Avoid These Common NFT Scams to Protect Your Investments and Assets

Prioritize thorough research before committing any funds in the digital collectible space. Assess the credibility of platforms and creators, seeking transparency in their operations and history. Look for verified accounts, transparent transaction records, and solid community engagement to identify trustworthy projects.

Beware of unsolicited offers and high-pressure sales tactics. Genuine creators promote their work through established channels rather than random direct messages or exaggerated claims. Always verify the authenticity of content through reputable sources before proceeding with any transaction.

Be cautious when interacting with smart contracts. Review the code, if possible, and understand the terms involved. Engaging with unverified contracts can lead to irreversible losses. Additionally, stay informed about common tricks like phishing attempts and counterfeit collections, which can undermine your financial security.

Establish a budget and stick to it, avoiding impulsive decisions. Diversify your portfolio to mitigate risks and never invest more than you can afford to lose. Regularly monitor market trends and identify red flags, such as sudden price surges in unknown projects, which may indicate potential threats.

How to identify fake NFT marketplaces

Check for a secure connection. Authentic platforms should use HTTPS, ensuring data protection.

Look for user reviews and testimonials. Genuine sites often have a strong community presence with verified user experiences. Scrutinize comments for red flags, such as unusual patterns or many similar phrases.

Investigate the team behind the platform. Authentic marketplaces typically provide detailed information about their team members, including LinkedIn profiles and past experience in the industry. If this information is lacking or unverifiable, proceed with caution.

Examine the offered listings. Legitimate marketplaces showcase detailed project information, including artist backgrounds and transaction histories. Beware of platforms with limited details or generic images.

Check social media activity. Reliable platforms usually maintain active and engaging profiles across various channels. Analyze follower counts and interactions; a dormant or sparsely followed account might indicate a lack of legitimacy.

| Red Flags | Indicators of Authenticity |

|---|---|

| No clear contact information | Accessible support via chat or email |

| Unverified user accounts flooding listings | Active and verified profiles |

| Limited payment options | Diverse and secure payment methods |

| High gas fees for transactions | Transparent fee structure |

Monitor the platform’s listing practices. Authentic sites engage in regular curation and moderation of user listings. If the marketplace lacks oversight or allows numerous low-quality entries, its integrity may be questionable.

Review the terms of service. Reputable marketplaces have clear and understandable policies. Ambiguous terms or heavy legal jargon can indicate a lack of transparency and should raise concerns.

Conduct market research. Compare offerings with well-known platforms to establish a sense of valuation. Dramatic price disparities or extremely low fees could signal an unreliable marketplace.

Red flags in NFT project websites

Check for clear team information; lack of transparency can indicate potential issues. Authentic projects usually display profiles of developers and artists along with links to their social media or LinkedIn accounts.

Poor or nonexistent roadmap

A detailed plan outlining future developments is vital. If a website fails to provide a specific timeline or milestones, this could signal that the project lacks thoughtful preparation or long-term vision.

Unprofessional website design

A rushed or poorly designed site can imply that creators are not serious or invested. Look for high-quality visuals, well-written content, and functional features; these aspects often reflect the quality of the project itself.

Excessive promises of guaranteed returns can also raise suspicions. Any claims suggesting guaranteed profits should be treated with caution, as they often indicate unrealistic expectations or deceptive intentions.

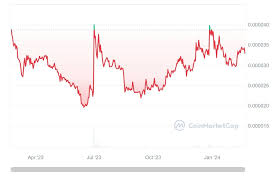

The dangers of pump and dump schemes in NFTs

Investors should be cautious about artificially inflated market values used to mislead participants. This manipulation often begins with influencers promoting specific assets, creating a false sense of demand.

Common characteristics of these schemes include:

- Sudden spikes in price without any significant news or updates.

- Heavy promotion on social media platforms by anonymous profiles.

- Low trading volume prior to aggressive marketing efforts.

- Exclusive offers or free giveaways that encourage rapid buying.

Once prices reach a peak, the orchestrators rapidly sell their holdings, causing prices to plummet. To safeguard against such practices, consider the following strategies:

- Conduct thorough research before making any purchases. Investigate project fundamentals and team backgrounds.

- Monitor transaction volumes and seller behaviors. Unusual activity can signal imminent manipulation.

- Avoid making impulsive decisions based on hype or sudden price changes.

- Engage with reputable communities and seek insights from seasoned investors.

Awareness and diligence can help prevent unwarranted financial losses during periods of market volatility.

Spotting counterfeit NFTs: what to look for

Check the provenance of the asset before making any purchase. Authenticity is confirmed through verified ownership history, traceable through blockchain records.

Examine the creator’s profile. Genuine artists usually have a reputable online presence, showcasing their work on various platforms along with a consistent history of sales.

Confirm the minting platform. Reputable marketplaces have built-in verification processes and often highlight verified creators, reducing the likelihood of falling for inauthentic offerings.

Look for unique characteristics in the asset. Original works often contain distinctive details or features that set them apart, while counterfeits may lack creativity or originality.

Be cautious of unusually low prices. If a deal seems too good to be true, it often is. Compare the pricing to similar items from trusted sources.

Read reviews and feedback from other collectors. Communities can provide insights and warnings about specific creators or listings that may not be legitimate.

Investigate recent activity on the asset’s blockchain address. A sudden influx of transactions or a lack of engagement might suggest questionable legitimacy.

Engage with the community. Forums or social media channels can be a valuable resource for guidance and advice, helping to identify potentially fraudulent items.

Why phishing attacks target NFT investors

Phishing attacks specifically aimed at this community often exploit the lack of awareness regarding wallet security. Investors frequently overlook basic protective measures, making them attractive targets. Cybercriminals employ sophisticated tactics, including impersonating official platforms and exploiting social media to create a false sense of legitimacy.

Many individuals overlook the importance of verifying URLs before entering sensitive information. Attackers frequently craft URLs that closely mimic legitimate sites, tricking users into entering their private keys or seed phrases.

The allure of quick profits draws individuals to less secure, unverified platforms, increasing vulnerability. Scammers take advantage of this appetite by creating fake marketplaces and auction sites designed to steal assets or identities.

Education around safe practices, such as enabling two-factor authentication and regularly updating software, can mitigate risks. Investors should remain vigilant and skeptical of offers that appear too good to be true. Regularly reviewing account activity and being cautious with unsolicited communications are also prudent strategies.

Engaging with trusted communities can help individuals stay informed about prevalent threats and learn from the experiences of others. Awareness and proactive measures are critical in reducing exposure to these malicious schemes.

Safe practices for verifying NFT authenticity

Check the ownership history on the blockchain. Use reputable block explorers to trace prior transactions and ensure the current holder is the original creator or a verified collector.

Examine the creator’s profile and portfolio on the marketplace. A well-established artist will have a robust presence, complete with past works, follower counts, and communications.

Investigate if the asset is linked to any external websites or social media. Authentic creators often promote their work outside the marketplace, establishing credibility through various platforms.

Review community feedback and discussions. Engaging with forums or groups focused on the specific category can provide insights into the legitimacy of the artwork and its creator.

Verify the scarcity. Authentic pieces typically have a clear edition size listed alongside public information on production methods. Unusually high edition sizes can be a red flag.

Utilize verification tools provided by platforms. Many marketplaces offer built-in verification processes that help to authenticate assets and their creators.

Assess the artwork’s metadata. Unique properties and attributes that illustrate a distinctive creation process can serve as indicators of authenticity.

Be cautious of incredibly low prices. If a price appears too good to be true compared to similar pieces or market standards, proceed with skepticism.

Stay updated on current trends regarding misrepresentation and types of fraudulent practices. Knowledge of evolving tactics can shield against unauthorized claims.

Q&A: NFT scams to avoid

How will scams and how to avoid them be discussed in the nft space by 2026, and what does this say about the wider crypto and cryptocurrency environment?

By 2026, guides about scams and how to avoid them in the nft space and broader nft world focus on teaching that every nft is a digital asset inside a fast-moving corner of crypto, so buyers must assume that some offers hide nft fraud or another type of fraud. Analysts describe the nft industry for art and collectibles as a magnet for investor scams because many types of nft scams are still poorly understood, and they explain how nft scams work, how these scams involve fake promises or fake projects, and how some of the biggest nft scams show that scams occur whenever hype outruns careful checks, so education becomes a standard part of entering this market.

How can everyday buyers in 2026 identify and avoid a nft phishing scam or other phishing scam that targets their nft account and crypto wallet on discord or other social channels?

In 2026, security experts tell users to treat any urgent message on discord or social media as a likely nft phishing scam or general phishing scam, and to verify every link before connecting a crypto wallet or signing a transaction. They recommend that people avoid clicking unknown links, always type the official website or trusted nft websites by hand, treat surprise airdrops as a common scam rather than a gift, and use clear checklists to spot and avoid fake website clones so that users can identify and avoid new tricks and avoid common mistakes when logging into marketplace accounts.

What makes rug pull schemes and pump-and-dump nft projects some of the most dangerous nft scams to watch in 2026 for people exploring the nft market?

In 2026, investigators still warn that a rug pull or a series of pump-and-dump nft and wider pump-and-dump nft scams can quickly drain value from a hyped nft collection and leave holders with worthless assets. They advise buyers to study the nft creator, check whether a project appears on established nft platforms and nft trading platforms, and remember that popular nft memes or sudden spikes in volume can be engineered by nft scammers who design investor scams to exploit the excitement of a growing nft community.

What are 5 nft scams around giveaways, free nft promotions, bidding scams and misleading nft sales that collectors should understand before jumping into a new nft drop?

In 2026, educators often highlight 5 nft scams that target newcomers: fake nft giveaway posts, nft giveaway scams that steal wallet permissions, bidding scams where offers are quietly switched to a lower currency, fake nfts that copy legitimate art, and surprise “discount” nft sales that push buyers into rushed decisions. They advise users to treat every free nft or list of free nfts as a potential trap, compare any price of an nft with trusted floor data, double-check the true price of the nft before signing, and remember that a new nft with no history rarely deserves premium pricing on day one.

How can someone in 2026 distinguish a counterfeit nft or other fake nfts from a legitimate nft when focusing on digital art and other art and collectibles?

By 2026, most serious platforms give buyers tools to spot a counterfeit nft or simple fake nfts by tracking creator histories, on-chain provenance and links back to verified profiles. Experts suggest that nft owners and nft holders confirm that a piece of digital art belongs to the same nft creator who made the original collection, that the marketplace marks it as a legitimate nft, and that any claim of a unique nft can be verified in smart contract data before purchasing an nft or committing any token to a sale.

How do practical checklists in 2026 help newcomers avoid nft scams when they start nft trading for the first time?

In 2026, beginner guides explain that anyone can avoid nft scams by following a small set of consistent rules, such as never rushing into offers and always verifying contracts and URLs. They encourage users to learn the most common types of nft scams, read summaries of 5 nft scams that appear again and again, and adopt habits like using a separate wallet for experiments so they can stay safe while exploring nft trading without risking all of their funds on one impulsive purchase.

How do scams in the nft ecosystem typically spread across nft platforms and nft trading platforms in 2027, and what patterns do analysts see in the wider nft world?

In 2027, analysts note that scams in the nft ecosystem often start on small nft platforms or lightly regulated nft trading platforms before moving into the mainstream nft world once a trick proves profitable. They report that successful schemes are copied rapidly, so once a particular method of fraud appears, security teams work quickly to document how such nft scams work, publish alerts, and help marketplaces update their defenses against copycat operations.

Why do case studies like frosties nft still appear in training materials by 2028 when experts discuss the biggest nft scams and investor scams in the history of the sector?

By 2028, educators still mention frosties nft and similar case studies when summarizing the biggest nft scams because these stories clearly show how investor scams can evolve from cute branding into major losses within days. They use these examples to teach that powerful marketing alone never proves a project is safe, that any celebrated drop can hide the same patterns as older schemes, and that long-term buyers should use structured due diligence rather than trusting social media sentiment.

How can nft owners and nft holders in 2026 use community tools to spot and avoid emerging nft scams to watch before they become widespread?

In 2026, experienced collectors tell nft owners and nft holders to rely on broad feedback from a critical nft community rather than on single influencers when deciding whether to back a project. They encourage people to review independent threads about nft scams to watch, check that each project has an official website with clear contact details, cross-check that information against reputable nft websites, and share suspicious behavior so others can spot and avoid new schemes earlier.

How might industry standards evolve by 2030 to help everyday participants avoid phishing and avoid nft scams while keeping the creative spirit of the nft space alive?

By 2030, many observers expect major marketplaces to embed stronger warnings and real-time checks that highlight nft phishing attempts, block obvious fake nfts, and share clearer labels about the risks of each type of fraud. They predict that as the nft space matures, nft trading rules, automated checks and wallet security tools will work together so that people who love art and collectibles can stay safe while exploring new projects without needing to become full-time security experts.