malicious entity to alter the blockchain.

What role do miners play in the Nakamoto Consensus?

Miners play a crucial role in the Nakamoto Consensus as they are responsible for validating transactions and securing the Bitcoin network. When users initiate transactions, miners bundle these into blocks and attempt to find a solution to the associated proof-of-work puzzle. Once they successfully mine a block, it is added to the blockchain, and the transactions within it are considered confirmed. Miners are incentivized by earning block rewards (newly minted bitcoins) and transaction fees, providing economic motivation for them to maintain the integrity of the network. This decentralized network of miners helps to prevent censorship and ensures that all transactions are processed fairly.

Can Nakamoto Consensus be vulnerable to attacks? What are the potential risks?

While Nakamoto Consensus has proven to be a robust security model, it is not entirely immune to attacks. One potential risk is the 51% attack, where a group of miners controlling more than half of the network’s hash power could manipulate the blockchain. They could potentially double-spend coins or censor transactions. However, such scenarios are highly unlikely for Bitcoin due to its massive and distributed mining power. Economic incentives align with honest mining behavior, as successfully executing such an attack would undermine the value of their own holdings. Other risks include the possibility of mining centralization, where a few entities control most of the hash power, posing threats to decentralization and security.

How does Nakamoto Consensus compare to other consensus mechanisms used in cryptocurrencies?

Nakamoto Consensus, which relies on proof-of-work, differs significantly from consensus mechanisms like proof-of-stake, delegated proof-of-stake, and others. In proof-of-work, miners expend computational resources to solve puzzles, while in proof-of-stake, validators are chosen based on the number of coins they hold and are willing to ‘stake,’ requiring less energy and hardware. This can lead to a more efficient and environmentally friendly network. However, critics argue that proof-of-stake may lead to centralization, where wealthier holders have greater influence. Nakamoto Consensus is considered highly secure due to the substantial energy requirements for mining, which makes attacking the network expensive. Each mechanism has its trade-offs, and the choice of consensus algorithm reflects the values and goals of the respective cryptocurrency community.

What is Nakamoto Consensus and why is it important for Bitcoin?

Nakamoto Consensus is a mechanism used in Bitcoin, named after its creator, Satoshi Nakamoto. It is a protocol through which nodes in the Bitcoin network reach an agreement on the state of the blockchain and the validity of transactions. This consensus mechanism is crucial because it ensures that all participants in the network agree on a single version of the blockchain, which prevents double-spending and maintains the integrity of the currency. By utilizing a decentralized network of miners who compete to solve complex mathematical problems, Nakamoto Consensus creates a secure and trustworthy system that does not rely on a central authority.

How does the process of reaching Nakamoto Consensus work in the Bitcoin network?

The process of reaching Nakamoto Consensus in the Bitcoin network primarily relies on Proof of Work (PoW). When a miner wants to add a new block to the blockchain, they must first solve a cryptographic puzzle, which requires significant computational power. Once they find the solution, they broadcast the new block to the network. Other nodes then validate the block and its transactions. If a majority of nodes agree that the block is valid, it is added to the blockchain. This process creates a competitive environment where miners are incentivized to act honestly, as the majority’s consensus helps in validating transactions and securing the network against fraud. Over time, longer chains become more trusted, encouraging miners to continue extending the longest chain, thereby reinforcing the consensus mechanism.

What is the role of Nakamoto consensus in blockchain technology?

Nakamoto consensus is a protocol used by blockchain networks like Bitcoin to reach consensus and ensure security without relying on a central authority. This consensus mechanism allows the network to add new blocks to the blockchain by having miners solve complex computational problems, ensuring that the first miner to solve it gets rewarded. The Nakamoto consensus is a groundbreaking technology that powers Bitcoin and ensures the security and decentralization of its blockchain network. It is designed to handle the Byzantine fault tolerance (BFT), which makes it resilient to malicious actors and network failures.

How does Nakamoto consensus ensure security and decentralization in Bitcoin?

Nakamoto consensus ensures security and decentralization by allowing participants in the Bitcoin blockchain network to reach consensus without the need for a central authority. The consensus process requires miners to validate transactions and add new blocks, which are then broadcast to the rest of the network. This mechanism ensures that no single entity can manipulate the blockchain, and the decentralized nature of the network makes it resistant to attacks or faults. In this way, Nakamoto consensus addresses the Byzantine fault tolerance problem, ensuring the integrity of Bitcoin transactions.

What is the relationship between Nakamoto consensus and Byzantine fault tolerance?

Nakamoto consensus and Byzantine fault tolerance (BFT) are closely related as Nakamoto consensus is designed to resolve the Byzantine Generals Problem, a theoretical scenario where distributed participants must agree on a single decision, despite some being faulty or malicious. In blockchain networks like Bitcoin, the Nakamoto consensus addresses BFT by using a proof-of-work mechanism where the majority of participants (miners) must agree on the validity of transactions. This ensures that even if some participants attempt to disrupt the network, the majority rule can maintain the integrity of the blockchain.

How does Nakamoto consensus compare to other consensus models, such as proof of stake?

Nakamoto consensus, used in Bitcoin’s proof of work system, differs from other consensus models like proof of stake (PoS) in several ways. While Nakamoto consensus requires miners to compete by solving computational puzzles to add new blocks to the blockchain, PoS allows validators to propose new blocks based on the number of coins they hold and are willing to “stake” as collateral. Nakamoto consensus ensures security and decentralization through high computational work, but it is energy-intensive compared to the more energy-efficient PoS, which requires less computational power to reach consensus.

What are the potential challenges and future developments of Nakamoto consensus?

The future of Nakamoto consensus involves addressing challenges such as energy consumption and scalability. While the mechanism ensures security and decentralization, its proof-of-work model consumes significant energy, which has led to criticism regarding its environmental impact. Alternative consensus mechanisms, like proof of stake, are being explored as energy-efficient solutions. Despite these challenges, Nakamoto consensus remains foundational to Bitcoin and other blockchain networks, playing a key role in ensuring the integrity and security of decentralized networks. As adoption of Bitcoin continues to grow, the future of Nakamoto consensus will likely involve improvements to enhance its scalability and reduce energy consumption.