The Evolution of Bitcoin Through History

The rise of decentralized monetary systems has transformed financial landscapes across the globe. Born out of a desire for autonomy and privacy, this innovative form of currency has sparked discussions about value, trust, and technological advancement. Since its inception, this digital asset has seen remarkable changes and adaptations, influencing both economies and individual lives.

From its humble beginnings, this virtual currency has navigated through challenges and triumphs, creating a narrative filled with intrigue and ambition. Developers and enthusiasts alike have contributed to a multifaceted ecosystem, continuously shaping its trajectory. The movement surrounding this currency has grown into a cultural phenomenon, impacting various sectors and igniting debates over its legitimacy and future.

As we delve into the milestones and pivotal moments that defined this financial revolution, we uncover the underlying principles driving its popularity. Each phase has unveiled unique insights into how this system of value operates, offering a window into the motivations and aspirations of its creators and users. The evolution of this asset is not merely a tale of numbers; it represents a broader story of innovation, resilience, and the ever-changing nature of currency itself.

The Birth of Bitcoin and Satoshi Nakamoto

The emergence of a revolutionary digital currency marked a significant turning point in the realm of financial technology. It represented a radical departure from traditional monetary systems, proposing a decentralized approach to value transfer. This innovation provided individuals with unprecedented autonomy over their financial transactions, fostering new pathways for economic interaction.

The Genesis Block

The inception of this digital currency can be traced back to a seminal moment in 2009, when the first block, known as the Genesis Block, was mined. This pivotal event laid the foundation for a burgeoning ecosystem, one that would grow exponentially in the years that followed. The block contained a unique message, hinting at the motivations behind this groundbreaking creation.

- It was mined on January 3, 2009.

- First transaction was conducted shortly after.

- Encapsulated a critique of traditional banking systems.

The Mystery of Satoshi Nakamoto

At the heart of this revolutionary movement lies the enigmatic figure known as Satoshi Nakamoto, the pseudonymous creator whose true identity remains shrouded in mystery. Nakamoto’s vision combined elements of cryptography, computer science, and economic theory, resulting in a framework that empowered individuals while challenging existing financial structures.

- Published a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” in 2008.

- Communicated with early adopters through online forums and mailing lists.

- Gradually ceased communication around 2010, leaving behind a legacy that sparked a global movement.

Early Adoption: Understanding the First Transactions

Initial enthusiasm surrounding decentralized digital currency led to a series of groundbreaking exchanges that laid the foundation for what would become a transformative financial system. These early dealings, characterized by innovation and experimentation, showcased the potential of this novel form of currency, captivating a niche audience eager to embrace change.

Pioneering Exchanges

Among the first recorded transactions, a notable event occurred in May 2010, when a programmer famously purchased two pizzas for 10,000 units of this digital currency. This landmark moment highlighted an emerging economy where virtual assets could facilitate real-world purchases. It also sparked interest in further practical applications, demonstrating how individuals could utilize this technology for everyday transactions.

Community and Growth

During this formative phase, a dedicated community formed around the movement, exchanging ideas and supporting one another in various ventures. Collectively experimenting, these early adopters found innovative uses for the medium and established an informal economy. Their efforts significantly contributed to the perception of digital currency as a legitimate, if unconventional, financial alternative.

Bitcoin’s Technical Innovations and Blockchain

This segment delves into remarkable advancements that have emerged alongside a decentralized digital currency. These innovations reshaped perceptions of financial transactions, establishing new paradigms for trust, security, and transparency. At the core of this transformation lies a novel technology that has facilitated a groundbreaking approach to data integrity and ownership verification.

Decentralization and Security

A key feature of this digital asset ecosystem is its decentralized nature, which eliminates the need for intermediaries. By distributing transaction records across a network of computers, it enhances security and reduces vulnerability to single points of failure. This approach not only empowers users but also promotes an unprecedented level of resilience against fraud and manipulation.

Smart Contracts and Versatility

Further technical innovations extend beyond secure transactions. Implementing programmable agreements, known as smart contracts, allows automatic execution of contractual conditions without third-party involvement. This versatility opens avenues for various applications beyond mere currency, influencing industries such as supply chain management, healthcare, and real estate.

Regulatory Challenges and Legal Developments

This section focuses on various hurdles and advancements in legislation surrounding digital currencies. As new technologies emerge, governments and regulatory bodies are continually assessing their implications to ensure consumer protection, prevent illicit activities, and establish fair market practices.

Key Regulatory Challenges

Several significant challenges have arisen as authorities attempt to implement effective regulations:

- Definitional Ambiguities: Differentiating between currencies, securities, and commodities complicates regulatory frameworks.

- International Disparities: Different countries adopt varied approaches, creating inconsistencies in enforcement and compliance.

- Taxation Issues: Determining appropriate tax treatment for transactions poses a challenge for many individuals and businesses.

- Safety and Security Concerns: Protecting consumers from fraud and maintaining market integrity are paramount.

Legal Developments

In response to mounting complexities, various legal advancements have been observed:

- Implementation of clear guidelines by regulatory authorities has started to take shape.

- Increased collaboration among international regulators aims to harmonize approaches and share information.

- Landmark court rulings have set precedents that influence how laws are interpreted and enforced.

- Legislative proposals are being introduced to establish robust frameworks, leading to a more stable environment for digital assets.

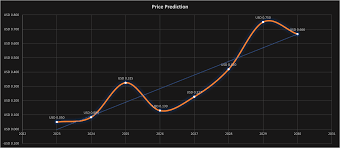

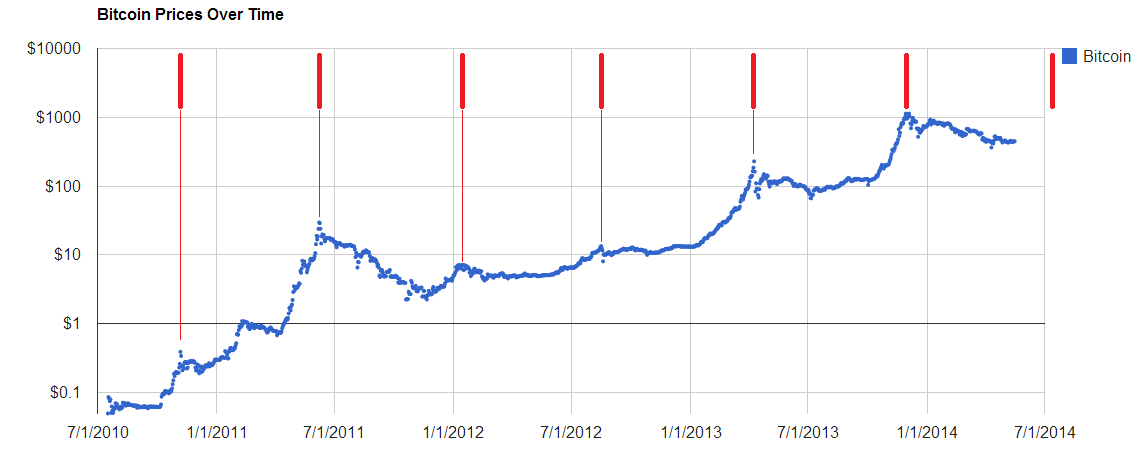

Market Fluctuations and Speculative Trading

Price volatility and speculative behavior play a crucial role in shaping market dynamics for digital assets. Traders and investors often react to various catalysts, leading to significant price movements in a short period. This environment attracts both seasoned professionals and newcomers alike, all seeking potential profits amid uncertainty.

Numerous factors contribute to these price swings, including regulatory developments, technological advancements, and shifts in public sentiment. Such influences create an atmosphere ripe for speculation, with participants attempting to capitalize on perceived trends. This can lead to rapid buying or selling, further amplifying market oscillations.

As speculative trading gains momentum, speculative bubbles can emerge, driven by hype and exaggerated expectations. Once a certain threshold of enthusiasm is reached, corrections may occur, causing sharp downturns. Understanding this intricate relationship between market fluctuations and speculative actions is essential for anyone engaged in trading or investing in the digital currency space.

The Future of Cryptocurrency and Bitcoin’s Role

As digital assets continue to gain traction, their potential influence on global economies and financial systems becomes increasingly significant. A promising horizon is emerging for these decentralized currencies, characterized by rapid technological advancements and shifting societal perceptions. This evolution opens doors to a multitude of applications, reshaping conventional notions of value and exchange.

In this dynamic landscape, a particular cryptocurrency stands at the forefront, often regarded as a gateway for newcomers. Its pioneering nature and widespread adoption make it a focal point for discussions about digital finance’s future. Key factors that will determine its trajectory include regulatory developments, institutional acceptance, and technological innovations that enhance usability and security.

Furthermore, as mainstream awareness grows, potential use cases expand beyond mere speculation and investment. Concepts such as smart contracts, decentralized finance, and tokenization are beginning to redefine traditional frameworks, suggesting a fundamental transformation in how individuals and businesses interact financially. Collaboration among developers, regulators, and users will be vital for navigating challenges and maximizing benefits associated with these digital currencies.

Ultimately, the evolution of this innovative asset class will depend on balancing risk and reward. With increasing scrutiny from regulatory bodies and the public, a robust framework will be necessary to facilitate sustainable growth. Nevertheless, the prospects remain bright for this financial revolution, charting a path towards a more inclusive and efficient economic future.

Q&A: History of bitcoin

What is the origin of Bitcoin and who created it?

Bitcoin was created in 2009 by an anonymous person or group of people using the pseudonym Satoshi Nakamoto. The concept was introduced in a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” which outlined a system for a decentralized digital currency that could operate without the need for a central authority. Nakamoto’s intention was to create a currency that allowed for secure, peer-to-peer transactions over the internet, revolutionizing how we think about money and financial exchange.

How has Bitcoin evolved since its launch?

Since its inception in 2009, Bitcoin has undergone significant evolution both technologically and culturally. Initially, it was primarily used by tech enthusiasts and libertarians. The first real-world transaction occurred in 2010 when a programmer famously bought two pizzas for 10,000 BTC. Over the years, Bitcoin has become more accessible to the general public, with user-friendly wallets and exchanges emerging. In addition, its value has seen dramatic fluctuations, garnering attention from investors, institutions, and even mainstream media. Today, Bitcoin is widely regarded as a digital gold and is used for both investment and transaction purposes, leading to developments like the Lightning Network aimed at improving transaction speeds and efficiency.

What challenges has Bitcoin faced over the years?

Bitcoin has faced numerous challenges since its creation. Initially, it struggled with perception, seen as a tool for illegal activities due to its association with the Silk Road dark web marketplace. It has also faced technical challenges, such as scaling issues—especially during periods of high transaction volume—which the community has been addressing through developments like SegWit and the Lightning Network. Regulatory scrutiny has intensified as governments worldwide seek to understand and control the implications of cryptocurrencies. Additionally, Bitcoin’s volatility poses risks for investors, with significant price fluctuations that can occur in short time frames. Despite these challenges, Bitcoin continues to adapt and grow, attracting a diverse range of users and investors.

What is the future outlook for Bitcoin and its role in finance?

The future of Bitcoin remains a topic of much debate among experts and enthusiasts. As mainstream adoption increases and more institutional investors enter the market, Bitcoin may solidify its position as a ‘digital gold’ and a hedge against inflation. Some foresee Bitcoin becoming a standard in digital finance, facilitating cross-border transactions more efficiently than traditional banking systems. However, challenges such as regulatory pressures, technological competition from other cryptocurrencies, and concerns regarding environmental sustainability due to Bitcoin mining practices may hinder its growth. Overall, many believe that Bitcoin will continue to be a significant player in the evolution of financial systems, advocating for change within traditional frameworks of money, yet its trajectory will depend on how it navigates these challenges over the coming years.

What were the main motivations behind the creation of Bitcoin?

Bitcoin was created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. The primary motivations for its creation included the desire to enable peer-to-peer transactions without the need for a trusted intermediary like a bank, to provide a decentralized currency that isn’t controlled by any single entity, and to allow for greater financial privacy. Additionally, Bitcoin was a response to the 2008 financial crisis, aiming to provide an alternative to traditional banking systems that had failed many individuals and institutions during that time.

How has the perception and usage of Bitcoin changed from its inception to today?

Initially, Bitcoin was viewed as a niche technology primarily used by tech enthusiasts and those interested in privacy. It was often associated with illegal activities on the dark web, which tarnished its reputation. However, over the years, the perception of Bitcoin has shifted significantly. Many now consider it a legitimate form of digital gold or a store of value, especially during times of economic instability. Large institutions and even some governments have started to embrace Bitcoin, leading to increased adoption and investment. Today, it is used for a variety of purposes, including remittances, online purchases, and even as an investment vehicle, reflecting a broader acceptance in mainstream finance and culture.