Best Crypto Grid Trading Bots Now Accessible on the Exchange

Best Crypto Grid Trading Bots Now Accessible on the Exchange

In recent times, advancements in financial technologies have led to the emergence of sophisticated tools aimed at optimizing investment processes. These strategies are designed to enhance efficiency and help traders navigate the complexities of market fluctuations. By utilizing algorithmic frameworks, participants can engage in systematic approaches that align with their risk appetite and market insights.

Traders seeking to maximize their potential gains can now explore various automated mechanisms tailored for dynamic market environments. Such innovations allow for seamless interaction with distinct price movements, enabling traders to capitalize on opportunities with precision and speed. By integrating these advanced systems, participants are better equipped to adapt to evolving market conditions and refine their overall trading approach.

As the adoption of these technologies grows, many are beginning to recognize the advantages of implementing strategic frameworks that respond promptly to market signals. This shift not only streamlines decision-making processes but also empowers traders to optimize their portfolios in real time. Embracing such tools can significantly impact overall performance and ultimately redefine how participants approach their trading endeavors.

Understanding Grid Trading Strategies

Strategic approaches within financial markets can harness price fluctuations to generate profits. These methodologies focus on taking advantage of market volatility through systematic buying and selling, aiming for consistent returns by establishing a network of positions.

At the core of these methodologies is a structured pattern that involves:

- Setting predetermined price levels for executing trades.

- Creating a mesh of buy and sell orders spaced at regular intervals.

- Responding to market movements dynamically while minimizing emotional decision-making.

These strategies can be particularly effective in ranging markets, where assets oscillate within a defined price range. They allow participants to capitalize on both upward and downward movements, thus potentially maximizing opportunities.

Key components of successful implementation include:

- Identifying price ranges where trading will occur.

- Determining the distance between order levels, which can affect overall profitability.

- Having a clear plan for contingencies, including exit strategies and risk management.

Understanding market conditions and asset behavior enhances the effectiveness of these methods, leading to improved results over time. It is essential to continually assess performance and adapt strategies as necessary to align with changing market dynamics.

Benefits of Using Trading Bots

Automated platforms have transformed the landscape of financial engagement by enabling users to capitalize on market opportunities with minimal human intervention. These innovative solutions offer various advantages that can enhance trading strategies and improve overall efficiency.

- 24/7 Operation: Automated systems can execute trades around the clock, taking advantage of opportunities even when users are not actively monitoring the markets.

- Emotionless Trading: Automated algorithms eliminate emotional decision-making, ensuring that trades are executed based solely on predefined criteria and strategies.

- Speed and Efficiency: Algorithms can analyze vast amounts of data and execute trades at lightning speed, far exceeding human capabilities.

In addition to the aforementioned advantages, other key benefits include:

- Backtesting Capabilities: Users can test strategies on historical data to evaluate their effectiveness before applying them in real-time, reducing risk and increasing confidence.

- Customizable Strategies: Users have the flexibility to adjust trading parameters and strategies, tailoring the approach to their individual preferences and risk tolerance.

- Consistent Performance: Automated systems can maintain a disciplined trading routine, leading to more consistent outcomes over time.

By leveraging these advanced technologies, participants can gain a competitive edge, enhance their trading experience, and potentially increase profitability in dynamic markets.

Top Exchanges for Crypto Grid Bots

Finding suitable platforms for automated strategies is crucial for effective market engagement. A variety of options exist, each offering distinct features and tools that cater to different styles of automation.

-

Binance: One of the largest cryptocurrency platforms, known for its diverse asset offerings and comprehensive support for automated strategies.

-

Coinbase Pro: Offers a user-friendly interface and powerful tools that simplify the deployment of automated routines for both beginners and seasoned traders.

-

Kraken: Recognized for its robust security measures and advanced order types, making it suitable for users interested in complex automated strategies.

-

Bitfinex: Provides advanced trading features and a customizable environment perfect for integrating various automated techniques.

-

Huobi: A major player in the market, known for its extensive selection of currencies and competitive fees, appealing to those utilizing automated routines.

When choosing a platform, it’s essential to consider factors such as user experience, asset diversity, fee structures, and available tools that support automation.

How to Choose the Right Bot

Selecting an automated trading solution requires careful consideration of various factors to ensure optimal performance and compatibility with individual trading styles. A clear understanding of personal goals and preferences is essential for making an informed choice.

Key Factors to Consider

- Trading Strategy: Identify your preferred approach, such as scalping or long-term investing, to match the capabilities of the software.

- Performance Metrics: Analyze historical performance data to assess the effectiveness and reliability of the solution.

- User Interface: A user-friendly interface can significantly enhance the usability and overall experience.

- Customization Options: Look for solutions that allow tailoring of settings to suit your unique strategy and risk tolerance.

- Support and Community: Evaluate the availability of customer support and community resources for troubleshooting and advice.

Testing and Evaluation

Prioritize testing selected solutions through demo accounts or backtesting. This process allows for a tangible assessment of how well the software aligns with your trading style without risking actual capital. Additionally, regularly reviewing performance and making adjustments based on changing market conditions is crucial for sustained success.

Real-World Success Stories

In this section, we explore remarkable instances where automated systems have significantly altered investment strategies and yielded substantial gains for users. These narratives highlight practical applications of algorithmic approaches, showcasing how traders have leveraged advanced methodologies to navigate volatile markets successfully.

Case Study: Empowering a Small Investor

One compelling story involves a novice investor who, after encountering challenges in manual strategies, turned to automation. By implementing an algorithmic approach, this individual experienced a remarkable transformation. Initially hesitant, they saw incremental profits grow into a consistent revenue stream. The ability to effectively manage trades around the clock allowed this investor to capitalize on market fluctuations previously overlooked.

A Professional Trader’s Experience

Another inspiring example comes from a seasoned trader, who integrated advanced algorithms into their portfolio management. This expert reported enhanced decision-making capabilities and risk management techniques. Over the span of a year, their reliance on systematic processes enabled them to not only preserve capital during downturns but also achieve gains that far surpassed traditional methods. Feedback from this professional illustrated how automation can elevate a trader’s performance through enhanced analytical precision.

Future Trends in Trading Automation

The landscape of financial markets is constantly evolving, and advancements in technology continue to reshape methodologies for executing trades. Automation in investment strategies is becoming an indispensable element, providing unparalleled speed and efficiency. As algorithms become more sophisticated and data analysis techniques improve, market participants are likely to witness a radical transformation in how trades are approached.

Integration of Artificial Intelligence

One significant trend is the growing integration of artificial intelligence within automated systems. These intelligent frameworks are expected to enhance decision-making processes by analyzing vast amounts of market data in real-time. The ability to learn from previous market movements and adapt strategies accordingly will empower traders to optimize their approaches and mitigate risks effectively. Embracing this technology opens avenues for predictive models that can foresee market shifts, placing participants ahead of the curve.

Decentralized Automation Solutions

Another emerging trend is the shift towards decentralized automation solutions. Blockchain technology facilitates transparency and security in automated transactions, reducing reliance on traditional intermediaries. This decentralization not only enhances the integrity of the trading ecosystem but also paves the way for more accessible platforms that cater to a wider audience. As a result, we can anticipate a surge in innovative applications designed to democratize access to profit-generating strategies.

Question-answer: Grid trading bots are now available in the exchange

What are grid trading bots and how do they function?

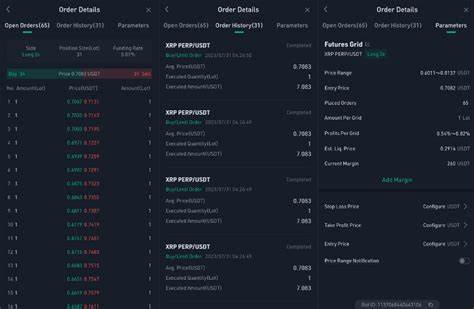

Grid trading bots are automated trading programs designed to execute trades based on a predefined grid strategy. This strategy involves placing a series of buy and sell orders at set intervals around a fixed price level. The idea is to profit from the market’s natural price fluctuations. When the price of a cryptocurrency moves up or down within the grid, the bot automatically executes trades to capitalize on these movements, thereby creating multiple revenue opportunities without requiring constant monitoring by the trader.

What advantages do new grid trading bots offer over traditional trading methods?

New grid trading bots present several advantages over traditional trading methods. Firstly, they operate 24/7, allowing traders to take advantage of price movements even when not actively watching the market. Secondly, these bots minimize emotional trading decisions by automating the buying and selling process based on rational algorithms. Additionally, many new bots incorporate advanced machine learning techniques to optimize trading strategies in real time, potentially increasing profitability. Lastly, grid trading is particularly effective in volatile markets, where price oscillations create numerous trading opportunities.

Are there specific exchanges where these new grid trading bots are available?

Yes, several cryptocurrency exchanges have started to integrate new grid trading bots into their platforms. Major exchanges such as Binance, KuCoin, and Bitfinex offer built-in grid trading options, making it easier for both novice and experienced traders to utilize these tools. Additionally, there are third-party trading platforms that also provide grid bot functionalities compatible with various exchanges. It’s essential to thoroughly research and choose a reputable exchange or trading platform that offers robust security measures and user-friendly interfaces to enhance your trading experience with grid bots.

Can I customize a grid trading bot according to my trading preferences?

Absolutely! Most modern grid trading bots allow users to customize their settings based on individual trading preferences. You can define parameters such as the size of the grid, the number of buy and sell orders, the trading pairs, and the price range within which the bot will operate. Additionally, some advanced bots even allow for the integration of technical indicators and risk management features. This level of customization helps traders align the bot’s strategy with their specific market outlook and risk tolerance, maximizing the potential for successful trades.

What should I consider before using a grid trading bot?

Before using a grid trading bot, there are several factors to consider. Firstly, ensure you have a solid understanding of grid trading strategies, as improper use can lead to losses. Secondly, assess the reputation and reviews of the bot or platform you intend to use; look for transparency regarding fees, performance history, and customer support. It’s also crucial to set a clear risk management plan, as market conditions can change rapidly and lead to unexpected losses. Lastly, consider starting with a demo account or small investments to test the bot’s performance before committing significant capital. This ensures you are comfortable with the bot’s operations and trading style.

What are grid trading bots and how do they work?

Grid trading bots are automated trading systems designed to improve trading efficiency by placing buy and sell orders at predetermined intervals within a specified price range. Essentially, these bots create a “grid” of orders, which helps traders take advantage of market fluctuations. When the price moves up or down, the bot executes trades automatically, buying low and selling high, thus potentially capturing profits in both rising and falling markets. The strategy is particularly effective in a ranging market, where prices oscillate around a certain level.

What should I consider before using a grid trading bot on an exchange?

Before using a grid trading bot, it’s crucial to assess several factors. First, understand the market conditions; grid trading works best in sideways or fluctuating markets rather than trending ones. Additionally, evaluate the bot’s fee structure, as high fees can erode profits. Research the specific bot’s performance history and user reviews to gauge its reliability. Finally, ensure you are comfortable with the level of risk involved; although grid trading can be profitable, it carries inherent risks, and it’s essential to set proper parameters such as grid size and stop-loss limits to manage potential losses effectively.

How does crypto grid trading work in a sideways market?

Crypto grid trading works in a sideways market by placing buy and sell orders at predetermined intervals. As the market price fluctuates within a set range, the grid bot executes trades to take advantage of price swings, buying low and selling high to capture profits.

What is the advantage of using a grid trading bot on exchanges like Binance or Crypto.com?

Using a grid trading bot on exchanges like Binance or Crypto.com allows traders to automate their trading strategies, manage multiple trading pairs, and reduce the need for manual monitoring. This automation can help take advantage of price fluctuations and potentially improve trading results.

How can traders create and set up a grid trading bot?

Traders can create and set up a grid trading bot by selecting a trading platform that offers grid trading tools, defining the grid parameters (such as the number of grids, price range, and interval), and configuring the bot to execute trades based on these settings. Many platforms provide user-friendly interfaces for setting up grid trading bots.

What should traders consider when choosing the best crypto grid trading bots?

When choosing the best crypto grid trading bots, traders should consider factors such as the bot’s features, compatibility with their preferred exchange, trading fees, and performance in various market conditions. Reviewing trading tutorials and comparing different bots can also help in making an informed decision.

What are the key benefits of using automated grid trading strategies?

Automated grid trading strategies offer benefits such as reducing manual trading effort, eliminating emotional decision-making, and executing trades based on predefined parameters. This approach can help traders capitalize on price fluctuations and maintain consistent trading activities.

How do grid trading bots handle price fluctuations and market volatility?

Grid trading bots handle price fluctuations and market volatility by placing buy and sell orders at different price levels within a predefined grid. The bot continuously executes trades as the price moves, aiming to profit from the volatility by buying at lower prices and selling at higher prices.

What are the common features of advanced grid trading bots?

Advanced grid trading bots often feature customizable parameters, integration with multiple exchanges, real-time market data analysis, and automated trading strategies. These features enable traders to fine-tune their trading approach and adapt to changing market conditions.

How does the use of grid trading bots compare to manual crypto trading?

The use of grid trading bots compares favorably to manual crypto trading by offering automation, reducing emotional biases, and providing the ability to manage multiple trading pairs simultaneously. Bots can execute trades based on predefined criteria, potentially leading to more consistent trading results compared to manual methods.

What is the role of trading fees in grid trading, and how can they impact profitability?

Trading fees play a significant role in grid trading, as they can impact overall profitability. High trading fees may erode profits from grid trading strategies, especially if the bot executes numerous trades. Traders should consider competitive trading fees when selecting a crypto exchange for grid trading.

What are the typical trading results and performance metrics for grid trading bots?

Typical trading results for grid trading bots include metrics such as profit and loss, trading volume, and the number of successful trades. Performance metrics help traders evaluate the effectiveness of their grid trading strategy and adjust parameters to optimize results.

How does bot trading utilize grid trading strategies on platforms like Binance and Crypto.com?

Bot trading utilizes grid trading strategies by setting up a grid of buy and sell orders at various price levels. This approach allows the trading bot to automatically execute trades based on predefined parameters, aiming to profit from price fluctuations within the grid on platforms like Binance and Crypto.com.

What are the benefits of using a grid bot for trading on Binance?

Using a grid bot for trading on Binance offers benefits such as automation of trading strategies, consistent trading performance without manual intervention, and the ability to manage multiple trading pairs simultaneously. The Binance grid bot can execute trades within a set price range, taking advantage of market volatility.

How can traders create and set up a grid trading bot on Binance?

Traders can create and set up a grid trading bot on Binance by accessing the grid trading feature within the Binance platform, configuring the bot’s parameters (such as grid levels, trading range, and intervals), and deploying it to execute trades automatically based on market conditions.

What is the difference between spot grid trading and futures grid trading?

Spot grid trading involves placing buy and sell orders at different price levels in the spot market, where assets are traded for immediate delivery. Futures grid trading, on the other hand, involves similar strategies but applied to futures contracts, which are agreements to buy or sell an asset at a future date.

How do automated grid trading bots manage price changes and market volatility?

Automated grid trading bots manage price changes and market volatility by continuously placing buy and sell orders at different price levels within a defined grid. As the market price fluctuates, the bot executes trades according to the grid parameters, aiming to profit from these price movements.

What are some popular grid trading bots available in the market?

Some popular grid trading bots available in the market include Altrady Grid, Binance Grid Bot, and Bybit Grid. These bots offer various features and configurations for executing grid trading strategies, catering to different trading needs and preferences.

How do grid bots automate trading on platforms like Crypto.com and Binance?

Grid bots automate trading on platforms like Crypto.com and Binance by continuously placing and adjusting buy and sell orders within a defined grid. The bots execute trades based on market conditions and predefined parameters, allowing traders to automate their strategies and manage trades efficiently.

What factors should traders consider when choosing the best grid trading bot?

When choosing the best grid trading bot, traders should consider factors such as the bot’s features, compatibility with their preferred exchange, trading fees, and performance metrics. Evaluating these factors helps ensure the bot aligns with the trader’s strategy and trading goals.

How do trading bots adapt to different types of trading and market conditions?

Trading bots adapt to different types of trading and market conditions by using algorithms that analyze market data and adjust trading parameters accordingly. Bots can be programmed to handle spot trading, futures trading, and various market scenarios, enabling them to optimize trading strategies based on real-time conditions.

What are the typical performance metrics for evaluating a grid trading bot?

Typical performance metrics for evaluating a grid trading bot include profit and loss, trading volume, the number of trades executed, and the bot’s overall profitability. These metrics help traders assess the effectiveness of their grid trading strategy and make adjustments as needed.