Breaking Cowswap Suffers 150000 Loss in Exploit

In the rapidly evolving landscape of blockchain technology, the security of decentralized platforms becomes increasingly paramount. With the rise of these innovative trading systems, incidents of unforeseen vulnerabilities can lead to significant financial repercussions for users and investors alike.

Recently, a serious incident highlighted the potential risks associated with one such platform. This unfortunate event underscores the importance of robust security measures and the constant need for vigilance in the face of emerging threats.

As the community grapples with the aftermath, it serves as a crucial reminder of the challenges faced by decentralized financial systems. Stakeholders are urged to reconsider their strategies and enhance protective measures to mitigate the chance of similar occurrences in the future.

Understanding the Cowswap Exploit Incident

The unfortunate event in question highlights significant vulnerabilities within decentralized finance platforms, manifesting in an unexpected financial downturn. It serves as a reminder of the ongoing challenges in ensuring robust security measures in the rapidly evolving landscape of blockchain technology. By analyzing this incident, we can gain insights into the weaknesses that can potentially jeopardize user assets and the overall integrity of decentralized exchanges.

Implications for Users and Developers

This situation underscores the necessity for all participants in the cryptocurrency ecosystem–ranging from developers to end-users–to remain vigilant and informed about potential risks. Users must be cautious and conduct thorough research before engaging with new platforms, while developers are urged to prioritize security audits and implement best practices to safeguard their projects.

Future Considerations in Decentralized Finance

The repercussions of this incident extend beyond immediate financial implications, prompting a broader discussion about the future of decentralized finance. Stakeholders are encouraged to collaborate on establishing more rigorous standards and frameworks that will not only enhance security but also foster trust among users, ultimately ensuring the sustainability of innovative financial solutions in the blockchain space.

How the Attack Was Executed

The incident unfolded through a series of strategic maneuvers that exploited vulnerabilities in the system’s infrastructure. By leveraging loopholes, the assailants were able to manipulate transactions, leading to substantial financial repercussions for the platform and its users.

Methods Employed

The perpetrators utilized a combination of deceptive tactics and technical knowledge to orchestrate their plan. This involved targeted manipulation of smart contracts, which governed the transaction processes, allowing them to bypass standard security measures.

Consequences of the Attack

As a result of these actions, several users found their assets compromised, resulting in an urgent need for the platform to address security weaknesses. The aftermath sparked a review of existing protocols and prompted discussions on enhancing protective measures against such threats.

| Aspect | Details |

|---|---|

| Targeted System | DeFi Platform |

| Technical Weakness | Transaction Processing |

| Impact on Users | Asset Compromise |

| Response Actions | Security Review |

Financial Impact on Cowswap Users

The recent incident has raised significant concerns regarding the overall financial wellbeing of individuals utilizing the platform. Users are facing unforeseen repercussions that could affect their investments and trust in similar decentralized services.

Many participants in the ecosystem are now reassessing their risk management strategies. Following the unfortunate event, a variety of consequences have emerged, leading to a ripple effect across the user base.

- Investment Re-evaluation: Users are likely considering their asset allocations and may shift investments to perceived safer alternatives.

- Trust Issues: Confidence in the platform has diminished, as users are wary of future encounters with vulnerabilities.

- Increased Vigilance: Individuals may invest more time in researching protocols and security measures prior to engaging further.

- Withdrawal Trends: Some users might opt to withdraw their assets, which could contribute to a decrease in market liquidity.

As the platform navigates through this challenging period, it remains crucial for users to stay informed about developments and consider adapting their strategies to preserve capital effectively.

Response from Cowswap Development Team

The recent incident has prompted the development team to address the community and stakeholders directly. Their primary focus is on transparency and ensuring that users feel secure in the platform’s future. The team acknowledges the severity of the situation and the impact it has had on many involved.

In their statement, they expressed their commitment to investigating the matter thoroughly. They are collaborating with security experts to analyze the vulnerability and strengthen the overall architecture of the system. This proactive approach aims to prevent similar occurrences in the future and to restore confidence among users.

Furthermore, the team emphasized their dedication to communication. They plan to provide regular updates on the progress of their investigation and any subsequent changes to enhance safety measures. By doing so, they hope to reassure users of their unwavering commitment to the platform’s integrity and resilience.

Lessons Learned from the Breach

The recent incident has highlighted several critical insights that can strengthen the overall security framework within the digital asset landscape. It serves as a stark reminder of the vulnerabilities that exist and the importance of proactive measures in safeguarding user assets.

- Importance of Rigorous Security Audits: Regular and thorough assessments of systems can identify potential weaknesses before they are exploited.

- Need for Robust Incident Response Plans: Having a clear strategy in place allows teams to react swiftly and effectively to any breaches.

- User Education and Awareness: Informing users about potential risks and safe practices is essential in minimizing exposure to threats.

- Continuous Monitoring: Implementing ongoing surveillance tools can help detect suspicious activities in real-time, enabling prompt action.

- Collaborative Approach: Working with other entities in the industry can lead to enhanced security measures through shared knowledge and resources.

These lessons remind us that in an ever-evolving landscape, vigilance, collaboration, and education are critical for maintaining security and trust among users.

Future Implications for Decentralized Finance

The recent vulnerabilities highlighted within digital finance platforms underscore the need for enhanced security measures and innovative solutions. As the decentralized finance landscape continues to evolve, stakeholders must navigate the balance between accessibility and robustness. Trust and resilience will play crucial roles in shaping the future of these systems.

One major implication of recent events is the growing importance of security audits and transparency protocols. Projects that prioritize rigorous examination of their code and operational frameworks will likely gain a competitive edge. This shift may encourage more platforms to adopt best practices, ultimately leading to an ecosystem that prioritizes user safety.

Moreover, the necessity for robust insurance mechanisms could become a priority for developers and investors alike. As the community becomes more aware of risks, platforms that offer protection against unforeseen incidents may attract more participants, thereby fostering wider adoption and confidence.

In addition, the evolution of governance models will be critical. With increasing incidents of breaches, decentralized organizations may explore more stringent governance structures to ensure accountability. This shift could empower users with a greater voice in decision-making, aligning with the core ethos of decentralization.

Ultimately, the lessons learned from recent challenges will drive innovation. Developers are likely to explore advanced technologies such as AI-driven security measures and enhanced user authentication methods. This proactive approach may help mitigate risks, creating a more stable and dynamic environment for users exploring decentralized finance.

Q&A: Breaking CowSwap loses 150000 in an exploit

What is the CowSwap exploit and how did it occur?

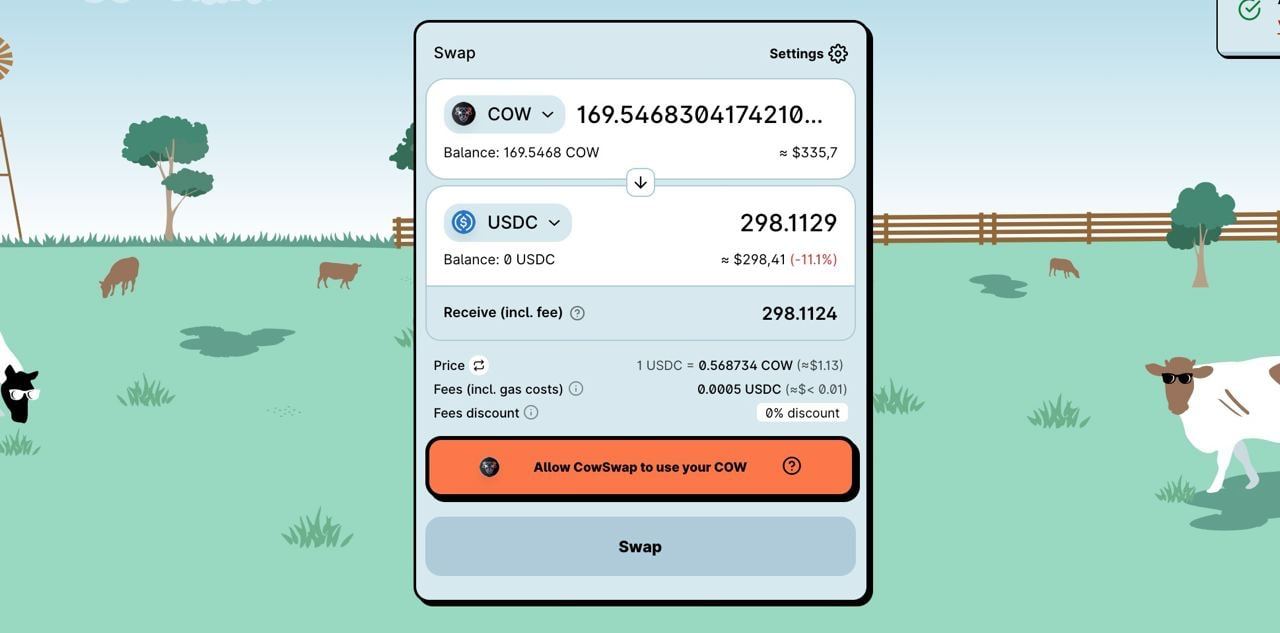

The CowSwap exploit refers to a security vulnerability within the CowSwap decentralized exchange that led to a loss of approximately $150,000. This exploit occurred due to a failure in the implementation of certain smart contracts, which allowed malicious actors to manipulate transaction processes. By exploiting these vulnerabilities, attackers were able to execute unauthorized trades or drain user funds. The incident highlights the necessity for robust security measures and regular audits of smart contracts in decentralized finance (DeFi).

Who is responsible for the CowSwap exploit and what steps are being taken to prevent future incidents?

The responsibility for the CowSwap exploit largely lies with the developers and auditors of the smart contracts that were compromised. In response to this incident, the CowSwap team has likely initiated a thorough investigation to pinpoint the vulnerabilities and has taken measures to patch the exploited contracts. Additionally, they may engage third-party security firms to audit their systems more rigorously, implement tighter security controls, and update their codebase to prevent similar occurrences in the future. Continuous monitoring and user education about safe trading practices are also essential components of their strategy moving forward.

What should users do if they have funds in CowSwap after the exploit?

If users still have funds in CowSwap after the exploit, they should first assess the current security status of the platform. It’s advisable to check for any announcements from the CowSwap team regarding the exploit and any subsequent actions taken to secure the platform. Users should consider withdrawing their funds to a secure wallet if they feel uncertain about the security of CowSwap at this time. Additionally, users should stay informed about updates and developments related to the incident, as well as best practices for securing their assets in the future.

What implications does the CowSwap exploit have for the DeFi space as a whole?

The CowSwap exploit serves as a critical reminder of the potential risks and vulnerabilities inherent in the DeFi space. Recent incidents like this cast doubt on the robustness of smart contracts and the security of decentralized platforms. They can lead to decreased user confidence, potential regulatory scrutiny, and increased calls for tighter security standards across all DeFi applications. For the industry to mature, developers must prioritize security, transparency, and accountability in order to rebuild trust with users and attract new participants. Lessons learned from this incident may also drive innovation in security practices, audits, and governance within the DeFi ecosystem.

How does the loss from the CowSwap exploit compare to other recent exploits in the DeFi space?

The $150,000 loss from the CowSwap exploit, while significant, is relatively modest compared to some other high-profile incidents in the DeFi space, where millions of dollars have been lost due to exploits and hacks. For instance, exploits like the SushiSwap hack and the Poly Network breach resulted in losses of $60 million and $600 million, respectively. However, this does not diminish the seriousness of the CowSwap incident; every loss affects user trust and the stability of the DeFi ecosystem. Each exploit, regardless of magnitude, underscores the pressing need for enhanced security protocols and better practices across the DeFi landscape to safeguard against potential threats.