Understanding What Is Bitcoin and Its Impact on the Modern Economy

The emergence of a decentralized monetary system has transformed the landscape of finance in unprecedented ways. This innovative form of currency represents a shift away from traditional banking practices, empowering individuals with new opportunities for transactions and investments. The allure of this digital asset lies not only in its unique features but also in the implications it carries for the future of global economics.

Delving into the inception of this groundbreaking technology reveals a narrative filled with ambition, creativity, and the desire for autonomy. Its creation marked a pivotal moment in the world of finance, challenging established norms and introducing novel concepts of value exchange. The motivations behind this digital currency reflect a broader quest for transparency and security within the financial system.

As this financial phenomenon continues to evolve, its ramifications extend beyond mere transactions. The conversations surrounding it have sparked debates among economists, policymakers, and everyday users, highlighting the diverse perspectives on its potential benefits and drawbacks. By examining its journey, we can gain insights into how it has reshaped not only individual financial behavior but also broader economic frameworks.

What is Bitcoin and How It Works

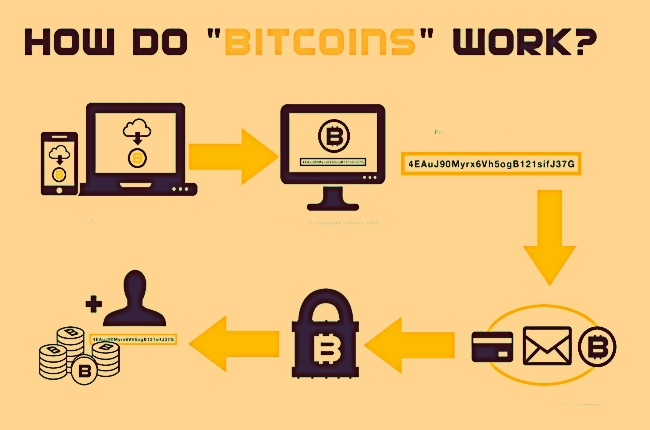

This digital currency represents a groundbreaking shift in the financial landscape, allowing individuals to engage in transactions without the need for traditional banking infrastructures. By leveraging advanced cryptographic techniques, this form of currency enables secure, peer-to-peer exchanges, fostering a new era of economic interaction. Understanding its mechanics is crucial for appreciating its transformative potential.

Key Features of This Digital Currency

- Decentralization: Operates without a central authority, minimizing the risk of manipulation.

- Transparency: All transactions are recorded on a public ledger, ensuring clear tracking of funds.

- Security: Utilizes cryptography to protect transaction data, making it difficult to counterfeit or double-spend.

- Limited Supply: Capped at a certain quantity, which introduces scarcity and may influence value.

How Transactions Are Conducted

- Initiation: A user creates a transaction to transfer value to another individual.

- Verification: Network participants, known as miners, validate the transaction through complex computations.

- Inclusion: Once validated, the transaction is grouped with others and added to the blockchain, the permanent ledger.

- Completion: Upon confirmation, the recipient gains access to the transferred funds.

The Historical Context of Bitcoin’s Creation

The emergence of a decentralized digital currency was not a spontaneous event but rather a culmination of various technological, economic, and societal factors. Throughout history, the evolution of financial systems has frequently mirrored the prevailing needs and challenges of the time. In the late 20th and early 21st centuries, rising concerns regarding traditional banking practices and the fragility of financial institutions laid the groundwork for an innovative approach to currency.

Technological Advancements

During the 1990s and early 2000s, significant breakthroughs in computer science and cryptography paved the way for secure online transactions. These advancements contributed to the foundation necessary for creating a non-centralized monetary system. The introduction of protocols for digital signatures and hashing algorithms offered the tools required to establish trust without intermediaries.

Economic Climate

The global financial landscape experienced severe upheaval, highlighted by events such as the dot-com bubble and the 2008 financial crisis. These occurrences fostered a growing skepticism toward banks and government-issued currencies, prompting individuals to seek alternative forms of money. The necessity for a resilient monetary model that operated outside central authority became increasingly clear.

| Year | Event | Significance |

|---|---|---|

| 1998 | Introdution of e-gold | First digital currency that allowed users to conduct transactions backed by gold. |

| 2008 | Global Financial Crisis | Increased mistrust in traditional banking systems and state-controlled currencies. |

| 2009 | Release of the Whitepaper | Conceptual framework for decentralized currency laid out by an anonymous entity. |

Key Contributors to Bitcoin’s Development

The evolution of this groundbreaking digital currency has been shaped by a diverse group of individuals who have played pivotal roles in its conception and ongoing advancement. Their contributions span technical innovations, community building, and the establishment of foundational principles that govern the ecosystem.

Satoshi Nakamoto is perhaps the most enigmatic figure in this narrative. As the anonymous creator, their publication of the original white paper laid the groundwork for the technology and its underlying philosophy. The decision to remain hidden has fueled speculation and intrigue, adding to the allure of this revolutionary financial tool.

Following Nakamoto, numerous developers and advocates have significantly influenced the trajectory of this digital asset. Notable figures include Gavin Andresen, who became the lead developer after Nakamoto’s departure, helping to steer the project during its formative years. His efforts in engaging the community and managing code revisions have been critical in maintaining the software’s integrity and fostering collaboration among contributors.

Hal Finney, an early adopter and developer, also made substantial contributions. He was the first person to receive a transaction, showcasing the practical application of the system. Finney’s work emphasized the importance of security and innovation, which laid the groundwork for many subsequent enhancements.

Furthermore, the establishment of Various Foundations and organizations has provided essential support for development. Groups like the Bitcoin Foundation have played a vital role in advocating for the technology, educating the public, and promoting standardization, thus aiding in its acceptance and integration into traditional finance.

These individuals and groups, among others, have collectively shaped the journey of this digital revolution. Their relentless pursuit of innovation and commitment to the community continue to influence its future, ensuring that the vision of a decentralized and open financial system persists.

How Bitcoin Affects Modern Finance

The emergence of decentralized digital currency has significantly transformed the landscape of contemporary monetary systems. By introducing an innovative approach to transactions, this phenomenon challenges traditional banking models, prompting financial institutions to adapt or face obsolescence. The implications of this shift extend beyond mere currency exchanges, influencing investment strategies, regulatory frameworks, and consumer behavior.

The rise of this virtual currency has fostered a new wave of financial technologies, commonly referred to as fintech. Companies utilizing blockchain technology offer enhanced security, reduced transaction costs, and faster processing times, catering to an increasingly digital-savvy clientele. This has compelled established banks to innovate, leading to the development of new products and services that incorporate elements of decentralized finance.

Moreover, the growing acceptance of this currency in mainstream commerce signals a gradual shift in public perception regarding alternate financial assets. As investors recognize its potential for diversification, they explore its role in their portfolios, further legitimizing its presence in global markets. This evolution encourages a broader conversation about asset value, risk management, and the future of currency itself.

Regulators worldwide are reassessing their approaches in light of these advancements. New policies are emerging to address compliance, consumer protection, and taxation, ensuring that this digital innovation aligns with existing financial standards. This regulatory attention underscores the importance of maintaining stability in financial ecosystems while embracing pioneering technologies.

In conclusion, the influence of this new financial instrument is palpable, as it reshapes the way people think about money, investment, and financial services. Its ongoing evolution will undoubtedly continue to challenge norms and inspire innovations within the global economy.

Challenges and Criticisms of Bitcoin

The emergence of decentralized digital currency has sparked extensive debate among economists, developers, and regulators. While this revolutionary financial technology has garnered a loyal following, it also faces significant issues and skepticism regarding its viability and ethical implications.

- Volatility: The value of this cryptocurrency experiences extreme fluctuations, which can deter its use as a reliable medium of exchange or store of value.

- Regulatory Concerns: Governments around the world are grappling with how to regulate this new asset class, leading to uncertainty for both users and investors.

- Security Issues: Despite blockchain technology’s inherent advantages, exchanges and wallets are not immune to hacking and fraud.

- Environmental Impact: The energy-intensive mining process raises alarms regarding sustainability, contributing to a larger carbon footprint.

These aspects highlight the complexities surrounding the adoption of this form of currency, prompting ongoing discussions about its future.

- Scalability: The capacity to handle increasing transaction volumes remains a contentious point, as network congestion can lead to higher fees.

- Market Manipulation: The lack of oversight makes this system vulnerable to price manipulation by unscrupulous actors.

- User Anonymity: While anonymity is often touted as a benefit, it also facilitates illegal activities, raising ethical dilemmas for proponents.

Ultimately, the path forward for this pioneering financial innovation will require addressing these hurdles while fostering a balanced conversation about its long-term implications.

The Future of Bitcoin and Blockchain Technology

The evolution of this decentralized currency and its underlying ledger system hints at a transformative journey ahead. As new challenges and opportunities arise in the digital financial landscape, potential advancements may significantly reshape personal finance, societal structures, and various industries. The resilience and adaptability of the ecosystem are likely to play crucial roles in determining the trajectory of digital assets and their applications.

Potential Developments in Cryptographic Innovations

As the landscape progresses, future innovations are anticipated to enhance the security, scalability, and efficiency of blockchain networks. Improvements in cryptographic techniques might provide increased privacy options for users while maintaining transparency essential for trust. Furthermore, the integration of artificial intelligence and machine learning could lead to more sophisticated, responsive systems capable of managing intricate transactions seamlessly.

Broader Adoption and Regulatory Landscape

Wider acceptance of digital currencies is expected as institutions and individuals recognize their utility. However, successful integration will likely depend on the establishment of clear regulatory frameworks. Governments and organizations may collaborate to create guidelines that balance innovation with consumer protection, paving the way for mainstream engagement. As these dynamics evolve, the interplay between regulation and technology may determine the sustainability and growth of decentralized financial systems.

Q&A: What Is Bitcoin?

What is the purpose of cryptocurrencies like bitcoin?

Cryptocurrencies like bitcoin were created to function as a peer-to-peer electronic cash system, allowing users to make transactions without relying on traditional financial institutions. Bitcoin operates on a distributed ledger called the blockchain, which ensures transparency and security for every transaction made.

How can someone buy and sell bitcoin?

To buy and sell bitcoin, users can register on cryptocurrency exchanges, which allow trading between fiat currencies and crypto assets like BTC. Users need a bitcoin wallet to store their private and public keys, which are essential for authorizing transactions. Bitcoin exchanges facilitate the process of buying or selling bitcoin, often with lower fees compared to traditional financial systems.

What happens during a bitcoin halve event?

A bitcoin halve event occurs approximately every four years and reduces the reward for mining new blocks by 50%. This mechanism is built into bitcoin’s protocol to control the supply of new bitcoin, ensuring that the total amount of bitcoin never exceeds 21 million. Halving events often impact the bitcoin price due to reduced supply.

Why is bitcoin often compared to digital gold?

Bitcoin is often compared to digital gold because it shares characteristics like scarcity and store of value. With a capped supply of 21 million, bitcoin is a form of digital money that cannot be inflated, similar to precious metals. Its decentralized nature and resistance to manipulation by central banks further reinforce this comparison.

How does bitcoin differ from traditional financial systems?

Bitcoin operates without the need for third parties like a bank or payment processor, allowing users to make transactions directly. Unlike traditional financial systems, bitcoin uses a distributed ledger to record every transaction ever made, ensuring transparency and reducing high fees. This peer-to-peer system eliminates the need for intermediaries, making it a revolutionary alternative to fiat currencies.

What is bitcoin mining and how does it work?

Bitcoin mining is the process of validating and adding new transactions to the bitcoin blockchain. Miners use powerful computers to solve complex mathematical problems, and the first one to solve the problem gets to add a new block to the blockchain. This process is known as mining, and miners are rewarded with new coins for their efforts.

How does a bitcoin transaction work?

A bitcoin transaction involves transferring value from one bitcoin address to another. Each transaction is recorded on the bitcoin blockchain and requires a private key to authorize the transfer. The transaction is then broadcast to the network, where bitcoin miners verify and include it in a new block.

What is the role of a node in the bitcoin network?

A node in the bitcoin network is a computer that maintains a copy of the bitcoin blockchain and helps validate and relay transactions. Nodes ensure the integrity of the network by enforcing consensus rules and verifying that every transaction adheres to the protocol.

Why is the bitcoin supply capped at 21 million?

The bitcoin supply is capped at 21 million to create scarcity, similar to precious metals like gold. This limit is hardcoded into bitcoin’s protocol and ensures that no more than 21 million coins will ever exist, making bitcoin a deflationary asset.

What is the difference between fiat currencies and bitcoin?

Fiat currencies, like the US dollar, are issued and regulated by central banks, while bitcoin is a decentralized digital money that operates without third parties. Bitcoin uses proof of work to secure its network, whereas fiat currencies rely on government backing and monetary policy.