Upcoming Bitcoin Halving Date and What It Means for Investors – Next Bitcoin Halving

In the ever-evolving landscape of digital currencies, certain pivotal moments hold significant weight for enthusiasts and investors alike. These milestones can drastically influence market dynamics, shaped by foundational principles of supply and demand. Understanding these events is crucial for anyone navigating this financial ecosystem.

One such critical occurrence treads the line between anticipation and strategy. As reductions in miner rewards approach, both seasoned traders and newcomers alike prepare for potential shifts that may follow. Historical patterns reveal how previous instances have sparked substantial interest and speculation within the community, often resulting in price fluctuations.

As the countdown continues, participants must remain vigilant and informed. Engaging with reliable information and market analysis can empower individuals to make educated decisions in an arena characterized by unpredictability. The coming months promise to be filled with excitement, as stakeholders await developments that could redefine the trajectory of the market.

Understanding Bitcoin Halving Events

In the realm of cryptocurrency, specific occurrences play a vital role in shaping market dynamics and influencing value. These pivotal moments, often observed at regular intervals, lead to significant changes in the way rewards are distributed to participants who validate transactions. This process is critical for maintaining an efficient and secure network while also introducing scarcity in an otherwise limitless environment.

Each occurrence reduces the remuneration given to miners, thereby impacting their incentives and overall network security. This strategic reduction not only fosters an environment of limited availability but also ignites interest among investors and enthusiasts alike. As a result, such events often correlate with heightened speculation and fluctuations in market price.

Understanding these occurrences requires a grasp of underlying principles driving supply and demand within this ecosystem. The mathematical algorithms governing these changes ensure that new units are released in a predictable manner, instilling confidence in long-term viability and resilience.

Each of these events marks a milestone in the evolution of the digital currency landscape, creating ripples that extend beyond mere monetary implications. Observers and stakeholders closely monitor these significant adjustments, recognizing their profound potential to reshape investment strategies and financial behavior in an ever-evolving market.

Historical Context of Bitcoin Halving

Understanding the events that shape the landscape of digital currencies requires an examination of milestone occurrences within their ecosystems. A significant aspect of these occurrences are programmed adjustments that impact scarcity and, consequently, market dynamics. Historical patterns reveal valuable insights into how these adjustments influence both miner incentives and investor behavior over time.

Impact on Supply and Demand

The reduction in issuance of new coins plays a crucial role in the economic principles governing this digital asset. As miners receive fewer rewards for their efforts, the available supply diminishes while demand potentially grows, often leading to volatility in pricing. Analyzing past events highlights how the market responded to these deliberate changes in currency inflation rates.

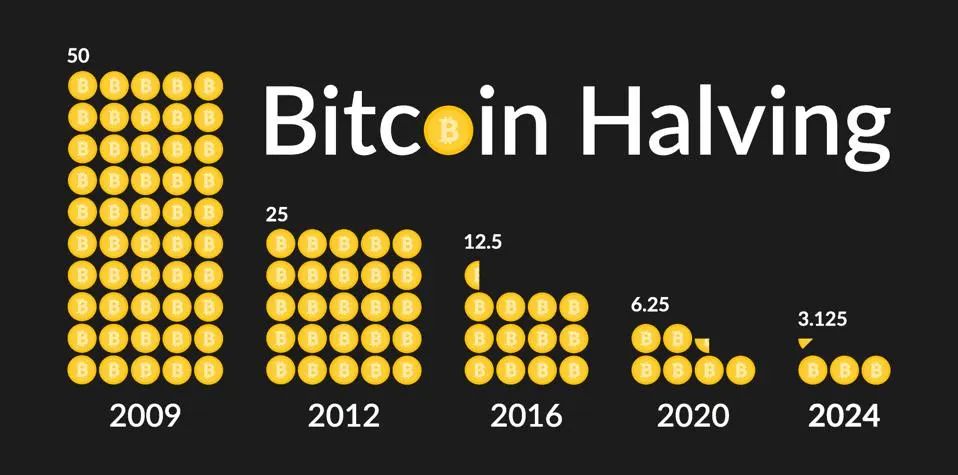

| Event Date | Block Reward | Price (Approx.) |

|---|---|---|

| November 2012 | 50 to 25 | $12 |

| July 2016 | 25 to 12.5 | $657 |

| May 2020 | 12.5 to 6.25 | $8,500 |

Market Reactions

Following these significant events, historical trends show a tendency for increased interest and speculation, often culminating in price surges. Investors frequently position themselves ahead of anticipated changes, influencing trading volumes and overall sentiment in the market. Assessing these patterns reveals both cyclical behavior and underlying motivations driving the investment decisions of participants.

Impact on Bitcoin’s Market Value

The bitcoin halving cycle, a periodic reduction in bitcoin block reward, has historically influenced the valuation of cryptocurrency significantly. Traders and investors often anticipate price movements as this event approaches, leading to speculation about future trends. Understanding these shifts is crucial for anyone looking to navigate this volatile environment effectively. Everything you need to know about the bitcoin halving explained can help you prepare for potential market changes.

Historical Trends and Speculative Sentiment

Previous occurrences, such as the 2016 halving and the last bitcoin halving, have shown substantial price rallies in the months following each reduction. This phenomenon can largely be attributed to a decrease in the rate of new supply entering circulation. As demand remains steady or even increases, such imbalances tend to create upward pressure on pricing. Market participants become increasingly bullish, fueling speculation and leading to heightened trading activity. Since the last halving, the bitcoin market has experienced significant growth, reinforcing the importance of understanding the history of bitcoin halvings.

Potential Market Reactions

Anticipation surrounding reward adjustments, such as the next bitcoin halving date, often manifests in preemptive buying behavior. Players in this ecosystem meticulously monitor any developments, which may contribute to enhanced volatility. As historical patterns suggest, excitement generated by this event may trigger not only an immediate rally but also sustained bullish momentum in the longer term. Market psychology, influenced by these key milestones, plays an integral role in shaping valuation trajectories. Leading up to the halving, many investors trade bitcoin more actively, hoping to capitalize on potential price increases.

Anticipated Date Halving

The upcoming bitcoin halving 2024 is generating significant excitement among enthusiasts and investors alike. This event involves a systematic reduction in rewards granted to miners, from 6.25 bitcoin per block to 3.125 bitcoin per block, which historically has substantial implications for the market. As the bitcoin halving countdown continues, many are eager to ascertain the exact timing of this milestone that occurs approximately every four years.

Current estimates suggest this major event is likely to take place in mid-2024, following previous trends observed in past occurrences. Community experts analyze blockchain data to project this timeline, relying on block generation rates to inform their predictions. As more blocks are mined, anticipation builds surrounding the potential market effects that may follow this pivotal adjustment. The next halving is expected to follow the halving schedule, reducing the reward from 6.25 btc to 3.125 btc.

Engaged participants in the cryptocurrency market are closely monitoring indicators that may influence the event’s date. While block production is largely consistent, fluctuations can occur, creating variations in timing. Keeping an eye on these factors allows for better preparation and strategic planning as the date approaches. Prior to the halving, many investors adjust their portfolios to align with the anticipated changes in the bitcoin market.

How Halving Affects Miners

Adjustment in reward distribution during certain intervals, such as the bitcoin’s halving, significantly impacts those engaged in cryptocurrency mining. This event instigates fluctuations in profitability and operational strategies for miners, compelling them to adapt to new market conditions. Understanding these effects is crucial for anyone involved in this field.

Profitability and Operational Shifts

When block rewards are reduced, miners experience an immediate effect on revenue. For many, this triggers a reevaluation of equipment efficiency and energy consumption. Miners may find it necessary to invest in more advanced technology or enhanced power solutions to sustain profitability. As a result, only those with optimal setups can remain competitive in the evolving landscape. The halving reduced the reward from 6.25 bitcoin per block to 3.125 bitcoin per block, directly impacting miners’ income.

Market Dynamics and Engagement

In addition to direct financial implications, reward adjustments can influence market sentiment. Anticipation of reduced issuance often results in price speculation, which can alter mining strategies. Miners may hold on to mined assets rather than liquidate them, expecting value appreciation. This behavioral change can also precipitate wider market trends, affecting the decisions of investors and operators alike. Months after the halving, the market often stabilizes, but the initial period can be highly volatile.

Potential Implications for Investors

As significant events like the bitcoin halving 2024 approach within the cryptocurrency realm, market participants often recalibrate their strategies in anticipation of potential shifts. Historical patterns indicate that such occurrences can lead to price volatility, creating both opportunities and risks. Understanding these dynamics plays a crucial role for those looking to navigate this evolving landscape.

Market Sentiment: Anticipation of upcoming events can lead to heightened excitement within the community. This increased enthusiasm may drive prices upward, presenting a potential for profitable trades. However, it is essential to remain cautious, as market euphoria can quickly transform into panic, leading to sudden downturns. Prior to the halving, many investors trade bitcoin more aggressively, hoping to capitalize on the expected price surge.

Supply Dynamics: Decreased issuance of new coins, such as the reduction from 6.25 bitcoin per block to 3.125 bitcoin per block, often impacts scarcity and demand. As mining rewards diminish, existing holders may perceive assets as more valuable, potentially triggering upward price movements. Investors should consider how these changes in supply might affect their holdings and strategies. The halving is to control the supply of bitcoin, ensuring that bitcoin will be mined at a decreasing rate over time.

Long-Term Strategies: For many, such pivotal happenings reinforce the importance of a long-term investment outlook. While short-term fluctuations can be enticing, maintaining a focus on overarching trends and fundamentals may yield better outcomes in the evolving market environment. The future bitcoin halving dates are already pre-programmed, providing a clear timeline for investors to plan their strategies.

Ultimately, being well-informed and adaptable is crucial for success in this rapidly changing asset class. The bitcoin halving is a pre-programmed event that has a profound impact on the bitcoin market, and understanding its implications can help investors make more informed decisions.

Predictions for Future Price Trends

Market analysts and enthusiasts continually explore potential patterns that could influence asset valuation. Anticipating shifts in demand and supply forces, investors attempt to gauge future price trajectories informed by various factors. Notably, historical events, such as the first bitcoin halving and the 2016 halving, often shape these expectations, offering insights into how market dynamics may unfold. The halving of the block reward has consistently been a major driver of price movements in the bitcoin market.

Factors Influencing Future Valuation

- Supply reduction mechanisms that can boost rarity and desirability.

- Market sentiment driven by global economic conditions and regulatory changes.

- Technological advancements enhancing transaction utility and scalability.

- Institutional adoption facilitating increased liquidity and widespread acceptance.

Potential Scenarios

- Optimistic outlook: Increased adoption and positive regulatory news could propel values to new heights.

- Consolidation phase: Extended periods of stability might lead to gradual appreciation as confidence grows.

- Pessimistic view: Market corrections driven by negative sentiment or regulatory backlash could hinder growth.

Ultimately, diverse viewpoints contribute to a rich discourse surrounding possible market developments. Investors must remain vigilant and informed to navigate the complexities of this ever-evolving landscape.

Q&A: When is the next bitcoin halving

What is Bitcoin halving and why is it important?

Bitcoin halving is a predefined event in the Bitcoin network that occurs approximately every four years, or after every 210,000 blocks have been mined. During a halving event, the reward that miners receive for adding a new block to the blockchain is cut in half. This mechanism is crucial because it reduces the rate at which new Bitcoins are created, effectively controlling inflation. Halvings have historically led to price increases due to the reduced supply of new coins entering the market, making them significant events for investors and the cryptocurrency community.

When is the next Bitcoin halving expected to occur?

The next Bitcoin halving is projected to occur, although the exact date can vary slightly due to fluctuations in the network’s mining speed. Halving events are predictable in a general sense, but since Bitcoin’s block generation time averages around 10 minutes, the timing can shift depending on the number of miners and their computational power. As the event approaches, the cryptocurrency market typically begins to buzz with increased speculation and interest.

How does Bitcoin halving affect the price of Bitcoin?

Historically, Bitcoin halvings have been associated with significant price appreciation in the months and years following the event. This correlation occurs because when the mining rewards are halved, the supply of new Bitcoins entering circulation decreases, which can lead to increased demand. Market sentiment often builds ahead of the halving as investors buy in anticipation of potential price increases. However, it’s important to note that past performance does not guarantee future results, and many factors can influence Bitcoin’s price.

What will happen if Bitcoin mining becomes less profitable after the halving?

If Bitcoin halving leads to a significant reduction in mining rewards, some miners might find it unprofitable to continue operating their mining rigs, especially those with high operational costs. This could result in a decrease in the overall hash rate of the network. However, experienced miners often adapt through efficiency improvements or by utilizing lower-cost electricity sources. Additionally, if the price of Bitcoin increases post-halving, it may offset the reduced rewards, keeping mining viable for most participants. The ecosystem is resilient, but some degree of fluctuation in mining activity can be expected.

How can I prepare for the Bitcoin halving event?

Preparing for the Bitcoin halving involves several steps. First, stay informed and educated about the implications of halving events and how they have historically affected the market. Consider your investment strategy; for some, this may mean accumulating Bitcoin beforehand. Additionally, be aware that prices can experience volatility around halving events, so it’s prudent to set clear investment goals and risk management strategies. Finally, follow reputable news sources and community discussions to gauge market sentiment leading up to the event, as this can aid in making informed decisions.

What is Bitcoin halving and why is it significant?

Bitcoin halving is an event that occurs approximately every four years, or every 210,000 blocks mined, where the reward for mining new blocks is cut in half. This is a critical feature of Bitcoin’s monetary policy, designed to limit the total supply of Bitcoin to 21 million coins and create scarcity. The significance of halving events lies in their historical correlation with price increases, as the reduction in the supply of new bitcoins can lead to higher demand among investors, potentially driving up the price. Each halving event also attracts considerable attention from the media and the crypto community, fostering increased interest and investment in Bitcoin.

When is the next bitcoin halving expected to occur?

The next bitcoin halving is expected to occur. This halving event will reduce the block reward from 6.25 BTC per block to 3.125 BTC per block. The halving is a pre-programmed event in the bitcoin protocol designed to control the supply of 21 million bitcoins and occurs approximately every four years.

How does bitcoin halving impact the bitcoin price?

Bitcoin halving events historically lead to increased demand for bitcoin as the supply of new bitcoin is reduced. Following a halving, bitcoin miners receive fewer rewards per block, which can decrease the number of new bitcoins entering the market. Previous halving events, such as the first halving in 2012, the second halving in 2016, and the third halving in 2020, have been followed by significant price increases.

What was the block reward before the third bitcoin halving?

Before the third bitcoin halving in 2020, the block reward was 12.5 BTC per block. After the halving occurred, the reward was reduced to 6.25 BTC per block. The next halving in 2024 will further reduce the reward to 3.125 BTC per block. This process will continue until the supply of 21 million bitcoins is fully mined.

How many bitcoin halvings have occurred so far?

There have been three bitcoin halvings so far. The first halving occurred in 2012, reducing the block reward from 50 BTC to 25 BTC. The second halving took place in 2016, lowering the reward to 12.5 BTC. The third halving in 2020 further reduced the reward to 6.25 BTC. The upcoming halving will decrease the reward to 3.125 BTC.

Why is bitcoin halving important for the bitcoin ecosystem?

Bitcoin halving is important because it controls the issuance of new bitcoins and helps maintain the scarcity of bitcoin. The halving is expected to control inflation within the bitcoin ecosystem by reducing the number of new bitcoins entering circulation. This mechanism ensures that bitcoin remains a deflationary asset and follows a predictable supply schedule until the last bitcoin is mined around the year 2140.