Understanding What Is a Crypto Swaps and Their Significance in the Digital Currency Market

In the rapidly evolving landscape of virtual currencies, enthusiasts and investors often find themselves navigating a labyrinth of terminology and concepts. This vibrant market offers a plethora of opportunities for individuals to engage with different types of digital assets, but the mechanics behind the exchange processes can appear daunting. Grasping the fundamentals of asset transformation is crucial for those looking to thrive in this innovative financial arena.

At its core, the exchange of one digital token for another serves as a pivotal function in the broader ecosystem. Individuals seeking to diversify their portfolios or capitalize on market trends rely on these mechanisms to facilitate their transactions effortlessly. The ease with which one can transition between various forms of digital wealth underscores the dynamic nature of this market and its potential for growth.

As we explore the nuances of these exchanges, it becomes vital to break down the concepts into manageable pieces. By demystifying the processes involved, participants can make informed decisions and engage with confidence. Through this journey, we will uncover the vital aspects that define these transactions, empowering readers to navigate the world of digital assets with greater ease and insight.

What Are Crypto Swaps?

In the rapidly evolving digital asset landscape, individuals and institutions seek ways to exchange different tokens seamlessly. This process enables participants to access varied financial instruments and benefit from market opportunities without needing to convert assets back to traditional currency.

These exchanges offer several advantages, enhancing flexibility and opportunities for traders. Here are some key points to consider:

- Facilitates direct exchanges between different digital tokens.

- Allows for hedging against price fluctuations.

- Streamlines trading processes, reducing the need for multiple transactions.

- Increases market efficiency by providing liquidity.

By engaging in these transactions, users can explore different investment strategies or adjust their asset holdings based on market conditions. This mechanism serves as a crucial element of the broader digital currency ecosystem, promoting innovation and accessibility in finance.

How Crypto Swaps Work

The process of exchanging digital assets in the realm of virtual currencies allows individuals to trade one asset for another seamlessly. This mechanism can serve various purposes, from portfolio diversification to taking advantage of market fluctuations, making it a crucial element of the digital financial landscape.

The Mechanics of Asset Exchange

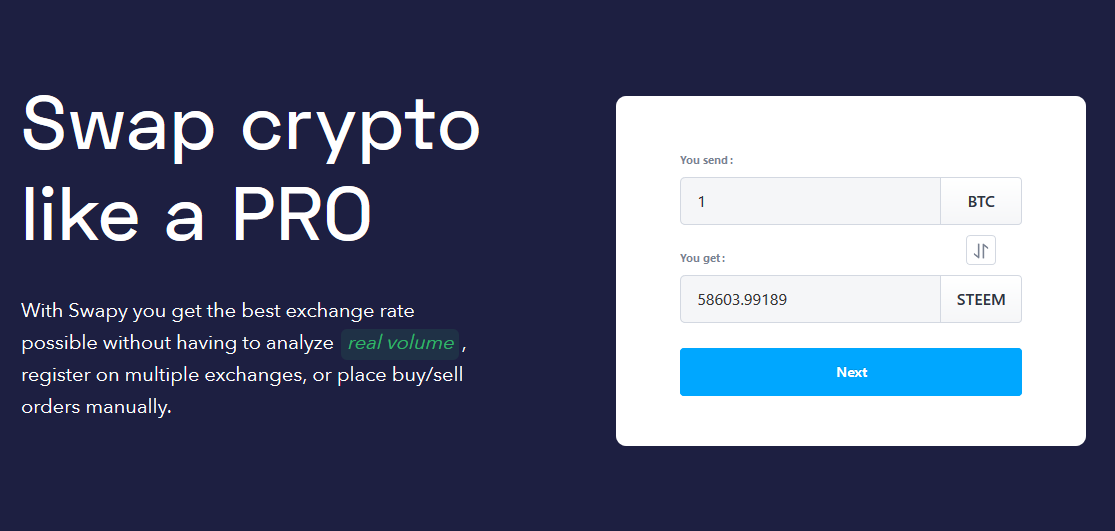

When an individual initiates an exchange, they typically use a platform designed to facilitate these transactions. The user specifies the asset they wish to offer and the one they want in return. Once both parties agree on the terms, the transaction is executed automatically, ensuring efficiency and transparency. This automated process minimizes the risks associated with manual trades and enhances user experience.

Benefits of Digital Asset Trading

Participating in these exchanges offers several advantages. Firstly, users gain access to a range of different digital currencies, allowing for greater flexibility in their investment strategies. Secondly, the speed of transactions can lead to immediate realization of profits or losses, aligning with the fast-paced nature of financial markets. Lastly, this method often incurs lower fees compared to traditional trading services, making it a cost-effective solution for many traders.

Advantages of Using Swaps

The process of exchanging one asset for another has gained popularity due to its numerous benefits. This mechanism allows individuals and organizations to optimize their resource management while minimizing risks associated with traditional financial transactions.

One significant advantage is the flexibility it offers. Participants can tailor their agreements to meet specific needs, allowing for greater customization than in conventional trading methods. This adaptability can lead to more favorable terms for both parties involved.

Another key benefit is the potential for cost savings. By eliminating intermediaries, participants can reduce fees associated with transactions, making it more economical. Additionally, this efficiency enables quicker execution of trades, providing a competitive edge in fast-moving markets.

The ability to hedge against market volatility is yet another compelling reason to engage in these transactions. By exchanging assets strategically, participants can guard themselves against unfavorable price movements, enhancing their overall financial stability.

Furthermore, this practice fosters increased liquidity. By allowing for continuous exchanges, it ensures that assets can be easily converted, promoting a more dynamic trading environment. This accessibility can attract more participants, ultimately benefiting the ecosystem as a whole.

Risks Involved in Crypto Swaps

Engaging in the exchange of digital assets carries inherent uncertainties that participants must acknowledge. These dangers may stem from market volatility, security vulnerabilities, and operational shortcomings, all of which can significantly impact the outcome of asset trades. It is essential for traders to be well-informed about these risks to make sound decisions.

Market Volatility

The digital asset marketplace is characterized by extreme price fluctuations, which can occur within short timeframes. This volatility may lead to unexpected losses for individuals who fail to anticipate rapid market movements. Those involved in exchanges should remain vigilant and manage their investments prudently.

Security Concerns

Another significant risk relates to the safety of assets during transactions. Weaknesses in technology or human error can expose users to theft or loss of funds. Ensuring that proper precautions are taken, such as using reputable platforms and implementing robust security measures, is crucial for mitigating these threats.

| Type of Risk | Description |

|---|---|

| Market Volatility | Significant and sudden price changes that can lead to financial losses. |

| Security Risks | Potential loss of funds due to hacking or fraud. |

| Liquidity Issues | Difficulty in executing trades without affecting prices adversely. |

| Regulatory Changes | Unexpected alterations in laws that might impact trading practices. |

Popular Platforms for Swaps

Today, a variety of platforms cater to those looking to exchange digital assets seamlessly. Each of these services offers unique features, user experiences, and transactional efficiencies. Below are some of the notable choices available in the market.

Decentralized Platforms

Decentralized services have gained traction due to their independence from traditional financial institutions. Users can trade assets directly with each other, promoting privacy and control over transactions.

- Uniswap: A widely-used decentralized exchange that operates on the Ethereum network, allowing users to swap numerous tokens effortlessly.

- SushiSwap: An evolution of Uniswap, it adds additional features like yield farming and staking opportunities.

- Curve Finance: Specializes in stablecoin swapping, offering low slippage for users looking to exchange stable assets.

Centralized Platforms

Centralized exchanges provide a more user-friendly approach, often featuring higher liquidity and advanced trading tools. These platforms typically require users to create accounts but offer a streamlined experience for traders.

- Binance: One of the largest exchanges globally, known for its vast selection of cryptocurrencies and user-friendly interface.

- Coinbase: A popular choice for beginners, offering ease of use and a straightforward process to exchange assets.

- Kraken: Renowned for its security and robust trading features, catering to both novice and experienced traders.

With the increasing popularity of digital currencies, the choice of platforms continues to expand, giving users ample opportunities to engage in exchanging assets effectively.

Future Trends in Crypto Swapping

The landscape of digital exchanges is continuously evolving, driven by technological advancements and shifting user preferences. As the market matures, new methodologies and frameworks are being developed to enhance the efficiency and security of asset exchanges. This section explores potential directions that the market could take as innovations reshape the way users interact with their digital assets.

One significant shift is the increasing adoption of decentralized platforms, which empower users by reducing reliance on central authorities. This trend promotes transparency and fosters a sense of community among participants. Furthermore, as privacy concerns become more pronounced, protocols that prioritize user anonymity and data protection are likely to gain traction.

Another emerging element is the integration of artificial intelligence and machine learning. These technologies can analyze vast amounts of data to predict market movements, helping users make informed decisions. Automation in trading strategies will also simplify participation for less experienced individuals, thereby broadening the user base.

Moreover, interoperability between various networks is on the rise. Enhanced compatibility allows users to transfer assets across different ecosystems seamlessly. This will not only facilitate smoother transactions but also encourage the growth of hybrid platforms that combine the best features of centralized and decentralized systems.

Lastly, the regulatory landscape is anticipated to mature, influencing how assets are exchanged. Clearer guidelines will likely foster trust and promote wider acceptance among mainstream investors. As stakeholders adapt to these regulatory changes, the methods of asset exchanges will also evolve, ensuring a safer and more reliable environment for all participants.

Q&A: What Is a Crypto Swap?

What is a crypto swap and how does it work?

A crypto swap is a type of trade that allows users to exchange one cryptocurrency for another without needing to go through traditional markets. Instead of selling one crypto asset for fiat currency and then buying another, a swap facilitates a direct exchange. This is often done through decentralized exchanges (DEXs) or swap platforms where users can specify which cryptocurrencies they want to trade. The swap mechanism typically involves smart contracts to ensure that both parties receive their respective assets securely and automatically, which enhances transparency and reduces the risk of fraud.

Are crypto swaps safe to use or do they carry risks?

While crypto swaps can be convenient and efficient, they do carry certain risks. One primary risk is the potential for price slippage, which occurs when the price of the cryptocurrency changes between the time the swap is initiated and completed. This can lead to receiving less favorable rates. Additionally, using decentralized platforms exposes users to smart contract vulnerabilities; if a contract is poorly coded, it could be exploited. Furthermore, there’s the risk of regulatory changes and market volatility affecting the assets being swapped. Users should conduct thorough research and consider using reputable platforms that implement robust security measures.

What are the benefits of using crypto swaps instead of traditional exchanges?

Crypto swaps offer several advantages over traditional exchanges. Firstly, they provide a more direct means of trading without needing to convert cryptocurrencies to fiat currencies, which can save time and transaction fees. Secondly, many swaps operate on decentralized platforms, allowing users to maintain control of their funds throughout the trading process, reducing the risks associated with central custodians. Additionally, swaps can offer access to a wider variety of trading pairs and often have lower barriers to entry, making it easier for novice traders to participate in the market. Lastly, the use of smart contracts can enhance the speed and efficiency of trades, allowing for nearly instantaneous transactions.

Can I use crypto swaps for token pairs that are not commonly traded?

Yes, many crypto swap platforms allow users to swap a wide array of token pairs, including those that are less commonly traded. These platforms often utilize automated market-making (AMM) protocols, which do not rely on traditional order books but instead use liquidity pools to enable swaps between various tokens. As long as the token you want to swap has liquidity available in the pool, you should be able to make the trade. However, it’s essential to keep an eye on the liquidity and volume of the tokens involved, as low liquidity can result in higher slippage and less favorable swap rates.

How do I determine the best rates for crypto swaps?

To find the best rates for crypto swaps, it is advisable to compare multiple platforms and tools that offer swap services. Various decentralized exchange aggregators can check rates across different DEXs to help you find the optimal rate for your desired swap. In addition to comparing rates, it’s crucial to assess transaction fees, which can vary significantly between platforms. Some often include hidden fees in the swap rate, so always read the terms and fine print. Keep an eye on market trends and the overall liquidity of the tokens involved, as this can impact the rates you receive. By doing your research and comparing options, you can secure better swap rates effectively.

How does a cryptocurrency swap work, and what is the swap process in the cryptocurrency market?

A cryptocurrency swap refers to the direct exchange of one cryptocurrency for another without needing to convert it to fiat currency first. The swap process typically involves selecting the crypto token to exchange, choosing the desired cryptocurrency asset, reviewing the exchange rate, and confirming the swap. Crypto swaps occur on a cryptocurrency exchange or within a crypto wallet app, depending on the platform. Swapping allows users to trade one cryptocurrency for another efficiently.

What is the difference between a cryptocurrency swap and trading on a crypto exchange?

A cryptocurrency swap refers to the instant exchange of one crypto token for another at a predetermined rate, often without requiring an order book. In contrast, trading on a crypto exchange involves placing buy or sell orders, which depend on market supply and demand. Swapping allows users to trade one cryptocurrency directly, while trading often involves setting specific price levels and waiting for orders to be filled.

How can users swap tokens using a crypto wallet?

Users can perform token swaps directly within a crypto wallet that supports swapping features. The process involves selecting the crypto token to swap, choosing the cryptocurrency asset they wish to swap for, verifying the exchange rate, and confirming the swap transaction. Wallet apps that facilitate the exchange of one cryptocurrency for another make swapping easier for crypto holders looking to diversify their cryptocurrency assets.

What are the benefits of swapping cryptocurrencies instead of selling crypto for fiat and rebuying?

Swapping cryptocurrencies provides a faster and often more cost-effective way to exchange tokens compared to selling crypto for fiat and rebuying. Swapping eliminates the need for multiple transactions, reducing lower transaction fees and minimizing exposure to exchange rate fluctuations. Users swap crypto to diversify their cryptocurrency portfolios without leaving the cryptocurrency ecosystem.

How does the choice of a crypto exchange impact the ability to swap one cryptocurrency for another?

The choice of a crypto exchange affects the ability to swap one cryptocurrency for another based on factors such as supported tokens, exchange rates, and transaction fees. Some exchange platforms facilitate the exchange of one cryptocurrency more efficiently, while others may require additional steps, such as using intermediary tokens. Choosing the right cryptocurrency exchange ensures a smooth and secure swapping experience.