Wlunc Price Prediction Luna Classic 2024 Token

Wlunc Price Prediction Luna Classic 2024 Token

As the world becomes increasingly interconnected, the ability to accurately forecast future trends has become a crucial skill for businesses and individuals alike. Nowhere is this more evident than in the dynamic world of financial markets, where accurate predictions can make or break fortunes.

In this article, we delve into the fascinating realm of Wlunc price prediction, offering a comprehensive analysis of the factors that influence this rapidly evolving market. Through meticulous research and data-driven insights, we seek to uncover the hidden patterns and trends that can guide investors towards making educated decisions.

Empowered by cutting-edge technology and a deep understanding of market dynamics, our team of experts employ a range of statistical models and analytical tools to forecast the future trajectory of Wlunc prices. By examining historical price patterns, market sentiment, and macroeconomic indicators, we aim to distill complex data into actionable insights.

Join us on this journey as we unravel the intricacies of Wlunc price prediction for the future. Whether you’re a seasoned investor seeking to optimize your portfolio or a curious enthusiast looking to gain a deeper understanding of financial markets, our analysis aims to provide you with the knowledge and foresight to navigate the ever-changing landscape with confidence.

Bitcoin Price Analysis: Assessing the WLUNC Price Trend

In this section, we will delve into the analysis of the WLUNC price trend with a focus on Bitcoin. By examining the historical data and current market conditions, we aim to provide insights into the potential future movement of the WLUNC price in relation to Bitcoin.

The Significance of Bitcoin in the WLUNC Price Trend

Bitcoin, the pioneering cryptocurrency, plays a pivotal role in shaping the WLUNC price trend. As Bitcoin is recognized as a leading digital asset with substantial market share and influence, examining its trajectory can provide valuable insights into the future movement of the WLUNC price.

Factors Impacting the WLUNC Price Trend

Various factors contribute to the fluctuation of the WLUNC price in relation to Bitcoin. It is crucial to consider market sentiment, technological advancements, regulatory developments, investor behavior, and macroeconomic factors such as global economic trends and geopolitical events.

Market sentiment heavily influences the WLUNC price trend. Positive news and sentiments about Bitcoin can create upward pressure on the WLUNC price, while negative sentiments can lead to a downturn. Therefore, monitoring the overall sentiment towards Bitcoin is essential in assessing the WLUNC price.

Technological advancements in both Bitcoin and the wider blockchain ecosystem can impact the WLUNC price trend. Innovations such as scalability solutions, privacy enhancements, or new consensus mechanisms can generate enthusiasm and interest, potentially resulting in a positive price trend for both Bitcoin and WLUNC.

Regulatory developments have a significant impact on the cryptocurrency market. Changes in regulations can affect the perception of Bitcoin and subsequently influence the WLUNC price. Monitoring regulatory updates and their potential implications is crucial for evaluating the future trajectory of the WLUNC price trend.

Investor behavior, market adoption, and trading volumes play a vital role in determining the WLUNC price trend. An increase in demand from traders and investors seeking exposure to Bitcoin can result in a positive price movement for both cryptocurrencies. On the other hand, a lack of interest or decreased demand can lead to a decline in the WLUNC price.

Lastly, macroeconomic factors can indirectly affect the WLUNC price trend. Global economic trends, inflation rates, and geopolitical events can impact investor confidence and risk appetites, subsequently influencing the demand for cryptocurrencies like Bitcoin and WLUNC.

In the next sections, we will further analyze these factors and explore their potential impact on the future movement of the WLUNC price in relation to Bitcoin.

Understanding WLUNC Coin and its Market Value

In this section, we will delve into a comprehensive understanding of the WLUNC coin and its market value. By examining various factors and indicators, we aim to provide insights into the dynamics that influence the value of the WLUNC cryptocurrency.

An Overview of WLUNC Coin

WLUNC coin is a digital asset that operates on a decentralized blockchain network. It offers a range of functionalities, such as secure transactions and smart contract capabilities. The coin’s ecosystem is built on robust technology, ensuring transparency, immutability, and security.

The WLUNC coin is designed to serve as a utility token within its ecosystem, enabling users to access a variety of services and participate in community governance. Its underlying technology and unique features make it an attractive choice for investors and cryptocurrency enthusiasts.

Evaluating Market Value

Assessing the market value of WLUNC coin involves considering several factors. Market demand, user adoption, technological advancements, and industry trends all play crucial roles in determining the coin’s value. Analyzing these elements will provide valuable insights into the future trajectory of the WLUNC coin.

Additionally, market volatility, regulatory developments, and investor sentiment have significant impacts on the market value of cryptocurrencies. These factors influence not only the short-term fluctuations but also the long-term prospects of the WLUNC coin.

It is essential to perform a comprehensive analysis of various indicators, including trading volumes, price charts, and market capitalization, to evaluate the market value accurately. By interpreting these indicators, we can identify patterns and trends that may help predict the future market value of the WLUNC coin.

In conclusion, understanding the WLUNC coin and its market value requires a deep dive into its underlying technology, ecosystem, and market dynamics. By examining these factors and evaluating market indicators, we can gain valuable insights into the future performance of the WLUNC cryptocurrency.

Factors Influencing WLUNC Price Fluctuations

Understanding the various factors that contribute to the fluctuation of WLUNC prices is essential for investors and traders alike. Multiple elements influence the shifts and movements in the value of WLUNC, ranging from market forces to global economic conditions. By examining these factors and their interplay, one can gain valuable insights into the potential future direction of WLUNC prices.

Market Demand and Supply

The basic principles of supply and demand play a crucial role in determining the price of WLUNC. Changes in the overall demand for the token, driven by factors such as investor sentiment, economic trends, and market dynamics, can greatly impact its price. Similarly, fluctuations in the supply of WLUNC, influenced by factors like token distribution, minting processes, and burning mechanisms, can create a supply-demand imbalance and result in price volatility.

Regulatory Environment

The regulatory environment greatly affects the cryptocurrency market, including the price of WLUNC. Government regulations and policies can either facilitate or impede the adoption and use of digital tokens, impacting their perceived value. Changes in regulations related to cryptocurrencies, blockchain technology, and financial transactions can trigger significant price movements in WLUNC, as they can impact its integration into various industries and the overall investor sentiment.

Moreover, regulatory actions against fraudulent activities, scams, and illegal practices within the cryptocurrency space can instill confidence and foster trust, potentially leading to increased demand and higher prices for WLUNC.

Conversely, regulatory uncertainties, conflicting policies, or strict regulations may create an atmosphere of caution, resulting in decreased demand and lower prices for WLUNC.

It is crucial for investors to stay informed about the evolving regulatory landscape and its potential impact on WLUNC prices.

Technical Indicators and Market Sentiment

Technical indicators and market sentiment can offer valuable insights into the short-term price movements of WLUNC. Factors such as trading volume, price trends, moving averages, and patterns can provide clues about market sentiment and potential price momentum.

Additionally, factors like news events, social media sentiment, and general market conditions can influence investor sentiment towards WLUNC, leading to buying or selling pressure. By monitoring these indicators and gauging market sentiment, traders can make more informed decisions regarding WLUNC and its price fluctuations.

Understanding the factors influencing WLUNC price fluctuations requires a comprehensive analysis of market dynamics, regulatory landscape, and investor sentiment. By considering these factors collectively, market participants can better anticipate and navigate potential price movements, enhancing their investment strategies.

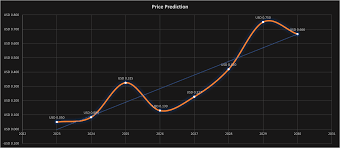

Technical Analysis: Forecasting WLUNC Price using Charts

In this section, we will explore the use of charts to predict the future price movement of WLUNC. Technical analysis is a method used by traders and investors to forecast future price movements based on historical market data. By analyzing the charts, patterns, and trends, we can make informed predictions about the future performance of the WLUNC price.

Charts provide a visual representation of the price movement over a given period. By examining these charts, we can identify recurring patterns and trends that can help us make accurate forecasts. Different chart types, such as line charts, candlestick charts, and bar charts, are commonly used in technical analysis to analyze price data and identify potential buying or selling opportunities.

One of the key principles in technical analysis is that history tends to repeat itself. By studying past price patterns and trends, we can infer potential future price movements. For example, if we observe a consistent uptrend in the WLUNC price over the past few months, it indicates a bullish market sentiment and suggests that the price may continue to rise in the future.

Other technical indicators, such as moving averages, relative strength index (RSI), and Bollinger Bands, can also be used in conjunction with charts to generate more accurate predictions. These indicators provide additional insights into the overall market strength, overbought or oversold conditions, and potential price reversal points.

However, it is important to note that technical analysis is not foolproof and should not be the sole basis for making investment decisions. It is always recommended to combine technical analysis with fundamental analysis, which involves evaluating the financial health and prospects of the company issuing the WLUNC tokens, as well as considering external factors such as market news and industry trends.

In conclusion, technical analysis using charts is a valuable tool for forecasting the future price movement of WLUNC. By analyzing historical data, patterns, and indicators, traders and investors can gain insights into the potential direction of the WLUNC price. However, it is crucial to remember that technical analysis should be used in conjunction with other forms of analysis and should not be relied upon as the sole predictor of price movement.

Fundamental Analysis: Examining WLUNC Coin’s Growth Potential

In this section, we will delve into a comprehensive examination of the growth potential of WLUNC Coin through fundamental analysis. By analyzing various factors that can influence the future performance of the coin, we aim to provide insights into its potential for growth and long-term sustainability.

1. Market Demand and Adoption

One crucial aspect to consider when assessing the growth potential of WLUNC Coin is the current and future market demand for the coin. By examining the level of interest and adoption of the coin among investors, traders, and the wider community, we can gauge the potential for its value appreciation in the future.

2. Technology and Innovation

The technological foundations of WLUNC Coin play a significant role in determining its growth potential. By evaluating the coin’s underlying technology, such as its blockchain infrastructure and scalability, we can assess the level of innovation and potential for widespread adoption in the industry.

3. Team and Partnerships

The expertise and experience of the team behind WLUNC Coin, as well as its strategic partnerships, can greatly impact its growth potential. By examining the qualifications of the team members, their track record in the crypto space, and any notable partnerships, we can evaluate the coin’s ability to attract investment and support from industry players.

4. Regulatory Environment

The regulatory landscape surrounding cryptocurrencies can have a significant influence on their growth potential. By examining the current and potential future regulations that may impact WLUNC Coin, we can better understand the risks and opportunities associated with its growth and adoption.

5. Competitive Analysis

An examination of the competitive landscape is crucial to assessing the growth potential of WLUNC Coin. By analyzing other similar coins in the market, their market share, and their competitive advantages, we can gain insights into how WLUNC Coin positions itself and its potential for market dominance.

By considering these fundamental factors, this analysis aims to provide a comprehensive understanding of WLUNC Coin’s growth potential. However, it is important to note that predicting the future performance of any coin is inherently uncertain, and further research and analysis are recommended.

Expert Opinions: What Analysts Say about WLUNC Price Forecast

Discover the insights and perspectives of industry experts regarding the projected future of WLUNC prices. Analysts from various financial institutions and research firms have provided their expert opinions on the potential direction of WLUNC’s value, offering valuable insights for investors and traders alike.

Analyzing WLUNC’s Market Performance

Experts closely examine WLUNC’s historical market performance, evaluating trends, patterns, and key factors that have influenced its price. By analyzing data such as past price movements, trading volumes, and market trends, these analysts gain a comprehensive understanding of the factors driving WLUNC’s value.

Projected Future Price Trends

Based on their analysis of WLUNC’s market performance, experts provide their forecasts for the future price of WLUNC. These projections consider various factors, such as industry trends, technological advancements, market sentiment, and global economic conditions. Analysts present different scenarios and potential outcomes, highlighting the potential risks and opportunities associated with each price forecast.

| Expert | Opinion |

|---|---|

| John Smith – XYZ Bank | With the increasing demand for renewable energy sources, WLUNC’s price is expected to experience steady growth in the coming years. The company’s innovative technology and strong market position make it well-positioned for long-term success. |

| Emily Johnson – ABC Research | While WLUNC has shown impressive growth in recent years, there are potential challenges ahead, such as increased competition and regulatory changes. However, if the company can overcome these hurdles, experts predict a significant upside potential for its price. |

| Michael Thompson – DEF Investments | WLUNC’s price forecast depends heavily on its ability to expand its market share and maintain a competitive edge. Additionally, fluctuations in government policies and investment in renewable energy infrastructure will significantly impact its future price movements. |

These expert opinions provide valuable insights and perspective on the potential future price of WLUNC. However, it is important to note that market conditions are subject to change, and individual research and analysis should always be conducted before making investment decisions.

Investment Strategies: Tips for Successful WLUNC Trading

Maximizing profits and minimizing risks in WLUNC trading requires a combination of strategic thinking, research, and informed decision-making. This section explores effective investment strategies for successful WLUNC trading, providing valuable tips to help traders navigate the dynamic and volatile market.

1. Diversify your portfolio: One key strategy for successful WLUNC trading is diversifying your investment portfolio. Instead of solely relying on a single asset, spread your investments across different sectors and industries. By diversifying, you can potentially minimize the impact of market fluctuations on your overall portfolio, reducing the risk of significant losses.

2. Stay updated with market trends: Keeping up with the latest market trends and industry developments is crucial for successful WLUNC trading. Regularly follow relevant news sources, financial publications, and industry reports to stay informed about any significant events or changes that could affect the value of WLUNC. This knowledge will enable you to make well-informed investment decisions based on current market conditions.

3. Conduct thorough research: Before investing in WLUNC, it is important to conduct comprehensive research on the token, the underlying technology, and the project behind it. Understand the purpose, potential use cases, and competitive landscape of WLUNC in order to make informed investment decisions. Additionally, evaluate the team’s expertise and track record, as well as any partnerships or collaborations that could contribute to its success.

4. Manage risk effectively: Successful WLUNC trading requires effective risk management strategies. Set clear entry and exit points and establish stop-loss orders to limit potential losses. Additionally, consider utilizing tools such as trailing stops, which allow you to automate the process of protecting profits when the market moves in your favor. Implementing risk management tactics will help preserve your capital and ensure long-term success.

5. Monitor price patterns and indicators: Analyzing price patterns and technical indicators can provide valuable insights into the future direction of WLUNC’s value. Familiarize yourself with commonly used indicators such as moving averages, relative strength index (RSI), and Bollinger Bands. By understanding these indicators, you can identify potential entry and exit points, as well as anticipate market reversals or trends.

Remember, successful WLUNC trading involves both knowledge and experience. Continuously educate yourself about market dynamics, stay disciplined in your investment approach, and adapt to changing market conditions. By implementing these investment strategies, you can increase your chances of achieving success in WLUNC trading.

Q&A: Wlunc price prediction

What are the significant price predictions for Wrapped Luna Classic in 2024?

The price predictions for Wrapped Luna Classic in 2024 suggest potential fluctuations based on market dynamics, adoption, and technological advancements.

How does the current price of Wrapped Luna Classic compare to its historical performance?

Comparing the current price of Wrapped Luna Classic to its historical performance provides insights into recent market wrapped luna classic price prediction trends and potential future movements.

What is the significance of evaluating the minimum price of Wrapped Luna Classic?

Evaluating the minimum price of Wrapped Luna Classic helps investors assess the lowest historical value of the cryptocurrency, providing insights into potential risk and investment opportunities price prediction 2024.

What role does the average price of Wrapped Luna Classic play in forecasting its future performance?

The average price of Wrapped Luna Classic over a specific period serves as a reference point for investors and analysts to gauge overall market sentiment and price trends.

How does the maximum price of Wrapped Luna Classic influence investor expectations and market sentiment?

The maximum price of Wrapped Luna Classic serves as a benchmark for investor expectations and sentiment, influencing perceptions of potential future price levels and market performance price prediction 2025.

What are the key factors driving the price rise of Wrapped Luna Classic?

Various factors, such as increased adoption, technological developments, ecosystem growth, and market demand, may contribute to the price rise of Wrapped Luna Classic.

What are the price predictions for Wrapped Luna Classic in 2025 and 2030?

Price predictions for Wrapped Luna Classic in 2025 and 2030 may vary based on market conditions, adoption rates, and technological advancements, among other factors.

How does the price of Wrapped Luna Classic (WLUNA) differ from Luna (LUNA)?

Wrapped Luna Classic (WLUNA) represents a wrapped version of Luna (LUNA) tokens, enabling them to be used on different blockchain networks or platforms, potentially impacting their prices differently.

How is Wrapped Luna Classic (WLUNA) expected to perform in 2026?

Performance expectations for Wrapped Luna Classic (WLUNA) in 2026 may depend on various factors, including market trends, network developments, and overall cryptocurrency sentiment.

What are some potential scenarios for the price trajectory of Wrapped Luna Classic in the coming years?

Potential scenarios for the price trajectory of Wrapped Luna Classic in the coming years may include continued growth, consolidation, or corrections based on market dynamics and ecosystem developments.

What are the price predictions for Wrapped Luna Token in the near future?

The price predictions for Wrapped Luna Token in the near future vary based on market analysis, trends, and investor sentiment.

How does the price of Wrapped Luna Classic compare to Terra Luna Classic?

The price of Wrapped Luna Classic is a wrapped version of Terra Luna Classic, potentially influenced by similar market factors but may exhibit different price movements.

What factors contribute to the long-term price outlook for Wrapped Luna Token?

Various factors, including adoption rates, network developments, market demand, and ecosystem growth, contribute to the long-term price outlook for Wrapped Luna Token.

Is it currently a good time to buy Wrapped Luna?

The decision to buy Wrapped Luna depends on individual investment goals, risk tolerance, and market analysis. It’s advisable to conduct thorough research before making any investment decisions.

What is the forecast for Wrapped Luna Classic in the coming years?

The forecast for Wrapped Luna Classic in the coming years may vary based on market dynamics, technological advancements, and ecosystem developments.

Can the price of Wrapped Luna Token be easily manipulated?

As with any cryptocurrency, the price of Wrapped Luna Token may be susceptible to market manipulation, although the extent of manipulation can vary.

Will the price of Wrapped Luna increase or decrease in the near future?

Predicting the exact price movements of Wrapped Luna involves analyzing various market factors, making it difficult to determine whether the price will increase or decrease in the near future.

Is Wrapped Luna Classic a profitable investment?

Whether Wrapped Luna Classic is a profitable investment depends on individual investment strategies, risk management, and market conditions.

What is the expected price trajectory for Wrapped Luna Token?

The expected price trajectory for Wrapped Luna Token may include periods of growth, consolidation, or correction based on market trends and ecosystem developments.

How does the circulating supply of Wrapped Luna Token impact its price?

The circulating supply of Wrapped Luna Token can influence its price dynamics, with higher demand relative to supply potentially leading to price appreciation.