Unveiling the BSI Crypto Indicator for Enhanced Trading Strategies

In the dynamic world of financial markets, gaining clarity amidst the chaos is crucial. Traders continually seek methods to sharpen their decision-making processes, relying on various signals to guide their actions. As technology evolves, tools designed to interpret market behavior become essential for those aiming to achieve consistent results.

By diving into advanced methods that analyze market patterns, participants can uncover opportunities that may have previously gone unnoticed. A deep understanding of these analytical resources can transform a trader’s approach, leading to more informed choices. Embracing innovative techniques allows individuals to adapt their strategies, ultimately fostering greater confidence in their market engagements.

As we explore unique methodologies tailored towards optimizing trade decisions, it becomes evident that knowledge plays a pivotal role. Harnessing these insights not only enhances performance but also empowers traders to navigate the complexities of the investment landscape with newfound assurance.

Understanding the BSI Crypto Indicator

This section aims to provide insight into a specific tool designed to assist traders in navigating the complexities of digital asset markets. By offering valuable signals, it aids in making informed decisions based on market movements and trends. Understanding its mechanisms can lead to enhanced strategies and potential profitability.

Key Features of the Tool

The instrument offers a range of functionalities that cater to various aspects of market analysis. Here are some notable aspects:

| Feature | Description |

|---|---|

| Signal Generation | Provides alerts based on specific criteria, indicating potential opportunities for entry or exit. |

| Historical Data Analysis | Utilizes past performance data to identify trends and patterns, enhancing future predictions. |

| Customizability | Allows users to adjust parameters to better fit their personal trading styles and risk appetites. |

Benefits of Utilizing This Tool

Employing this analytical mechanism can significantly improve decision-making processes. By interpreting the signals generated, traders can better align their strategies with market conditions, potentially leading to increased success rates. Furthermore, understanding its outputs can foster a more profound comprehension of the market dynamics at play.

How BSI Enhances Trading Strategies

Integrating advanced analytical tools into market approaches can significantly transform the way investors make decisions. By harnessing unique data metrics, traders can refine their techniques and improve overall performance. This method of interpretation fosters a more nuanced understanding of market dynamics, paving the way for enhanced forecasting and risk management.

Improving Market Analysis

Utilizing sophisticated metrics allows participants to gain deeper insights into market trends. These analytical frameworks provide tailored signals that highlight potential opportunities, enabling individuals to act swiftly and confidently. Consequently, the overall decision-making process becomes more data-driven, reducing reliance on intuition alone.

Risk Management Through Insights

Effective strategies are not only about identifying potential winning trades but also about minimizing losses. By employing these sophisticated metrics, traders can gauge volatility and spot potential pitfalls. This level of understanding equips participants to implement well-informed stop-loss orders and hedge their positions appropriately, ultimately safeguarding their capital.

Key Features of the BSI Indicator

This section highlights essential attributes of a powerful analytical tool designed to enhance market assessment. By understanding its primary functions, traders can leverage insights to inform their strategies and decision-making processes.

One notable characteristic is its ability to synthesize diverse data points, providing a comprehensive overview of market momentum. This capability enables users to identify trends and assess potential reversals efficiently.

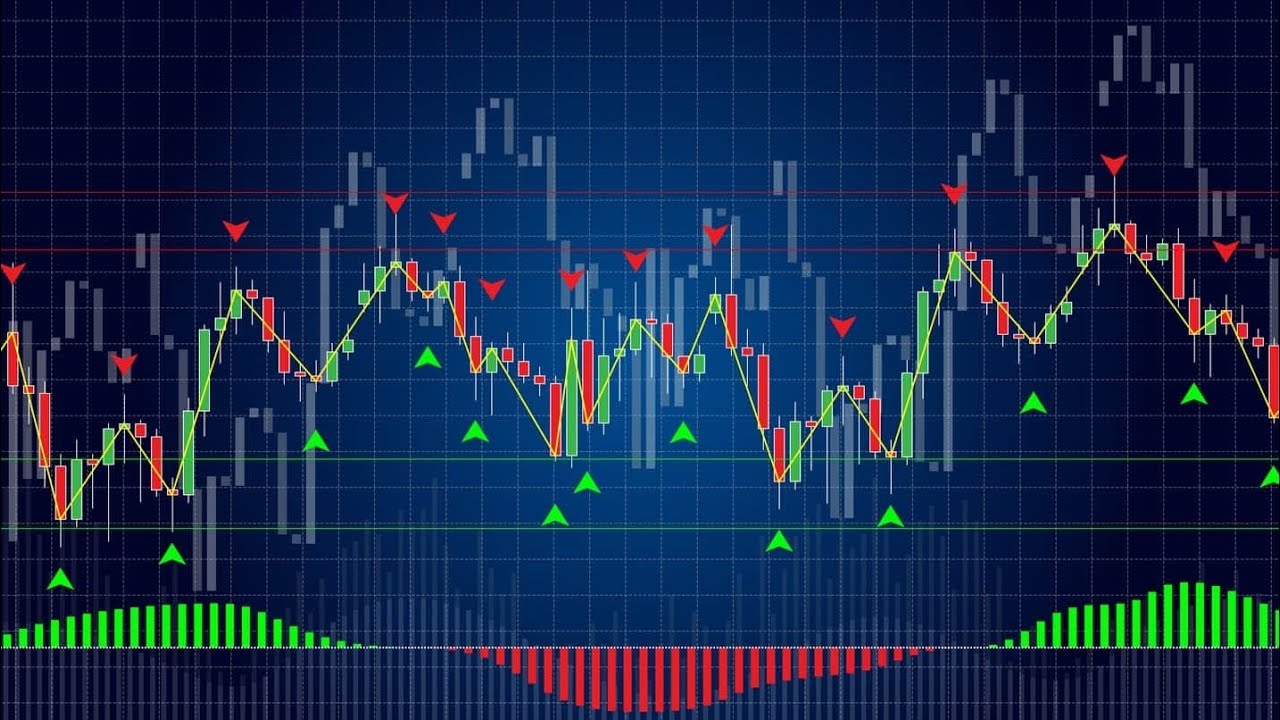

Additionally, the tool incorporates user-friendly visualization features, simplifying the interpretation of complex information. With clear graphs and signals, traders can quickly gauge market conditions without getting bogged down by intricate calculations.

Another significant aspect is its adaptability to various timeframes, allowing individuals to apply it across short-term and long-term trading strategies. This flexibility ensures that it can cater to a wide range of trading styles and preferences.

Moreover, it utilizes advanced algorithms that enhance predictive accuracy, giving traders a reliable edge in anticipating market movements. This predictive power is crucial for making informed trades and minimizing risks.

Finally, the tool supports customizations, enabling users to tailor parameters according to their unique trading objectives. This personal touch fosters a more effective approach to analyzing potential opportunities and challenges in the market.

Implementing BSI in Your Analysis

Incorporating advanced analytical tools into your market evaluations can significantly enhance decision-making processes. By utilizing these resources, traders can develop a deeper understanding of market dynamics and identify potential opportunities. An effective application of these tools allows for more informed strategies and increased confidence in trading actions.

To integrate this analytical approach into your assessments, begin by familiarizing yourself with key principles and methodologies. Establish a systematic framework that enables seamless application of your insights. Start with historical data analysis, which can provide context and reveal patterns that inform future performance predictions.

In your practical implementation, consider combining insights derived from the analysis with other relevant market indicators. This synergy can help refine entry and exit points, allowing for a comprehensive view of market behavior. Regularly reviewing and adjusting your techniques will further optimize performance and promote sustained improvement.

Additionally, cultivate the habit of monitoring trends and shifts in market sentiment. Staying attuned to developments can reveal valuable signals that inform your trading strategy. Through diligent practice and continued learning, you’ll be equipped to navigate fluctuating conditions and enhance overall trading effectiveness.

Common Mistakes with BSI Usage

Effective utilization of this analytical tool can significantly enhance trading strategies. However, numerous traders often encounter pitfalls that hinder their potential success. Understanding these common errors is crucial to maximizing the effectiveness of the system and achieving desired results.

One prevalent mistake is over-reliance on signals without considering broader market conditions. Traders sometimes treat the outputs as infallible guidance, overlooking other fundamental and technical aspects. This narrow focus may lead to misguided decisions and unexpected losses.

Another frequent issue involves misinterpretation of the data presented. New users might not fully grasp the nuances or fail to recognize the importance of context. Without a comprehensive understanding, miscalculations can occur, resulting in suboptimal actions.

Additionally, many individuals neglect the significance of risk management practices. In the pursuit of high returns, they often expose themselves to excessive risks, which can jeopardize their capital. Maintaining a balanced approach is essential for long-term sustainability in trading.

Lastly, failing to backtest strategies prior to implementation often leads to unforeseen challenges. Many traders dive into live markets without sufficient testing, culminating in avoidable errors. Thoroughly evaluating various scenarios can significantly improve one’s approach and outcomes.

Comparing BSI to Other Indicators

In the landscape of market analysis, various tools exist to aid traders in making informed decisions. Each method possesses unique characteristics, strengths, and weaknesses, depending on the specific needs and strategies of the user. Understanding how one approach stacks up against others is crucial for optimizing performance in financial environments.

Strengths and Weaknesses

Different analytical tools serve diverse purposes. Some focus on trend identification, while others emphasize momentum or volatility. For instance, moving averages provide insights into price direction by smoothing out fluctuations, but they may lag behind rapid changes. In contrast, oscillators like the Relative Strength Index (RSI) can signal overbought or oversold conditions, allowing traders to capitalize on potential reversals, yet they may produce false signals in ranging markets.

Utility in Decision-Making

When comparing various methods, it’s essential to evaluate how they complement each other. Many traders find that utilizing multiple sets of data can enhance their strategic approach, as relying solely on one tool might lead to incomplete analysis. The integration of different techniques can provide a fuller picture, allowing individuals to make nuanced decisions tailored to current market dynamics.

Case Studies: BSI in Action

This section delves into practical examples showcasing how the BSI tool has been effectively employed by traders to enhance their decision-making processes. Through real-life scenarios, we will illustrate its impact on performance and risk management, demonstrating its utility across varying market conditions.

- Example 1: Trend Following Strategy

A trader identified a consistent bullish trend in a cryptocurrency over several weeks. Utilizing the BSI framework, they assessed sentiment and price movements effectively. By entering trades aligned with the indicator’s recommendations, they were able to achieve a 30% return within a month. - Example 2: Risk Mitigation

In a volatile market, another investor sought to mitigate risks. By analyzing the BSI metrics, they recognized potential reversal signals and adjusted their positions accordingly. This proactive approach resulted in avoiding significant losses during a sudden downturn, preserving their capital. - Example 3: Swing Trading Success

A group of partners engaged in swing trading leveraged insights derived from the BSI. They focused on identifying opportunities with high probability setups. Their disciplined approach, guided by the tool’s signals, led to consistent profits over several months, demonstrating the effectiveness of this strategy.

These cases exemplify various applications of the framework, underscoring its versatility and the valuable insights it provides to both novice and experienced market participants. Analyzing past outcomes allows traders to refine their tactics and better navigate future challenges.

Q&A: BSI Crypto Indicator

What is the BSI Crypto Indicator and how does it work?

The BSI Crypto Indicator is a technical analysis tool designed to help traders make informed decisions in the cryptocurrency market. It combines various metrics and algorithms to assess market trends, volatility, and momentum. The indicator generates signals based on historical price data and can be customized to fit individual trading strategies. By analyzing these signals, traders can identify potential entry and exit points, enhancing their trading effectiveness and potentially increasing their profits.

How can traders benefit from using the BSI Crypto Indicator?

Traders can derive several benefits from using the BSI Crypto Indicator. Firstly, it provides clear buy and sell signals, helping traders to make quicker and more informed decisions. Secondly, it enables users to analyze market trends and psychological factors influencing price movements. Thirdly, the BSI Crypto Indicator can be tailored to various trading styles, whether day trading, swing trading, or long-term investing. Lastly, it facilitates better risk management by signaling when to enter or exit positions, thus potentially reducing losses and increasing overall trading performance.

Is the BSI Crypto Indicator suitable for beginners in trading?

Yes, the BSI Crypto Indicator can be suitable for beginner traders. Its user-friendly interface and straightforward signals make it accessible for those who may not have extensive trading experience. Moreover, the indicator often comes with educational resources or support communities that can help new traders understand how to interpret its signals effectively. However, it is crucial for beginners to supplement the use of the BSI Crypto Indicator with a solid understanding of basic trading principles and risk management strategies to maximize its benefits.

Are there any limitations to the BSI Crypto Indicator that traders should be aware of?

While the BSI Crypto Indicator is a powerful tool, it is not without limitations. One potential drawback is that, like all technical indicators, it relies on historical data, which may not always predict future performance accurately. Market conditions can change rapidly, and the indicator may produce false signals during extreme volatility or unforeseen events. Additionally, traders should be cautious not to rely solely on the BSI Crypto Indicator for their decisions; it is most effective when used in conjunction with other analysis methods and components of a comprehensive trading strategy. Therefore, understanding its limitations is vital for successful trading.

How does the ivan on tech bsi indicator combine technical analysis and on-chain analysis?

The ivan on tech bsi indicator combines technical analysis and on-chain analysis by integrating historical trading data with real-time blockchain metrics. This allows traders to assess the state of the crypto market more effectively, offering insights into bitcoin strength and short-term trends to determine whether the market is bullish or bearish.

What is the purpose of the bsi cloud in crypto trading?

The bsi cloud is a feature of the ivan on tech bsi indicator that helps traders visualize trend shifts in the crypto market. By analyzing short-term trends and identifying dynamic line movements, the bsi cloud allows users to see when the market is experiencing extreme strength or potential trend reversals.

How does the bitcoin strength index help in predicting future market behavior?

The bitcoin strength index evaluates the internal bar strength and trading volume, providing insights into the cryptocurrency market’s short-term and long-term trends. By combining this data with on-chain sentiment, the indicator helps traders make informed predictions about future market behavior.

Why is the ivan on tech bsi indicator considered one of a kind?

The ivan on tech bsi indicator is considered one of a kind because it integrates technical indicators and tools with on-chain analysis in a single platform. This unique approach offers crypto traders a comprehensive view of market trends, making it easier to determine whether the market is bullish or bearish.

What makes the bsi indicator useful for crypto traders?

The bsi indicator is useful for crypto traders because it allows users to see trend switches and short-term dynamics within the market. By providing insights into bitcoin strength and analyzing both technical and on-chain data, the indicator enables traders to make better-informed decisions when it comes to trading and predicting future market behavior.