NVT Ratio in Crypto Understanding Its Significance for Investors and Market Analysis

The analysis of the NVT metric serves as a crucial tool for investors seeking to assess true asset worth within the blockchain sphere. By examining network activity against market capitalization, this figure provides insights that can significantly influence investment decisions and portfolio management.

Investors should closely monitor fluctuations of this metric, as it can reveal periods of overvaluation or undervaluation. A rising NVT metric often indicates inflated asset prices relative to the actual utility derived from network transactions, suggesting potential profit-taking opportunities. Conversely, a declining figure might signify undervaluation, alerting investors to potential buying signals in the market.

Analyzing historical trends and correlations with price movements can enhance decision-making. It is advisable to supplement this metric with other indicators such as trading volume and investor sentiment to form a holistic view. Strategic adjustments based on this analysis could yield considerable benefits in portfolio performance and risk management.

How to Calculate NVT Ratio for Cryptocurrencies

To determine the valuation metric, follow this formula:

Value = Market Capitalization / Daily Transaction Volume

First, gather the market capitalization data. This figure represents the total worth of the cryptocurrency, calculated by multiplying the current price per unit by the total number of units in circulation.

Next, obtain the daily transaction volume. This data reflects the total value of all transactions conducted within a 24-hour period for the specific asset. Sources for this information can include various blockchain explorers or specialized cryptocurrency data platforms.

Once you have both numbers, simply perform the division. The outcome will help you assess the relationship between the market value and the actual usage of the currency on the network.

A higher figure might indicate that the asset is overvalued relative to its usage, while a lower value can suggest potential undervaluation. Regularly tracking this metric over time can provide insights into market trends and trading decisions.

Consider comparing this ratio with historical values or similar assets to gain context. This analysis enables better strategic planning and investment choices.

Analyzing Historical Trends of NVT Ratio and Price Correlation

To effectively evaluate the relationship between network value and transaction volume, analyze the historical trends and their correlation with asset prices. Recent data indicates significant shifts, particularly during market fluctuations.

An optimal approach to interpretation requires focusing on key periods of divergence and convergence. For instance, when the valuation rises despite a decline in transactional activity, it signals a potential overvaluation, suggesting caution for investors. Conversely, consistent price rises paired with increasing transaction volume generally denote a healthy market.

| Period | Price Trend | Network Value vs. Transaction Volume | Implication |

|---|---|---|---|

| Q1-Q2 | Sharp Increase | Stagnant | Potential Overvaluation |

| Q3 | Steady Growth | Boosted | Healthy Market |

| Q4 | Decline | Increased Transactional Volume | Market Correction |

Utilize historical data to identify patterns. Instances where the correlation tightens can indicate impending price movements, allowing for strategic trading decisions. Always consider external factors such as regulatory announcements or technological advancements that may influence these metrics.

Interpreting NVT Ratio: What High and Low Values Indicate

Values exceeding 100 indicate potential overvaluation, suggesting that the asset may be overpriced relative to its transaction activity. This could imply a correction on the horizon or a period of investor speculation. Caution is advised during such phases, as market sentiment often drives prices higher than justified by underlying usage metrics.

Conversely, values below 20 signal potential undervaluation, indicating that the asset could be undervalued compared to its transaction volume. This scenario may attract long-term investors looking for buying opportunities, especially if fundamental developments support future growth potential.

Analyzing Transaction Activity

It’s crucial to compare these values over time. A rising value during a bullish market could point to unsustainable growth, while a decline in low-value periods might reflect underlying issues. Monitoring trends helps establish whether valuations align with actual usage, providing deeper insights into market health.

Impact on Investment Decisions

Understanding these metrics allows investors to make informed decisions. High values suggest a cautious approach, recommending either profit-taking or shorting, while low values can signal purchasing opportunities. Always assess alongside other indicators to formulate a well-rounded strategy.

Comparing NVT Ratio Across Different Cryptocurrencies

Analyze the performance of major currencies like Bitcoin and Ethereum against lesser-known assets such as Chainlink and Cardano. Bitcoin typically shows a lower ratio due to its high transaction volume relative to market capitalization, reflecting its established status and investor confidence. On the other hand, Ethereum often presents a higher measure, indicating speculative investment trends and transformative market dynamics linked to its smart contract capabilities.

Chainlink, with its unique position in decentralized oracle services, often displays a fluctuating metric, influenced by adoption rates among developers and partnerships within the blockchain ecosystem. Cardano, characterized by its ongoing development process and community-driven initiatives, may reveal varying indicators based on investor sentiment and protocol upgrades.

In terms of investment decisions, a lower figure generally suggests undervaluation, while a high reading can signal caution or speculative bubbles. For strategic positioning, consider diversified portfolios that blend established and emergent projects, aiming to balance stability with growth potential. Regular monitoring of these parameters allows for informed adjustments in asset allocation, enhancing investment outcomes.

Evaluate the metrics periodically, as shifts in transaction volumes and market capitalizations can significantly alter the interpretations. Investors should incorporate these analyses into broader research frameworks, ensuring a well-rounded approach to market engagement.

Using NVT Ratio in Investment Decision-Making

Monitor the value created relative to the transaction activity in the market to evaluate investment opportunities. A low metric suggests undervaluation, while a high metric may indicate overvaluation. Utilize historical data to identify trends, focusing on significant deviations as potential buy or sell signals.

Incorporate this metric with other financial indicators for a more robust analysis. Consider volume changes; if an increase is observed alongside a low value, it could signal growing interest, making it a favorable entry point. Conversely, a high reading with declining volume indicates waning investor enthusiasm, serving as a warning sign.

Analyze the metric within the context of macroeconomic conditions and regulatory news that could influence market sentiment. Continuous monitoring allows for timely adjustments to your strategy based on shifts in the underlying assumptions of valuation.

Lastly, backtest your strategies using historical scenarios to understand how well this analysis performed under varying market conditions. This approach helps refine decision-making processes and improves the likelihood of successful investments in the future.

Limitations of NVT Ratio in Cryptocurrency Valuation

Investors should be aware of several shortcomings associated with this analytical tool. Relying solely on one method can lead to misguided conclusions. Consider the following limitations:

1. Market Manipulation

- Artificial volume can distort the effectiveness of the metric.

- Wash trading or coordinated activities may result in misleading readings.

2. Network Activity Variability

- Inherent fluctuations in transaction volumes can lead to temporal inaccuracies.

- Short-term spikes might misrepresent long-term potential and trends.

3. Lack of Context

- Does not account for external factors such as regulatory changes and technological advancements.

- Variations in utility among different projects can skew interpretations.

Understanding these factors is crucial for making informed investment decisions. Cross-comparing with additional indicators enriches analysis and mitigates risks.

Q&A: NVT ratio crypto

What does network value to transaction mean in 2026+ and how is the bitcoin nvt ratio used for bitcoin network valuation?

Network value to transaction is a ratio analysis that compares bitcoin network value to activity, helping with network valuation of a crypto asset like btc. In 2026+, many analysts use the nvt ratio to frame whether the bitcoin network is priced in line with network usage and utility value rather than hype in the bitcoin market.

How is nvt ratio is calculated in 2026+ and why does ratio is calculated by dividing need a clear denominator?

Nvt ratio is calculated by dividing bitcoin’s market capitalization by on-chain transaction volume, so the denominator is the on-chain transaction volume over a chosen period. In 2026+, clarity matters because on-chain transaction volume can be measured differently, including usd volume transmitted and volume transmitted through the blockchain, which can change the absolute value of the ratio.

What is the relationship between bitcoin’s market capitalization, market cap, and usd measures in 2026+ when evaluating bitcoin’s price?

Bitcoin’s market capitalization is the market cap of the bitcoin network, typically expressed in usd by multiplying circulating supply by bitcoin price. In 2026+, this connects bitcoin’s price to network value because a larger market cap can imply higher expectations even if on-chain data shows flat network usage.

Why do people compare bitcoin nvt ratio to price-to-earnings and pe ratio in 2026+, and what is the link to company’s earnings?

Nvt is often described as a price-to-earnings style metric for a payment network, where market cap is like the price of a stock and transactions act like company’s earnings. In 2026+, this analogy to pe and pe ratio helps traditional finance audiences understand ratio for stocks logic, even though bitcoin’s “earnings” are proxied by transaction activity.

What does high nvt mean in 2026+ and how do high nvt ratio and higher nvt relate to overvalued or undervalued conditions?

High nvt indicates that bitcoin network value is high relative to on-chain transaction volume, which can suggest an overvalued or undervalued debate depending on context. In 2026+, a high nvt ratio or higher nvt often implies valuation is running ahead of network usage, so it may flag overheating rather than fundamentals.

What does low nvt ratio signal in 2026+ and how can lower nvt or average nvt help identify market tops and bottoms?

Low nvt ratio means the bitcoin blockchain is transmitting strong activity relative to market cap, which can hint at undervaluation. In 2026+, comparing lower nvt to average nvt can help map market tops and bottoms by showing when valuation compresses or expands versus network usage.

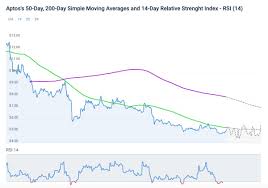

What is nvt signal in 2026+ and how can a moving average make it more usable for market tops analysis?

Nvt signal commonly refers to smoothing the bitcoin nvt ratio with a moving average to reduce daily noise in on-chain data. In 2026+, this can improve timing around market tops by highlighting sustained high nvt ratio regimes instead of short spikes that might not matter for the broader bitcoin market.

How can high nvt and price correction connect in 2026+ and why does suggests that bitcoin may overheat after a price increase?

When high nvt persists, it suggests that bitcoin may be priced far above the activity reflected in on-chain transaction volume, especially after a sharp price increase or increase in price. In 2026+, that mismatch can precede a price correction as expectations normalize back toward network usage and utility value.

How do choices about on-chain transaction volume, usd volume transmitted, and absolute value affect nvt value in 2026+?

Nvt value depends heavily on what counts as transaction volume, including whether you focus on usd volume transmitted or adjust for internal transfers, exchanges, or batching. In 2026+, different definitions change the absolute value and can shift whether the ratio looks like high nvt or low nvt ratio, so consistent methodology is critical.

What role do willy woo and on-chain data frameworks play in 2026+ for transactions ratio interpretation of bitcoin’s price?

Willy woo is commonly associated with popularizing on-chain frameworks and making the transactions ratio easier to discuss for btc investors. In 2026+, the practical takeaway is not the name but the method: use the nvt ratio alongside other on-chain data to judge bitcoin’s price context, not as a standalone trigger for market tops and bottoms.