Crypto Profit Calculator Calculate Your Profits with Ease

Crypto Profit Calculator Calculate Your Profits with Ease

In a world where digital currencies have revolutionized the financial landscape, staying ahead of the game is crucial. Whether you’re a seasoned investor or a curious observer, understanding the potential earnings from your cryptocurrency ventures is paramount. Introducing a groundbreaking tool that will unravel the mysteries of your crypto profits – the Crypto Profit Calculator.

Imagine having an all-in-one solution that empowers you to effortlessly analyze and predict your financial gains without any complicated calculations. With the Crypto Profit Calculator, you can unlock the potential of your crypto portfolio by harnessing the power of data analytics and insights. Discover the true value of your digital assets and make informed decisions that will shape your financial future.

With its intuitive interface and comprehensive features, this revolutionary tool offers a seamless experience for both beginners and seasoned traders. Whether you’re exploring new investment opportunities or tracking the performance of your existing portfolio, the Crypto Profit Calculator will become your trusted companion on the exciting journey towards financial freedom.

Experience the excitement of watching your earnings grow exponentially as you unleash the full potential of your cryptocurrency investments. With the Crypto Profit Calculator by your side, the world of digital finances will no longer be shrouded in uncertainty. Get ready to take control of your financial destiny and embark on a thrilling adventure into the world of crypto profits!

Understanding Cryptocurrency Investments

Delving into the world of digital currencies requires a comprehensive understanding of cryptocurrency investments. This section aims to provide a brief overview of the key concepts and considerations involved in investing in these decentralized assets.

- Decentralization: Cryptocurrencies operate on a decentralized network, meaning they are not controlled by any central authority, such as a government or financial institution.

- Volatility: The crypto market is known for its high volatility, with prices frequently experiencing rapid fluctuations. This characteristic can present both opportunities and risks for investors.

- Market Adoption: Cryptocurrencies vary in their level of market adoption and acceptance. It is crucial to assess the potential for widespread adoption when considering an investment.

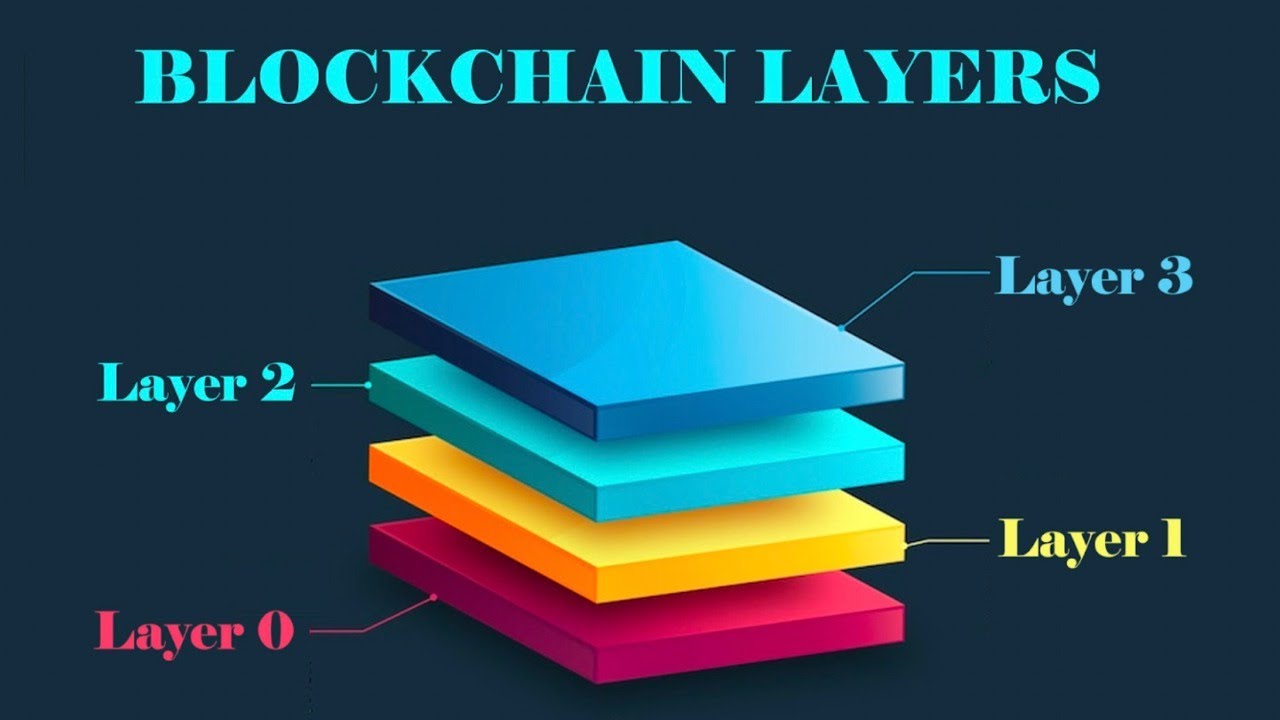

- Blockchain Technology: Cryptocurrencies are built on blockchain technology, a decentralized and transparent ledger system that enables secure and tamper-proof transactions.

- Portfolio Diversification: Including cryptocurrencies in an investment portfolio can potentially provide diversification benefits, reducing overall risk.

- Risk Management: Due to the inherent volatility, risk management strategies, such as setting stop-loss orders and conducting thorough research, are essential for successful cryptocurrency investments.

- Fundamental Analysis: Evaluating the underlying technology, team, and potential real-world applications of a cryptocurrency can provide insights into its long-term prospects.

- Technical Analysis: Utilizing techniques such as chart patterns and indicators can assist in predicting price movements and identifying optimal entry and exit points.

Understanding these fundamental aspects of cryptocurrency investments is crucial for making informed decisions in this rapidly evolving market. By gaining knowledge and staying updated with current trends, investors can navigate the crypto landscape with confidence and potentially capitalize on this emerging asset class.

How Does a Crypto Revenue Estimator Function?

Curious about the inner workings of a cryptocurrency revenue estimation tool? In this section, we will delve into the mechanics behind this innovative instrument, shedding light on its underlying principles and functionalities.

Step 1: Data Input and Selection

The first step in utilizing a crypto revenue estimator involves inputting and selecting the necessary data. Users are typically required to provide details such as the cryptocurrency they own or plan to invest in, the amount of cryptocurrency they possess or intend to acquire, the timeframe for their investment, and any additional parameters, depending on the specific tool.

Step 2: Algorithm Analysis

Once the data has been submitted, the crypto revenue estimator employs complex algorithms to analyze the provided information. These algorithms take into account a multitude of factors, including historical crypto prices, market trends, volatility, and potential external influences. The goal is to generate accurate and insightful financial forecasts based on the given inputs.

Note: Some estimators may adopt different algorithms, methodologies, or proprietary models, thus offering varying levels of accuracy and complexity.

During this stage, the revenue estimator might also consider variables such as mining difficulty (for cryptocurrencies that are mined), block rewards, staking rewards (for proof-of-stake currencies), and transaction fees (if applicable). This holistic analysis aims to provide a comprehensive understanding of potential earnings.

Step 3: Calculation of Projected Revenue

After the algorithm analysis, the crypto revenue estimator calculates the projected revenue based on the input data and the derived insights. The tool then displays the estimated earnings over the specified timeframe, giving users an idea of the potential profits they could expect to generate.

It is important to note that these estimations are based on historical data and probabilistic calculations, and thus should be taken as an informative guide rather than a set guarantee of future profits.

The crypto revenue estimator may also present the results in various formats, including graphical representations, tables, or detailed breakdowns, to enhance the user experience and facilitate comprehension of the projected earnings.

In conclusion, a crypto revenue estimator operates through a series of sequential steps, involving data input, algorithmic analysis, and the calculation of projected revenue. By utilizing these tools, individuals can gain valuable insights into potential earnings in the dynamic world of cryptocurrency.

Choosing the Right Crypto Profit Calculator

When it comes to measuring your returns in the world of cryptocurrencies, finding the right tool is crucial. A crypto profit calculator allows you to determine your potential earnings by analyzing various factors and providing accurate calculations. However, with numerous options available, selecting the perfect calculator can be a challenging task.

Here are some key considerations to keep in mind when choosing a crypto profit calculator:

- Accuracy: Ensure that the calculator you choose provides accurate calculations based on real-time data. Check for user reviews and testimonials to gauge its reliability.

- Supported Cryptocurrencies: Verify that the calculator supports the particular cryptocurrencies you are interested in. It’s important to have access to a wide range of options for accurate projections.

- Features and Customization: Look for a calculator that offers advanced features and customization options. This allows you to tailor the calculations based on your specific investment strategies and preferences.

- User-Friendly Interface: Opt for a calculator with a user-friendly interface that is easy to navigate. A simple and intuitive design will save you time and effort when inputting and interpreting data.

- Compatibility: Consider the platform compatibility of the calculator. Choose one that is compatible with your preferred devices, whether it’s a web-based tool, a mobile app, or both.

- Additional Resources: Some calculators provide additional resources such as educational materials, market insights, and investment advice. These can be valuable tools to enhance your understanding and decision-making process.

By carefully evaluating these factors, you can ensure that you select a reliable and effective crypto profit calculator that meets your specific needs. Remember, having the right tool at your disposal can greatly help you in making informed investment decisions and optimizing your cryptocurrency earnings.

Inputting Data for Accurate Results

When using a tool to determine the potential returns on your digital investments, it is essential to provide accurate and reliable data. By inputting precise information, you can obtain a realistic estimation of your earnings without any misleading or incorrect results.

Start by entering the relevant details regarding your cryptocurrency investment. Include the initial investment amount, the duration of your investment, and the interest rate or average return percentage. These factors will significantly influence the outcomes of your profit calculation.

Next, input the current value of your cryptocurrency holdings. This value should be based on the most recent market prices, ensuring that your calculations reflect the current market conditions accurately. Additionally, consider the fluctuations in prices and try to input an average value to minimize the impact of short-term market volatility.

Furthermore, it is crucial to consider any fees or expenses associated with your cryptocurrency transactions. These may include exchange fees, mining fees, withdrawal fees, or any other costs incurred during the buying, selling, or exchanging process. Including these expenses in your calculations will provide a more accurate representation of your net profits.

Lastly, don’t forget to take into account any taxes that may apply to your cryptocurrency earnings. Tax regulations vary depending on your jurisdiction, so ensure that you input the appropriate tax rate or percentage to calculate your post-tax profits correctly. By considering the tax implications, you can avoid surprises and accurately assess the profitability of your crypto investments.

- Enter accurate initial investment amount.

- Provide the true duration of your investment.

- Input the current value of your cryptocurrencies.

- Consider any applicable fees or expenses.

- Include the appropriate tax rate or percentage.

As the accuracy of the results depends on the accuracy of the input data, taking the time to input reliable and precise information will lead to trustworty calculations. Remember to update the data regularly to reflect changes in market conditions and ensure ongoing accuracy in your profit calculations.

Analyzing the Results: Making Informed Decisions

Examining the Outcomes: Enhancing Decision-Making

Once you have obtained the numerical outcomes from the cryptocurrency performance assessment tool, it is crucial to delve deeper into the analysis and grasp the implications of the data. By employing a thoughtful evaluation framework, you can transform the information into valuable insights that will empower you to make well-informed decisions in the crypto market.

Firstly, it is essential to consider the trends and patterns that emerge from the results. Explore the recurring themes that manifest within the data, identifying any notable spikes or dips in performance. This holistic perspective will assist you in understanding the underlying dynamics of your cryptocurrency investments, enabling you to adapt your strategies accordingly.

Furthermore, it is imperative to assess the factors influencing the fluctuations in your earnings. Scrutinize the various elements that contribute to the success or decline of your cryptocurrency portfolio. This comprehensive analysis may involve evaluating market trends, governmental policies, technological advancements, and investor sentiments. By understanding the complex ecosystem in which cryptocurrencies operate, you will be better equipped to anticipate market movements and optimize your profits.

In addition to external factors, it is equally crucial to evaluate the traits and behaviors inherent within your investment portfolio. Determine the performance disparities between different cryptocurrencies and identify the key drivers behind their respective outcomes. Pinpoint the strengths and weaknesses of individual assets, considering their historical data, market capitalization, liquidity, and general market perception. Armed with this knowledge, you can make informed decisions about which cryptocurrencies to retain, divest, or further invest in.

| Key Analysis Points | Possible Actions |

|---|---|

| Identify dominant market trends | Adjust investment allocation accordingly |

| Evaluate influential external factors | Stay updated on cryptocurrency news and developments |

| Analyze performance disparities | Consider rebalancing your portfolio |

Ultimately, by delving deep into the analysis of your cryptocurrency earnings, you gain a deeper understanding of the potential risks and rewards associated with the crypto market. Armed with this knowledge, you can navigate the ever-evolving landscape of cryptocurrencies with confidence, ensuring that your investment decisions are backed by a robust assessment of the data, trends, and dynamics shaping the industry.

Next Steps: Maximizing Your Digital Asset Earnings

Once you have successfully utilized the unique tools and resources available for calculating and managing your digital assets, it is crucial to explore additional strategies and actions that can help you maximize your earnings. This section will outline key steps you can take to enhance the profitability of your cryptocurrency investments without relying solely on the profit calculator.

1. Expanding Your Investment Portfolio

One way to boost your cryptocurrency earnings is by diversifying your investment portfolio. Consider exploring other digital assets that have the potential for substantial growth. Conduct thorough research and stay updated on the latest market trends to identify promising opportunities. This approach can help reduce risk and potentially generate higher returns.

2. Engaging in Active Trading

Active trading refers to the practice of regularly buying and selling cryptocurrencies to take advantage of short-term price fluctuations. By closely monitoring the market and implementing effective trading strategies, you can potentially capitalize on price movements and generate additional profits. However, it is essential to educate yourself about trading techniques and manage risks diligently.

Unleashing the full potential of your cryptocurrency earnings requires continuous learning, adaptability, and a proactive attitude towards the market. By embracing these next steps and leveraging them effectively, you can enhance your digital asset portfolio’s profitability beyond what the profit calculator alone can offer.

Q&A: Crypto profit calculator

How can you calculate your profit or loss when selling bitcoin?

To calculate your profit or loss when selling bitcoin, subtract the buy price (the price at which you acquired the bitcoin) from the sell price (the price at which you sold the bitcoin), taking into account any fees incurred during the transaction.

What are some methods to calculate your crypto gains for tax purposes?

You can calculate your crypto gains for tax purposes by keeping track of your transactions, including buy and sell prices, and determining crypto tax the difference between the two to assess your capital gains or losses.

When selling ethereum, how do you calculate your profit or loss?

Similar to selling bitcoin, calculating your profit or loss when selling ethereum involves subtracting the buy price (the price at calculate crypto which you purchased ethereum) from the sell price (the price at which you sold ethereum), considering any associated fees.

What role does your wallet play in calculating profits or losses when selling crypto?

Your wallet stores records of your cryptocurrency transactions, which are essential for calculating profits or losses when selling eth crypto. It helps you track buy and sell prices and any fees incurred during transactions.

How do you calculate your capital gains when selling dogecoin for fiat currency?

To calculate your capital gains when selling dogecoin for fiat currency, subtract the buy price of dogecoin from the sell price, accounting for any fees or expenses incurred during the transaction.

Can you provide steps to calculate your profit and loss when selling crypto?

To calculate your profit and loss when selling crypto, subtract the buy price of the crypto asset from the sell price, then deduct any fees or expenses associated with the transaction to determine your net profit or loss.

What is the significance of determining the exit fee when calculating profits or losses?

The exit fee refers to any fees or expenses incurred when exiting a crypto position, such as selling crypto for fiat currency. It is essential to consider these fees when calculating profits or losses to obtain an accurate financial picture.

How can you calculate profit when selling BTC for fiat currency?

To calculate profit when selling BTC for fiat currency, subtract the buy price of BTC (in fiat currency) from the sell price (also in fiat currency), considering any associated fees or expenses.

When selling crypto, why is it crucial to enter the amount accurately?

Entering the amount accurately when selling crypto ensures that your profit or loss calculations are precise. It helps in determining the total value of the transaction and calculating gains or losses accordingly.

What steps should you follow to calculate your profit or loss when selling crypto?

To calculate your profit or loss when selling crypto, identify the buy price and sell price of the crypto asset, subtract the buy price from the sell price, and account for any fees or expenses incurred during the transaction.

How can you calculate your crypto profit using a free crypto profit calculator?

A free crypto profit calculator can help you calculate your crypto profit by subtracting the purchase price of your crypto assets from their selling price, taking into account any fees or expenses incurred during the transaction.

What role does fair market value play in determining the value of your crypto assets?

Fair market value refers to the current price at which your crypto assets could be sold in an open and competitive market. It helps determine the value of your crypto holdings accurately.

Can you explain the importance of taking profit when managing your cryptocurrency investments?

Taking profit involves selling a portion of your cryptocurrency holdings when their value increases, allowing you to realize gains and reduce risk. It is an essential strategy for managing crypto investments effectively.

How can a cryptocurrency profit calculator assist you in calculating your crypto taxes?

A cryptocurrency profit calculator can help you calculate your crypto taxes by determining your crypto profits and losses, which are essential for reporting capital gains or losses on your tax return.

What factors should you consider when using a crypto investment calculator?

When using a crypto investment calculator, consider factors such as the purchase price of your crypto assets, their current market value, any trading fees incurred, and your desired return on investment.

How do you calculate your crypto profit and losses for tax reporting purposes?

To calculate your crypto profits and losses for tax reporting, subtract the purchase price of your crypto assets from their selling price, including any associated fees or expenses. This calculation helps determine your capital gains or losses.

Can you explain the process of using a crypto profit calculator to calculate your gains and losses?

To use a crypto profit calculator, input the purchase price and selling price of your crypto assets, along with any applicable fees. The calculator will then subtract the purchase price from the selling price to calculate your gains or losses.

What is the significance of knowing the market value of your cryptocurrency portfolio?

Knowing the market value of your cryptocurrency portfolio allows you to assess its overall performance, track investment returns, and make informed decisions about buying, selling, or holding crypto assets.

How does reinvesting your profits contribute to the growth of your crypto portfolio?

Reinvesting your profits involves using the gains from previous investments to purchase additional crypto assets, thereby increasing the size and potential returns of your crypto portfolio over time.

How can crypto investors successfully plan their investments using tools like a crypto profit calculator?

Crypto investors can successfully plan their investments by using a crypto profit calculator to assess potential gains and losses, analyze different investment scenarios, and determine the best strategies for maximizing returns and managing risk.