Understanding What Is an IPOs and the Journey of Crypto Firms Going Public

In recent years, the landscape of finance has been dramatically transformed, with novel financial entities seeking avenues to access broader pools of capital. This phenomenon heralds a new era where innovative ventures are making their way towards public engagement, inviting a variety of investors to partake in their growth stories. Such transitions mark a significant milestone, not only for the enterprises involved but also for the financial ecosystem as a whole.

As these ventures navigate the complexities of public offerings, they encounter a myriad of regulations, strategic considerations, and market reactions. Each step on this path requires careful planning and foresight, as they aspire to establish credibility and attract diverse investment streams. The intricate dance between corporate aspirations and investor expectations shapes the success of these endeavors, making it crucial to grasp the underlying elements that influence this fascinating process.

With the integration of traditional financial practices and the dynamic nature of digital assets, the regulatory environment plays a pivotal role in shaping how these entities present themselves to the public. By examining the motivations and challenges that accompany this transition, stakeholders can better appreciate the nuances of participating in this evolving landscape. Embracing the opportunities and risks inherent in such ventures ultimately defines the trajectory of their market presence.

What is an IPO in Crypto?

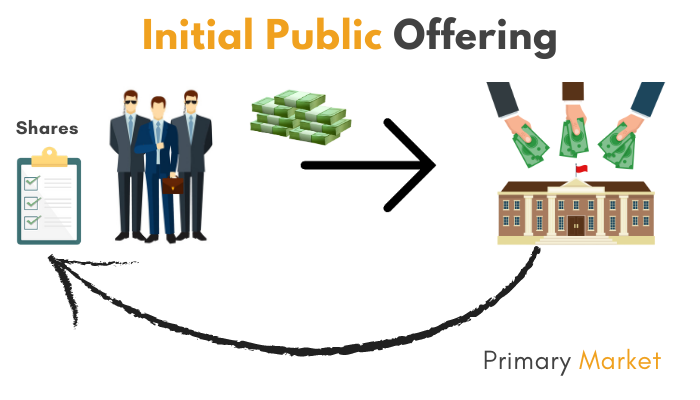

The process of transitioning a digital asset or blockchain-focused venture into the public market represents a significant milestone for the project and its stakeholders. This approach allows for broader investment while adhering to regulatory frameworks. By tapping into public funding, these ventures can accelerate growth and enhance their operational reach.

Key Features of This Process

- Public Access: Individuals can invest in the venture via traditional financial markets, expanding the investor base.

- Regulatory Compliance: Companies must navigate various legal requirements to ensure transparency and protect investors.

- Capital Generation: This method facilitates influx of funds, which can be crucial for expanding operations or developing new technologies.

Advantages of Going Public

- Increased Credibility: Being publicly traded often enhances the reputation of a project, attracting more serious investors.

- Market Visibility: Public listings draw attention, improving brand awareness in a competitive environment.

- Liquidity: Publicly available shares provide a means for early investors to realize gains more easily.

Differences Between ICOs and IPOs

The landscape of fundraising has evolved significantly, giving rise to various methods for organizations to secure capital. Among these, two prominent approaches stand out: token offerings and traditional equity sales. Each method caters to different audiences and adheres to distinct regulatory frameworks, reflecting the diverse nature of investment opportunities.

Regulatory Frameworks

One of the key distinctions lies in the regulatory oversight surrounding each method. Token offerings often operate in a less regulated environment, allowing companies to engage with a wider array of investors, including those without extensive financial backgrounds. In contrast, equity sales are subject to stringent regulations imposed by government bodies, ensuring that only accredited investors can participate in many instances.

Investment Structure

The structure of investment also varies significantly between the two. In a token offering, participants receive digital tokens representing value or utility within a specific ecosystem, which may not confer ownership rights. Conversely, equity offerings grant investors shares in the company, entitling them to a portion of the profits and potential voting rights, thus fostering a direct alignment of interests between investors and the organization.

Regulatory Landscape for Cryptocurrency IPOs

The current environment surrounding the issuance of digital assets is characterized by a complex framework of regulations that aim to balance innovation and investor protection. Authorities around the globe are grappling with how best to oversee these digital fundraising mechanisms while fostering an ecosystem conducive to growth.

One of the primary considerations is the classification of digital tokens, which can significantly impact the regulatory requirements they must adhere to. Various jurisdictions approach this classification differently, leading to a patchwork of regulations that companies must navigate. Understanding local laws is crucial for entities looking to enter the public market.

Moreover, compliance with securities regulations is paramount. In many regions, tokens offered during a public offering are treated as securities, subjecting them to stringent disclosure obligations and reporting standards. Companies are required to provide detailed information to investors, including financial health, operational risks, and the intended use of funds raised.

Additionally, the role of regulatory bodies, such as the SEC in the United States, cannot be understated. These organizations monitor compliance and enforce regulations to safeguard investor interests. Companies must engage with these institutions early in the process to ensure adherence to relevant laws and avoid potential fines or sanctions.

Lastly, as the landscape continues to evolve, there is an ongoing debate among stakeholders regarding the need for a unified regulatory framework. Advocates argue that a coherent approach would not only streamline compliance but also enhance market integrity and public confidence in digital investments.

Steps in the IPO Process

The journey towards becoming a publicly traded entity involves several critical phases that require careful planning and execution. Each step is essential to ensure compliance with legal requirements and to build an efficient foundation for future growth and investor relations. The following sections outline the key stages in this transformative endeavor.

Preparation and Documentation

Prior to engaging with investors, a comprehensive strategy must be established. This includes assembling a core team comprising financial advisors, legal experts, and underwriters. This team will aid in drafting the necessary documentation, including the prospectus, which outlines the company’s financial performance, operational strategy, and potential risks associated with investment.

Roadshow and Pricing

Following the preparation of documentation, a promotional tour, often referred to as a roadshow, takes place. During this phase, executives present their vision to potential investors across various locations. Subsequently, the final offering price is determined based on market demand and investor feedback. It is during this crucial stage that the company aims to strike a balance between raising sufficient capital and retaining favorable valuation.

Benefits of Going Public for Crypto Firms

Taking the step to become publicly traded offers numerous advantages that can significantly enhance the growth trajectory of digital asset enterprises. By accessing a wider pool of resources and increasing visibility, these ventures can propel themselves into new realms of opportunity. Here are some key advantages that can stem from this transformative move.

Access to Capital

One of the most notable benefits of becoming publicly listed is the ability to secure substantial funding. This influx of capital can be vital for scaling operations, conducting research, and expanding market presence. Specifically, firms can:

- Attract institutional investors looking for diversified portfolios.

- Utilize equity financing to fund innovative projects.

- Decrease reliance on traditional venture capital, thus retaining more control.

Increased Credibility and Trust

Publicly traded organizations often enjoy enhanced reputation and trust among consumers and partners. This credibility can lead to:

- Improved relationships with stakeholders, including regulators and clients.

- Increased media attention and public interest, driving customer engagement.

- A stronger position in negotiations with suppliers and other businesses.

Overall, transitioning to a public entity can exponentially benefit digital asset firms by providing them with essential resources and fostering a trustworthy image in an evolving market.

Risks Involved in Crypto IPOs

Launching a new venture in the digital currency realm presents an array of challenges that investors must carefully navigate. The potential for substantial rewards is often accompanied by equally significant threats that can impact both the market and individual stakeholders. Recognizing these dangers is essential for anyone contemplating participation in such initiatives.

Market Volatility

The nature of digital assets is inherently volatile, with prices subject to rapid fluctuations. This volatility can lead to unpredictable market behavior during the initial phase, potentially resulting in significant financial losses for those investing during the debut period.

Regulatory Uncertainty

Governments around the world continue to grapple with how to regulate the digital currency ecosystem. Changes in legal frameworks or new regulations can drastically affect the operational capabilities of newly public ventures, adding another layer of risk for investors.

| Type of Risk | Description |

|---|---|

| Market Volatility | Sudden price fluctuations can lead to significant losses. |

| Regulatory Uncertainty | Shifts in laws may hinder business operations and investor confidence. |

| Technology Failures | Potential technical issues or security breaches can undermine trust. |

| Liquidity Concerns | Limited trading volume may complicate the ability to sell assets quickly. |

Q&A: What Is an IPO? How Crypto Firms Go Public

How does an initial public offering work for a private company?

An initial public offering allows a private company to raise capital by selling shares to public investors for the first time. The company works with underwriters, typically investment banks, to determine the IPO price and market the shares to institutional and retail investors. Once the IPO is completed, the company becomes publicly traded, and its shares are listed on a stock exchange, allowing investors to buy and sell them in the open market.

Why might crypto companies choose to go public through an IPO?

Crypto companies may pursue an IPO to raise capital from public investors, enhance their credibility, and expand their market presence. By going public, these companies can access additional funding for growth initiatives, such as developing new technologies or expanding their user base. Publicly traded companies in the crypto sector, like Coinbase, have also used IPOs to increase visibility and transparency within the market.

What is the difference between an initial public offering and an initial coin offering?

An initial public offering involves a company raising capital by selling shares to public investors, making it a publicly traded company. An initial coin offering, on the other hand, allows a company to raise funds by selling crypto assets or tokens directly to investors. While IPOs are heavily regulated and involve listing on a stock exchange, ICOs are typically less regulated and focus on offering coins or tokens that can be used within the company’s platform or ecosystem.

What are the alternative methods to a traditional initial public offering?

Alternative methods to a traditional IPO include direct public listings and reverse mergers with special purpose acquisition companies (SPACs). In a direct listing, a company sells existing shares directly to the public without issuing new shares or using underwriters. SPACs allow a private company to go public by merging with a publicly traded entity, providing a faster and often less expensive route to public markets compared to a traditional IPO.

How does an IPO impact the stock price of a company?

An IPO can significantly influence a company’s stock price. If the IPO is well-received by public investors, the stock price may rise quickly due to high demand. Conversely, if demand is lower than expected, the price may drop. Following an IPO, stock price fluctuations are often driven by market conditions, company performance, and investor sentiment. Publicly traded companies must adapt to these factors to maintain their market valuation.

How does a traditional IPO process work for a private company?

A traditional IPO process involves a private company working with an investment bank to prepare for public trading. The process includes filing regulatory documents, such as a prospectus, determining the final IPO price, and marketing the offering to institutional and individual investors. Once completed, the company transitions from private to public, and its shares are listed on a stock exchange, making them available for public trading.

What are the benefits of an IPO for a company?

An IPO can provide significant benefits, including access to public markets for raising capital, increased visibility, and credibility in the stock market. Selling shares to the public allows the company to fund expansion, reduce debt, or invest in new projects. Additionally, going public through an IPO can attract new investors and create liquidity for existing shareholders.

How do market conditions affect the decision to go public?

Market conditions play a critical role in a company’s decision to go public. Favorable conditions, such as strong stock market performance and high investor demand, can lead to a higher IPO price and successful launch. Conversely, poor market conditions may delay an IPO or reduce the proceeds from selling shares to the public. Companies often time their IPOs to coincide with periods of market stability and investor confidence.

What are some alternative methods to a traditional IPO?

Companies can choose alternative methods, such as direct public listings or special purpose acquisition companies (SPACs), to go public. A direct listing allows a company to sell existing shares directly to the public without issuing new shares, avoiding some complexities of a traditional IPO. SPACs involve merging with a publicly listed entity, offering a faster and more flexible way to access public markets.

Can cryptocurrency firms go public through an IPO?

Yes, cryptocurrency firms can go public through an IPO, similar to other companies. These firms may work with investment banks to sell shares of their company or crypto assets to the public. Crypto exchanges and blockchain-based companies that conduct an IPO gain access to public markets, allowing them to raise capital and increase visibility in the cryptocurrency and stock market. Examples of crypto firms going public include Coinbase, which listed its shares on a stock exchange through a direct listing.