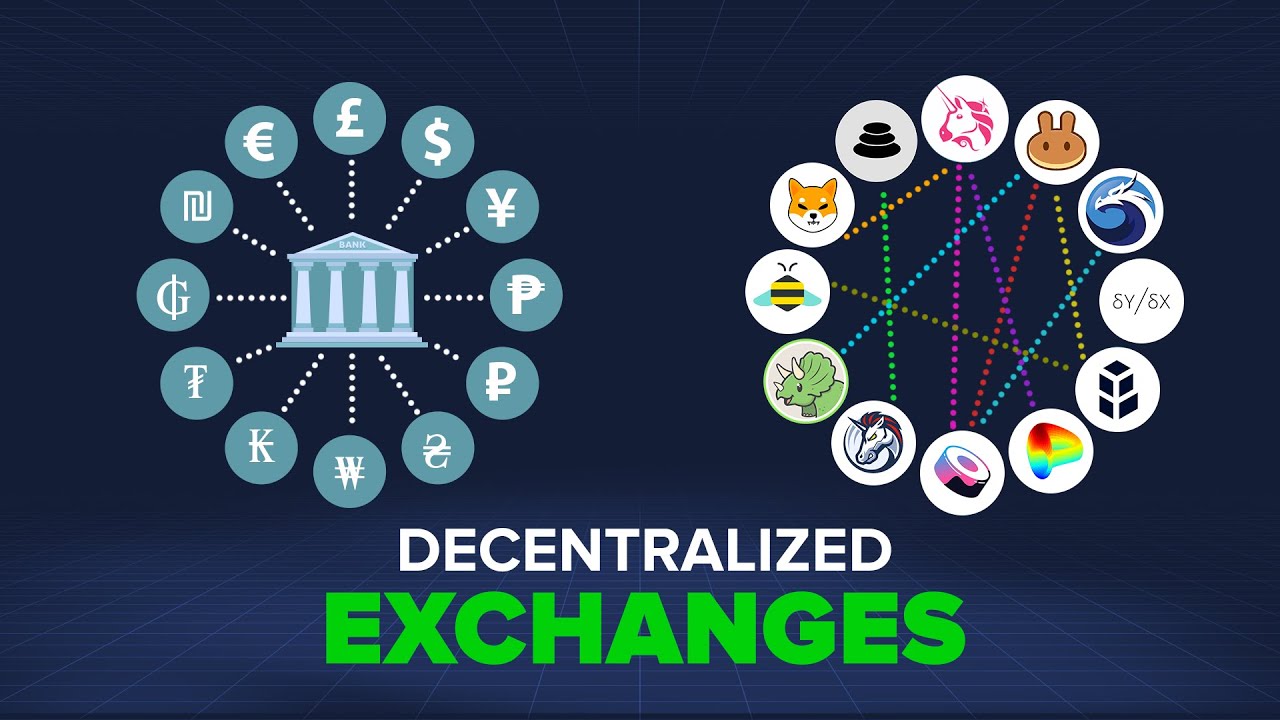

Understanding Decentralized Exchanges (DEX) and Their Functionality

The evolution of financial interactions has led to a new paradigm wherein individuals engage in trading assets directly with one another. This shift has been empowered by technological innovations that facilitate seamless transactions without intermediaries, providing users with enhanced autonomy over their trading experiences.

In this landscape, traditional models are being challenged, giving rise to a system that promotes transparency, accessibility, and security. Participants are increasingly seeking alternatives that minimize reliance on centralized authorities, fostering an environment where trust is established through technology rather than by intermediaries.

These platforms operate on the principles of blockchain technology, leveraging smart contracts to ensure that transactions occur in a secure and efficient manner. By removing the need for a central governing body, individuals can engage with one another directly, reshaping the way assets are exchanged in the digital realm.

What Are Decentralized Exchanges?

In the evolving landscape of digital finance, platforms that facilitate peer-to-peer transactions have gained significant attention. These systems empower users to trade assets directly with one another, eliminating the need for intermediaries. This innovation fosters enhanced privacy, security, and control over one’s own funds, appealing to a diverse range of participants in the market.

Such platforms utilize blockchain technology to create an environment where users can engage in trading without relying on traditional financial institutions. The architecture ensures that transactions are conducted in a trustless manner, meaning parties can complete trades without needing to trust each other or a central authority. This not only reduces the risk of fraud but also enhances the overall transparency of trading activities.

Participants in these platforms typically retain custody of their assets, which contrasts sharply with conventional trading venues where users must deposit their funds. This fundamental difference in asset control empowers individuals by giving them full ownership and responsibility for their investments.

Key Features of DEX Platforms

Decentralized platforms have rapidly transformed the landscape of digital asset trading, providing users with a range of unique attributes that differentiate them from traditional counterparts. These characteristics enhance user autonomy, bolster security, and establish a more inclusive trading environment. Below, we explore the pivotal features that make these platforms appealing to traders worldwide.

User Control and Autonomy

One of the primary advantages of utilizing these platforms is the level of control users maintain over their assets. Unlike conventional systems, where funds are held by a central authority, decentralized environments empower individuals to manage their wallets directly. This feature not only elevates user autonomy but also minimizes the risk associated with third-party breaches.

Enhanced Privacy and Security

Another significant aspect of these platforms is their commitment to privacy. By leveraging blockchain technology, they ensure that personal data remains confidential, enabling users to trade without compromising sensitive information. Additionally, decentralized frameworks are less susceptible to hacking attempts, as there is no central point of failure, thus providing an added layer of security.

| Feature | Description |

|---|---|

| User Control | Users maintain full ownership of their assets and keys. |

| Privacy | Minimal personal data collection; transactions can be anonymous. |

| Security | Lower risk of hacking due to the absence of a central authority. |

| Liquidity Pools | Facilitates trading by allowing users to contribute funds for liquidity. |

| Token Variety | Supports a wide range of trading tokens, often beyond mainstream assets. |

How DEX Facilitates Peer-to-Peer Trading

The evolution of digital asset platforms has transformed the way individuals conduct transactions, allowing for direct interactions between users without the need for an intermediary. This innovative approach promotes autonomy, security, and efficiency in the trading process, enabling participants to engage in financial exchanges with minimal barriers.

At the core of this concept are several key advantages that enhance the experience of trading directly with peers:

- Direct Ownership: Users maintain complete control of their assets during the entire trading process.

- Anonymity: Transactions can often be conducted without the necessity of sharing personal information, thereby safeguarding user privacy.

- Lower Fees: By eliminating middlemen, platforms significantly reduce transaction costs, resulting in better value for users.

- Global Accessibility: Participants from various regions can engage in trading without restrictions imposed by geographical or regulatory barriers.

- Enhanced Security: With no central authority, the risk of hacks or theft of funds at a central point is considerably lower.

Furthermore, the functionality of these platforms typically incorporates various mechanisms that enable seamless transactions:

- Smart Contracts: Automated agreements facilitate transactions without the need for trust in an intermediary.

- Liquidity Pools: Participants can contribute to pools that increase market liquidity, making it easier for users to find matching trades.

- Order Matching: Advanced algorithms pair buyers and sellers, optimizing the trading process.

- Decentralized Governance: Community members often have a say in platform decisions, fostering a sense of ownership and engagement.

By leveraging these features, peer-to-peer trading becomes more accessible and efficient, ultimately reshaping the landscape of financial transactions in the digital age.

Advantages Over Centralized Exchanges

Digital trading platforms that operate without intermediaries offer numerous benefits compared to their traditional counterparts. These platforms empower users by granting greater control over their assets, enhancing security measures, and fostering a more transparent trading environment.

One of the primary advantages is the elimination of a central authority, which reduces the risk of hacking incidents that often target centralized services. Users retain ownership of their private keys, ensuring that funds remain secure and accessible only to them. This model significantly mitigates the chances of losing assets due to an exchange’s failure or insolvency.

Moreover, these platforms typically provide increased privacy. Personal information is less frequently required, allowing individuals to trade without revealing sensitive data. This aspect appeals to those who prioritize confidentiality and wish to maintain a lower profile within the cryptocurrency space.

Additionally, the transparency inherent in these alternative platforms often leads to better price discovery. Transactions occur directly between participants, creating a more competitive atmosphere where users can benefit from improved pricing strategies without fees associated with intermediary services.

Lastly, accessibility is enhanced since users can participate globally without the restrictions imposed by centralized services. Individuals from different regions are able to trade freely, promoting inclusivity and wider participation across the digital asset landscape.

Common Mechanisms of DEX Operations

This section explores the prevalent methodologies that facilitate the functioning of peer-to-peer platforms for asset trading. These systems leverage innovative technologies to eliminate the need for intermediaries, allowing participants to engage directly with one another while Upholding security and efficiency. Understanding these operational frameworks is crucial for anyone looking to navigate the dynamic landscape of cryptocurrency trading.

Order Book Systems

One of the primary approaches employed in these platforms involves utilizing order books. This mechanism allows users to place buy and sell orders that are matched based on price and time. It creates a transparent and organized marketplace where traders can ascertain the current market dynamics and make informed decisions. The decentralized nature of this system ensures that transactions can occur swiftly and securely without the intervention of a central authority.

Automated Market Makers

An alternative method is the use of Automated Market Makers (AMMs), which eliminate the traditional order book model. Instead, AMMs rely on liquidity pools that are funded by users who provide their assets in exchange for trading fees. This system enables trades to be executed through smart contracts, facilitating seamless transactions while maintaining a constant price algorithm. AMMs have gained popularity for their ability to ensure liquidity and attractive trading experiences for users.

Future Trends in Decentralized Trading

The landscape of peer-to-peer financial platforms is evolving rapidly, influenced by advancements in technology and user preferences. As participants seek greater autonomy, the push for innovative solutions is leading to significant changes in how assets are traded. This section explores emerging patterns that are expected to shape the future of this trading environment.

1. Enhanced Privacy Features

Users are becoming more aware of their data privacy and security. Therefore, the following trends are anticipated:

- Increased adoption of zero-knowledge proofs to assure transaction confidentiality.

- Development of platforms integrating anonymous trading protocols.

- Use of decentralized identity solutions to enhance user protection.

2. Integration of Advanced Technologies

The infusion of cutting-edge technologies into trading platforms is likely to foster efficiency and accessibility. Key innovations include:

- Artificial Intelligence for improved trading strategies and market analysis.

- Smart contracts enabling automated and trustless transactions.

- Cross-chain interoperability allowing seamless asset exchanges across different networks.

As these trends materialize, they have the potential to redefine trading, offering users a more secure and efficient environment for exchanging digital assets.

Q&A: Decentralized exchanges and how dex works

What are decentralized exchanges (DEX), and how do they differ from centralized exchanges?

Decentralized exchanges (DEX) are platforms that facilitate the trading of cryptocurrencies without the need for a central authority or intermediary. Unlike centralized exchanges, which hold users’ funds and execute trades through a central server, DEX allows users to trade directly from their wallets using smart contracts. This means that users retain control over their funds throughout the trading process, reducing the risk of hacks or theft associated with centralized platforms. DEX often has a more transparent and censorship-resistant environment, but they may have lower liquidity and can be less user-friendly, especially for beginners.

How does liquidity work on a decentralized exchange, and what strategies can traders use to ensure better trading experiences?

Liquidity on a decentralized exchange is provided by users through liquidity pools, which are collections of tokens locked in a smart contract. When users trade on a DEX, they are essentially swapping tokens from these liquidity pools. The more liquidity available in a pool, the less slippage users experience during trades. Traders can improve their experiences by looking for DEXs with higher liquidity, utilizing limit orders where available, and participating as liquidity providers themselves, often earning fees and incentives in return. It’s also essential for traders to conduct research on the health and reputation of the DEX they choose to ensure a smooth trading process.

What are the potential risks associated with using decentralized exchanges?

While DEXs offer advantages like enhanced security and user control over funds, they also come with specific risks. Smart contract vulnerabilities could lead to exploits where funds are stolen or liquidated. Additionally, the lack of regulation means that there’s less recourse if a problem occurs, such as a failed transaction or exchange failure. Furthermore, DEXs can suffer from lower liquidity, resulting in higher slippage, especially for large trades. Users should also be aware of the risks associated with impermanent loss when providing liquidity to pools, particularly in volatile markets. Overall, while DEXs are an exciting alternative to traditional trading, users need to understand these risks and do their own research before engaging.

How can beginners start trading on decentralized exchanges, and what are some important features to look for?

Beginners can start trading on decentralized exchanges by following a few essential steps. First, they need to set up a cryptocurrency wallet, such as MetaMask or Trust Wallet, where they can store their digital assets. Once the wallet is set up, they can connect it to a DEX of their choice, like Uniswap or SushiSwap, and deposit funds. Important features to look for when choosing a DEX include the user interface’s intuitiveness, the total liquidity available, transaction fees, security audits, and community support. Beginners should start with small trades to get comfortable with the platform and utilize educational resources provided by many DEX platforms to understand trading mechanics better. Practicing caution and conducting thorough research will help ensure a positive experience as they navigate the world of decentralized trading.

How do decentralized exchanges work compared to centralized exchanges?

Decentralized exchanges (DEXs) operate on blockchain networks, allowing users to trade cryptocurrencies directly without relying on a central authority. Unlike centralized crypto exchanges like Binance or Coinbase, DEXs allow users to trade crypto assets using smart contracts, providing greater control over their assets and enhancing privacy.

What are the benefits of using a decentralized exchange for crypto trading?

Using a decentralized exchange (DEX) offers several advantages, such as increased security, privacy, and control over your crypto wallet. DEXs allow users to trade cryptocurrencies directly from their wallets without needing to trust a third party. They also enable access to decentralized finance (DeFi) applications, expanding trading opportunities.

How do decentralized exchanges (DEXs) interact with blockchain networks like Ethereum?

Decentralized exchanges use blockchain networks, such as the Ethereum blockchain, to facilitate crypto transactions. By utilizing smart contracts, DEXs enable crypto traders to swap tokens in a secure and transparent manner, interacting directly with the blockchain, without intermediaries or centralized control.

What are decentralized crypto exchanges, and how do they support DeFi?

Decentralized crypto exchanges (DEXs) are platforms that facilitate the trading of crypto assets without a central authority. These exchanges support decentralized finance (DeFi) by enabling users to trade cryptocurrencies, lend assets, and participate in liquidity pools, all through decentralized applications (dApps) on blockchain networks.

How do DEX aggregators work to improve the trading experience for users?

DEX aggregators help improve the user experience by pooling liquidity from various decentralized exchanges. This enables users to find the best prices and trading pairs across multiple DEXs, reducing slippage and providing more efficient and cost-effective transactions when trading cryptocurrencies.