Understanding the Legality of Bitcoin Around the World

The rapid emergence of virtual currencies has sparked significant interest and debate on their status within various jurisdictions. As these digital assets continue to gain traction among investors and consumers alike, the varying responses from governments have created a complex landscape that is continually evolving. This article aims to shed light on how different regions are approaching the regulation and acceptance of these innovative financial instruments.

Many countries have chosen to embrace innovation, creating frameworks that foster the growth of these new assets while balancing the need for security and transparency. Conversely, some nations have expressed skepticism, imposing restrictions and outright bans. This divergence in regulatory approaches raises important questions about consumer protection, financial stability, and the future of digital currencies.

As stakeholders navigate this intricate terrain, understanding the diverse legal frameworks in place becomes crucial. The impact of these regulations on the development of the digital economy can shape the way these assets are perceived and utilized in everyday transactions. By examining the specific positions of various nations, one can gain insights into the broader implications for international finance and commerce.

Global Perspectives on Cryptocurrency Legality

The landscape of digital assets varies significantly across different jurisdictions, reflecting a multitude of cultural, economic, and political factors. Nations are navigating the complexities of new financial technologies and their implications, resulting in a diverse array of approaches. Some governments embrace these innovations, fostering an environment that encourages investment and development, while others adopt more cautious or prohibitive stances, aimed at mitigating potential risks.

Varied Approaches by Region

In some regions, regulatory frameworks are evolving rapidly, with authorities striving to create a balanced approach that supports innovation while ensuring consumer protection. For instance, certain countries have implemented comprehensive guidelines, establishing clear parameters for businesses and users. In contrast, others continue to operate in a gray area, where minimal regulation leads to uncertainty and potential legal challenges.

The Impact of Legislation on Adoption

The divergent stances taken by governments directly influence the adoption of digital currencies. In areas with supportive regulatory environments, there is generally higher acceptance among both businesses and consumers. Conversely, strict regulations or outright bans can hinder growth and innovation, leading to a constrained market. Understanding these regional dynamics is crucial for stakeholders aiming to navigate the complexities of this evolving financial ecosystem.

Understanding Different Legal Frameworks

Navigating the landscape of digital currencies involves recognizing the diverse sets of rules and guidelines established by various jurisdictions. Each region has developed its own approach, leading to a mosaic of regulations that can vary dramatically in scope and enforcement. This variation not only affects how participants engage with these assets but also shapes the overall market environment, including innovation and investment opportunities.

Global Perspectives on Digital Currency Regulation

As countries grapple with the rise of digital assets, their responses have resulted in distinct paradigms. Some governments embrace these innovations, seeing potential for economic growth and technological advancement, while others adopt a more cautious or prohibitive stance, concerned about risks such as fraud, money laundering, and financial instability. Understanding these differing perspectives is essential for any entity looking to operate within this space.

Comparative Overview of Approaches

| Country | Regulatory Approach | Key Legislation/Authority |

|---|---|---|

| United States | Multi-layered framework with federal and state levels | SEC, CFTC, FinCEN |

| European Union | Proposed comprehensive regulation through MiCA | European Commission |

| China | Strict prohibition on trading and ICOs | People’s Bank of China |

| Australia | Supportive approach with licensing requirements | Australian Transaction Reports and Analysis Centre (AUSTRAC) |

By studying the nuances of how various nations handle these digital assets, individuals and organizations can better position themselves to engage with this dynamic market effectively and compliantly.

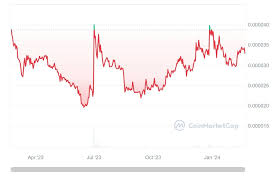

Impact of Regulation on Bitcoin Markets

The influence of governing frameworks on digital asset markets is profound. Regulations can either foster growth and innovation or hinder development and stagnate progress. The regulatory environment shapes the behavior of investors, traders, and service providers within the ecosystem, ultimately determining the stability and viability of these markets.

When authorities establish clear guidelines, they can enhance trust among participants, encouraging more individuals and institutions to engage with these assets. Clarity surrounding compliance and operational standards can lead to increased investment and market participation, driving overall market maturity. In contrast, ambiguity or overly restrictive measures may prompt skepticism and decreased activity, potentially leading to volatility and market contraction.

The geographical disparities in regulatory approaches also contribute to a fragmented landscape. Regions with supportive conditions may attract innovation and investment, while those with stringent regulations risk losing their competitive edge. As jurisdictions continue to adapt their regulatory stances, the dynamics of the digital asset market will continue to evolve, reflecting the ongoing tension between innovation and oversight.

Challenges in International Compliance

As digital currencies gain traction globally, taking strides in innovation and financial inclusion, various hurdles arise in ensuring adherence to diverse regulatory frameworks. The complexity of these frameworks often leads to ambiguity, making it challenging for entities operating in different jurisdictions to maintain compliance.

Varied Regulatory Environments

The first significant challenge comes from the heterogeneous nature of regulations across countries. Each region adopts its own approach, which can lead to the following issues:

- Inconsistent definitions of digital assets.

- Diverse taxation policies affecting transactions and holdings.

- Variation in anti-money laundering (AML) and know your customer (KYC) requirements.

Enforcement and Update Concerns

Another prevalent difficulty is the rapid pace at which technology evolves compared to regulatory frameworks. This disconnection results in:

- Old regulations becoming obsolete and ineffective.

- Challenges in enforcement due to jurisdictional issues.

- Difficulty in monitoring cross-border transactions.

These challenges necessitate a collaborative approach among governments, regulatory bodies, and the industry to foster a cohesive and adaptive environment for digital assets that promotes compliance while encouraging innovation.

Future Trends in Cryptocurrency Laws

As digital currencies continue to evolve, the frameworks governing their use and regulation must adapt to emerging trends. The growing adoption of these technologies highlights the necessity for clearer guidelines that address the unique challenges presented by decentralized finance. Looking ahead, it is essential to consider how various jurisdictions will shape the future landscape of digital assets.

Emphasis on Consumer Protection

One significant trend is the increasing focus on safeguarding individuals participating in the digital economy. Regulatory bodies are likely to implement stricter measures aimed at enhancing transparency and accountability among platforms that facilitate transactions. This shift may entail more rigorous disclosure requirements and the establishment of standards to protect users from fraud and manipulation.

International Cooperation and Standardization

Another emerging direction is the push for harmonization of regulations across borders. As more countries engage in discussions about the challenges and opportunities presented by virtual currencies, collaborative efforts may result in interconnected policies that foster consistency. This could lead to the establishment of global standards that not only streamline compliance for businesses but also enhance trust among users.

The future trajectory of frameworks governing digital assets will be shaped by the need for innovation balanced with accountability, ensuring that both markets and participants are adequately protected as the ecosystem continues to mature.

Case Studies of Notable Jurisdictions

This section explores various regions and their distinctive approaches to digital assets, highlighting how regulations and policies shape the environment for innovation and adoption. By examining specific examples, we can better understand the diverse frameworks and their implications for users and businesses alike.

Switzerland has established itself as a prominent hub for digital assets, with a regulatory framework that promotes innovation while ensuring investor protection. The Swiss Financial Market Supervisory Authority (FINMA) has issued clear guidelines, classifying different types of tokens based on their purpose, which has attracted numerous startups to the region. This approach fosters a transparent ecosystem where companies can thrive, while consumers are safeguarded.

In contrast, China has taken a more restrictive stance, implementing outright bans on initial coin offerings and crypto trading platforms. The government views these activities as potential threats to financial stability and has cracked down on mining operations. Despite this, certain areas, such as the city of Hangzhou, are exploring the use of blockchain technology for administrative purposes, demonstrating a more nuanced perspective within specific contexts.

Singapore stands out for its forward-thinking regulatory approach, embracing digital currencies as part of its broader financial technology initiative. The Monetary Authority of Singapore (MAS) has introduced a licensing regime that encourages innovation while establishing necessary safeguards against money laundering and fraud. This balanced perspective has positioned Singapore as a leading destination for digital asset businesses, contributing to a vibrant startup ecosystem.

El Salvador has garnered attention for its pioneering move to recognize a specific digital currency as legal tender. This unprecedented decision aims to boost financial inclusion and attract foreign investment. While the initiative has sparked debates about economic implications and risks, it illustrates a bold shift towards integrating digital assets into mainstream financial systems.

Through these case studies, we observe that the approach to digital currencies varies significantly across different jurisdictions. While some countries adopt progressive policies to nurture innovation, others prioritize regulation and caution, reflecting their unique economic contexts and societal values.

Q&A: Is bitcoin legal

Is Bitcoin legal in all countries?

No, Bitcoin is not legal in all countries. Its legality varies significantly from one jurisdiction to another. Some countries, like El Salvador, have fully embraced Bitcoin, recognizing it as legal tender. In contrast, others, like China, have imposed strict regulations, effectively banning its use and trading. Many nations lean towards a middle ground, allowing cryptocurrency trading under certain conditions but imposing regulations to curb illicit activities.

What are the key regulatory challenges Bitcoin faces globally?

Bitcoin faces various regulatory challenges globally, primarily including issues related to taxation, consumer protection, anti-money laundering (AML), and combating the financing of terrorism (CFT). Governments are concerned about the anonymity cryptocurrencies provide, which could facilitate illegal activities. Additionally, discrepancies in regulations can create a fragmented market, making it difficult for businesses to operate internationally. Balancing innovation and protection remains a critical challenge for regulators worldwide.

How does the legal status of Bitcoin impact its use in everyday transactions?

The legal status of Bitcoin significantly impacts its usability in everyday transactions. In countries where Bitcoin is recognized as legal tender, businesses are more likely to accept it for payments, leading to increased adoption among consumers. Conversely, in jurisdictions where Bitcoin is restricted or banned, users may have limited options for spending it. Regulatory clarity often encourages more merchants to accept Bitcoin, fostering a more robust ecosystem for cryptocurrency transactions.

Are there any international organizations that regulate Bitcoin?

While no single international organization regulates Bitcoin globally, several bodies provide guidelines and recommendations. The Financial Action Task Force (FATF) is one of the prominent organizations that focuses on combating money laundering and terrorist financing, issuing regulations that member countries are encouraged to implement. Additionally, the International Monetary Fund (IMF) and Bank for International Settlements (BIS) have expressed interest in fostering a cohesive regulatory framework for cryptocurrencies, but enforcement and implementation remain largely in the hands of individual countries.

What are the implications of Bitcoin regulation for investors?

Regulation of Bitcoin carries several implications for investors. On one hand, clear regulations can enhance investor protection, lessen the risk of fraud, and increase overall market stability, leading to greater confidence among investors. On the other hand, strict regulations could impose barriers to entry, hinder innovation, and create uncertainty in the marketplace. Investors need to stay informed about the regulatory landscape in their respective countries, as changes in legislation can significantly impact the value and use of Bitcoin as an investment vehicle.

Is Bitcoin considered legal in all countries?

Bitcoin is not considered legal in all countries. The legal status of Bitcoin and other cryptocurrencies varies significantly across the globe. Some countries, like El Salvador, have embraced Bitcoin as legal tender, while others, such as China, have outright banned its use and trading. Many nations fall somewhere in between, regulating cryptocurrencies under their existing financial laws. This means that while Bitcoin may be legal to hold in some countries, trading or using it for payments could be restricted or banned altogether. Therefore, it’s essential for individuals to understand their own country’s regulations regarding cryptocurrencies to remain compliant.

How do different countries regulate cryptocurrencies?

Countries regulate cryptocurrencies in various ways, reflecting their economic strategies, technological adoption, and financial security concerns. In the European Union, for instance, there are ongoing efforts to create a comprehensive regulatory framework, balancing innovation and consumer protection. The United States adopts a more fragmented approach, with different states having their own regulations alongside federal oversight. Some countries, like Japan, have established clear guidelines that integrate cryptocurrencies into their existing financial systems, requiring exchanges to register and comply with anti-money laundering laws. Conversely, countries like India have had fluctuating regulations, occasionally proposing bans but also hinting at regulatory clarity in the future. Overall, the regulatory environment is evolving, and businesses and investors in the cryptocurrency space must stay informed about the latest developments in each jurisdiction to navigate compliance effectively.

Which was the first country to make Bitcoin legal tender, and what does it mean?

El Salvador was the first country to make Bitcoin legal tender in 2021. This means Bitcoin can be used alongside the national currency for everyday transactions, and businesses in the country are required to accept it as a form of payment.

Is Bitcoin legal in the United States, and how is it regulated?

Bitcoin is considered legal in the U.S., but it is not classified as legal tender. The legal status of cryptocurrencies like Bitcoin varies by state, and they are regulated as commodities or property, subject to capital gains tax when sold or traded.

What is the stance of the Reserve Bank of India on Bitcoin and other cryptocurrencies?

The Reserve Bank of India has not classified Bitcoin as legal tender but allows individuals to buy and sell it through cryptocurrency exchanges. However, there have been calls to ban cryptocurrency or heavily regulate it due to concerns about financial stability and illegal activities.

Why do some countries ban cryptocurrency mining, and is Bitcoin mining legal everywhere?

Some countries ban cryptocurrency mining due to its high energy consumption, environmental concerns, or blackouts caused by excessive electricity demand. While Bitcoin mining is legal in many countries, its status depends on local regulations, with some governments considering it illegal.

How does the introduction of central bank digital currencies affect Bitcoin’s legal status?

Central bank digital currencies (CBDCs) are government-regulated digital alternatives to cryptocurrencies like Bitcoin. While CBDCs do not directly ban cryptocurrency, their introduction may lead to stricter regulations on Bitcoin transactions and mining to ensure the dominance of state-controlled digital currencies.