Margin Trading Now Available in the Exchange App

Margin Trading Now Available in the Exchange App

In the ever-evolving landscape of digital finance, enthusiasts are witnessing an array of innovative features designed to enhance user engagement and investment strategies. These advancements empower individuals by introducing a unique approach, allowing them to explore diverse dimensions of asset management. With technological strides, participants can now experience tailored services that elevate their investment journeys.

Recent enhancements in financial platforms have transformed the way users interact with their portfolios, presenting an opportunity to maximize their potential. By leveraging tools that facilitate increased operational capacity, individuals can now navigate the complexities of market dynamics more effectively. Such offerings play a crucial role in shaping a new generation of investors, who are eager to capitalize on emerging trends.

The incorporation of sophisticated functionalities into user interfaces signifies a shift toward a more dynamic and versatile investing experience. This not only broadens the horizons for seasoned participants but also invites newcomers to engage with financial markets in a more strategic manner. The recent features enable users to optimize their positions and make informed decisions that align with their financial goals.

What Is Crypto Margin Trading Exchange?

This financial practice allows participants to amplify their purchasing capacity by utilizing borrowed funds. By leveraging available resources, individuals can engage in larger transactions than they could solely with their own capital. This method introduces both opportunities for increased returns and the potential for greater risks, making it essential for traders to understand its dynamics fully.

Key Components of This Financial Practice

Several critical elements define the use of borrowed funds in trading activities:

| Term | Description |

|---|---|

| Leverage | The use of borrowed capital to increase the potential return on investment. |

| Collateral | Assets pledged as security for the borrowed funds, minimizing risk for the lender. |

| Liquidation | The process where a broker sells off assets to cover losses if an account’s equity falls below a certain threshold. |

The Benefits and Risks

Utilizing borrowed capital can lead to significant financial gains when market conditions are favorable. However, there are inherent dangers, including the possibility of substantial losses if the market moves unfavorably. Therefore, it is crucial for participants to assess their risk tolerance and market knowledge before engaging in this type of activity.

Benefits of Margin Trading for Investors

Engaging in leveraged strategies can significantly enhance the potential rewards for investors looking to amplify their returns. By utilizing borrowed funds, participants can access greater capital than what is available within their personal resources, leading to unique opportunities within the financial markets.

- Increased Purchasing Power: Utilizing additional capital allows investors to buy more assets than they could otherwise afford, enhancing their position in the market.

- Potential for Higher Returns: When the market moves favorably, the profits generated from leverage can far exceed those achieved through traditional investment methods.

- Diverse Opportunities: With greater funds, investors can explore a wider range of financial instruments and market segments, diversifying their portfolios effectively.

- Flexibility in Strategy: The availability of leveraged funds allows for more sophisticated strategies, enabling better adaptation to changing market conditions.

- Hedging Capabilities: Leveraged positions can serve as a hedge against other investments, providing a protective layer for portfolios during volatile market phases.

While leveraging offers significant advantages, it also carries increased risks. Investors must approach these strategies with careful consideration and proper risk management techniques to ensure a balanced approach in their investment journey.

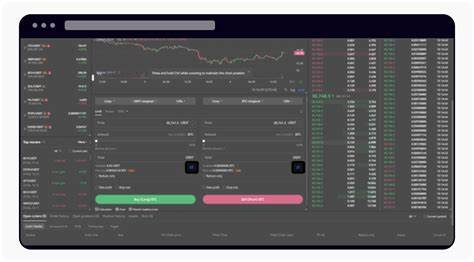

How to Use Your Exchange App

Engaging with digital markets through a mobile platform can enhance your experience and open up new opportunities. Understanding the functionalities of the software is key to optimizing your actions and making informed decisions. Below are essential steps to get you acquainted with the essential features at your disposal.

Setting Up Your Profile

Begin by creating an account, which serves as your digital identity in the marketplace. Provide the required information and complete any verification processes. This often includes confirming your email and phone number for security purposes. Once registered, ensure to enable two-factor authentication to safeguard your assets.

Navigating the Interface

The user interface is designed to facilitate ease of access to various functionalities. Familiarize yourself with the different sections such as market trends, asset listings, and transaction history. Take advantage of educational resources offered within the application to enhance your knowledge. Remember to regularly check notifications for important updates or alerts related to your account.

Understanding Margin Calls and Risks

Engaging in leveraged positions presents both opportunities and challenges for investors. It allows participants to amplify their potential returns, but it also introduces significant risks that must be carefully considered. An essential aspect of this dynamic is the requirement to maintain a certain level of equity, which can invoke critical consequences if not adhered to.

A margin call occurs when the value of an investor’s equity falls below the broker’s required threshold. This situation prompts the broker to request additional funds or securities to restore the account to its minimum equity level. Failure to address this demand promptly may result in the forced liquidation of assets, potentially leading to substantial financial losses.

It is crucial for participants to understand the inherent risks associated with using leverage. Fluctuations in the market can lead to rapid changes in asset values, and without diligent monitoring, the effects can be detrimental. Educating oneself on these concepts is vital to navigating this financial landscape effectively.

Strategies for Successful Margin Trading

Engaging in leveraged positions can be a rewarding yet challenging endeavor. Employing the right approaches significantly enhances the chance of achieving favorable outcomes. Success in this arena requires a blend of risk management, market analysis, and psychological resilience.

1. Risk Management: It is crucial to establish a clear risk management plan. Determine the maximum loss you are willing to accept and stick to it. Utilizing stop-loss orders can help protect your capital and minimize potential losses.

2. Market Research: Conduct thorough analysis before making any moves. Employ technical and fundamental analysis to gain insights into price movements and market trends. Understanding the forces driving the market can inform smarter decisions.

3. Start Small: If you are new to the practice, begin with minimal exposure. This approach allows you to become accustomed to the dynamics involved without risking significant capital. Gradual growth in your position sizes can lead to better results over time.

4. Stay Informed: The financial landscape is ever-evolving. Keeping abreast of news, events, and changes in economic indicators can provide valuable context for your decisions. Being well-informed will assist in anticipating market fluctuations.

5. Emotional Control: Psychological factors play a pivotal role in the outcome of positions. Maintaining emotional discipline helps to avoid impulsive decisions driven by fear or greed. Sticking to your plan and remaining calm can improve your chances of success.

Incorporating these strategies into your approach can lead to a more structured and effective experience in pursuing leverage. By prioritizing analysis and discipline, individuals can strive to turn opportunities into profitable outcomes.

Future Trends in Margin Trading Technology

The evolution of leveraged financial operations is set to reshape the landscape of investment strategies, driven by advancements in technology. As more participants seek enhanced tools for capital allocation, the integration of innovative solutions will play a crucial role in empowering users and optimizing their experiences. This shift will likely pave the way for improved efficiency, accessibility, and risk management in financial markets.

Integration of Artificial Intelligence

One significant trend on the horizon is the integration of artificial intelligence into leveraged financial tools. AI algorithms can analyze vast amounts of data in real-time, providing users with insights and predictive analytics to make informed decisions. By minimizing human error and enhancing data interpretation, these technologies promise to revolutionize how investors interact with their assets.

Enhanced Risk Management Solutions

As the landscape becomes more competitive, the demand for sophisticated risk management solutions will increase. Advanced analytics and real-time monitoring systems will likely emerge, enabling users to better assess their exposure and make proactive adjustments. This evolution will not only help mitigate potential losses but also bolster user confidence in employing various financial strategies in diverse market conditions.

Question-answer: Margin trading is now available in the exchange app

What is margin trading and how does it work?

Margin trading is a trading strategy that involves borrowing funds from a broker or exchange to trade assets, allowing traders to leverage their positions. In a margin trading setup, traders deposit a certain amount of their own capital as collateral, known as the margin. The broker then lends them additional funds to increase their purchasing power. This means that traders can open larger positions than their initial investment would allow. However, margin trading also comes with higher risks; if the market moves against a trader’s position, they could incur significant losses, potentially exceeding their initial investment. It’s essential to understand both the potential rewards and risks before engaging in margin trading.

What are the advantages of using margin trading on my favorite exchange app?

Using margin trading on your preferred exchange app offers several advantages. First, it allows you to amplify your potential profits by enabling you to control a larger position with a relatively smaller investment. This means that successful trades can yield higher returns. Second, margin trading can increase liquidity in the market, as it encourages more trading activity by allowing traders to enter and exit positions swiftly. Additionally, many exchange apps today provide user-friendly interfaces and advanced tools that make it easier for traders to manage their margin positions effectively. However, it’s crucial to maintain a clear risk management strategy to mitigate potential losses when using this feature.

Are there any risks associated with margin trading that I should be aware of?

Yes, margin trading carries inherent risks that traders need to be aware of before engaging in this type of trading. The primary risk is the potential for significant losses; because you are borrowing capital, if the market moves against you, your losses can exceed your initial investment. This situation is known as a margin call, where the broker requires you to deposit more funds to maintain your position. Furthermore, leveraging increases the volatility of your investments, meaning that while you can achieve higher profits, you also face a higher chance of incurring substantial losses. It’s vital to employ proper risk management techniques, such as setting stop-loss orders and not investing more than you can afford to lose when trading on margin.

How can I start margin trading on an exchange app, and what requirements should I meet?

To start margin trading on an exchange app, you typically need to follow these steps. First, ensure that you have a verified account on the exchange platform you wish to use, as many platforms require traders to complete identity verification to comply with regulations. Second, check if margin trading is available on the specific app; some exchanges have designated margin trading sections. After that, you may need to enable margin trading in your account settings. Depending on the platform, there may be specific requirements such as minimum balance or margin ratio that you’ll need to meet before you can start trading on margin. Lastly, it’s advisable to educate yourself about margin trading and its associated risks before actively engaging in leveraged trading to make informed decisions.

What are the key features of margin trading on crypto exchanges?

Margin trading on crypto exchanges involves trading with leverage, using margin as collateral to amplify trading positions. It includes features like isolated margin, cross margin, and maintenance margin requirements.

How do trading fees differ between spot and margin trading?

Margin trading fees typically include higher trading fees compared to spot trades due to the additional risk and leverage involved. These fees can vary depending on the exchange and trading platform.

What is the difference between isolated margin and cross margin trading?

Isolated margin trading limits the margin to a specific position, while cross margin trading uses the entire balance of the trading account as collateral for all open positions, affecting overall risk management.

What should be considered when choosing a crypto margin trading platform?

When choosing a crypto margin trading platform, consider factors such as margin trading fees, available trading pairs, margin requirements, and the platform’s reputation and tools, like those offered by the crypto.com exchange.

How do maintenance margin requirements affect margin trading?

Maintenance margin requirements ensure that traders maintain a minimum amount of equity in their margin account. If the account falls below this threshold, the exchange may issue a margin call or liquidate positions.

What are some of the best crypto margin trading exchanges in 2024?

Some of the best crypto margin trading exchanges in 2024 include those offering advanced trading tools, low trading fees, and a wide range of margin trading options, such as the crypto.com exchange and other top platforms.

How can traders learn more about margin trading strategies?

Traders can learn more about margin trading strategies through educational resources provided by exchanges, trading platforms, and online courses focusing on margin trading concepts and techniques.

What are the benefits of trading with margin in the crypto market?

The benefits of trading with margin include the ability to amplify trading profits, access to higher leverage, and the potential for increased trading opportunities, though it also involves higher risk.

How do margin trading fees impact overall trading costs?

Margin trading fees, including interest on borrowed funds and transaction costs, can significantly impact overall trading costs. Traders should factor these fees into their strategies to manage profitability.

What role does a margin account play in cryptocurrency trading?

A margin account allows traders to borrow funds to trade larger positions, leveraging their investments. It involves managing margin requirements and maintaining sufficient collateral to support leveraged trades.

What are the key features of cryptocurrency margin trading on exchanges?

Cryptocurrency margin trading on exchanges allows traders to use margin as collateral to amplify their trading positions. It involves maintaining a margin trading account, managing margin requirements, and potentially dealing with margin calls if equity falls below maintenance levels.

How does the crypto.com exchange app facilitate margin trading?

The crypto.com exchange app provides users with access to a margin trading facility, allowing them to trade with leverage on a variety of trading pairs. It offers powerful trading tools and real-time access to crypto trades.

What are some of the best crypto margin trading platforms?

Some of the best crypto margin trading platforms offer a wide range of trading instruments, low trading fees, and advanced features for margin trading, including Bitcoin margin trading exchanges and top-rated cryptocurrency margin trading services.

What is the role of margin in trading crypto assets?

Margin in trading crypto assets serves as collateral to increase trading volume and leverage positions. It allows traders to amplify their trades, but it also introduces the risk of margin calls if market conditions move against them.

How does margin trading work in the context of Bitcoin?

Margin trading with Bitcoin involves using borrowed funds to trade larger positions in the Bitcoin market. Traders need to manage margin rules, monitor trade volume, and ensure they meet margin requirements to avoid liquidation.

What benefits can traders expect from crypto margin trading?

The benefits of crypto margin trading include the potential for increased trading profits, access to higher leverage, and the ability to trade larger positions than would be possible with just the available capital.

How does a margin trading account differ from a standard trading account?

A margin trading account differs from a standard trading account by allowing traders to borrow funds to trade larger positions. It requires maintaining margin collateral and is subject to margin trading rules and potential margin calls.

What are the potential risks associated with margin trading?

The risks of margin trading include the possibility of a margin call if equity falls below the maintenance margin, higher trading fees, and the potential for significant losses if trades move unfavorably.

How do trading fees impact margin trading on cryptocurrency exchanges?

Trading fees impact margin trading by adding to the overall cost of trades. Higher fees can reduce profits, so it is important to choose exchanges that offer competitive margin trading fees and lower trading costs.

What tools are available for managing margin trading effectively?

Tools for managing margin trading effectively include real-time price charts, margin calculators, and trading alerts provided by crypto trading platforms. These tools help traders monitor positions and manage risk efficiently.